Daily Technical Report

April 02, 2014

Sensex (22446) / Nifty (6721)

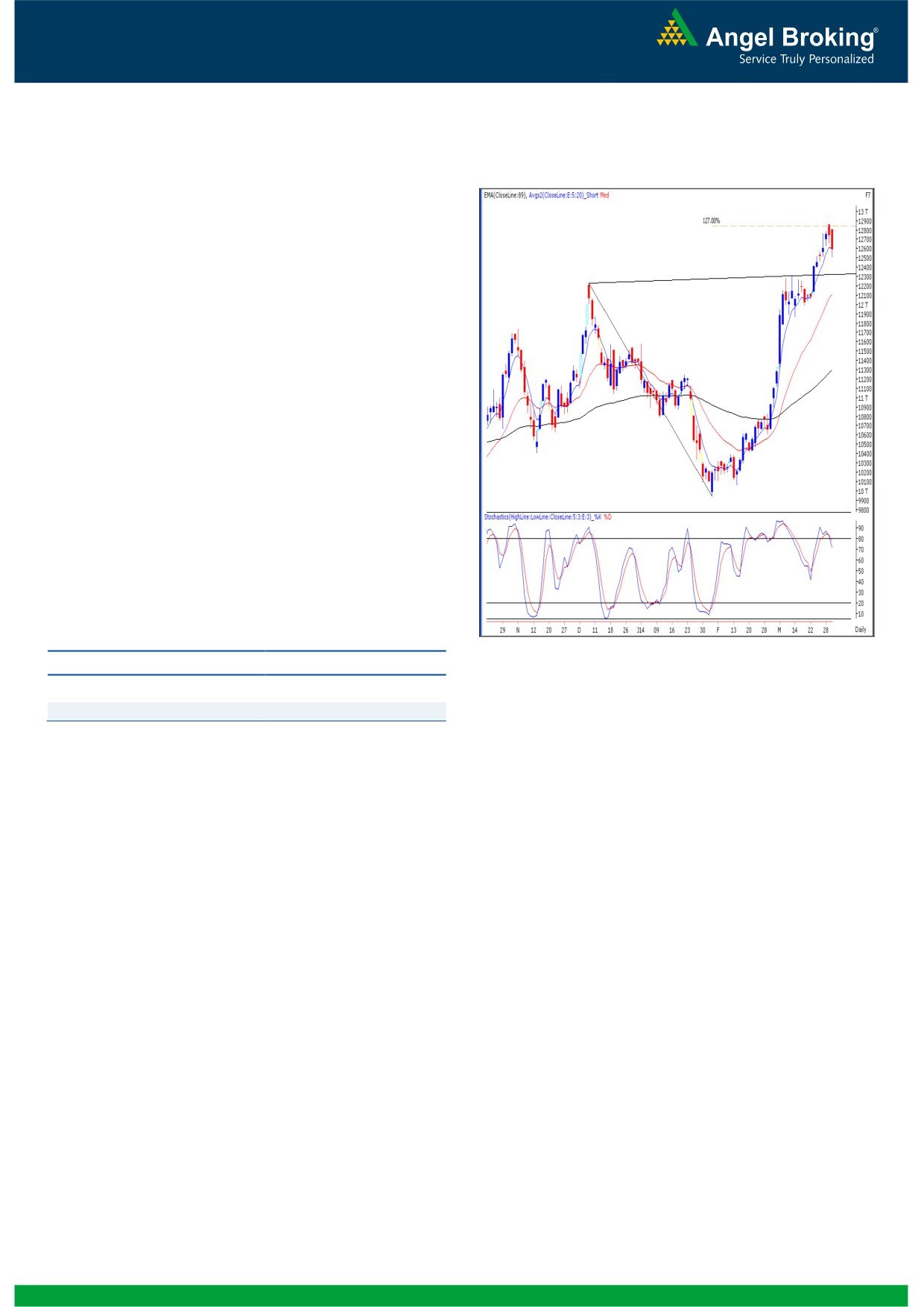

Exhibit 1: Nifty Daily Chart

Yesterday, our benchmark index opened on a muted note

considering quiet mood across the globe. Once again index

witnessed a modest profit booking near day’s high and as a

result slipped inside the negative territory. However, a smart

recovery from day’s low resulted in a closing with nominal

gains. On the sectoral front, the Banking and Realty sectors

were sunder pressure; whereas the IT, TECH and Consumer

Durables counters were the major gainers. The advance to

decline ratio was strongly in favor of the advancing counters.

