Daily Technical Report

August 22, 2013

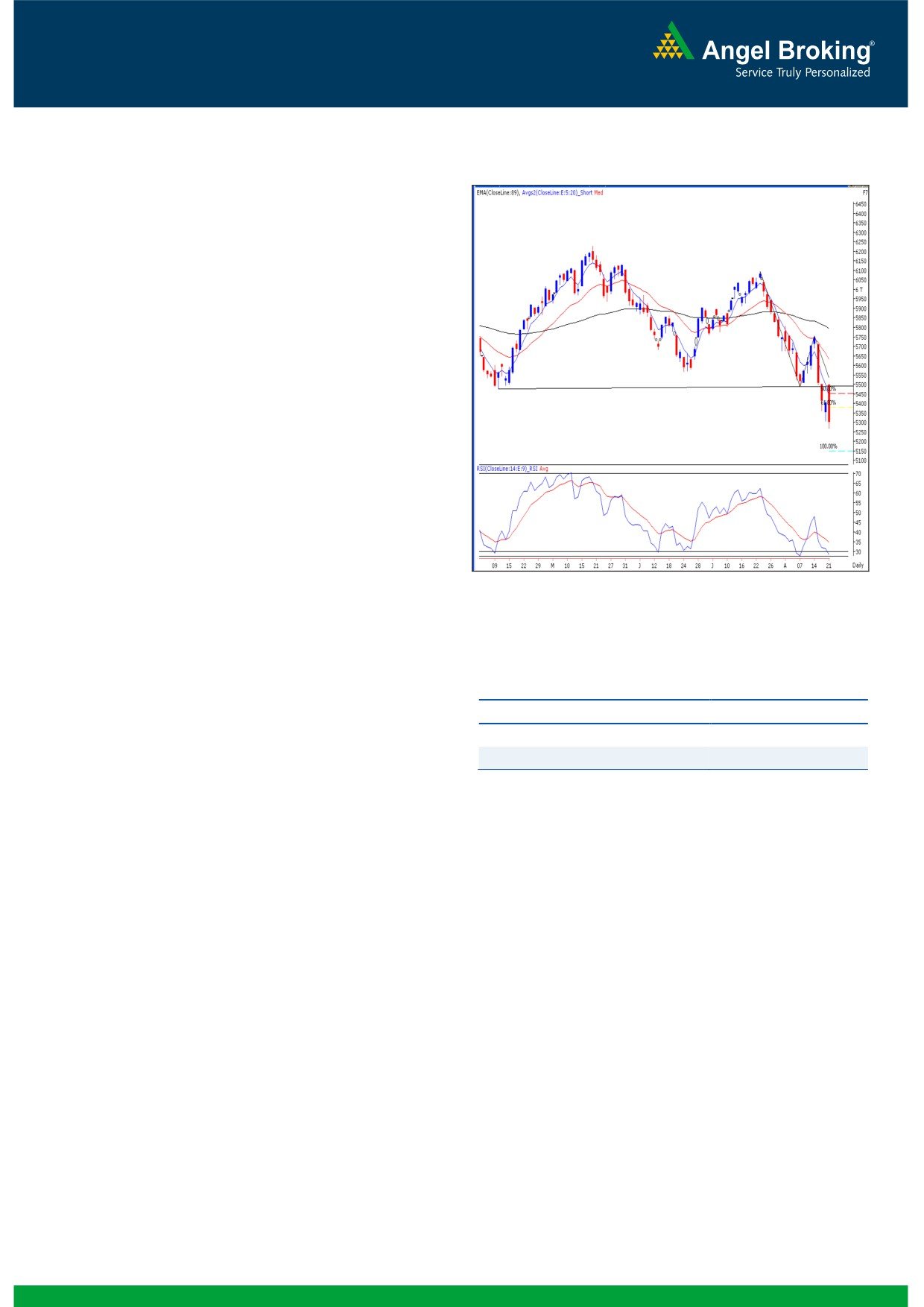

Exhibit 1: Nifty Daily Chart

Sensex (17906) / NIFTY (5303)

Yesterday, our market opened with more than a percent upside

gap as the measures from the RBI helped to calm the storm in

the bond markets. However, indices failed to sustain at higher

levels on the back of massive selling pressure in few

heavyweight constituents and significant rupee depreciation. As

a result, Nifty eventually slipped well inside the negative

territory. The Metal, Oil & Gas, Realty and FMCG counters

plunged during the session; whereas the Consumer Durables

and Banking sector somehow managed to close in the positive

territory with very nominal gains. The Advance to Decline ratio

was strongly in favor of declining counters. (A=886 D=1372)

Formation

The ’89-day EMA’ and the ’89-week EMA’ are placed at

19304/ 5795 and 18595/ 5613 levels, respectively.

