Daily Technical Report

December 01, 2014

Sensex (28694) / Nifty (8588)

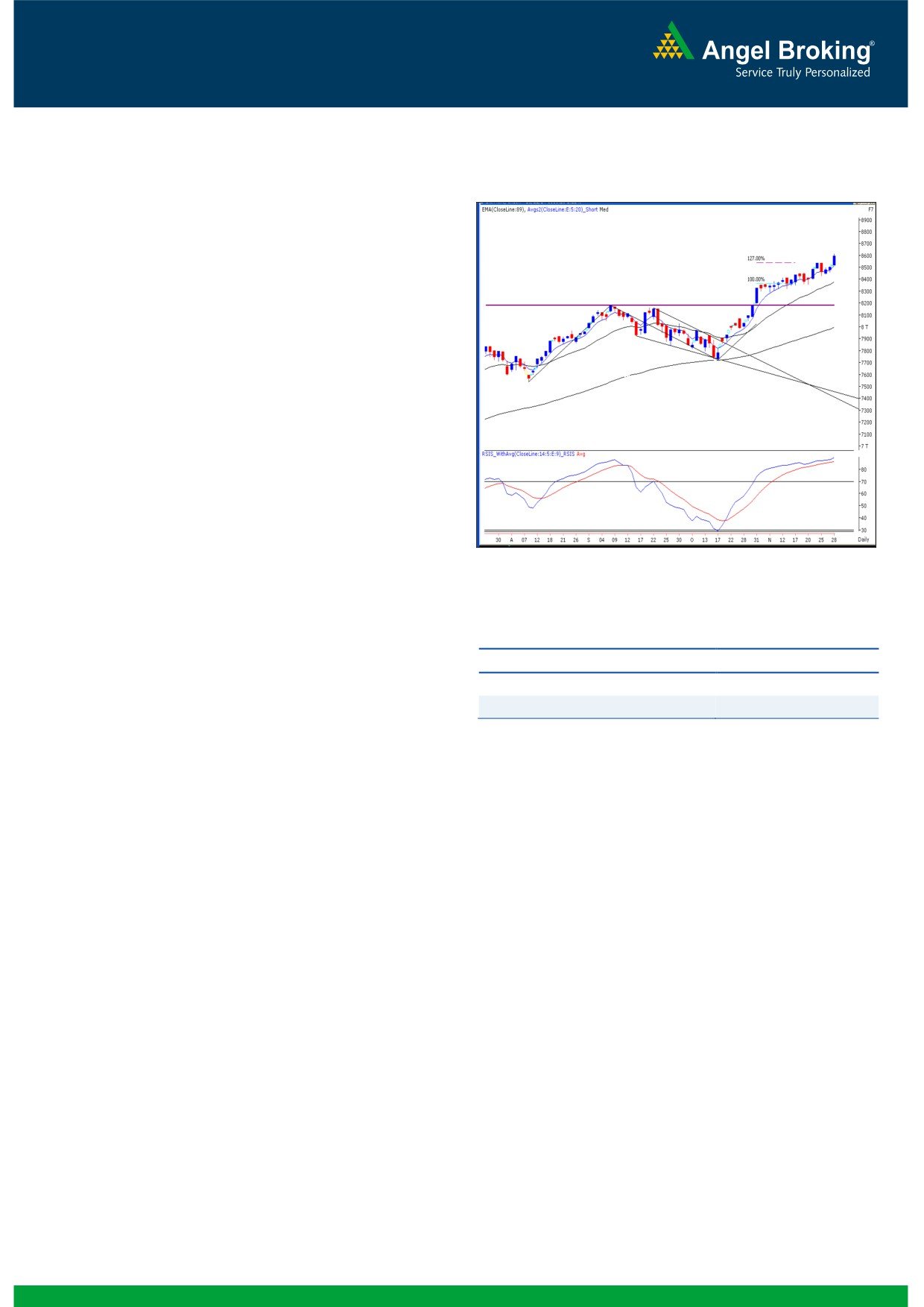

Exhibit 1: Nifty Daily Chart

The concluding session of the week opened on a cheerful

note on the back of optimistic global cues. This momentum

accelerated as the day progressed and as a result, the Nifty

posted a close at the historical high by adding more than a

percent to the previous close. Barring nominal loss in the IT

sector, all other sectors ended the week on a positive note.

