Daily Technical Report

September 02, 2013

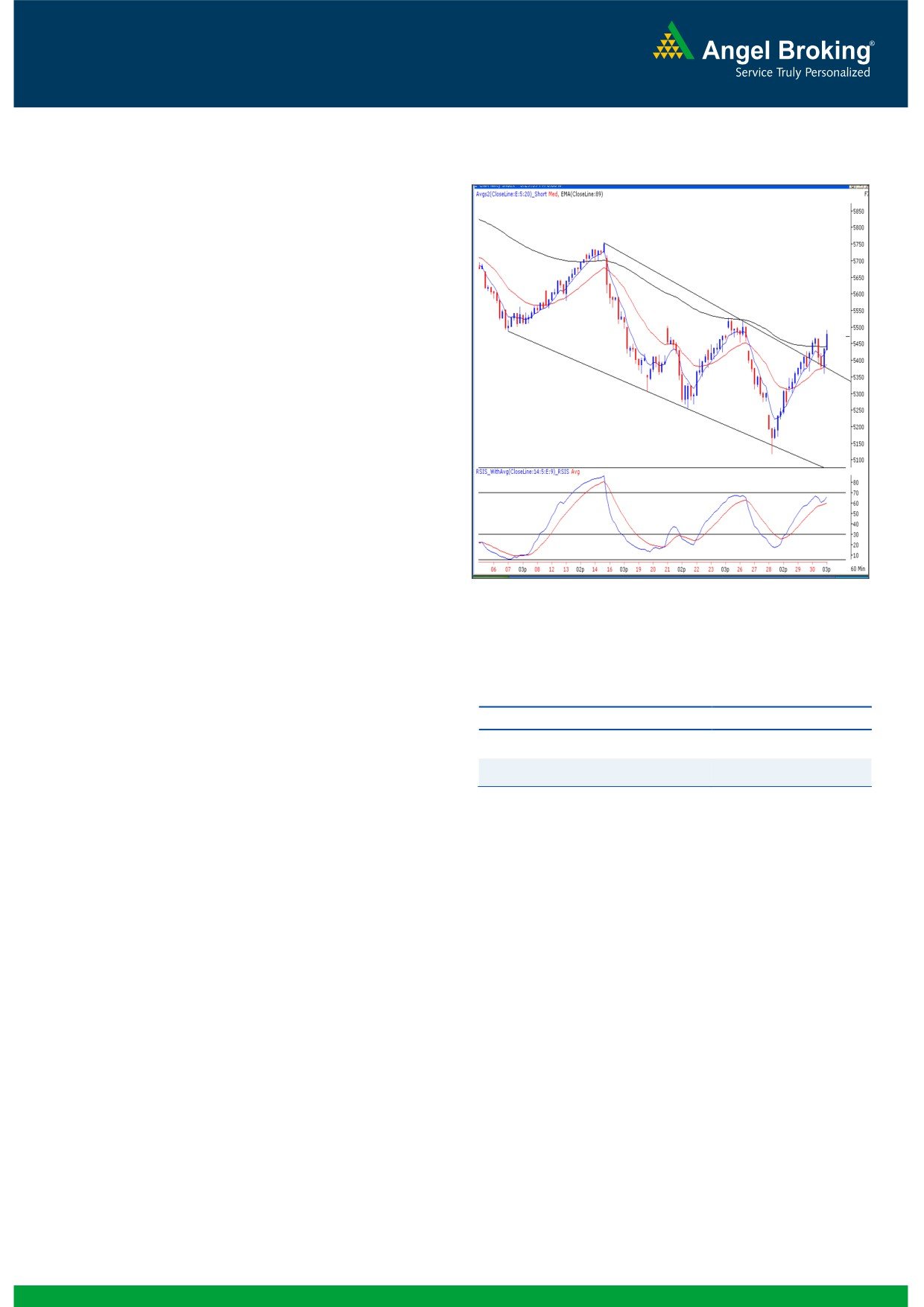

Exhibit 1: Nifty Hourly Chart

Sensex (18620) / NIFTY (5472)

On Friday, our benchmark indices opened on a flat note as

indicated by the SGX nifty. Subsequently, the index picked up

the previous sessions up trend and moved nearly a percent

higher during the first half. During midsession, the index

slipped into negative territory due to immense selling pressure;

but a sharp recovery towards the end led the index to close

almost at the highest point of the day. On the sectoral front,

the Consumer Durables, Healthcare, Banking and IT sectors

were among the leading gainers; whereas the Metal & Capital

goods counters remained under pressure throughout the

session. The advance to decline ratio was marginally in favor

of advancing counters. (A=1137 D=1085) (Source-

Formation

The ’89-day EMA’ and the ’89-week EMA’ are placed at

19164 / 5738 and 18609 / 5613 levels, respectively.

