Daily Technical Report

February 02, 2015

Sensex (29183) / Nifty (8809)

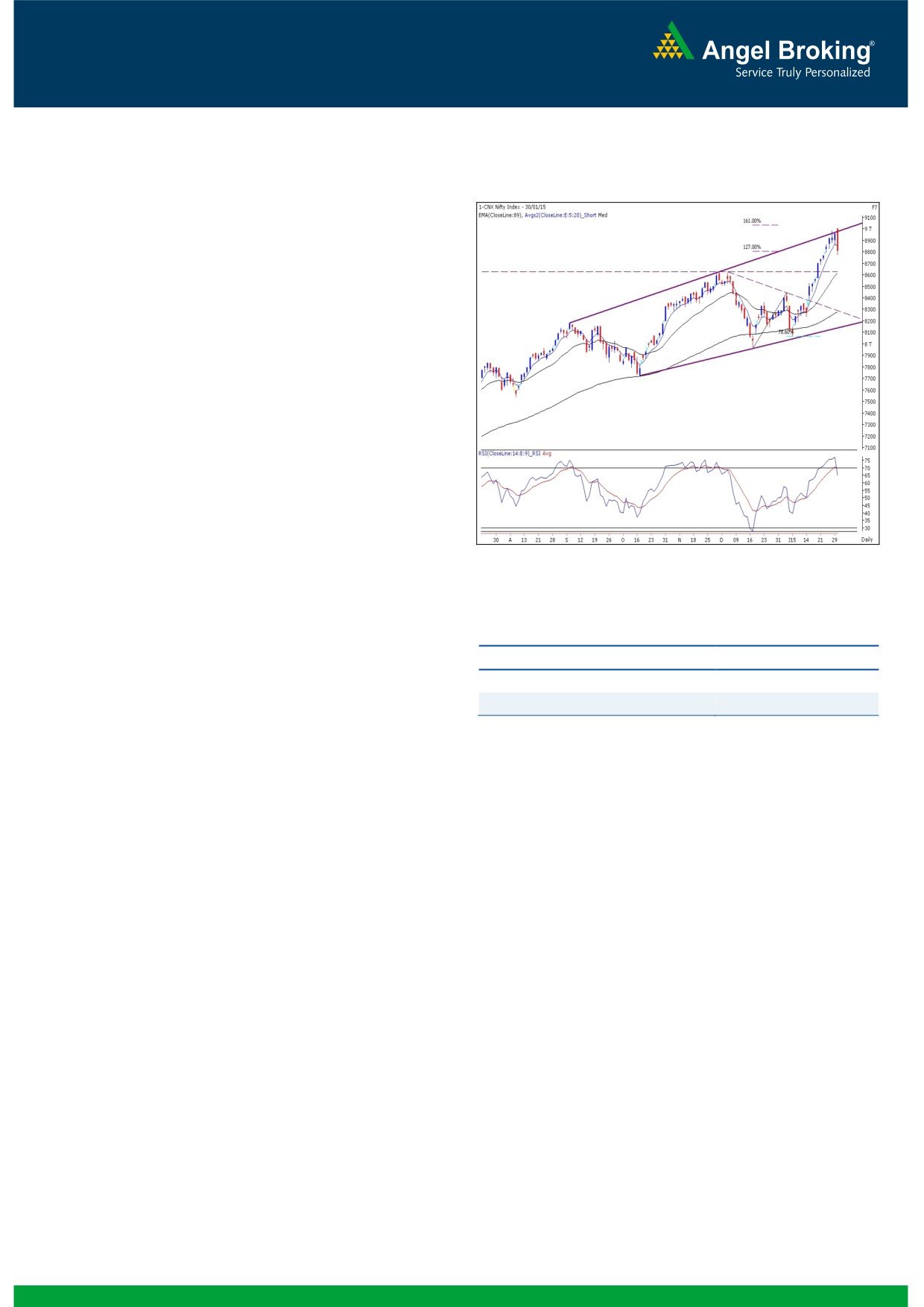

Exhibit 1: Nifty Daily Chart

The concluding session of the week, Friday, opened slightly

higher and the market then traded with immense pessimism

throughout the day owing to poor 3QFY2015 earnings

recorded by some major banking stocks. As a result, the

Nifty closed with more than one and half a percent of loss

for the day. Barring the Realty, Power and IT, all other

sectors ended in the negative territory amongst which the

Banking, Auto and Consumer Durables were the major

losers. The advance to decline ratio was in favor of the

declining

counters.