The Banking, Auto, Capital Goods and Realty were among

the major contributors. The advance to decline ratio was

marginally in favor of the declining counters. (A=1481

Formations

The ’89-day EMA’ and the ’89-week EMA’ are placed

at 26746 / 7994 and 23128 / 6918 levels, respectively.

The ’20-day EMA’ and the ‘20-week EMA’ are placed

at 28020 / 8378 and 26784 / 8007 levels, respectively.

Source: Falcon

Actionable points:

Trading strategy:

As in the previous week, the concluding session turned out

View

Neutral

to be a trend decider for the concluded week as well. As

Support Level

8500

mentioned in our earlier report, the Nifty marched towards

Resistance Levels

8620 - 8650

the target levels of 8500 - 8550 in the initial part of week.

We had also mentioned about being a bit cautious and

staying light on positions after approaching this important

resistance zone. This strategy played out well during the first

half of the week as we witnessed a nearly one and half a

percent cut in the Nifty from the high. Still, we hadn't

advised traders to short the Nifty; in fact, we continued to

concentrate on stock specific movements. Following this, the

Nifty soared on Friday on the back of a sharp cut in global

crude oil prices. The Nifty has now surpassed our expected

level of 8550; but despite having a strong momentum on

the upside, we would not provide any trade set up until we

get a clear development on the charts. Meanwhile, it's

advisable to stick to a stock centric approach and trade with

a proper exit strategy. If the momentum persists in the

market then we may see an extended move towards 8650 -

8680 levels on the Nifty. On the flipside, 8500 - 8420 are

seen as immediate support levels for the index.

1

Daily Technical Report

December 01, 2014

Bank Nifty Outlook - (18513)

