Daily Technical Report

August 19, 2013

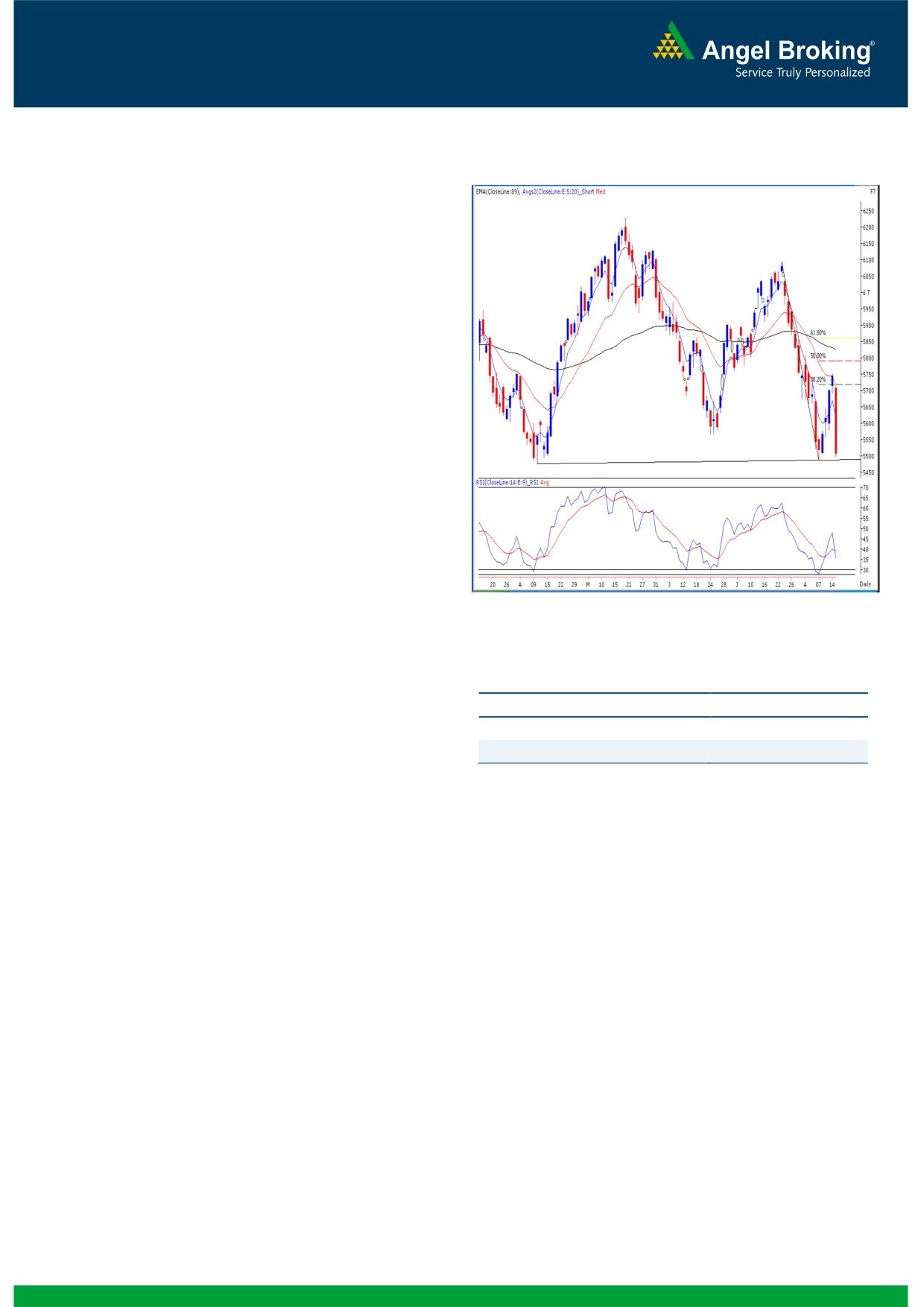

Exhibit 1: Nifty Daily Chart

Sensex (18598) / NIFTY (5508)

On Friday, our benchmark indices opened lower as indicated

by the SGX Nifty. Right from the opening tick, we witnessed

immense selling pressure in the market. As a result, the Nifty

plunged by more than 4% during the session. All sectors

remained under pressure and closed in negative territory. The

decline was mainly led by Consumer Durables, Realty, Metal

and Banking stocks. The Advance to Decline ratio was strongly

in favor of declining counters. (A=711 D=1608) (Source-

Formation

The ’89-day EMA’ and the ’89-week EMA’ are placed at

19384/ 5825and 18611 / 5620 levels, respectively.

The ’20-day EMA’ and the ‘20-week EMA’ are placed at

19240 / 5721 and 19319 / 5803, respectively.

The monthly ‘RSI-Smoothened’ oscillator is signaling a

negative crossover.

Source: Falcon:

The weekly ‘Lower Top - Lower Bottom’ formation in Nifty

is still intact.