Formation

The ’89-day EMA’ and the ’89-week EMA’ are placed at

21046 / 6265 and 19714 / 5903 levels, respectively.

The ’20-day EMA’ and the ‘20-week EMA’ are placed at

21761 / 6493 and 21061 / 6272 levels, respectively.

Source: Falcon

Trading strategy:

Actionable points:

Our markets opened on a flat note and traded in a narrow

range just ahead of RBI monetary policy announcement. Post

View

Neutral

the event, index shed a bit from day’s high and sneaked below

Resistance Levels

6750 - 6800

the 6700 mark. However, the hourly ’20 EMA’ acted as a

strong support for the index and as a result, strong buying

Support Levels

6675 - 6580

interest among few heavyweight constituents pulled the index

back into the positive territory. Last two sessions’ movement

was quite identical and hence, we are observing yet another

‘Hanging Man’ Japanese candlestick pattern on the daily chart.

An occurrence of such pattern at market top does not bode

well for the bulls. But, we reiterate that considering monthly

breakout from the ‘Ascending Triangle’, we can only expect a

near term correction towards 6580 - 6540 levels if the Nifty

manages to close below yesterday’s low of 6675. On the

higher side, 6750 - 6800 are seen as an immediate resistance

zone for the market. We reiterate that traders should adopt a

stock centric approach and avoid taking undue risk.

1

Daily Technical Report

April 02, 2014

Bank Nifty Outlook - (12589)