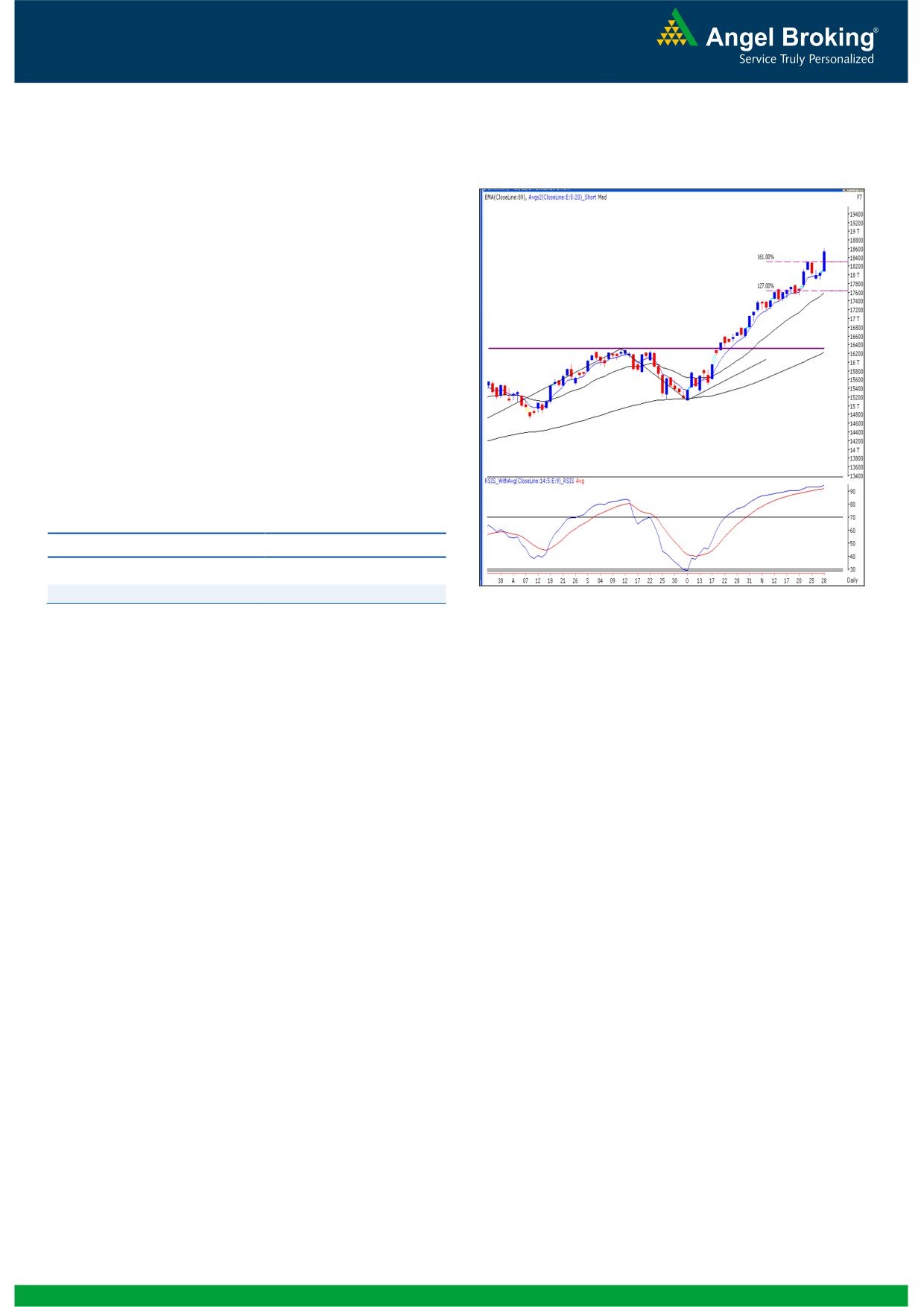

Exhibit 2: Bank Nifty Daily Chart

On Friday, the Bank Nifty opened higher in-line with the

benchmark index and posted a mammoth single day

gains of more than two and half a percent to end the

session tad above the 18500 mark. The banking index

has now moved well byond our expection of 18300 -

18400 levels. Going forward, looking at the momentum,

the possibility of extending this rally towards 18700 -

18800 cannot be ruled out. However, due to unfavorable

risk to reward ratio, it becomes difficult to provide a trade

set up. Traders are advised to focus on its constituents

and trade with proper exit strategy. On the flipside,

18300 - 18100 are seen as immediate support levels for

the index.

Actionable points:

View

Neutral

Resistance Levels

18600 - 18700

Support Levels

18300

Source: Falcon

2

Daily Technical Report

December 01, 2014

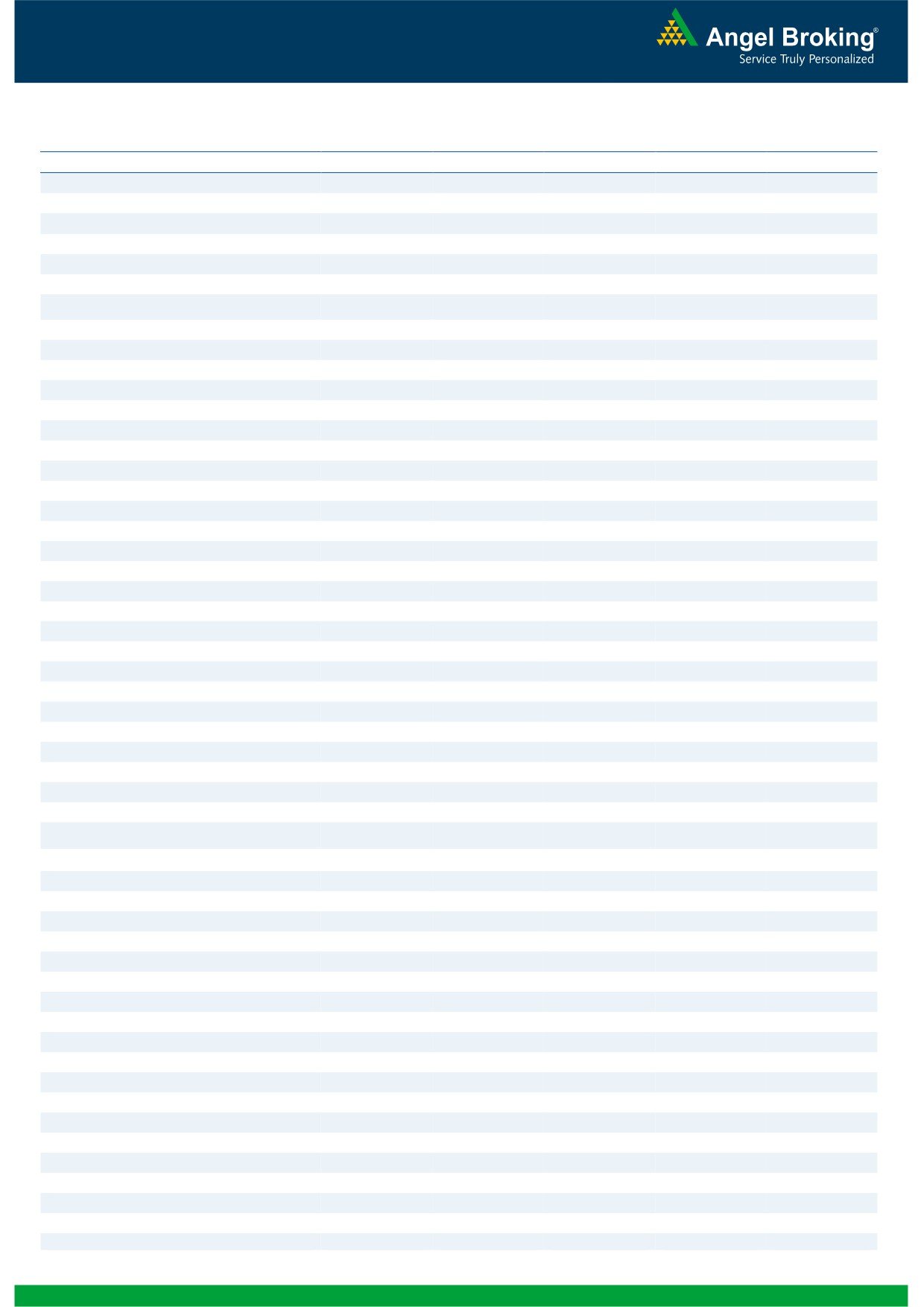

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

28,328

28,511

28,667

28,850

29,005

NIFTY

8,473

8,531

8,574

8,631

8,675

BANKNIFTY

17,871

18,192

18,404

18,725

18,937

ACC

1,425

1,450

1,465

1,490

1,505

AMBUJACEM

221

225

229

233

237

ASIANPAINT

703

724

737

757

770

AXISBANK

465

473

479

488

494

BAJAJ-AUTO

2,604

2,622

2,649

2,667

2,694

BANKBARODA

990

1,039

1,069

1,118

1,148

BHARTIARTL

373

378

384

389

395

BHEL

277

281

284

287

290

BPCL

709

728

756

775

804

CAIRN

254

257

262

265

270

CIPLA

624

630

638

644

652

COALINDIA

342

348

353

360

364

DLF

140

144

150

154

160

DRREDDY

3,569

3,587

3,613

3,632

3,658

GAIL

474

481

490

497

506

GRASIM

3,489

3,522

3,554

3,587

3,618

HCLTECH

1,628

1,645

1,662

1,679

1,696

HDFC

1,140

1,150

1,164

1,174

1,188

HDFCBANK

938

947

957

966

976

HEROMOTOCO

3,094

3,121

3,142

3,168

3,189

HINDALCO

171

172

174

175

177

HINDUNILVR

774

780

789

796

805

ICICIBANK

1,700

1,727

1,752

1,779

1,804

IDFC

152

156

159

162

165

INDUSINDBK

708

729

745

766

781

INFY

4,312

4,336

4,367

4,391

4,422

ITC

357

360

363

366

369

JINDALSTEL

136

138

142

144

148

KOTAKBANK

1,148

1,175

1,192

1,219

1,235

LT

1,612

1,626

1,641

1,655

1,670

LUPIN

1,437

1,459

1,472

1,493

1,506

M&M

1,283

1,303

1,316

1,336

1,348

MARUTI

3,244

3,295

3,327

3,379

3,411

NMDC

138

139

141

142

143

NTPC

140

141

142

144

145

ONGC

370

375

382

387

394

PNB

978

1,025

1,054

1,101

1,130

POWERGRID

138

140

142

144

146

RELIANCE

963

977

997

1,012

1,032

SBIN

303

312

317

327

332

SSLT

224

227

234

238

244

SUNPHARMA

831

836

842

846

853

TATAMOTORS

514

524

531

541

549

TATAPOWER

91

92

93

94

95

TATASTEEL

456

465

470

479

484

TCS

2,600

2,622

2,657

2,678

2,713

TECHM

2,609

2,624

2,647

2,662

2,685

ULTRACEMCO

2,448

2,466

2,490

2,508

2,532

WIPRO

575

581

585

590

595

ZEEL

369

376

381

388

393

3

Daily Technical Report

December 01, 2014

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Research Team

Sameet Chavan

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4