Daily Technical Report

October 29, 2012

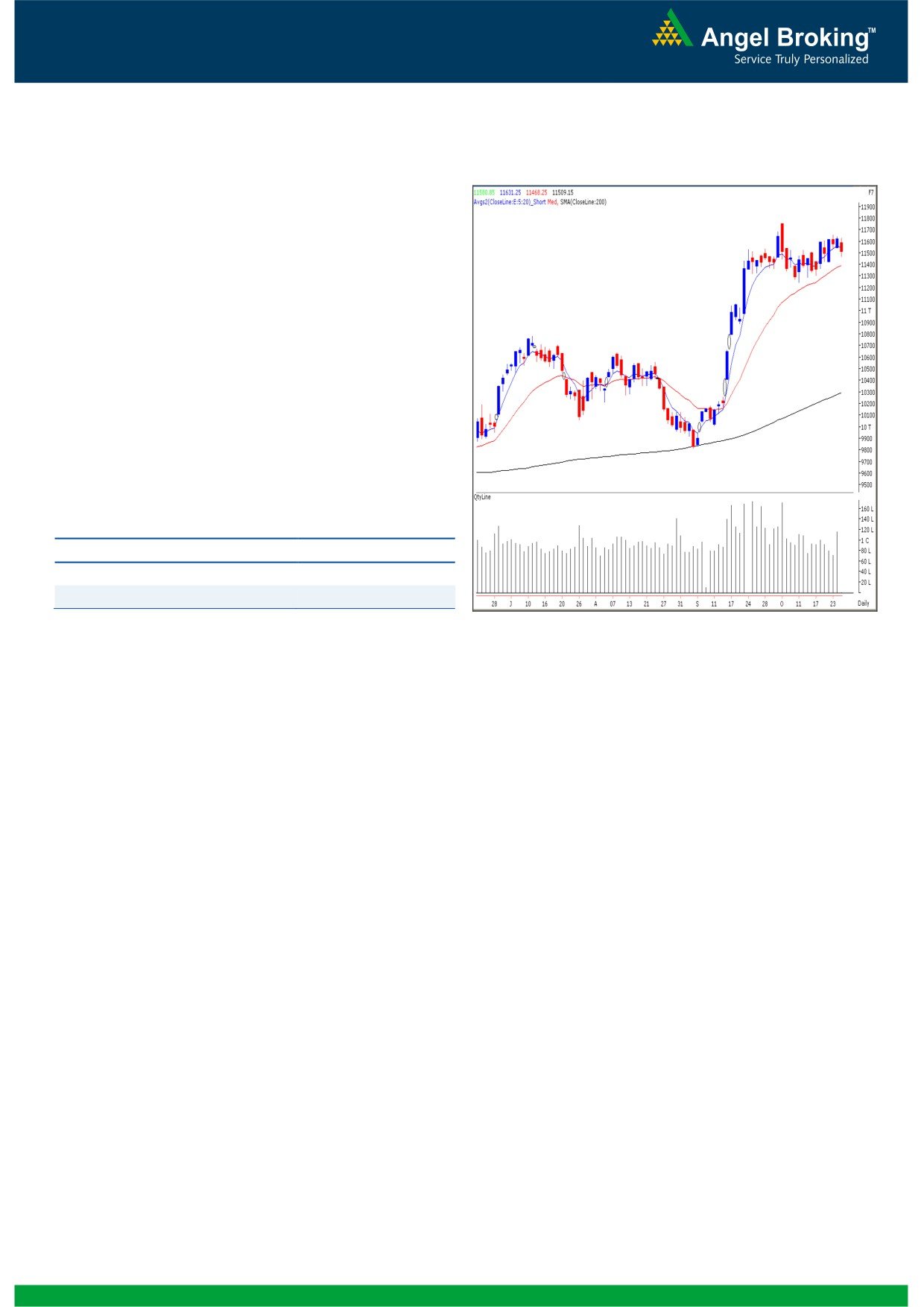

Exhibit 1: Nifty Daily Chart

Sensex (18625) / NIFTY (5664)

The first day of November series ended with weakness on

Friday where our Indices closed in red on the back of fall in

global markets and weakness in FMCG. However, markets

are still in the range of 5729 - 5633 levels. On sectoral

front, Consumer Durables and FMCG counters contributed

heavily in Friday’s fall. Auto counters remained resilient on

the back of M&M results. The advance to decline ratio was

strongly in favor of declining counters (A=1030 D=1801)

Formation

The ’20-day EMA’ and the ’20-week EMA’ are placed at

18650 / 5667 and 17986 / 5456 levels, respectively.

The monthly ‘RSI’ oscillator is moving higher from the 50

mark and the positive in the ADX (9) indicator is intact.