The ’20-day EMA’ and the ‘20-week EMA’ are placed at

Source: Falcon:

18647 / 5514 and 19183 / 5743 levels, respectively.

The monthly ‘RSI-Smoothened’ oscillator is still negatively

poised; whereas the weekly ‘Stochastic’ momentum

Actionable points:

oscillator has given a positive crossover.

View

Bullish above 5495

The weekly chart depicts yet another ‘Bullish Hammer’

Japanese candlestick pattern.

Expected targets

5529 - 5578

Support levels

5363 - 5303

The ‘Lower Top - Lower Bottom’ formation in weekly chart

is still intact.

Trading strategy:

It was a complete roller-coaster ride for the market participants

The weekly ‘Stochastic’ momentum oscillator is also signaling

as we witnessed a ‘V’ shape recovery from the lows. In our

positive crossover. On the lower side, the immediate support

previous report, we had mentioned that if the Nifty stays above

levels are seen around 5360 - 5300 levels. Although the

5504, then we might expect some bounce back in our market.

current price action indicates a near term bounce in our

However, the Nifty could not close above 5504 and corrected

market, we would like to highlight that the intermediate trend

sharply towards our mentioned target of 5100 by Wednesday

remains bearish as the weekly ‘Lower Top Lower Bottom’

afternoon. The second half of the week completely

formation and the Negative crossover in monthly ‘RSI-

overshadowed by the bulls as the recovery from the low of

Smoothened’ oscillator are still intact. Therefore any up

5118 left everyone flabbergasted. The weekly chart now

move in the near term can only be construed as a pullback.

depicts one more ‘Bullish Hammer’ Japanese candlestick

We would advise traders to adopt stock specific approach

pattern. The pattern implication remains same and the pattern

and follow strict stop losses.

needs confirmation in the form of a closing above the high of

5529. In this scenario, we can expect an extended bounce

towards 5640 - 5720 levels. The price pattern in hourly chart

also supports the above mentioned hypothesis. The Nifty has

oscillated within a ‘Downward Sloping Channel’ in hourly chart

and during Friday’s session, a channel pattern breakout has

been confirmed.