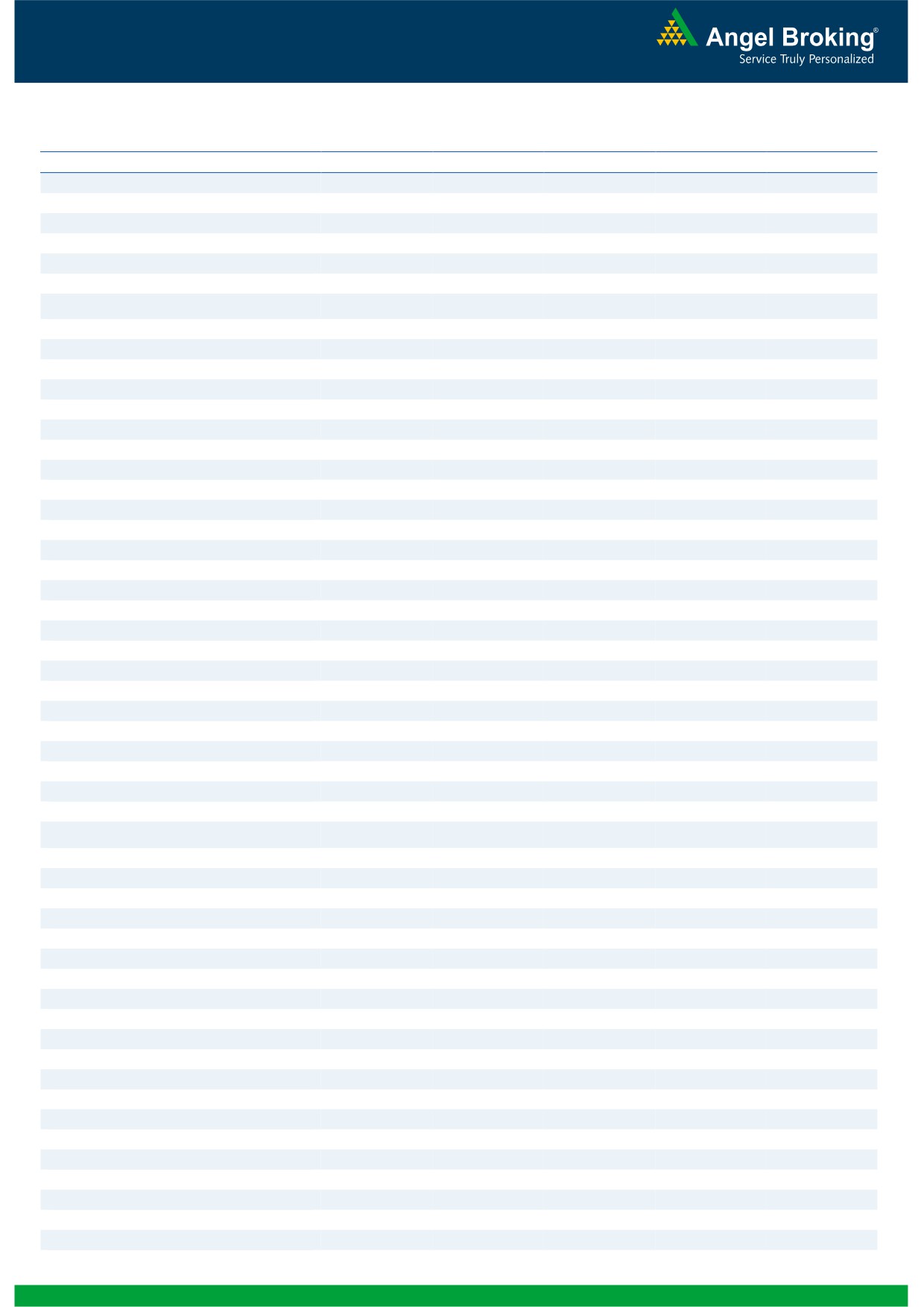

Exhibit 2: Bank Nifty Daily Chart

Unlike our benchmark index, the Bank Nifty opened

slightly lower and remained cautious before the event.

Post the announcement, the banking conglomerates

started facing immense selling pressure, which lasted

almost throughout the session. As a result, the banking

index shed more than a percent as compared to the

previous week. In our previous report, we had clearly

mentioned that Bank Nifty is facing a strong resistance

around the 127% Fibonacci retracement level of the fall

from 12226 (high on December 09, 2013) to 9944 (low

on February 04, 2014). As expected, a sustainable move

below Monday’s low of 12660 led to a correction towards

the immediate support level of 12570. Going forward, if

the selling pressure persists then the Bank Nifty may slide

towards 12470 - 12350 levels. On the flipside, 12700 -

12869 levels would now act as immediate resistance for

the banking index.

Actionable points:

Source: Falcon

View

Neutral

Support Levels

12470 - 12350

Resistance Level

12700 - 12869

2

Daily Technical Report

April 02, 2014

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

22,219

22,333

22,409

22,523

22,599

NIFTY

6,653

6,687

6,710

6,744

6,766

BANKNIFTY

12,339

12,464

12,635

12,760

12,931

ACC

1,358

1,374

1,387

1,402

1,415

AMBUJACEM

195

199

202

206

209

ASIANPAINT

523

530

539

546

555

1,442

1,455

1,467

1,480

1,492

AXISBANK

BAJAJ-AUTO

2,026

2,046

2,065

2,084

2,104

BANKBARODA

705

721

731

747

757

BHARTIARTL

307

311

316

321

326

BHEL

188

191

195

198

202

BPCL

433

440

452

459

471

CAIRN

323

334

343

353

362

CIPLA

376

379

382

385

389

COALINDIA

278

284

288

294

298

DLF

168

171

175

178

181

DRREDDY

2,554

2,577

2,594

2,617

2,634

GAIL

368

371

374

378

381

GRASIM

2,805

2,827

2,864

2,887

2,924

HCLTECH

1,386

1,402

1,416

1,432

1,445

HDFC

860

875

885

899

909

HDFCBANK

720

729

741

750

762

HEROMOTOCO

2,216

2,233

2,259

2,276

2,302

HINDALCO

133

135

139

142

145

HINDUNILVR

589

595

602

608

614

ICICIBANK

1,194

1,209

1,234

1,249

1,273

IDFC

115

119

122

126

129

INDUSINDBK

486

493

498

505

511

INFY

3,255

3,284

3,305

3,334

3,355

ITC

343

347

350

355

358

JINDALSTEL

287

291

296

300

304

JPASSOCIAT

51

52

53

54

55

736

750

766

780

796

KOTAKBANK

LT

1,238

1,259

1,274

1,295

1,310

LUPIN

927

936

943

952

959

M&M

972

986

995

1,009

1,017

MARUTI

1,886

1,909

1,944

1,967

2,002

NMDC

135

136

138

140

142

NTPC

118

120

121

123

124

ONGC

317

321

324

327

330

PNB

705

720

735

750

765

POWERGRID

103

106

108

110

112

RANBAXY

361

366

370

375

378

RELIANCE

923

933

939

949

955

RELINFRA

422

428

434

440

446

SBIN

1,832

1,863

1,898

1,929

1,964

SESAGOA

183

188

191

196

199

SUNPHARMA

566

569

573

577

581

TATAMOTORS

396

400

403

407

410

TATAPOWER

82

83

84

85

87

TATASTEEL

380

391

397

408

414

TCS

2,129

2,153

2,169

2,193

2,209

ULTRACEMCO

2,105

2,132

2,159

2,185

2,212

3

Daily Technical Report

April 02, 2014

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Research Team

Sameet Chavan

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4