(A=1194 D=1669) (Source-

Formations

The ’89-day EMA’ and the ’89-week EMA’ are placed

at 27549 / 8276 and 24033 / 7199 levels, respectively.

Source: Falcon

The ’20-day EMA’ and the ‘20-week EMA’ are placed

at 28549 / 8614 and 27605 / 8294 levels, respectively.

Actionable points:

Trading strategy:

The Nifty came near the milestone 9000 mark (although it

View

Neutral

couldn’t surpass it) despite witnessing some amount of

Resistance Levels

8850 - 8920

volatility and uncertainty. The index had a dream run, with it

Support Levels

8775 - 8720

gaining for ten consecutive sessions post the Reserve Bank

of India’s (RBI) surprise 25bp rate cut move on January 15,

2015. However, poor set of earnings by some banking

However, we are in two minds because the Friday’s fall

heavyweights on Friday applied brakes on the ongoing

was mainly led by the financial stocks while we have not

optimism. Finally, the ten-day winning streak came to an

witnessed a weakness across the broader market. The

end as financial stocks tumbled on the concluding session

market has been in a bull trend over the past few months,

of the week. The Nifty missed the magical figure of 9000 by

and the few whipsaws we saw are a part of the market’s

a whisker (posting a high of 8996.60). In our previous

trending pattern as has been seen during previous bull

report, we had clearly mentioned about the Nifty continuing

runs. Thus, in order to form a near term directional view,

it’s up move towards the 8950 - 9000 levels; the index

we would want to closely observe the coming Monday’s

trended in line with our anticipation. We had also stated the

price action. The first scenario would be that if the Nifty

possibility

of some profit booking around the

sustains below the 8850 mark and then witnesses a

aforementioned levels, which materialized as well.

strong selling pressure in the heavyweight counters, then

the possibility of a near term correction towards 8700 -

The Nifty has now closed below its ‘5-Day EMA’ level of

8650 increases. In the other scenario, if the Nifty

8850 for the first time in the last eleven trading session.

manages to regain its position beyond the 8850 mark

Generally, a closing below this short term moving average

convincingly, then it may resume its higher degree

after a vertical rally indicates exhaustion of the trend or

uptrend to move towards 9000 - 9050 levels.

weakness in the near term. The daily ‘RSI’ momentum

oscillator too has turned down from the overbought

The coming week may witness some volatility on the back

territory, to confirm a negative crossover. Going by these

of important events like the RBI’s monetary policy on

technical evidences, and the Nifty facing a strong resistance

Tuesday. It’s advisable to trade with proper stop losses

around the 161% reciprocal retracement of the fall from

and avoid taking undue risks.

8626.95 to 7961.35, coupled with the depiction of the

higher end of the ‘Megaphone’ pattern on the weekly chart;

the possibility of a further correction towards 8700 - 8650

on the Nifty cannot be ruled out.

1

Daily Technical Report

February 02, 2015

Bank Nifty Outlook - (19844)

