Daily Technical Report

October 30, 2012

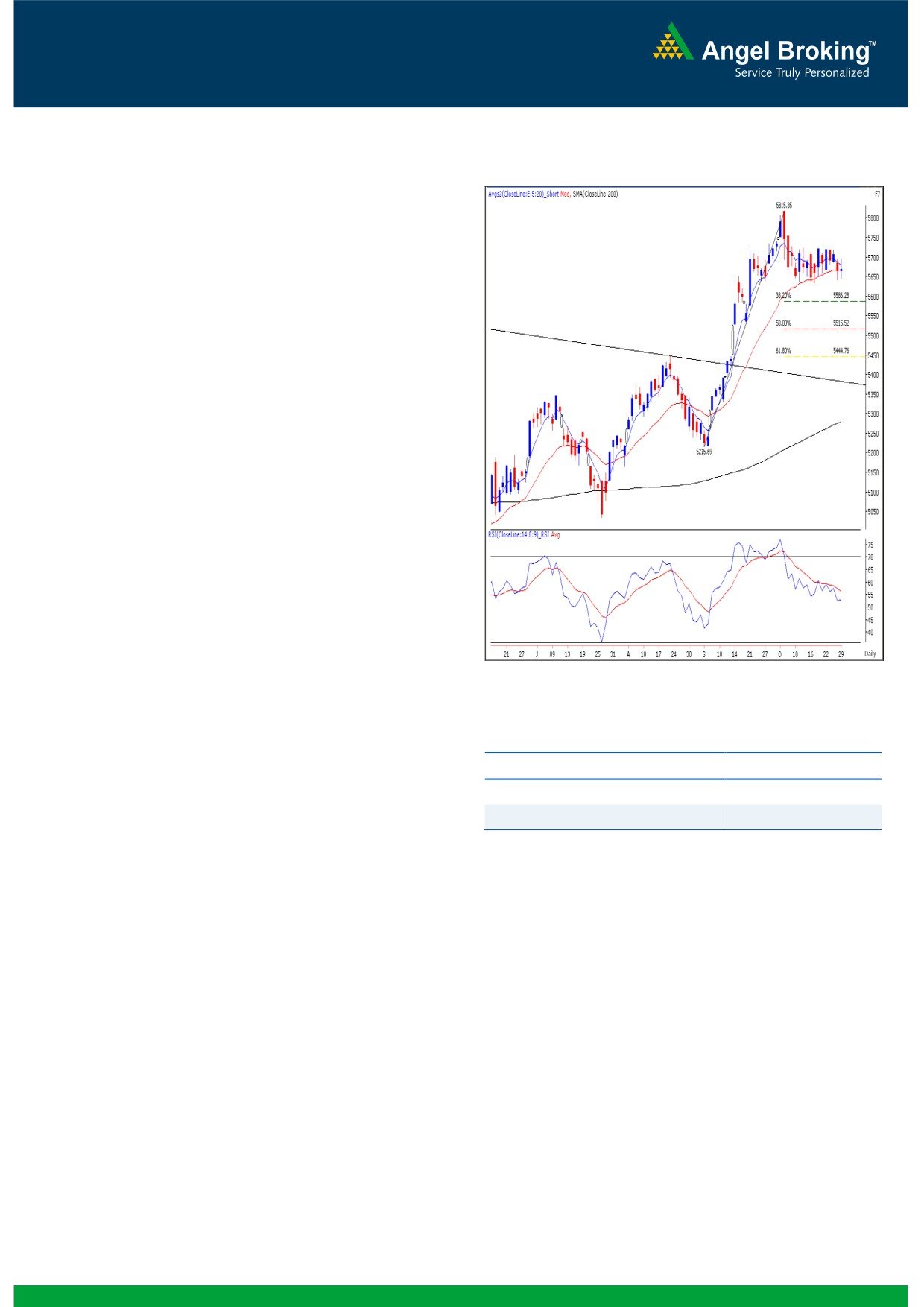

Exhibit 1: Nifty Daily Chart

Sensex (18636) / NIFTY (5666)

The beginning of the week was slightly on the optimistic side,

but once again Indices pared their early gains during the

second half and eventually closed on a flat note. Yesterday,

the Capital Goods, Realty and Power sectors were among

the major draggers; whereas the Oil & Gas heavyweight

Reliance Industries along with Capital Durables counters

supported the market. The advance to decline ratio was

strongly in favor of declining counters (A=1234 D=1604)

Formation

The ’20-day EMA’ and the ’20-week EMA’ are placed at

18650 / 5667 and 17986 / 5456 levels, respectively.