1

Daily Technical Report

September 02, 2013

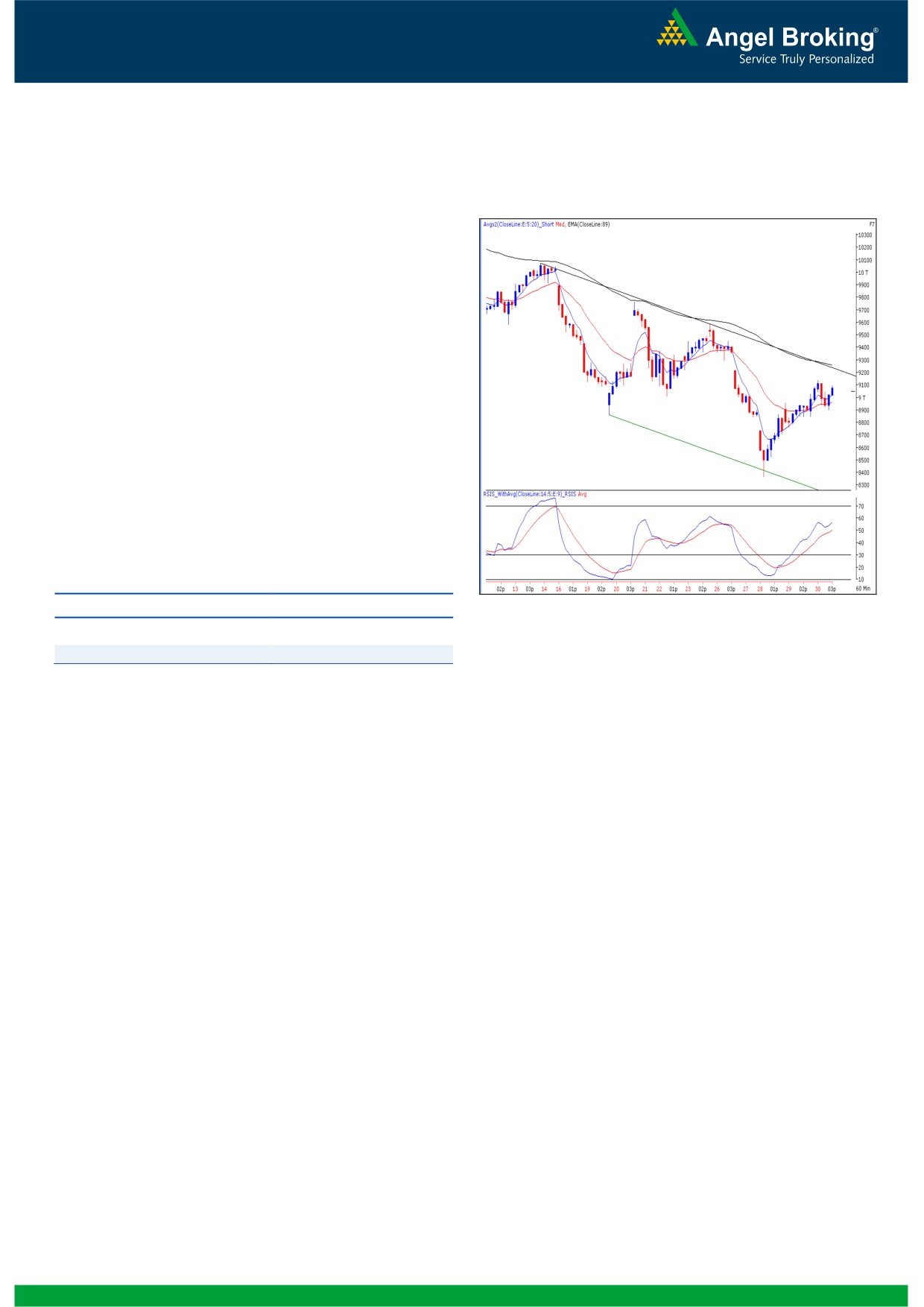

Bank Nifty Outlook - (9049)

Exhibit 2: Bank Nifty Hourly Chart

On Friday, the Bank Nifty too opened flat in-line with our

benchmark index and the overall price action was similar

where the index recovered sharply from the mid session low.

In the hourly chart, it is clearly seen that the index is

oscillating within the 'Downward Sloping Channel' and has

now approached the upper trend line of the pattern.

Considering the overall price patterns and positive placement

of momentum oscillators in the daily chart, we expect the

Bank Nifty to rally towards 9208 - 9294 if it manages to

sustain above the 9136 level. On the flipside, 9015 - 8899

levels would act as immediate support levels for Bank Nifty in

coming trading session.

Actionable points:

View

Bullish above 9136

Source: Falcon:

