Daily Technical Report

March 26, 2013

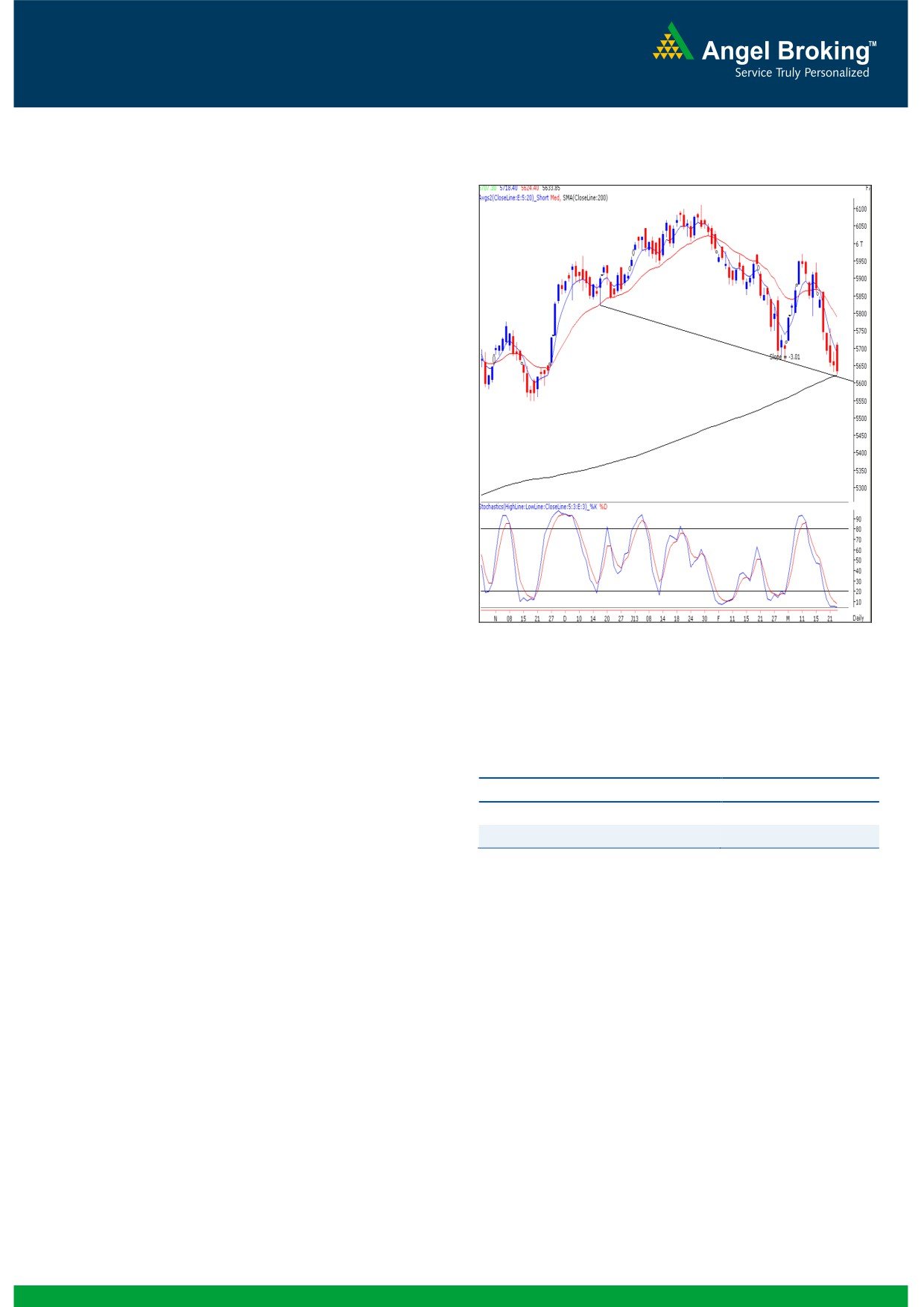

Exhibit 1: Nifty Daily Chart

Sensex (18681) / NIFTY (5634)

Yesterday for the 3rd consecutive session, the markets pared

all gains during the last hour of trade and eventually closed

marginally in the negative territory. The Capital Goods, Auto

and Metal counters were among the major losers whereas

Realty, Power and Oil & Gas stocks ended with some gains.

The advance to decline ratio was strongly in favor of

declining

counters

(A=1028 D=1884) (Source-

Formation

The ’20-day EMA’ and the ’20-week EMA’ are placed at

19165 / 5789 and 19146 / 5796 levels, respectively.

The ‘200 Day SMA’ is placed at 18536 / 5621.

The ‘Lower Top Lower Bottom’ formation on weekly

chart is confirmed for the first time after January 14,

2011.

We are witnessing a ‘Downward Sloping’ trend line

Source: Falcon:

support drawn by joining the lows of December 18,

2012 and March 04, 2013.

