Daily Technical Report

June 26, 2013

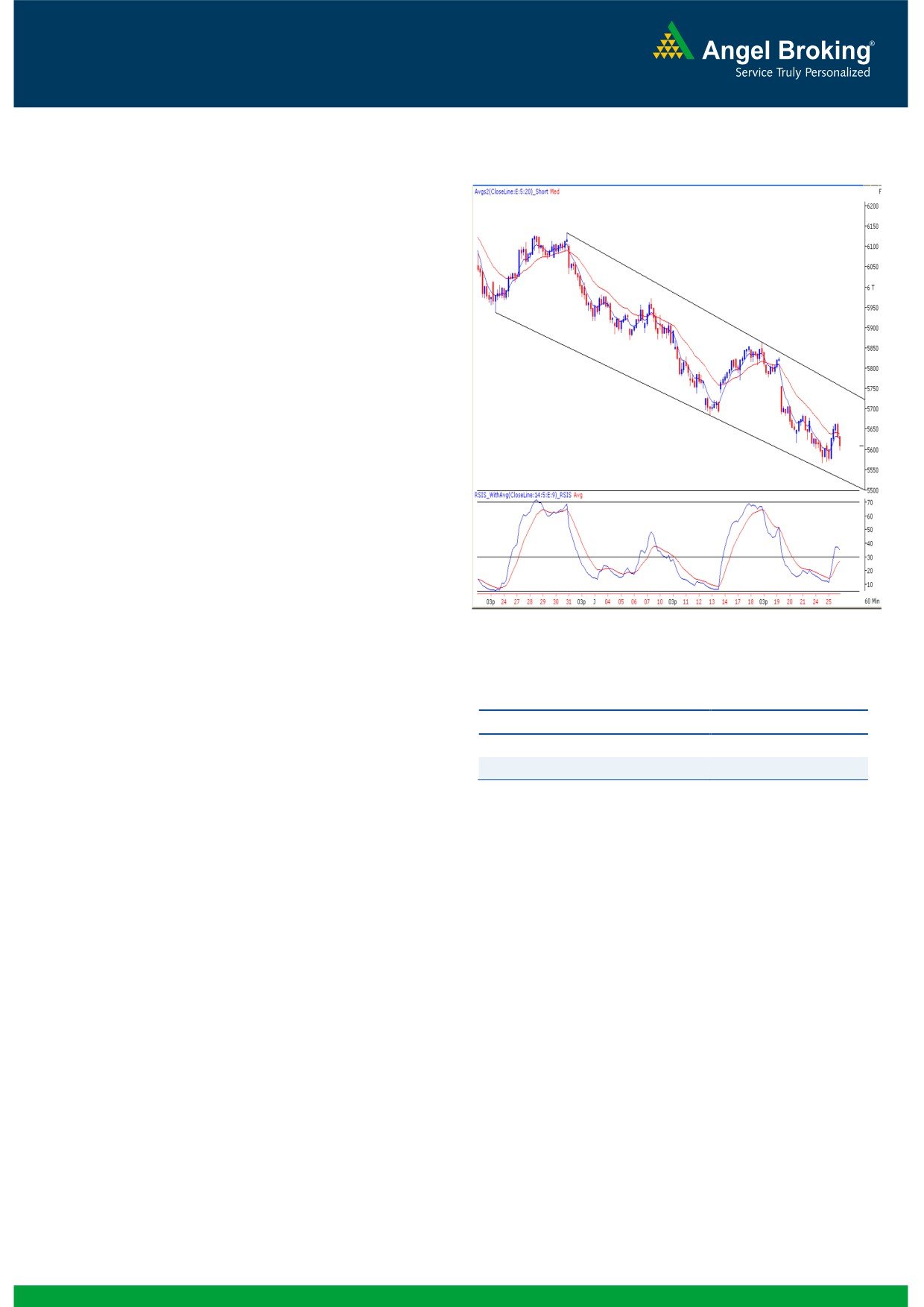

Exhibit 1: Nifty Hourly Chart

Sensex (18629) / NIFTY (5609)

Yesterday, markets opened marginally higher neglecting

negative cues for other major Asian bourses. During the

midsession, indices rallied gradually to post a high of 18801

/ 5666. However, we witnessed massive selling pressure

near day’s high, which eventually dragged indices to close

marginally above the opening point of the day. The Oil &

Gas, Capital Goods and FMCG counters ended with modest

gains; whereas the Power, Consumer Durable and Health

Care sectors remained under pressure throughout the

session. The advance to decline ratio was strongly in favor of

declining counters.