Expected targets

9208 - 9294

Support levels

9015 - 8899

2

Daily Technical Report

September 02, 2013

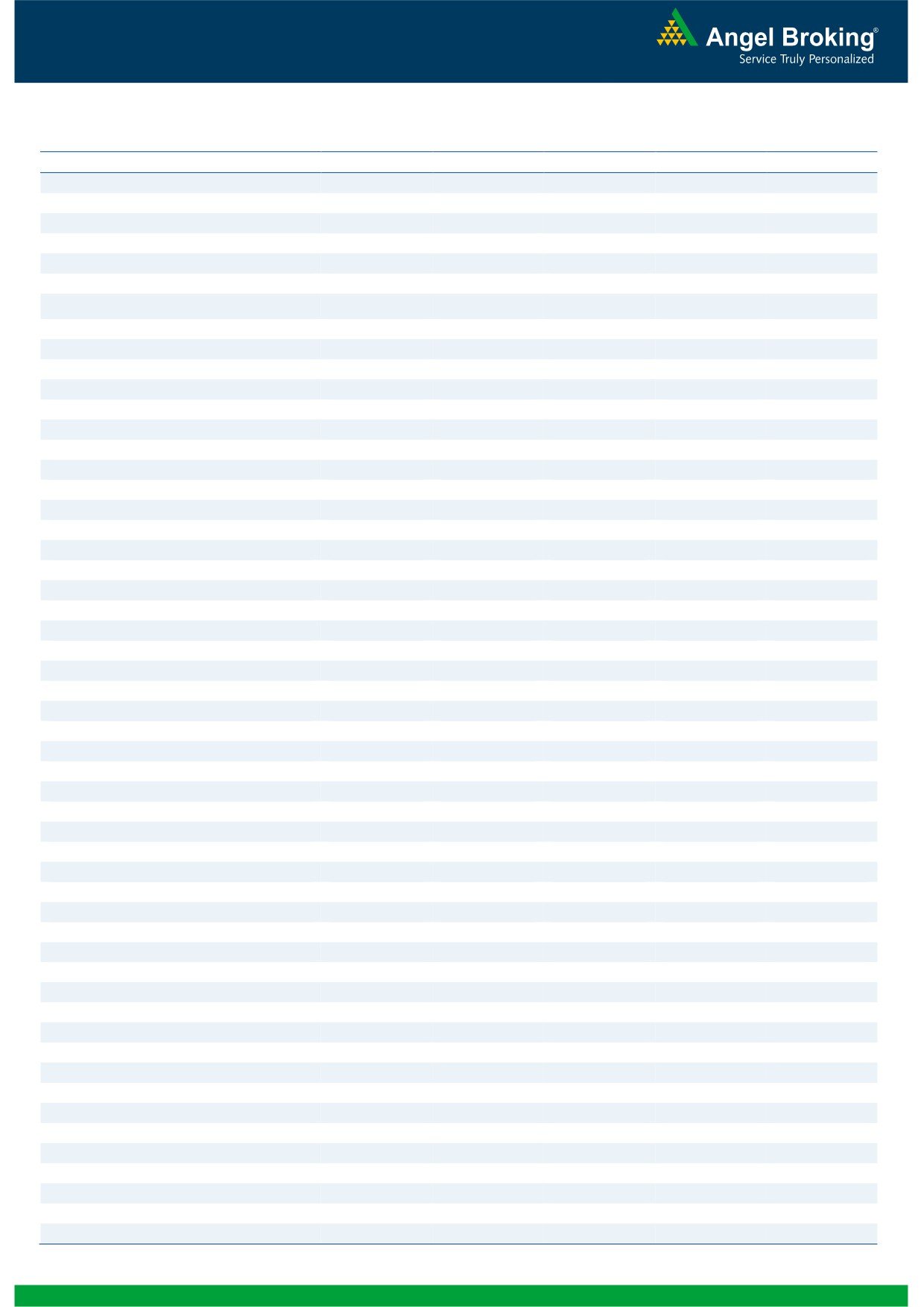

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

18,117

18,369

18,524

18,775

18,930

NIFTY

5,309

5,390

5,442

5,523

5,575

BANKNIFTY

8,722

8,885

9,010

9,174

9,299

ACC

915

940

958

982

1,000

AMBUJACEM

153

162

168

178

184

ASIANPAINT

382

401

413

433

444

AXISBANK

775

804

848

876

920

BAJAJ-AUTO

1,657

1,747

1,798

1,889

1,940

BANKBARODA

437

449

462

474

487

BHARTIARTL

285

292

297

304

309

BHEL

113

116

118

121

124

BPCL

259

266

271

278

282

CAIRN

311

316

321

326

331

CIPLA

383

400

410

427

437

COALINDIA

231

241

248

259

266

DLF

122

126

130

134

139

DRREDDY

2,135

2,214

2,291

2,369

2,446

GAIL

273

284

291

303

310

GRASIM

2,176

2,218

2,252

2,295

2,329

HCLTECH

997

1,019

1,032

1,054

1,067

HDFC

682

700

717

735

752

HDFCBANK

559

576

588

606

618

HEROMOTOCO

1,887

1,967

2,021

2,101

2,155

HINDALCO

98

102

105

109

112

HINDUNILVR

585

608

624

647

662

ICICIBANK

778

791

809

822

840

IDFC

75

78

82

84

88

INDUSINDBK

334

345

357

368

380

INFY

3,003

3,055

3,089

3,140

3,174

ITC

295

302

307

314

319

JINDALSTEL

200

211

229

240

257

JPASSOCIAT

31

32

33

34

36

KOTAKBANK

585

622

646

683

706

LT

701

713

723

735

745

LUPIN

758

777

804

823

850

M&M

751

767

784

800

818

MARUTI

1,215

1,229

1,239

1,253

1,263

NMDC

115

117

120

122

124

NTPC

126

128

130

133

135

ONGC

234

242

248

256

263

PNB

410

420

432

442

454

POWERGRID

92

95

97

99

101

RANBAXY

386

397

407

418

429

RELIANCE

816

835

847

866

879

RELINFRA

324

333

340

350

357

SBIN

1,449

1,484

1,505

1,540

1,561

SESAGOA

178

183

187

193

197

SUNPHARMA

484

502

522

540

560

TATAMOTORS

285

292

300

307

316

TATAPOWER

71

74

75

77

79

TATASTEEL

258

266

278

286

297

TCS

1,884

1,959

2,004

2,079

2,124

ULTRACEMCO

1,397

1,436

1,467

1,506

1,538

3

Daily Technical Report

September 02, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4