Daily Technical Report

October 03, 2013

Sensex (19517) / NIFTY (5780)

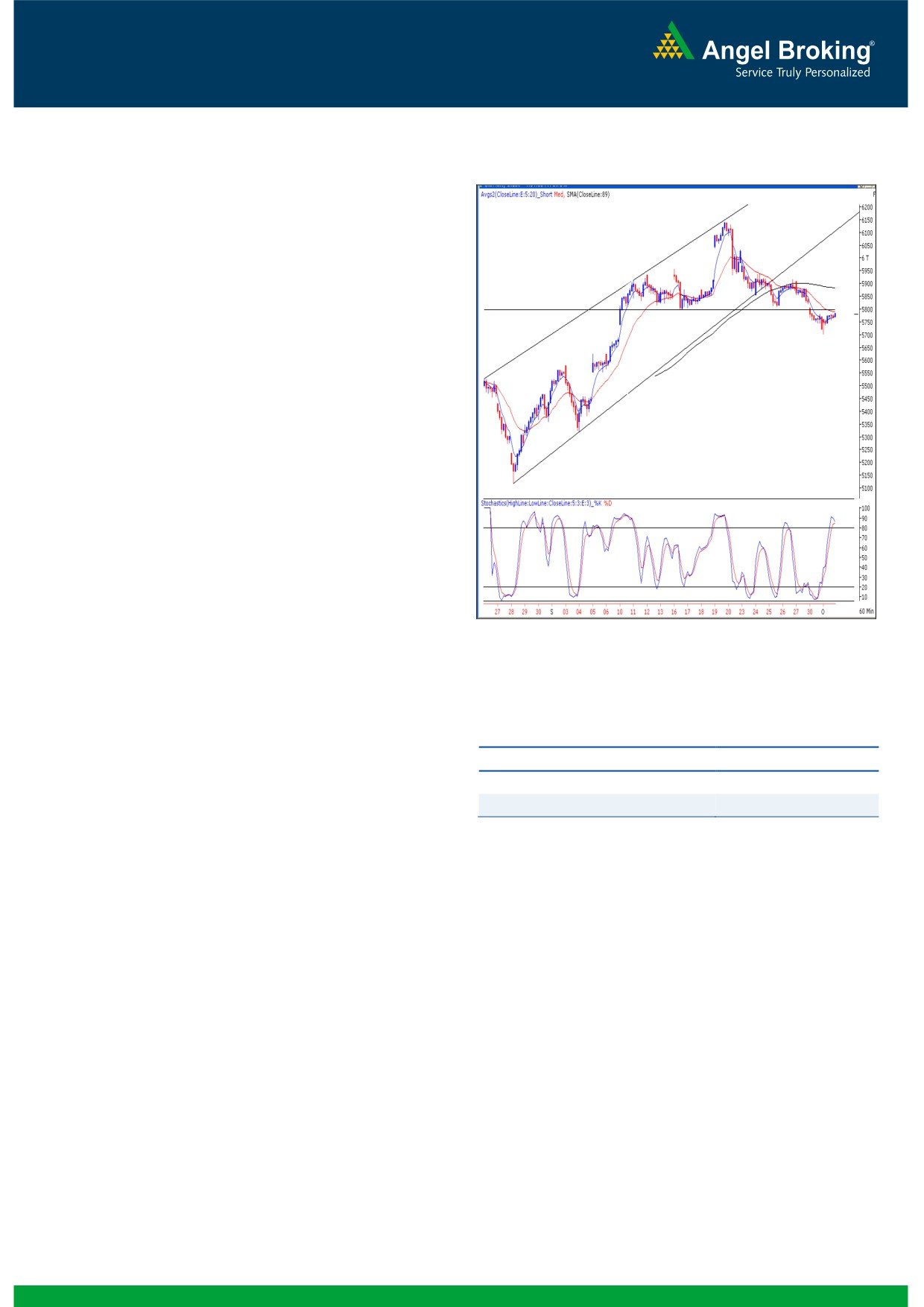

Exhibit 1: Nifty Hourly Chart

On Tuesday, our benchmark indices opened half a percent

higher as indicated by the SGX Nifty. Despite the early morning

dip, the index managed to recover sharply and posted a close

well inside the positive territory. Banking counters contributed

significantly in the pullback along with the Realty, Capital

goods and Auto stocks. The Oil & Gas and power counters

ended with minor losses. The advance to decline ratio was

strongly in the favor of the advancing counters. (A=1317

Formation

The ’89-day EMA’ and the ’89-week EMA’ are placed at

19350 / 5765 and 18725 / 5636 levels, respectively.

The ’20-day EMA’ and the ‘20-week EMA’ are placed at

19604 / 5797 and 19390 / 5779 levels, respectively.

The daily and monthly ‘RSI-Smoothened’ oscillator is

negatively poised.