Actionable points:

The 50% and 61.8% Fibonacci retracement levels of the

rise from 4531 (low of December 2011 candle) to 6230

View

Bearish below 5477

(high of May 2013 candle) are placed at 5380 and 5180,

Expected Target

5380

respectively.

Resistance Levels

5550 - 5590

Trading strategy:

We have been mentioning in our previous couple of reports

In-line with our expectation, we first witnessed a bounce

that the overall structure remains negative and we advise

towards 5720 - 5762 during the first half of the week. This

positional traders with a 5 to 7 week perspective to adopt a

week’s high of 5755 precisely coincides with the ’20 Day EMA’.

“Sell on Rise” strategy.

This technical tool is considered as a strong resistance and

during Friday’s session, we witnessed immense selling pressure

around ’20 Day EMA’. This eventually led to massive intraday

fall of more than four percent for the first time after September

22, 2011. Every attempt by the bulls to recover from the lows

got sold into and this single day fall overshadowed the entire

bounce seen during the previous four trading sessions. At

present, the monthly ‘RSI-Smoothened’ oscillator is signaling a

negative crossover. In addition, the weekly ‘Lower Top Lower

Bottom’ is still intact and indicates further weakness in the near

term. Considering all these technical evidences, we are of the

opinion that if Nifty stays below the crucial support level of

5477 then we are likely to see a further correction towards

5380 (50% Fibonacci retracement level) and even possibility of

testing the 5180 (61.8% Fibonacci retracement level) level

cannot be ruled out.

1

Daily Technical Report

August 19, 2013

Bank Nifty Outlook - (9451)

Exhibit 2: Bank Nifty Weekly Chart

On Friday, the Bank nifty too opened with a downside gap

in-line with our benchmark index and corrected

significantly. Also the “Bullish Engulfing “candlestick

pattern mentioned in the previous report is now negated.

Going forward considering the current negative

momentum, if the Bank Nifty sustains below 9420, then

we may witness further selling pressure towards

9300/9110. On the flipside, 9580 -9832 levels would act

as immediate resistance levels for Bank Nifty. At this

juncture, the charts of individual Banking heavyweights

such as SBI, ICICI, HDFC bank and AXIS bank do not

warrant buying from a trading prospective. Traders are

advised to stay light on position and trade with strict stop

losses.

Actionable points:

Source: Falcon:

View

Bearish Below 9420

Expected targets

9300- 9110

Support Levels

9580- 9832

2

Daily Technical Report

August 19, 2013

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

18,072

18,335

18,823

19,086

19,574

NIFTY

5,353

5,430

5,574

5,651

5,794

BANKNIFTY

9,116

9,284

9,587

9,755

10,059

ACC

1,128

1,143

1,167

1,182

1,206

AMBUJACEM

167

170

174

177

181

ASIANPAINT

400

410

423

432

446

AXISBANK

994

1,021

1,068

1,095

1,142

BAJAJ-AUTO

1,770

1,809

1,867

1,906

1,964

BANKBARODA

445

462

492

509

539

BHARTIARTL

322

329

338

345

355

BHEL

96

101

109

114

123

BPCL

277

284

294

301

311

CAIRN

290

296

304

309

317

CIPLA

404

410

418

423

431

COALINDIA

249

254

262

267

276

DLF

136

141

149

153

161

DRREDDY

2,112

2,139

2,177

2,204

2,242

GAIL

278

288

306

316

334

GRASIM

2,231

2,282

2,355

2,406

2,479

HCLTECH

888

904

923

939

958

HDFC

700

719

750

768

799

HDFCBANK

561

575

598

612

635

HEROMOTOCO

1,894

1,939

1,972

2,018

2,050

HINDALCO

89

91

94

97

100

HINDUNILVR

581

590

604

613

627

ICICIBANK

830

844

870

885

911

IDFC

102

104

108

110

113

INDUSINDBK

331

344

361

374

391

INFY

2,923

2,951

2,995

3,023

3,068

ITC

305

313

325

333

346

JINDALSTEL

200

207

216

223

232

JPASSOCIAT

27

28

31

32

34

KOTAKBANK

606

619

640

653

674

LT

729

743

769

783

809

LUPIN

785

801

825

841

865

M&M

803

822

847

866

891

MARUTI

1,272

1,298

1,344

1,370

1,416

NMDC

103

106

111

114

118

NTPC

134

137

141

143

147

ONGC

256

264

278

285

299

PNB

467

484

509

525

551

POWERGRID

94

96

98

100

101

RANBAXY

359

369

387

397

414

RELIANCE

787

807

837

857

887

RELINFRA

301

313

334

346

367

SBIN

1,518

1,544

1,579

1,605

1,640

SESAGOA

122

126

133

137

143

SUNPHARMA

525

534

544

553

563

TATAMOTORS

304

309

316

321

328

TATAPOWER

69

71

75

77

80

TATASTEEL

221

228

239

246

256

TCS

1,714

1,748

1,789

1,822

1,863

ULTRACEMCO

1,579

1,631

1,691

1,743

1,802

3

Daily Technical Report

August 19, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4