The ’20-day EMA’ and the ‘20-week EMA’ are placed at

Source: Falcon:

18954 / 5630 and 19184 / 5755, respectively.

The monthly ‘RSI-Smoothened’ oscillator is signaling a

negative crossover.

Actionable points:

The weekly ‘Lower Top - Lower Bottom’ formation in Nifty

is still intact.

View

Neutral

The 50% and 61.8% Fibonacci retracement levels of the

Support levels

5268 - 5180

rise from 4531 (low of December 2011 candle) to 6230

Resistance Levels

5306 - 5355

(high of May 2013 candle) are placed at 5380 and 5180,

respectively.

Trading strategy:

Yet another trading session turned out to be the nightmare for

the bulls. The benchmark index opened substantially higher as

the RBI on Tuesday late evening issued another set of steps to

shield banks from incurring financial losses due to declining

bond prices. However, this optimism was very short lived as the

index took a u-turn after testing strong resistance zone of

5486. This was mainly on the back of ongoing weakness in

INR. Considering ongoing pessimism and weak chart structure,

if Nifty stays below 5268 then we expect the index to test the

5180 level, which is the 61.8% Fibonacci retracement level of

the rise in monthly chart. On the upside, the intraday resistance

is seen around 5355 - 5400 levels. Traders are advised to note

that the momentum oscillators on the daily and the weekly

chart are extremely oversold and fresh positional short

positions at current levels are not advisable.

