Daily Technical Report

October 01, 2013

Sensex (19380) / NIFTY (5735)

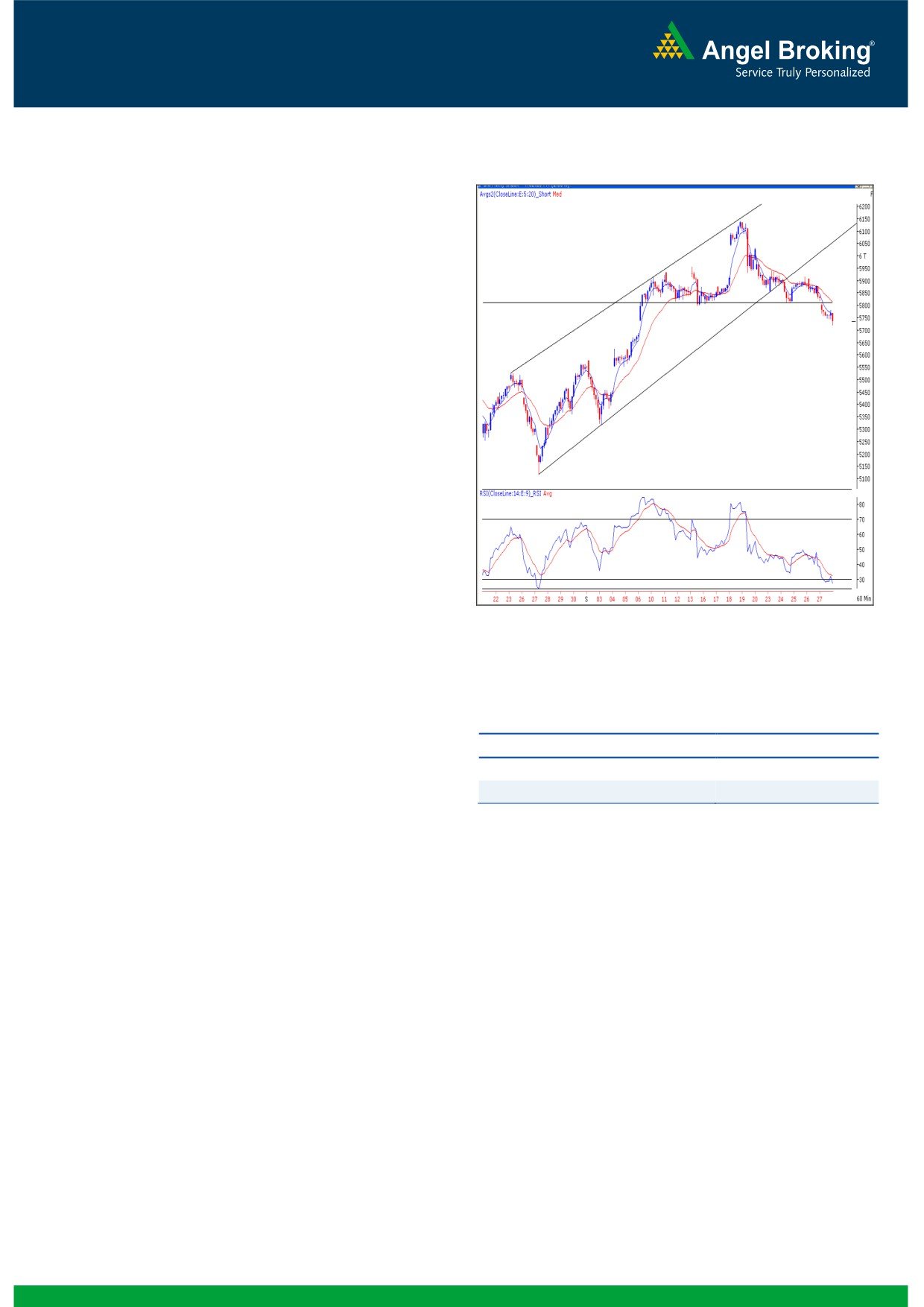

Exhibit 1: Nifty Hourly Chart

The opening session of the week began with half a percent

downside gap as indicated by the SGX Nifty. Selling pressure

intensified as the day progresses and as a result, the index

shed more than one and half a percent during the session.

Except IT sector, all other sectors closed in the negative

territory. The decline was mainly led by the rate sensitive

counters like, Capital goods, Banking, Metal and Realty. The

advance to decline ratio was strongly in the favor of declining

Formation

The ’89-day EMA’ and the ’89-week EMA’ are placed at

19347 / 5764 and 18722 / 5635 levels, respectively.

The ’20-day EMA’ and the ‘20-week EMA’ are placed at

19613 / 5799 and 19377 / 5775 levels, respectively.

The daily and monthly ‘RSI-Smoothened’ oscillator is

negatively poised.

The previous week’s candle resembles a ‘Spinning Top’

Japanese candlestick pattern.