The monthly ‘RSI’ oscillator is moving higher from the 50

mark and the positive in the ADX (9) indicator is intact.

The negative crossover in the weekly ‘Stochastic’

oscillator is still intact.

At present, the value of the Daily ‘RSI’ oscillator is 52.58.

The RSI trading above the 50 mark shows strength of the

current up trend.

Source: Falcon:

The 38.2% and 50% Fibonacci Retracement levels of the

rise from 17250 to 19138 / 5216 to 5815 are placed at

Actionable points:

18416 / 5586 and 18194 / 5515, respectively.

View for the day

Neutral

Trading strategy:

Resistance Levels

5729 - 5757

Every trading session is proving out to be a replica of the

Support Levels

5633 - 5586

previous trading sessions. It’s been 14 trading sessions that

we have been experiencing a range-bound activity. The

Conversely, a breach of 18535 / 5633 level may trigger near-

markets are clearly awaiting some trigger on the domestic or

term pessimism in the market and as a result, the market may

the global front and today’s RBI Monetary Policy might just

slide towards 18416 / 5586 and 18194 / 5515, which are

be the event traders are looking for. The technical levels are

38.2% and 50% Fibonacci Retracement levels of the rise from

still unchanged. We continue to mention that the sustainable

17250 to 19138 / 5216 to 5815, respectively. Traders are

breakout or breakdown on either side of the trading range

advised to trade with strict stop losses as we expect the volatility

(18886 to 18535 /

5729 to 5633) will provide clear

to increase on account of the RBI monetary policy.

direction for our market. A move beyond 18886 / 5729 level

may push indices higher towards 18973 - 19138 / 5757 -

5816. A move beyond 19138 / 5816 would attract further

buying in the market and as a result, the up move may

extend towards 19542 - 19812 / 5850 - 5945 levels.

