Daily Technical Report

April 29, 2013

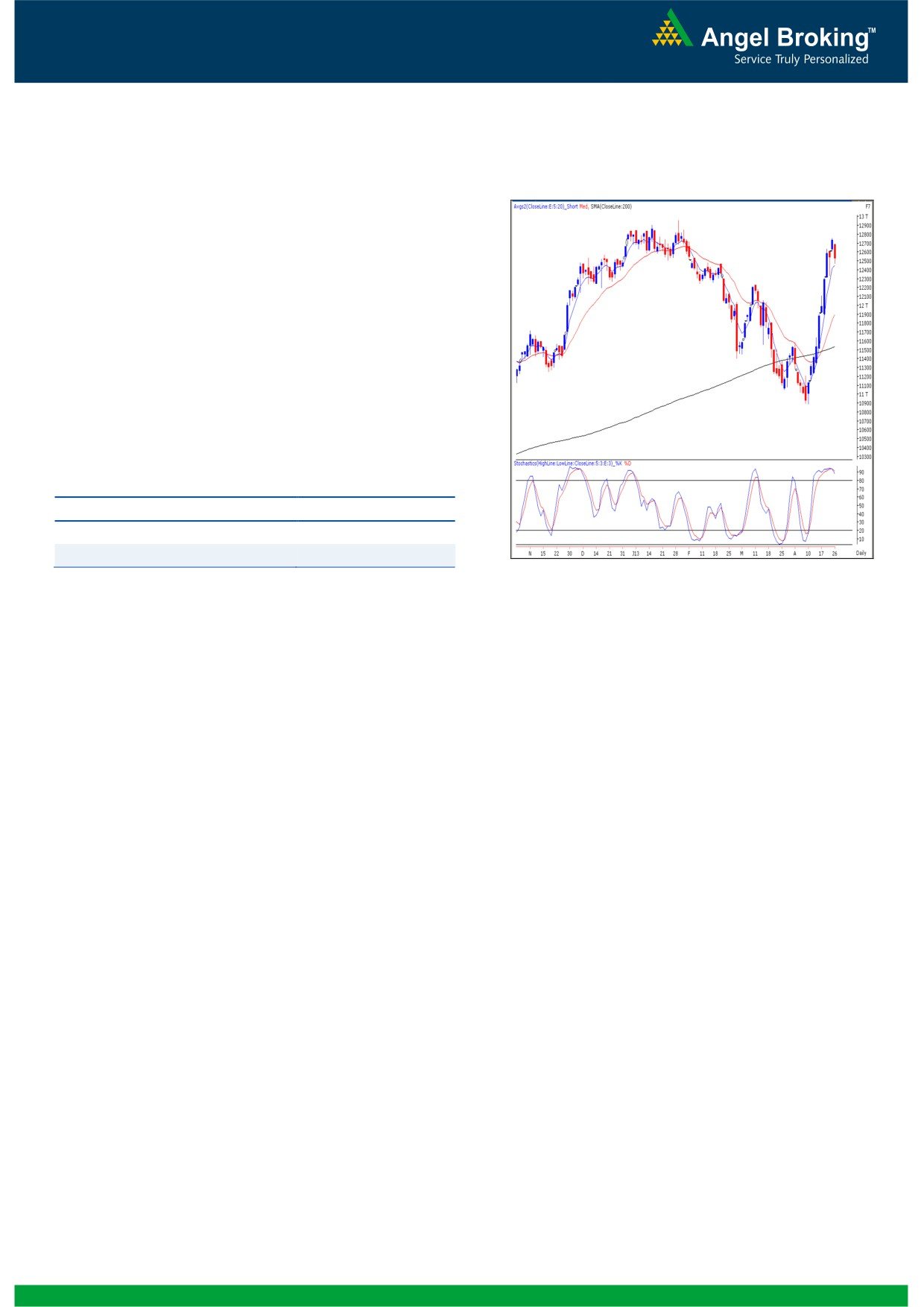

Exhibit 1: Sensex Daily Chart

Sensex (19287) / NIFTY (5871)

On Friday, indices opened on a flat note and thereafter

traded with a negative bias to close with a loss of 0.76%.

For the session most of the sectors ended in the red,

amongst which Realty, Oil & Gas and IT were among the

major losers, whereas Auto and Capital Goods counters

ended with gains. The advance to decline ratio was in

strongly in favor of declining counters (A=949 D=1356)

Formation

The ’20-week EMA’ and the ’20-day EMA’ are placed at

19038/ 5767 and 18902/ 5730 levels, respectively.

The ’89-day EMA’ and the ‘200-day SMA’ are placed at

19063/ 5773 and 18710 / 5673, respectively.