The previous week’s candle resembles a ‘Spinning Top’

Japanese candlestick pattern.

Source: Falcon

On a closing basis, the ‘Lower Top - Lower Bottom’

formation on the weekly chart is still intact (Nifty).

The 38.2% and 50% Fibonacci retracement levels of the

Actionable points:

rise from 5118 (weekly low of August 30, 2013) to 6143

(weekly high of September 20, 2013) are placed at 5750

View

Bearish below 5756

and 5630, respectively.

Resistance Level

5810 - 5825

Trading strategy:

Expected Targets

5700 - 5630

The overall price action seen during Tuesday's session can be

termed as a 'Tug of war' as the bulls managed to pull the index

from early morning lows and eventually, posted a close on

optimistic note. However the Nifty continues to trade below the

20 day EMA and the hourly 89 bar EMA. Also, the Head and

Shoulder pattern mentioned in our previous reports is still very

much intact. Considering the hourly chart, the up move can be

construed as a pull back and any weakness around 5790 -

5798 may drag the index to retest 5700 or lower levels. On

the upside, 5798 - 5877 would remain to act as a strong

resistance zone for our market in coming trading sessions.

1

Daily Technical Report

October 03, 2013

Bank Nifty Outlook - (9883)

Exhibit 2: Bank Nifty Weekly Chart

On Tuesday, in-line with our benchmark index, the Bank

Nifty too opened half a percent higher. However, barring

some early morning down ticks, the index gained

significantly as we witnessed single day gain of more than

two percent. Despite this price action, the overall higher

degree chart remains bearish and hence, the up move can

also be termed as a relief rally. We reiterate our view that

hourly ‘89 EMA’ (10034) level is a strong resistance for the

Bank Nifty. Also the lower top lower bottom structure on

the daily chart still continues to exist. On the downside,

9713 - 9580 are key support levels in coming trading

session. Any weakness around these levels would resume

the downtrend and in this scenario, the index may test

9400 - 9300 levels. On the flipside, if the index manages

to sustain above 10034 levels, than we may witness an

extended bounce up to 10190-10290 levels

Actionable points:

Source: Falcon

View

Neutral

Support Levels

9713 - 9580

Resistance Levels

10034 - 10190

2

Daily Technical Report

October 03, 2013

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX z

19,174

19,351

19,442

19,619

19,710

NIFTY

5,670

5,725

5,756

5,811

5,841

BANKNIFTY

9,463

9,673

9,793

10,003

10,123

ACC

1,076

1,088

1,104

1,115

1,131

AMBUJACEM

174

177

181

184

188

ASIANPAINT

443

449

456

462

469

AXISBANK

999

1,021

1,036

1,058

1,072

BAJAJ-AUTO

1,958

1,989

2,013

2,044

2,068

BANKBARODA

481

490

496

505

512

BHARTIARTL

303

313

319

328

334

BHEL

137

139

141

144

146

BPCL

317

322

325

330

333

CAIRN

314

316

318

320

322

CIPLA

428

430

433

435

438

COALINDIA

291

294

297

300

302

DLF

124

130

134

140

144

DRREDDY

2,347

2,377

2,403

2,433

2,459

GAIL

318

321

325

328

332

GRASIM

2,583

2,605

2,638

2,661

2,694

HCLTECH

1,049

1,060

1,075

1,086

1,101

HDFC

751

768

779

797

807

HDFCBANK

580

596

605

621

630

HEROMOTOCO

1,952

1,976

2,004

2,027

2,055

HINDALCO

107

109

111

112

114

HINDUNILVR

595

607

619

631

643

ICICIBANK

872

892

903

923

934

IDFC

87

89

90

92

93

INDUSINDBK

359

371

379

391

399

INFY

2,983

2,999

3,019

3,035

3,054

ITC

336

340

342

345

347

JINDALSTEL

225

229

232

236

239

JPASSOCIAT

34

34

35

36

36

KOTAKBANK

658

672

681

694

703

LT

766

783

794

810

821

LUPIN

836

844

854

862

872

M&M

808

820

833

845

858

MARUTI

1,339

1,359

1,385

1,405

1,431

NMDC

116

117

119

121

123

NTPC

140

142

145

147

150

ONGC

255

259

264

268

274

PNB

451

457

462

468

473

POWERGRID

97

98

99

100

100

RANBAXY

322

336

346

360

370

RELIANCE

811

816

823

828

835

RELINFRA

358

367

372

381

387

SBIN

1,601

1,622

1,635

1,656

1,670

SESAGOA

169

172

176

180

184

SUNPHARMA

582

586

592

596

602

TATAMOTORS

326

331

335

340

345

TATAPOWER

75

76

79

81

83

TATASTEEL

265

270

274

280

284

TCS

1,902

1,926

1,940

1,964

1,978

ULTRACEMCO

1,779

1,796

1,808

1,825

1,837

3

Daily Technical Report

October 03, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4