Daily Technical Report

September 03, 2015

Sensex (25454) / Nifty (7717)

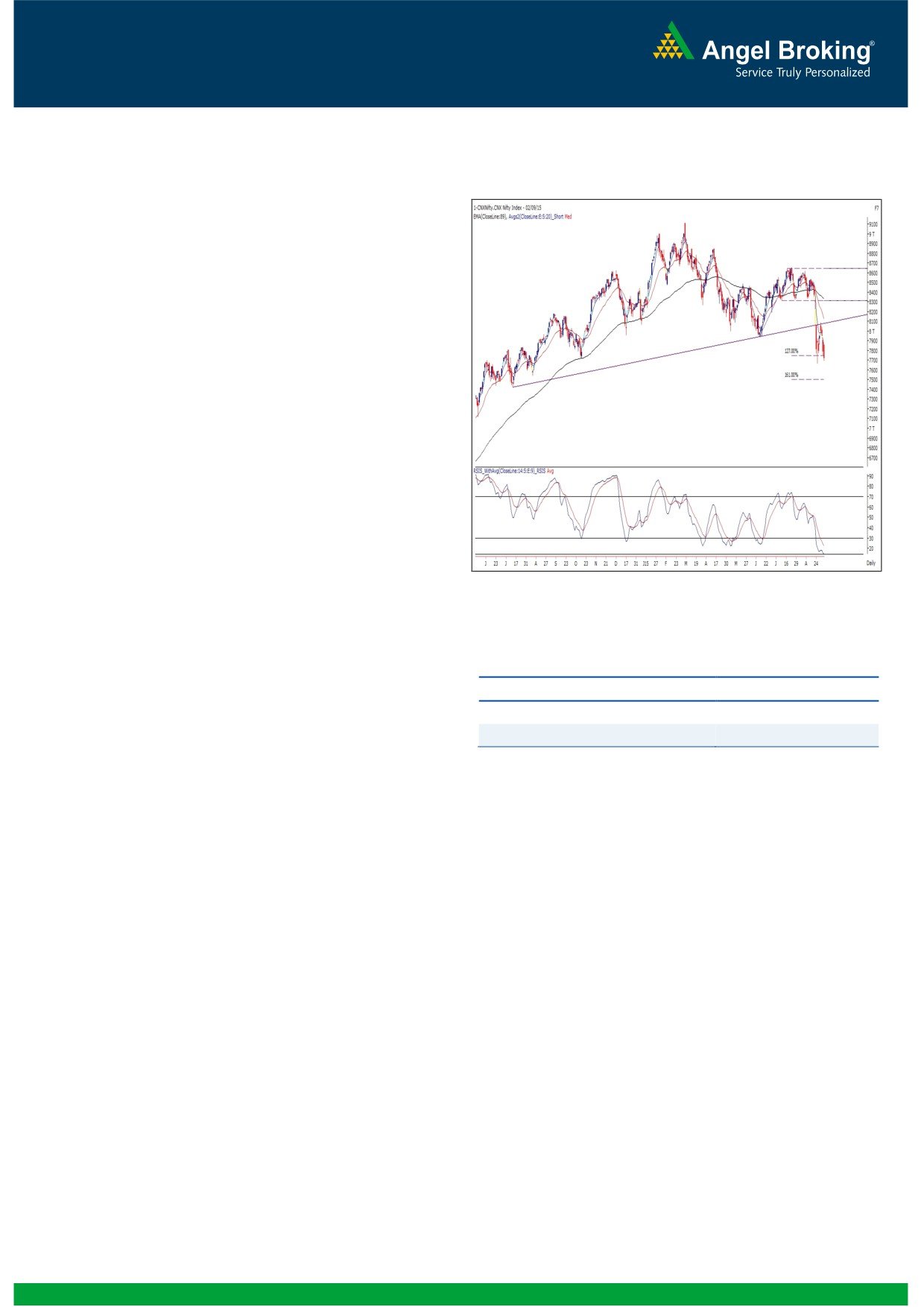

Exhibit 1: Nifty Daily Chart

Yesterday, our benchmark index opened higher as indicated

by the SGX Nifty. However, these gains were short lived as we

witnessed a gradual corrective move throughout the

remaining part of the day and thus, the Nifty ended the

session with nearly a percent loss. On the sectoral front, the

Auto, Banking, Capital goods and Oil & Gas sectors were the

major draggers; whereas, the IT, FMCG and Realty counters

traded with a strong positive bias. The advance to decline ratio

was marginally in favor of the declining counters. (A=1221

Formations

The ’89-day EMA’ and the ’89-week EMA’ are placed

at 27623 / 8364 and 25925 / 7811 levels, respectively.

The ’20-day EMA’ and the ‘20-week EMA’ are placed

at 27141 / 8232 and 27702 / 8386 levels, respectively.

Source: Falcon

Actionable points:

Trading strategy:

Yesterday, our benchmark index opened with a decent upside

View

Neutral

gap owing to positive news flow on the domestic front.

Resistance Levels

7820 - 7900

However, the index failed to sustain at higher levels as most of

Support Level

7667

the index heavyweights were falling fiercely due to mounting

selling pressure. In the process, the index went on to break

Tuesday’s low of 7746 and then tested the 7700 mark. We

maintain our view that the Nifty may give a minor bounce

considering the extremely oversold condition of the ‘RSI-

Smoothened’ momentum oscillator on the daily chart. Thus,

short term traders are advised to lighten up their short

positions and wait for further signals to emerge. In case of a

bounce, we may witness the Nifty to test 7820 - 7900 levels. It

must be noted that the directional view remains on the

downside and thus, it’s advisable to adopt a ‘Sell on rally’

approach. On the downside, 7667 would now be seen as an

immediate support level.