The negative crossover in the weekly ‘Stochastic’

oscillator is still intact.

At present, the value of the Daily ‘RSI’ oscillator is 52.58.

The RSI trading above the 50 mark shows strength of the

Source: Falcon:

current up trend.

Actionable points:

The 38.2% and 50% Fibonacci Retracement levels of the

rise from 17250 to 19138 / 5216 to 5815 are placed at

View for the day

Neutral

18416 / 5586 and 18194 / 5515, respectively.

Resistance Levels

5729 - 5757

Trading strategy:

Support Levels

5633 - 5586

The boredom continues in the market as prices are reluctant

to move out of the narrow trading range. It’s been nearly 10

On the flipside, the weekly ‘Stochastic’ is still negatively poised.

- 12 trading sessions that we have been experiencing a

The impact of this technical tool would be seen if indices

range-bound activity. As a result, the hourly chart now

sustain below 18535 / 5633. This may trigger near-term

depicts a ‘Channel’ pattern. Hence, we would continue to

pessimism in the market and as a result, the market may slide

await the sustainable breakout on either side from the

towards 18416 / 5586 and 18194 / 5515, which are 38.2%

trading range (breakout from the ‘Channel’ pattern) of

and 50% Fibonacci Retracement levels of the rise from 17250

18886 to 18535 / 5729 to 5633. The

’20-day EMA’

to 19138 / 5216 to 5815, respectively. Traders are advised to

continues to provide decent support to our market and the

trade with strict stop losses as we expect the volatility to

‘RSI’ oscillator is still above the 50 mark. As long as the ‘RSI’

increase post announcement of the RBI monetary policy.

oscillator stays above the 50 mark, the probability of the

market breaking out of the upper range of the ‘Channel’ i.e.

18886 / 5729 cannot be ruled out. In this scenario, we may

see a rally towards 18973 - 19138 / 5757 - 5816. A move

beyond 19138 / 5816 would attract immense optimism in

the market and as a result, the up move will get extended

towards 19542 - 19812 / 5850 - 5945 levels.