1

Daily Technical Report

October 30, 2012

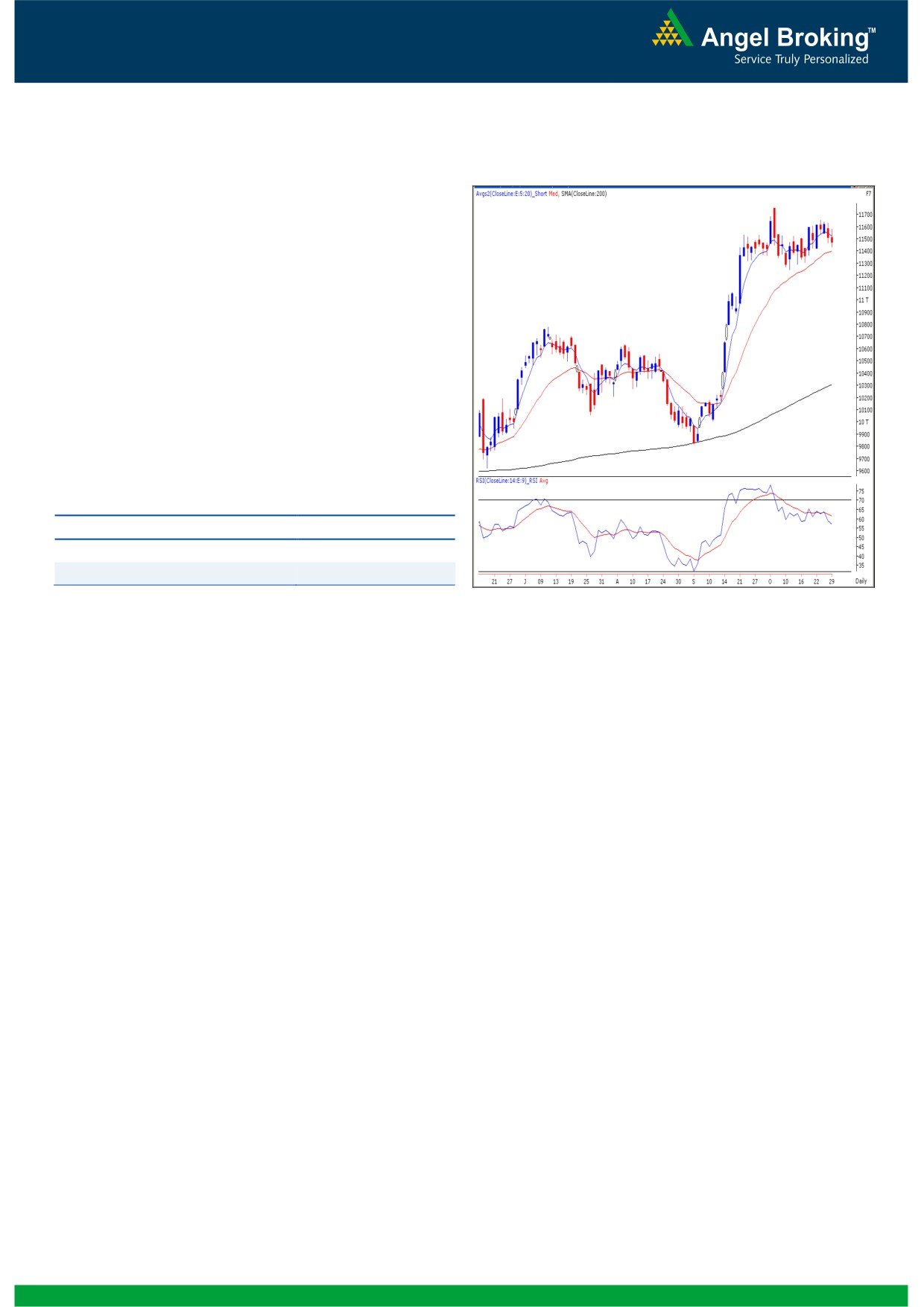

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (11472)

Yesterday, Bank Nifty opened on a pessimistic note and

traded in a narrow range throughout the session. The

momentum oscillator “Stochastic” on the daily chart

continues with its sell signal. In addition, now we are

witnessing a negative crossover in “RSI- Smoothened”

oscillator on the daily chart. The impact of the negative

crossover would be seen if the index sustains below

yesterday’s low of 11432. In this case the index is likely to

drift towards 11364 - 11303 levels. On the upside 11535

- 11598 levels are likely to act as resistance for the day.

Actionable points:

View for the day

Bearish Below 11432

Expected Targets

11364 - 11303

Resistance Levels

11535 - 11598

Source: Falcon:

2

Daily Technical Report

October 30, 2012

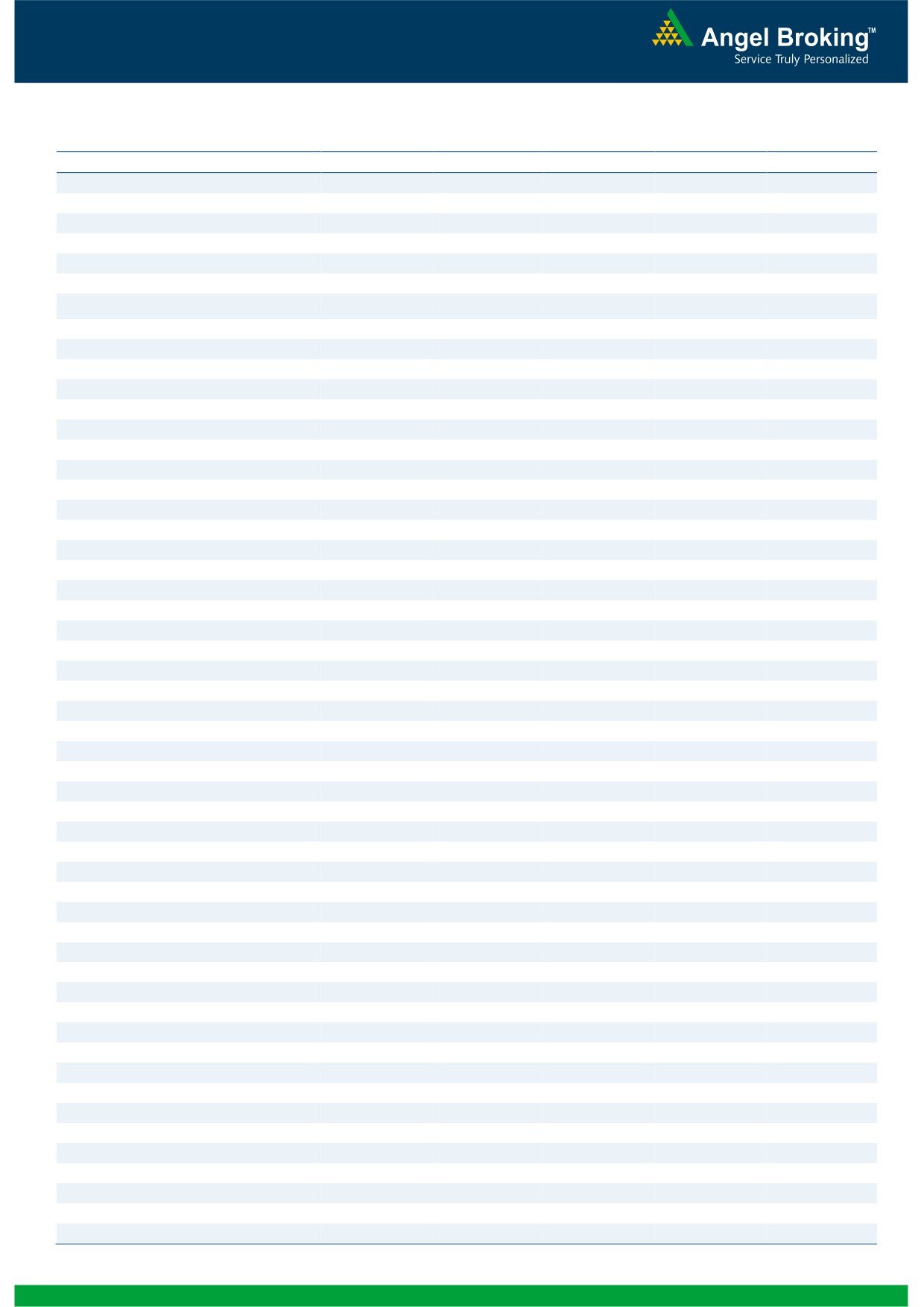

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

18,479

18,557

18,650

18,729

18,822

NIFTY

5,616

5,641

5,670

5,694

5,723

BANKNIFTY

11,343

11,407

11,497

11,561

11,650

ACC

1,397

1,406

1,413

1,422

1,429

AMBUJACEM

206

208

210

211

213

ASIANPAINT

3,869

3,900

3,924

3,955

3,979

AXISBANK

1,198

1,210

1,225

1,237

1,252

BAJAJ-AUTO

1,780

1,795

1,804

1,819

1,828

BANKBARODA

741

748

756

763

771

BHARTIARTL

264

267

269

272

274

BHEL

214

220

233

239

252

BPCL

338

340

345

347

351

CAIRN

333

334

336

337

338

CIPLA

354

357

359

362

364

COALINDIA

344

347

352

355

360

DLF

198

201

204

206

209

DRREDDY

1,671

1,684

1,695

1,708

1,718

GAIL

353

357

362

366

371

GRASIM

3,317

3,349

3,397

3,429

3,478

HCLTECH

602

606

610

614

618

HDFC

746

752

757

763

768

HDFCBANK

633

637

640

644

647

HEROMOTOCO

1,846

1,875

1,898

1,927

1,949

HINDALCO

112

113

114

115

116

HINDUNILVR

536

541

546

552

557

ICICIBANK

1,051

1,060

1,072

1,081

1,093

IDFC

156

157

158

160

161

INFY

2,296

2,316

2,327

2,347

2,359

ITC

284

286

288

290

292

JINDALSTEL

378

383

390

395

402

JPASSOCIAT

87

89

90

92

93

KOTAKBANK

600

605

613

618

627

LT

1,660

1,674

1,697

1,711

1,734

LUPIN

556

561

568

572

580

M&M

874

881

890

898

907

MARUTI

1,344

1,353

1,363

1,372

1,382

NTPC

165

166

168

170

171

ONGC

271

273

275

276

278

PNB

734

745

754

765

774

POWERGRID

113

114

115

116

116

RANBAXY

512

518

524

530

536

RELIANCE

797

804

809

816

821

RELINFRA

479

487

492

499

504

SBIN

2,129

2,148

2,176

2,196

2,224

SESAGOA

164

166

169

171

174

SIEMENS

671

679

684

692

696

SUNPHARMA

676

682

686

692

697

TATAMOTORS

248

253

258

263

269

TATAPOWER

104

105

106

108

108

TATASTEEL

397

399

402

405

407

TCS

1,291

1,300

1,310

1,319

1,329

ULTRACEMCO

2,010

2,023

2,035

2,047

2,059

WIPRO

335

340

343

348

351

3

Daily Technical Report

October 30, 2012

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4