The ‘Lower Top - Lower Bottom’ formation on the weekly

chart is still intact.

The weekly momentum oscillators, ADX (9) indicator and

‘3 & 8 EMA’ are signaling a positive crossover.

Source: Falcon:

The 61.8% and 78.6% Fibonacci retracement levels of

the fall from 20204 / 6112 to 18144 / 5477 are placed

at 19416 / 5870 and 19765 / 5976.

Actionable points:

Trading strategy:

The benchmark Indices have moved well during the week

View

Bearish Below 5860

and have now tested the 61.80% Fibonacci retracement level

Expected Target

5820 - 5791

(19416 / 5870) of the fall from 20204 / 6112 to 18144 /

Resistance Levels

5900 - 5925

5477. On the weekly chart, we are observing that the

momentum oscillators. ADX (9) indicators and ‘3 & 8 EMA’

Hence, any sustainable move below 19192 / 5853 would

are positively poised. Any sustainable move beyond this

result in a near term loss of optimism. In this scenario,

week’s high of 19435 / 5925 would in turn push the indices

indices may correct towards 18941 / 5760 and 18790 /

towards the 78.60% Fibonacci retracement level placed at

5710, which are 38.20% and 50% Fibonacci retracement

19762 / 5976. On the flipside, the price action seen in the

levels of the rise from 18144 / 5495 to 19435 / 5925,

last trading session of the week can be termed as an ‘Inside

respectively.

Day’ pattern. This candlestick formation occurs when the

The ECB Governing Council meeting and the RBI Monetary

entire price range of a given day falls within the price range

Policy are scheduled to be declared in the coming week and

of the previous day. The pattern is often used to signal the

thus volatility may increase significantly in the coming

indecisiveness because neither the bulls nor the bears are

sessions. We thus advise traders to trade with strict stop

able to send the price beyond the range of the previous day.

losses and avoid taking undue risks.

The said pattern will be confirmed below Thursday’s low of

19192 / 5853. This is also supported by the negative

placement of daily ‘Stochastic’ oscillator.