1

Daily Technical Report

October 29, 2012

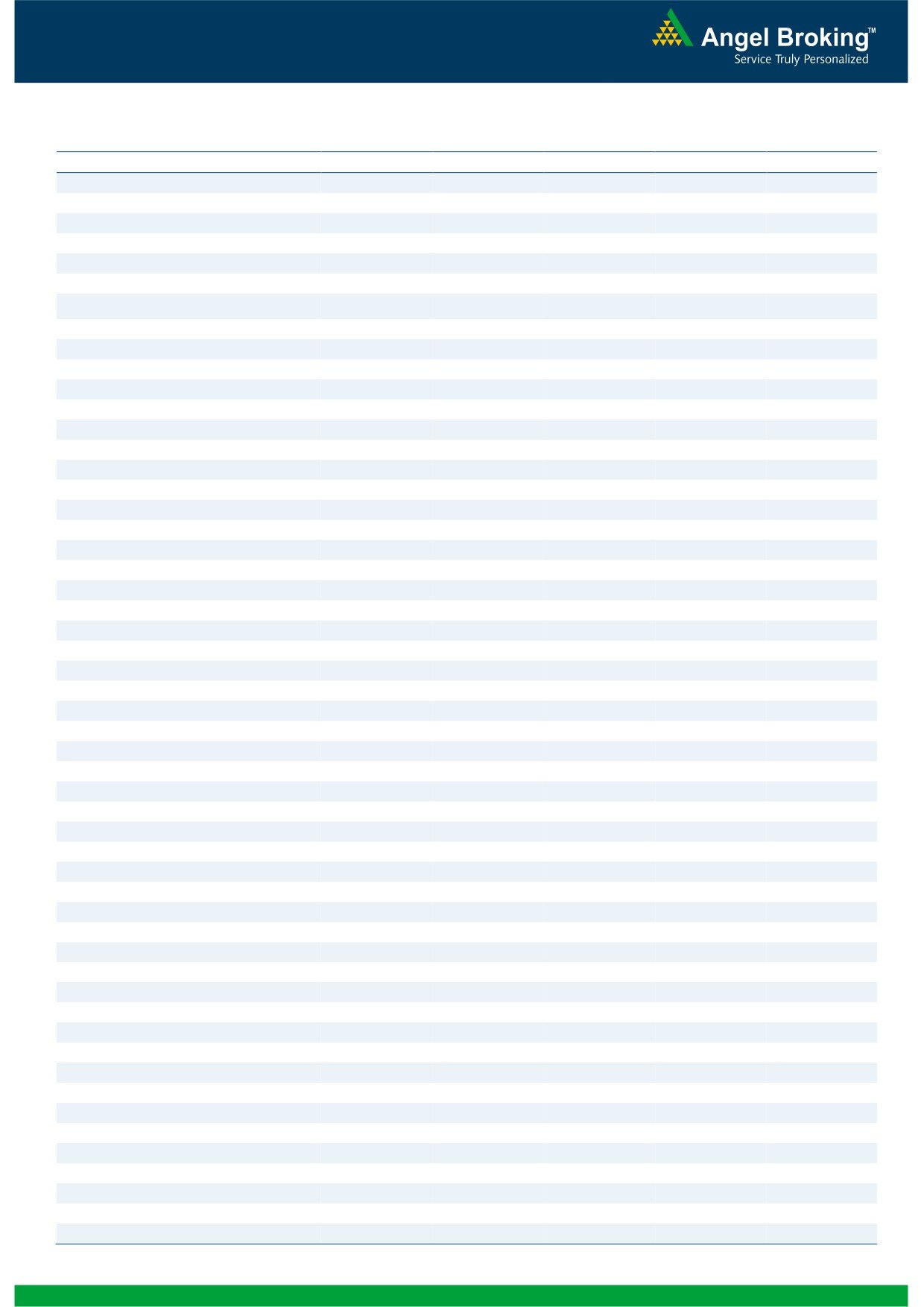

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (11509)

On Friday, Bank Nifty opened on a flat note and dragged

lower to close with a loss of nearly 1%.However, in line

with our benchmark indices the index continued its

sideways trading activity in the mentioned range of 11745

- 11245. We are now witnessing a negative crossover in

momentum oscillator “Stochastic” on the daily chart. The

impact of this oscillator would be seen if the index sustains

below Friday’s low of 11468. In this scenario the index is

likely to drift towards 11419 - 11364 levels. On the

upside 11598 - 11643 levels are likely to act as resistance

for the day.

Actionable points:

View for the day

Bearish Below 11468

Expected Targets

11419 - 11364

Resistance Levels

11598 - 11643

Source: Falcon:

2

Daily Technical Report

October 29, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

18,466

18,546

18,638

18,717

18,809

NIFTY

5,612

5,638

5,668

5,694

5,723

BANKNIFTY

11,373

11,441

11,536

11,604

11,699

ACC

1,385

1,394

1,407

1,417

1,430

AMBUJACEM

202

205

207

210

213

ASIANPAINT

3,840

3,882

3,913

3,955

3,986

AXISBANK

1,210

1,221

1,233

1,244

1,257

BAJAJ-AUTO

1,730

1,759

1,777

1,806

1,824

BANKBARODA

751

757

766

772

781

BHARTIARTL

261

264

267

269

272

BHEL

234

238

242

246

249

BPCL

344

346

349

351

354

CAIRN

330

333

335

338

340

CIPLA

347

351

357

361

366

COALINDIA

351

353

355

357

359

DLF

198

201

203

205

208

DRREDDY

1,639

1,655

1,678

1,693

1,716

GAIL

355

360

363

367

371

GRASIM

3,368

3,389

3,411

3,433

3,455

HCLTECH

600

604

610

615

620

HDFC

744

751

759

766

773

HDFCBANK

627

632

636

641

645

HEROMOTOCO

1,780

1,825

1,850

1,895

1,920

HINDALCO

111

112

113

114

114

HINDUNILVR

535

544

556

565

578

ICICIBANK

1,058

1,068

1,085

1,096

1,113

IDFC

154

156

158

160

162

INFY

2,308

2,319

2,332

2,343

2,356

ITC

281

283

288

290

294

JINDALSTEL

376

381

385

390

394

JPASSOCIAT

87

89

92

94

97

KOTAKBANK

600

607

616

623

632

LT

1,679

1,694

1,704

1,719

1,728

LUPIN

555

560

566

572

578

M&M

849

865

875

891

901

MARUTI

1,350

1,358

1,368

1,376

1,386

NTPC

164

167

169

172

174

ONGC

271

273

275

276

278

PNB

708

729

766

786

823

POWERGRID

111

113

115

116

118

RANBAXY

514

520

526

532

538

RELIANCE

785

792

799

806

813

RELINFRA

481

486

493

497

504

SBIN

2,136

2,155

2,180

2,198

2,223

SESAGOA

166

168

169

171

173

SIEMENS

670

675

683

688

696

SUNPHARMA

677

681

687

691

697

TATAMOTORS

257

259

262

264

267

TATAPOWER

102

103

105

106

107

TATASTEEL

394

397

399

402

405

TCS

1,299

1,307

1,315

1,323

1,330

ULTRACEMCO

2,023

2,033

2,041

2,051

2,059

WIPRO

331

334

337

339

343

3

Daily Technical Report

October 29, 2012

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4