1

Daily Technical Report

September 03, 2015

Bank Nifty Outlook - (16253)

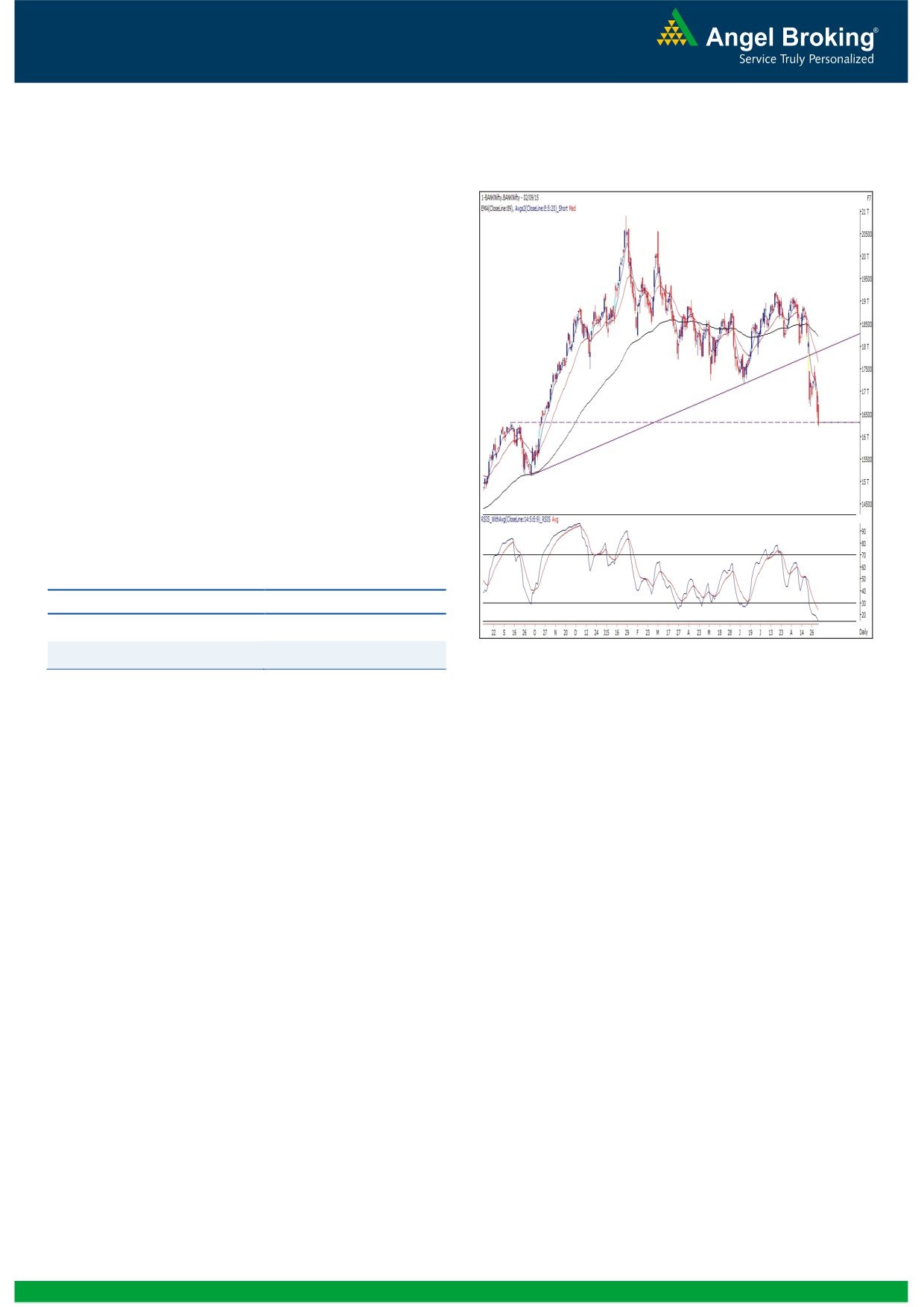

Exhibit 2: Bank Nifty Daily Chart

Yesterday, the Bank Nifty opened with an upside gap of

more than a percent owing to the positive news on the

domestic front. Post the gap up opening, the banking index

started falling from the initial trades and continued making

lower lows throughout the session. The fall in the banking

counters was so strident that the Bank Nifty couldn’t hold

Tuesday’s low of 16436.85. Currently, the Bank Nifty is

approaching the 38.20% retracement level (16100) of the

entire up move from 8366.75 to 20907.55, which may now

act as a crucial support for the index. A sustainable move

below this level may lead to further correction in the near

term. On the flipside, the immediate resistance for the Bank

Nifty is placed at 16655 and 16800 levels.

Actionable points:

View

Neutral

Resistance Levels

16655 - 16800

Source: Falcon

Support Level

16100

2

Daily Technical Report

September 03, 2015

Research Team Tel: 022 - 30940000

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

Angel/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market

making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material,

there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please

refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited

and its affiliates may have investment positions in the stocks recommended in this report.

Research Team

Sameet Chavan

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4