Source: Falcon

On a closing basis, the ‘Lower Top - Lower Bottom’

formation on the weekly chart is still intact (Nifty).

Actionable points:

The 38.2% and 50% Fibonacci retracement levels of the

rise from 5118 (weekly low of August 30, 2013) to 6143

View

Bearish below 5718

(weekly high of September 20, 2013) are placed at 5750

and 5630, respectively.

Resistance Level

5810

Expected Targets

5630 - 5550

Trading strategy:

Friday’s weak closing was followed by a gap down opening

considering weak global cues. The index then immediately

slipped below the important weekly low of 5798. This price

action triggered immense pessimism among market

participants. As expected, the Nifty then headed towards the

initial target of 5750 and eventually, closed lower than this

level. Considering the negative placement of daily momentum

oscillators and the ADX (9) indicator, we expect the negative

momentum to continue in coming trading session as well. In

this scenario, the index may test 50% Fibonacci retracement

level of the rise from 5118 (weekly low of August 30, 2013) to

6143 (weekly high of September 20, 2013, which is placed at

5630. However, in case of extreme pessimism, the index may

even test 5550 level. On the flipside, yesterday’s high of 5810

would act as immediate resistance for the index. Any news with

regards to the US debt ceiling may have a significant impact

on the markets and traders are advised to stay light on

positions before clarity emerges on that front.

1

Daily Technical Report

October 01, 2013

Bank Nifty Outlook - (9618)

Exhibit 2: Bank Nifty Weekly Chart

Yesterday, in-line with our benchmark index, the Bank

Nifty too opened lower with a percent gap. Subsequently,

the index traded within a narrow range for major part of

the session. However, volatility increased during the

concluding hour and in the process, the Bank Nifty

plummeted significantly to close at the lows of the session.

The index precisely met with our initial target of 9700.

Going forward, considering the negative chart structure,

and weak placement of the weekly momentum oscillators,

we expect the Bank Nifty to test 9405 - 9280 levels. On

the flipside, 9730 - 9815 levels would now act as a strong

resistance zone.

Actionable points:

View

Bearish Below 9580

Expected Targets

9405 - 9280

Resistance Levels

9730 - 9815

Source: Falcon

2

Daily Technical Report

October 01, 2013

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX z

19,102

19,215

19,433

19,545

19,764

NIFTY

5,663

5,699

5,755

5,791

5,846

BANKNIFTY

9,446

9,532

9,674

9,759

9,901

ACC

1,073

1,093

1,105

1,125

1,137

AMBUJACEM

179

181

183

185

188

ASIANPAINT

448

454

462

468

476

AXISBANK

983

995

1,008

1,020

1,032

BAJAJ-AUTO

1,957

1,972

1,993

2,008

2,029

BANKBARODA

477

485

491

500

506

BHARTIARTL

307

313

318

323

328

BHEL

132

135

138

140

143

BPCL

322

327

332

336

342

CAIRN

313

316

318

321

324

CIPLA

426

429

434

437

442

COALINDIA

284

289

298

304

313

DLF

124

126

129

131

134

DRREDDY

2,336

2,359

2,390

2,412

2,443

GAIL

315

321

326

333

337

GRASIM

2,596

2,621

2,652

2,678

2,709

HCLTECH

1,056

1,071

1,088

1,103

1,120

HDFC

742

753

767

778

791

HDFCBANK

573

583

598

608

623

HEROMOTOCO

1,929

1,969

2,008

2,049

2,088

HINDALCO

109

110

112

114

115

HINDUNILVR

613

620

626

633

639

ICICIBANK

856

870

893

907

930

IDFC

85

87

88

89

90

INDUSINDBK

355

362

368

375

382

INFY

2,964

2,989

3,022

3,046

3,079

ITC

334

337

342

345

350

JINDALSTEL

229

232

235

238

241

JPASSOCIAT

34

34

35

36

37

KOTAKBANK

658

668

679

689

699

LT

766

777

795

807

824

LUPIN

839

847

859

867

878

M&M

799

813

829

843

859

MARUTI

1,324

1,341

1,357

1,375

1,391

NMDC

116

118

121

124

127

NTPC

141

144

147

150

153

ONGC

256

262

268

274

280

PNB

451

456

464

469

477

POWERGRID

96

97

98

99

100

RANBAXY

323

327

332

336

342

RELIANCE

803

813

829

838

854

RELINFRA

356

363

376

383

396

SBIN

1,582

1,598

1,613

1,630

1,645

SESAGOA

176

178

182

184

188

SUNPHARMA

575

584

593

602

611

TATAMOTORS

325

329

334

338

344

TATAPOWER

79

80

81

82

83

TATASTEEL

256

264

274

282

292

TCS

1,895

1,911

1,937

1,953

1,978

ULTRACEMCO

1,764

1,787

1,813

1,836

1,862

3

Daily Technical Report

October 01, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4