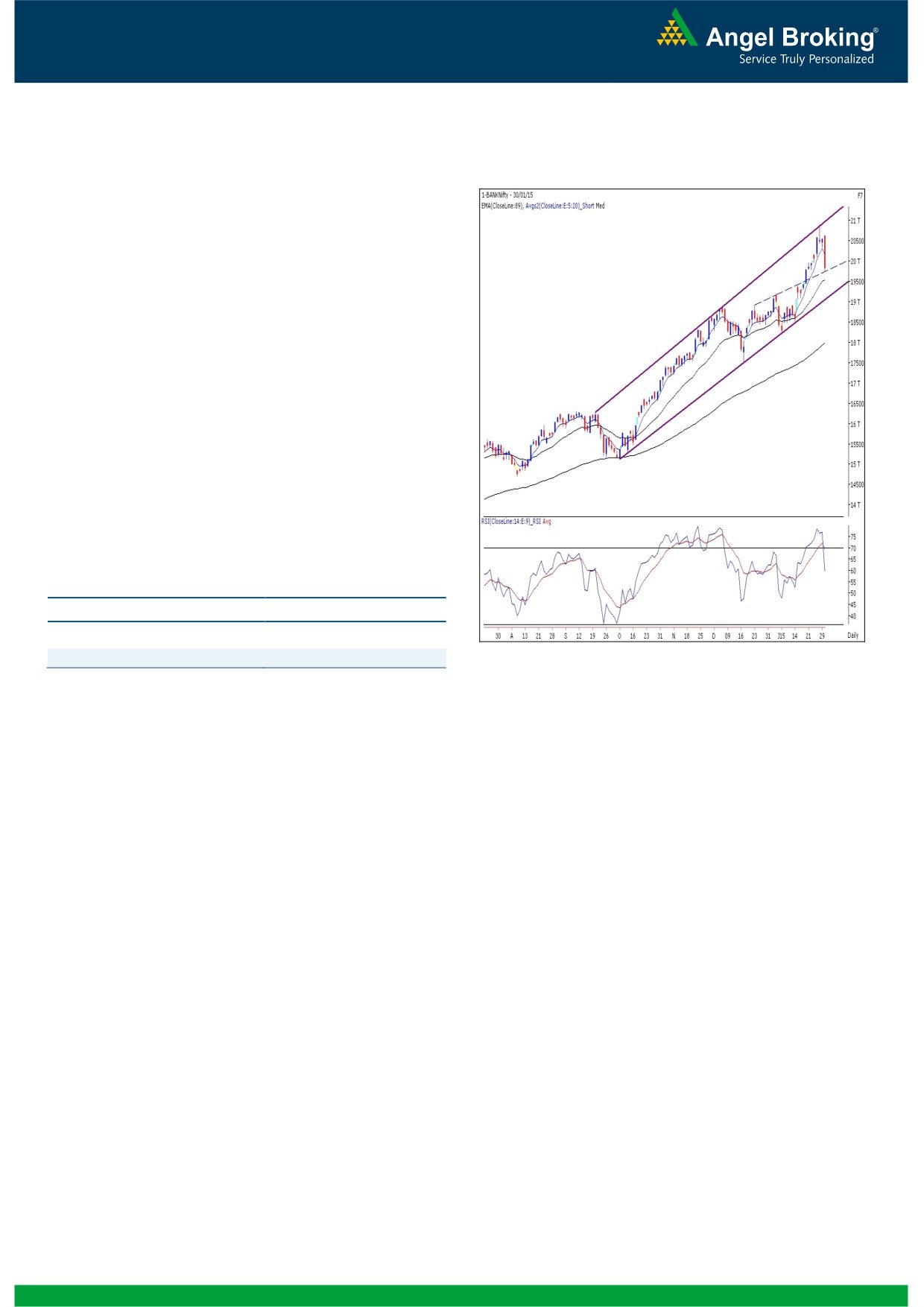

Exhibit 2: Bank Nifty Daily Chart

On Friday, the Bank Nifty too opened slightly higher and

then tumbled by more than three percent on the back of

poor set of Q3FY2015 numbers by the banking

heavyweights, the ICICI Bank and Bank of Baroda. The

Bank Nifty witnessed a tremendous selling pressure

immediately after the violation of Thursday’s low of

20338. The index couldn’t even stop at 20100 - 20000

levels. At this juncture, the Bank Nifty has reached it’s

hourly ’89 EMA’ level of 19800, which can be considered

as a strong support. Going forward, we may see

immediate bounce back towards 20000 - 20100 levels.

However, if the index fails to sustain beyond 20100 then

we may see Bank Nifty re-testing 19800 - 19700 levels.

The correction may extend towards 19500 - 19400 levels

if the index slips below the 19700 mark. Similar to the

Nifty, we would closely observe above mentioned levels.

Actionable points:

View

Neutral

Resistance Levels

20000 - 20100

Source: Falcon

Support Level

19700

2

Daily Technical Report

February 02, 2015

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Research Team

Sameet Chavan

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4