1

Daily Technical Report

April 29, 2013

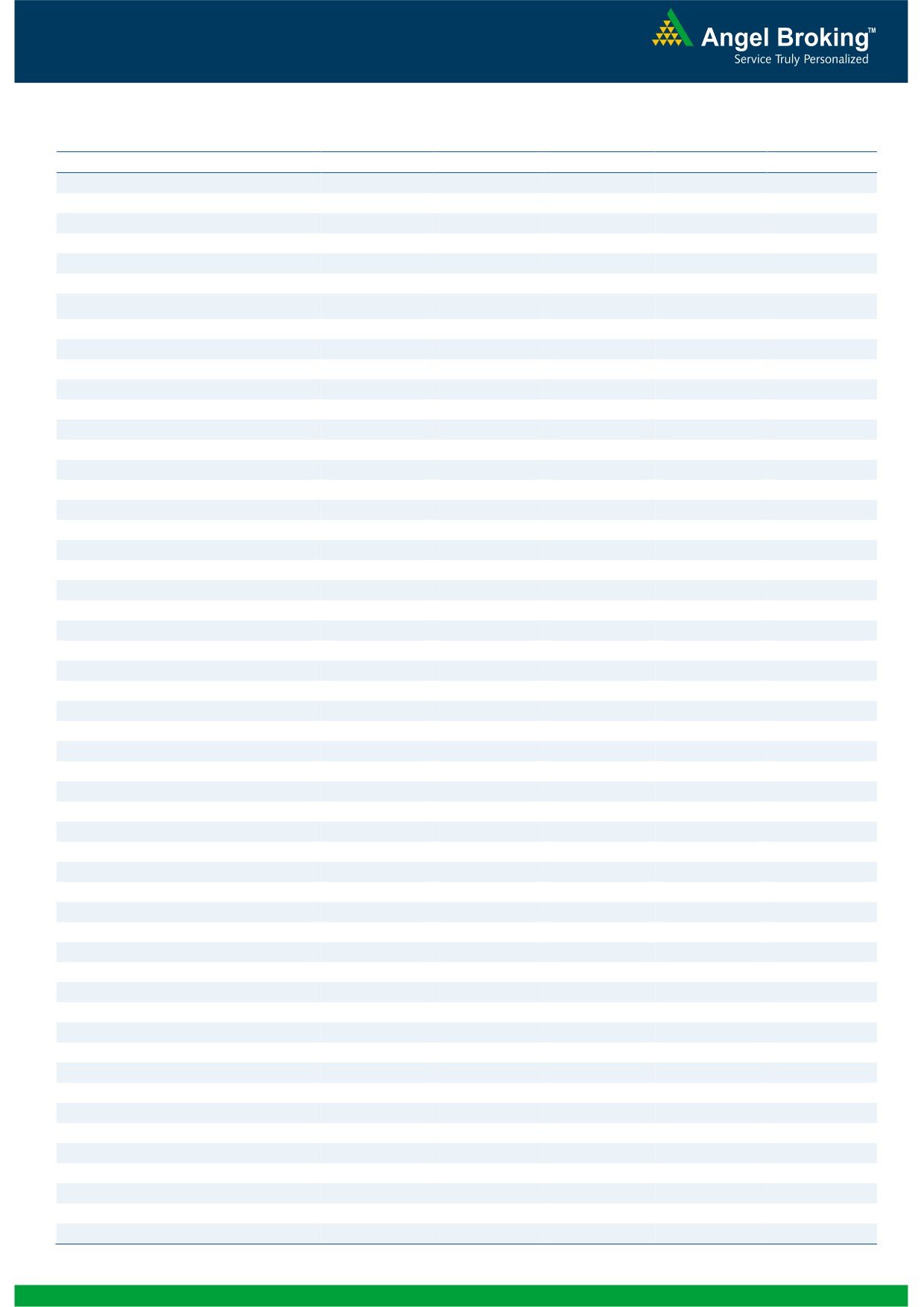

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (12533)

On Friday, Bank Nifty opened on a pessimistic note and

traded volatile throughout the session to close with a loss of

1.52%. The index has closed near the critical level of 11535.

The negative divergence in the momentum oscillator ‘RSI’ on

the hourly chart is still intact. Hence we believe that going

forward the index is likely to correct if it sustains below

Friday’s low of 12470. In this case the Bank Nifty is likely to

drift lower towards 12330 - 12262 levels. On the upside

12680 - 12756 levels are likely to act as resistance for the

day.

Actionable points:

View

Bearish Below 12470

Expected Target

12330- 12262

Resistance level

12680 - 12756

Source: Falcon:

2

Daily Technical Report

April 29, 2013

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

19,172

19,229

19,307

19,365

19,442

NIFTY

5,833

5,852

5,880

5,899

5,926

BANKNIFTY

12,352

12,442

12,561

12,652

12,770

ACC

1,223

1,235

1,250

1,262

1,276

AMBUJACEM

183

185

189

191

195

ASIANPAINT

4,635

4,670

4,727

4,763

4,820

AXISBANK

1,452

1,469

1,484

1,502

1,517

BAJAJ-AUTO

1,805

1,850

1,878

1,923

1,950

BANKBARODA

683

690

700

707

717

BHARTIARTL

304

311

316

323

328

BHEL

185

187

190

191

194

BPCL

405

409

414

418

423

CAIRN

295

298

300

303

305

CIPLA

403

407

409

413

416

COALINDIA

310

315

319

324

329

DLF

229

234

241

245

252

DRREDDY

1,955

1,973

1,991

2,009

2,028

GAIL

338

344

349

355

360

GRASIM

2,845

2,881

2,936

2,972

3,028

HCLTECH

653

669

693

708

733

HDFC

848

861

870

882

891

HDFCBANK

679

684

688

693

697

HEROMOTOCO

1,537

1,567

1,606

1,636

1,675

HINDALCO

97

98

99

100

101

HINDUNILVR

454

459

468

474

483

ICICIBANK

1,089

1,117

1,153

1,181

1,217

IDFC

151

153

156

158

161

INDUSINDBK

445

452

460

466

474

INFY

2,182

2,197

2,217

2,232

2,253

ITC

315

317

318

320

322

JINDALSTEL

305

310

318

323

330

JPASSOCIAT

72

74

76

77

79

KOTAKBANK

688

700

708

721

729

LT

1,490

1,515

1,531

1,556

1,571

LUPIN

672

679

686

692

699

M&M

868

879

892

903

917

MARUTI

1,519

1,596

1,645

1,722

1,770

NMDC

124

125

127

128

130

NTPC

151

153

155

157

160

ONGC

318

321

326

329

334

PNB

760

766

776

782

791

POWERGRID

109

110

110

111

111

RANBAXY

452

456

461

464

470

RELIANCE

767

780

802

815

838

RELINFRA

352

359

371

378

390

SBIN

2,242

2,265

2,300

2,323

2,357

SESAGOA

149

151

153

155

158

SUNPHARMA

941

949

962

969

982

TATAMOTORS

287

292

295

299

303

TATAPOWER

94

94

95

96

97

TATASTEEL

296

301

309

313

321

TCS

1,348

1,358

1,376

1,387

1,404

ULTRACEMCO

1,855

1,881

1,908

1,935

1,962

3

Daily Technical Report

April 29, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4