(A=981 D=1313) (Source-

Formation

The ’20-week EMA’ and the ’89-Week EMA’ are placed

at 19230/ 5825 and 18456/ 5585 levels, respectively.

The ’89-day EMA’ and the ‘200-day SMA’ are placed at

Source: Falcon:

19359/ 5866 and 19172 / 5814, respectively.

The weekly ‘RSI-Smoothened’ oscillators, the ‘ADX (9)

Actionable points:

indicator and ‘5 & 20 EMA’ are now signaling a

negative crossover.

View

Neutral

Support Level

5570

Resistance Levels

5666 - 5705

Trading strategy:

Yesterday, indices remained sideways for the initial couple of

hours. As expected, the lower end of the ‘Upward Sloping

Trend Line’ provided decent support for our market. During

the midsession, indices rallied nearly a percent on the back

of positive placement of hourly ‘RSI-Smoothened’ oscillator.

However, we witnessed immense selling near day’s high

which resulted in sharp decline towards the latter part of the

session. The daily chart now depicts a ‘Long Legged Doji’

Japanese candlestick pattern. The said pattern indicates an

uncertainty among the market participants and possibility of

the change in the direction. However, the pattern would be

confirmed only if indices sustain above yesterday’s high of

18801 / 5666. In this scenario, indices may bounce towards

18890 - 19000 / 5705 - 5750 levels. on the flipside, the

said pattern would be negated below the low of 18487 /

5570.