1

Daily Technical Report

August 22, 2013

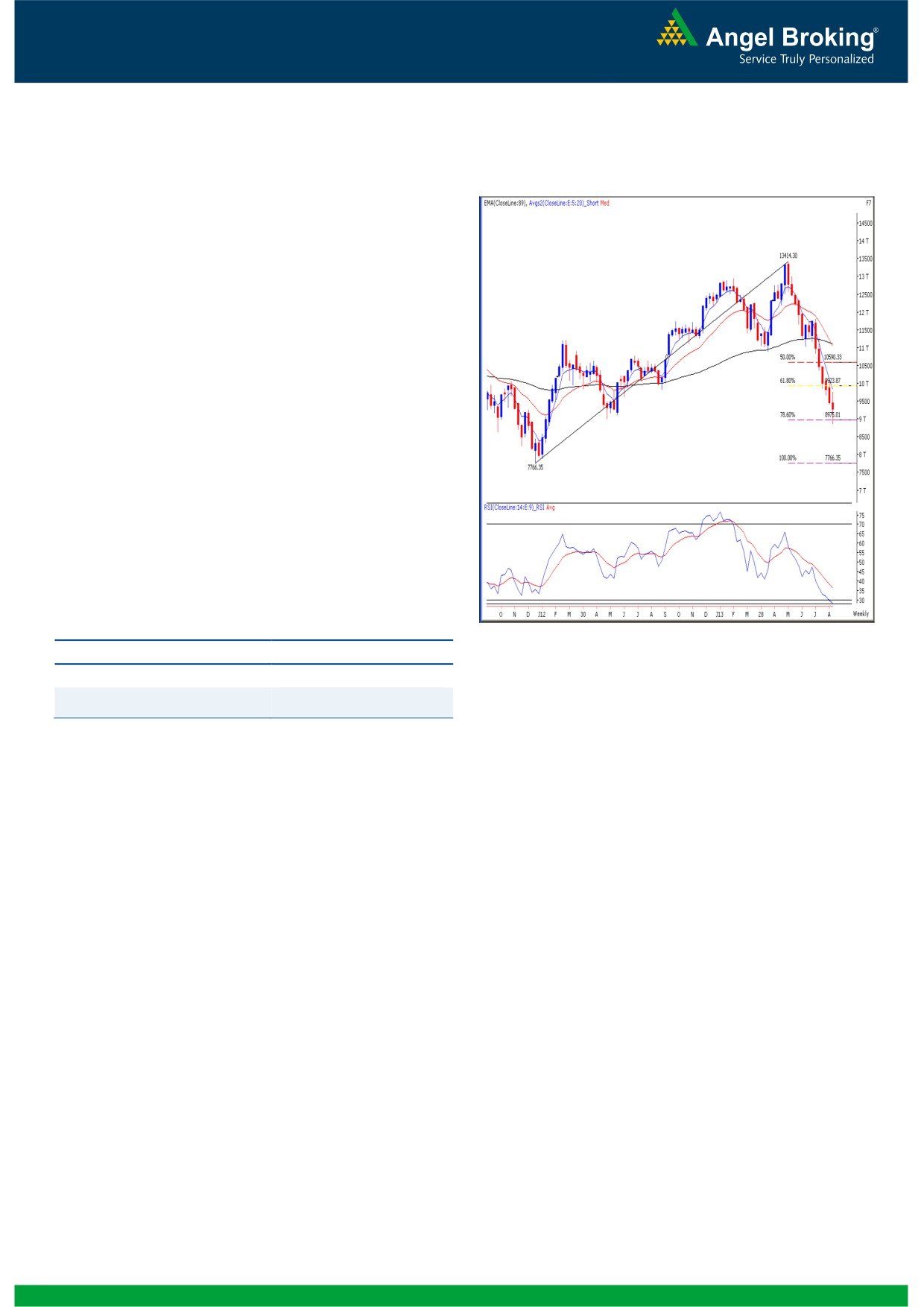

Bank Nifty Outlook - (9264)

Exhibit 2: Bank Nifty Weekly Chart

Yesterday, the Bank Nifty opened with a whooping five

percent upside gap on account of RBI's announcement

post the market hours on Tuesday. However, Rupee

depreciation caused mayhem on the street and the Bank

Nifty experienced massive selling pressure near day's high

and trimmed a major part of their early morning gains.

The high of 9767 precisely coincided with the hourly

resistance of '89 EMA'. Going forward, if the Bank Nifty

sustains below yesterday’s low of 9219 then we may

expect further lower levels of 9096 - 8995 to be tested.

On the flipside, 9277-9425 would act as an immediate

Resistance level. Similar to the chart of the Benchmark

indices, here too the oversold condition of momentum

oscillators on the daily and weekly chart does not give

comfort in creating fresh short positions on the Banking Index.

Actionable points:

Source: Falcon:

View

Neutral

Support levels

9096 - 8995

9277 - 9425

Resistance levels

2

Daily Technical Report

August 22, 2013

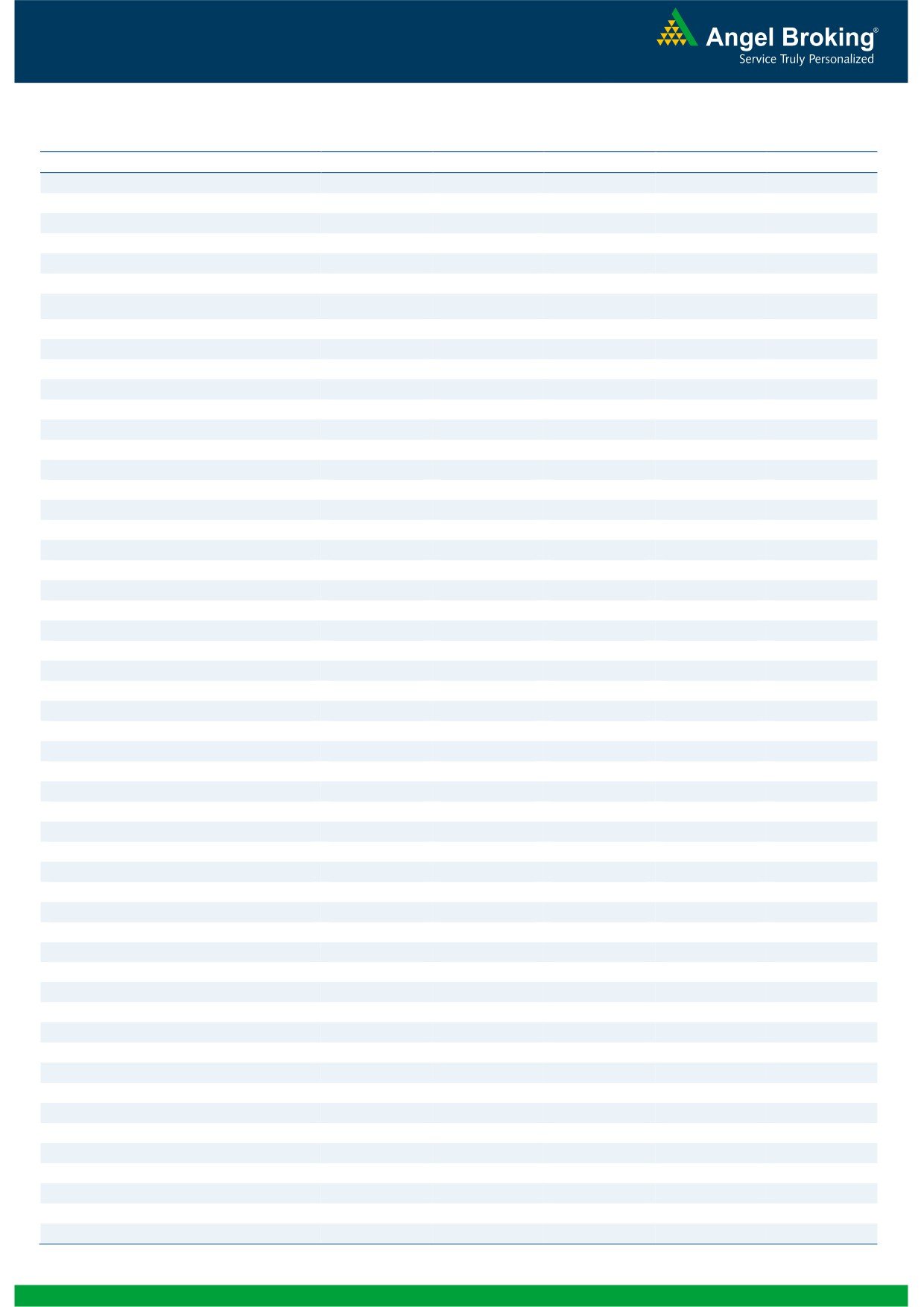

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

17,333

17,620

18,094

18,380

18,854

NIFTY

5,123

5,213

5,358

5,448

5,594

BANKNIFTY

8,750

9,007

9,387

9,644

10,023

ACC

938

972

1,034

1,069

1,131

AMBUJACEM

147

152

158

162

169

ASIANPAINT

401

408

418

425

435

AXISBANK

892

935

1,001

1,044

1,111

BAJAJ-AUTO

1,658

1,696

1,751

1,789

1,843

BANKBARODA

411

432

463

484

515

BHARTIARTL

276

287

306

317

336

BHEL

99

102

106

108

112

BPCL

265

275

289

299

313

CAIRN

281

290

304

313

327

CIPLA

381

387

397

402

412

COALINDIA

251

256

261

265

270

DLF

135

143

153

161

171

DRREDDY

1,961

2,004

2,070

2,113

2,179

GAIL

288

293

298

303

309

GRASIM

2,265

2,290

2,319

2,344

2,374

HCLTECH

861

874

894

906

926

HDFC

721

734

747

760

772

HDFCBANK

572

582

601

612

630

HEROMOTOCO

1,807

1,839

1,892

1,924

1,977

HINDALCO

87

90

95

98

103

HINDUNILVR

570

579

593

603

617

ICICIBANK

761

796

838

872

914

IDFC

93

97

103

107

114

INDUSINDBK

336

347

366

377

395

INFY

2,886

2,922

2,959

2,995

3,031

ITC

281

291

306

316

331

JINDALSTEL

211

216

223

228

234

JPASSOCIAT

27

29

31

33

36

KOTAKBANK

583

604

639

660

695

LT

663

686

728

752

794

LUPIN

742

755

775

788

809

M&M

751

767

792

808

832

MARUTI

1,245

1,265

1,295

1,315

1,345

NMDC

104

107

111

113

117

NTPC

124

127

132

135

140

ONGC

240

246

255

260

270

PNB

445

462

492

510

540

POWERGRID

96

97

98

99

100

RANBAXY

278

305

346

373

414

RELIANCE

745

764

800

819

854

RELINFRA

291

304

325

338

360

SBIN

1,446

1,497

1,574

1,625

1,702

SESAGOA

122

130

143

151

165

SUNPHARMA

452

467

491

507

531

TATAMOTORS

269

276

286

292

302

TATAPOWER

70

72

74

76

79

TATASTEEL

233

241

252

259

270

TCS

1,678

1,698

1,721

1,741

1,763

ULTRACEMCO

1,573

1,599

1,632

1,658

1,691

3

Daily Technical Report

August 22, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4