1

Daily Technical Report

June 26, 2013

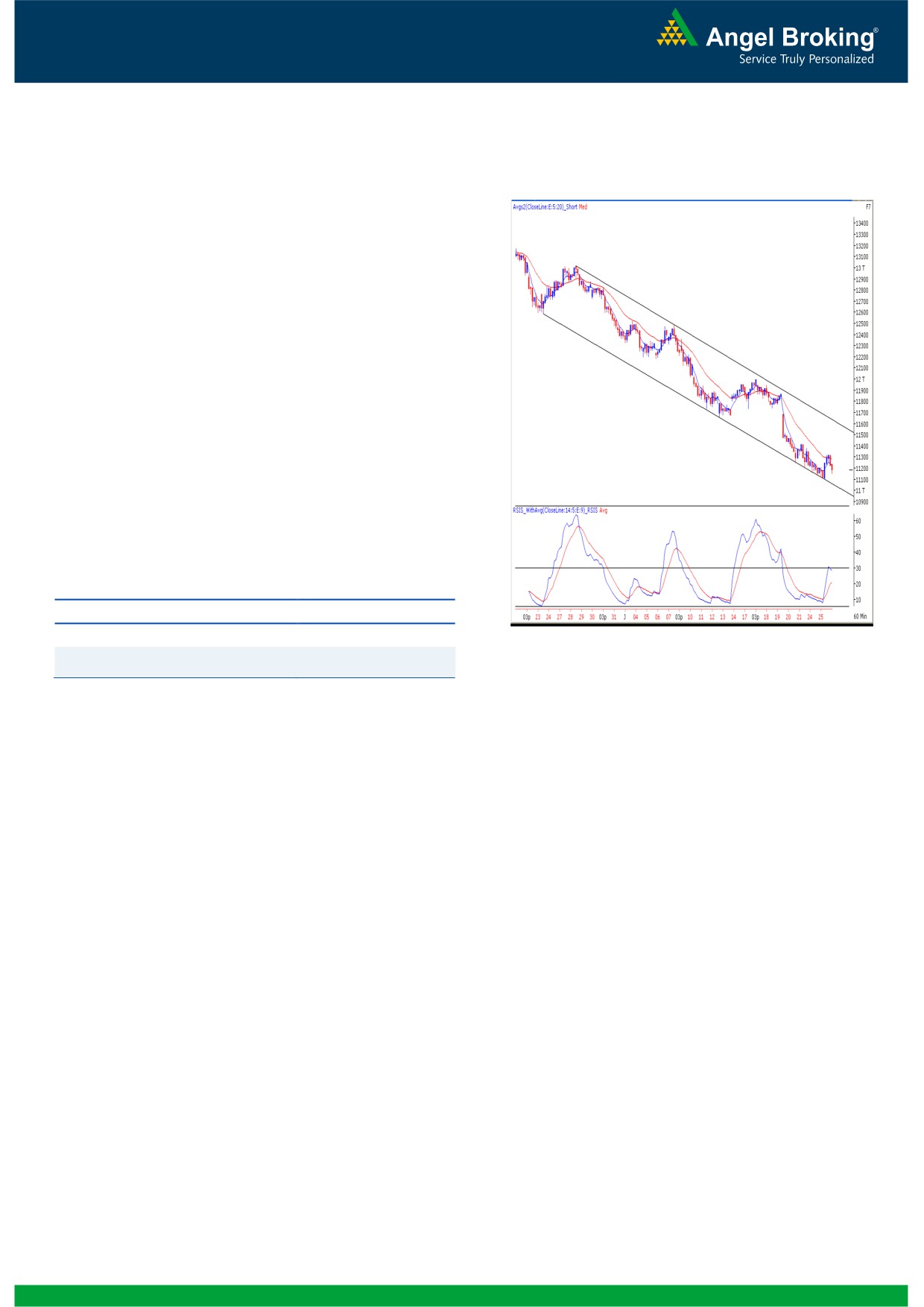

Exhibit 2: Bank Nifty Hourly Chart

Bank Nifty Outlook - (11181)

Unlike our benchmark indices, the Bank Nifty opened on a

quiet note and oscillated within a narrow trading range

throughout the session. During the session, the Bank Nifty

made a valiant attempt to move higher but faced strong

resistance near the hourly ’20 EMA’. As a result, index pared

down all its early gains to close with very minor gain. At this

juncture, the daily chart portrays a ‘Narrow Range’ body

formation, which indicates lack of interest among market

participants. Going forward, if index sustains above

yesterday’s high of 11326, then we may witness an intraday

rally towards 11420 - 11518. Conversely, a breach of

yesterday’s low of 11107 would trigger pessimism in the

market. In this case, the Bank Nifty may slide towards 11000

- 10888.

Actionable points:

View

Neutral

Support Levels

11107 - 11100

Source: Falcon:

Resistance Levels

11326 - 11420

2

Daily Technical Report

June 26, 2013

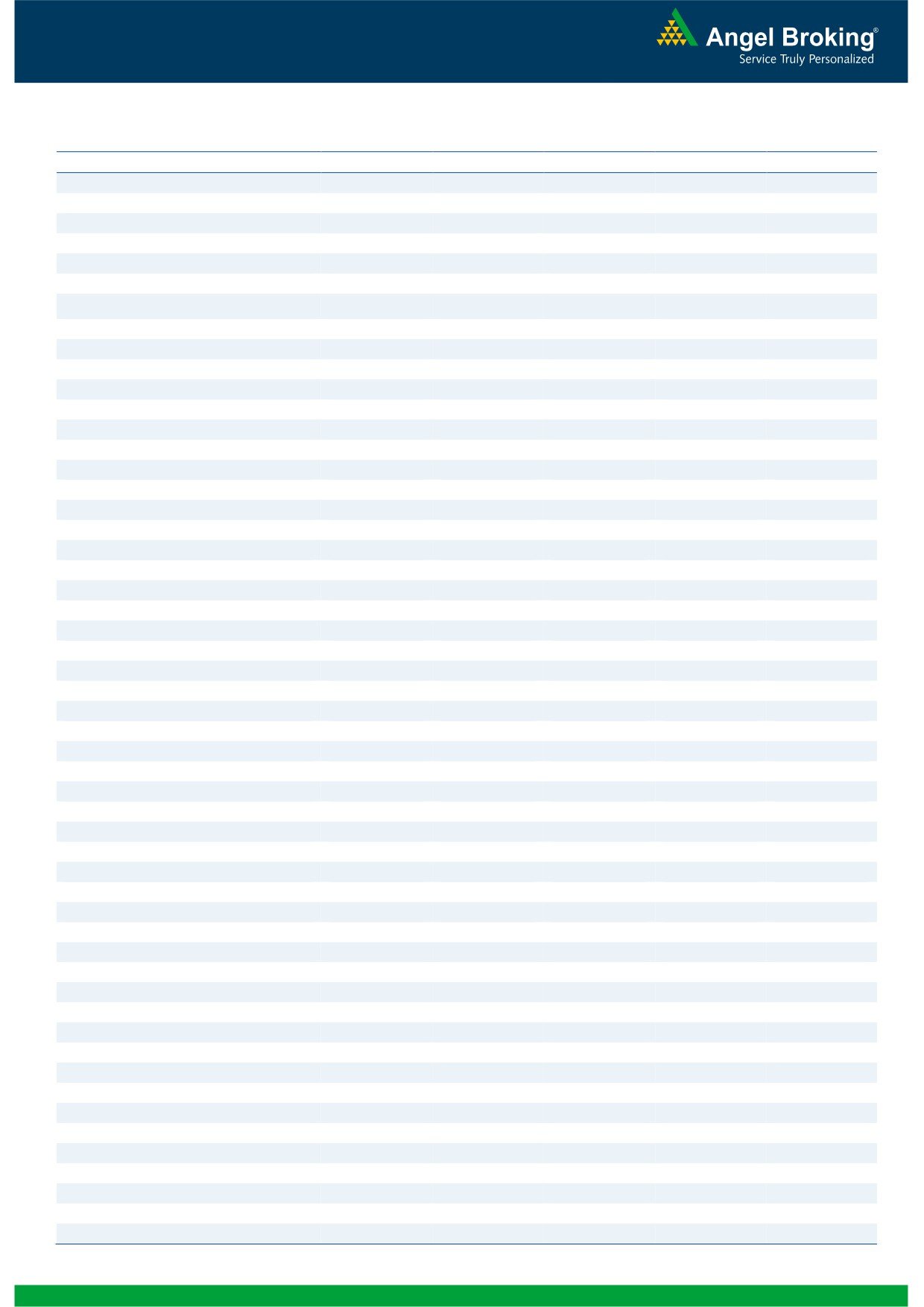

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

18,325

18,477

18,640

18,792

18,955

NIFTY

5,519

5,564

5,615

5,660

5,711

BANKNIFTY

10,987

11,084

11,205

11,302

11,422

ACC

1,144

1,158

1,169

1,183

1,193

AMBUJACEM

175

179

182

186

189

ASIANPAINT

4,229

4,295

4,361

4,428

4,494

AXISBANK

1,185

1,208

1,231

1,254

1,277

BAJAJ-AUTO

1,735

1,767

1,789

1,821

1,842

BANKBARODA

539

553

562

576

585

BHARTIARTL

274

285

291

302

308

BHEL

159

161

164

167

170

BPCL

330

338

345

353

360

CAIRN

265

270

279

284

292

CIPLA

372

376

379

382

385

COALINDIA

285

290

296

300

306

DLF

160

163

167

170

174

DRREDDY

2,062

2,081

2,104

2,123

2,146

GAIL

279

283

286

290

293

GRASIM

2,705

2,749

2,779

2,823

2,853

HCLTECH

732

742

754

764

776

HDFC

796

807

821

832

846

HDFCBANK

610

622

634

646

658

HEROMOTOCO

1,545

1,562

1,581

1,598

1,617

HINDALCO

93

95

97

99

100

HINDUNILVR

578

583

586

591

594

ICICIBANK

1,011

1,022

1,039

1,050

1,068

IDFC

129

131

133

135

138

INDUSINDBK

436

454

467

485

498

INFY

2,327

2,350

2,369

2,392

2,410

ITC

307

313

317

324

328

JINDALSTEL

196

202

208

214

220

JPASSOCIAT

46

49

51

53

55

KOTAKBANK

679

698

712

731

745

LT

1,319

1,343

1,365

1,389

1,411

LUPIN

752

763

781

792

811

M&M

912

935

947

970

982

MARUTI

1,480

1,513

1,535

1,568

1,590

NMDC

96

98

101

103

105

NTPC

133

136

140

142

147

ONGC

294

303

309

317

323

PNB

624

636

651

663

678

POWERGRID

99

101

104

106

109

RANBAXY

285

304

321

341

358

RELIANCE

781

793

806

817

831

RELINFRA

313

322

329

338

345

SBIN

1,871

1,890

1,920

1,938

1,968

SESAGOA

130

132

135

137

139

SUNPHARMA

934

941

950

958

967

TATAMOTORS

267

274

279

287

292

TATAPOWER

77

79

81

82

84

TATASTEEL

258

262

266

270

274

TCS

1,354

1,373

1,400

1,419

1,446

ULTRACEMCO

1,755

1,771

1,791

1,806

1,827

3

Daily Technical Report

June 26, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4