Actionable points:

Trading strategy:

Yesterday, we witnessed a gap up opening by nearly a

View

Neutral

percent in-line with other positive Asian bourses. Indices then

Resistance levels

5691 - 5720

slipped into a consolidation mode and lingered around the

Support levels

5620 - 5593

hourly ’20 EMA’ placed at 18875 / 5695. However, just

before the start of the final hour, we witnessed tremendous

selling pressure which eventually dragged indices

significantly lower from day’s high. In this process, indices

traded just below last week’s low of 18669 / 5631. The

‘Downward Sloping Trend Line’ mentioned in our earlier

report is now being tested for the second time in two

consecutive sessions. Considering the strong support zone of

this trend line and ‘200 day SMA’, we reiterate that Fresh

short positions should not be initiated at current levels as the

risk to reward ratio is unfavorable. For the day, we expect

18610 / 5593 to act as a decent support level. On the

flipside, the daily ‘Stochastic’ momentum oscillator is placed

well inside the extreme oversold. Hence, possibilities of a

near term bounce towards 19083 - 19240 / 5758 - 5820

levels cannot be ruled out.

1

Daily Technical Report

March 26, 2013

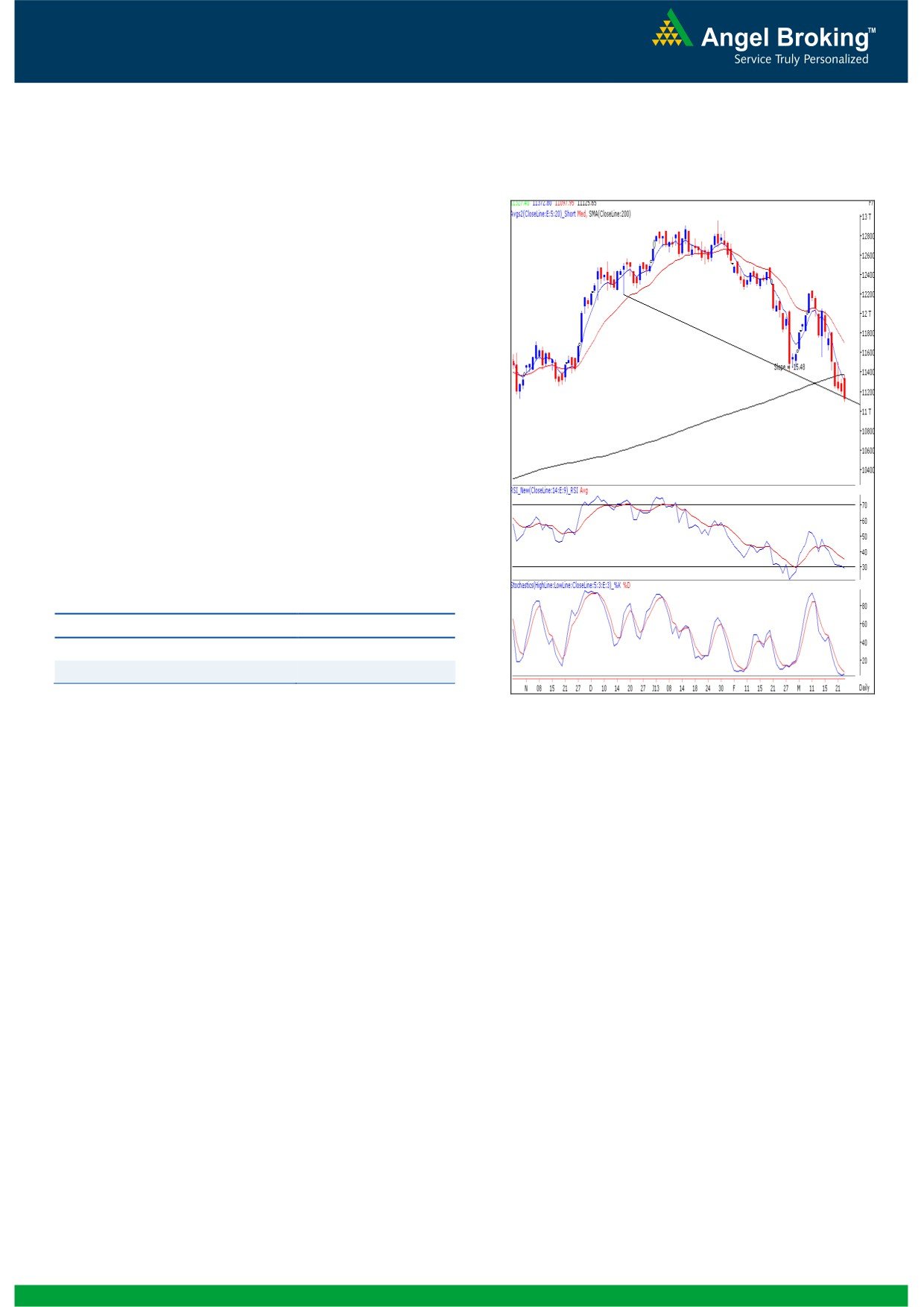

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (11126)

Yesterday, Bank Nifty opened on a positive note and

traded in a narrow range during first half of the session.

However during the second half selling pressure near the

resistance level of 11395 led the index lower to close at

the mentioned support of 11125. At this juncture the index

is hovering around the trend line support formed by

joining the significant lows of December 24, 2012 and

February 28, 2013. In addition the index has formed ‘Last

Engulfing Bottom’ candlestick pattern coupled with positive

divergence in ‘RSI’ momentum oscillator on the daily and

hourly chart. The mentioned pattern is a bullish reversal

pattern but requires confirmation in the form of a close

above the 11373 mark. For the day

11021 - 10940

levels are likely to act as support and 11347 - 11373

levels are likely to act as resistance for the day.

Actionable points:

View

Neutral

Resistance Levels

11347 - 11373

Support Level

11021 - 10940

Source: Falcon:

2

Daily Technical Report

March 26, 2013

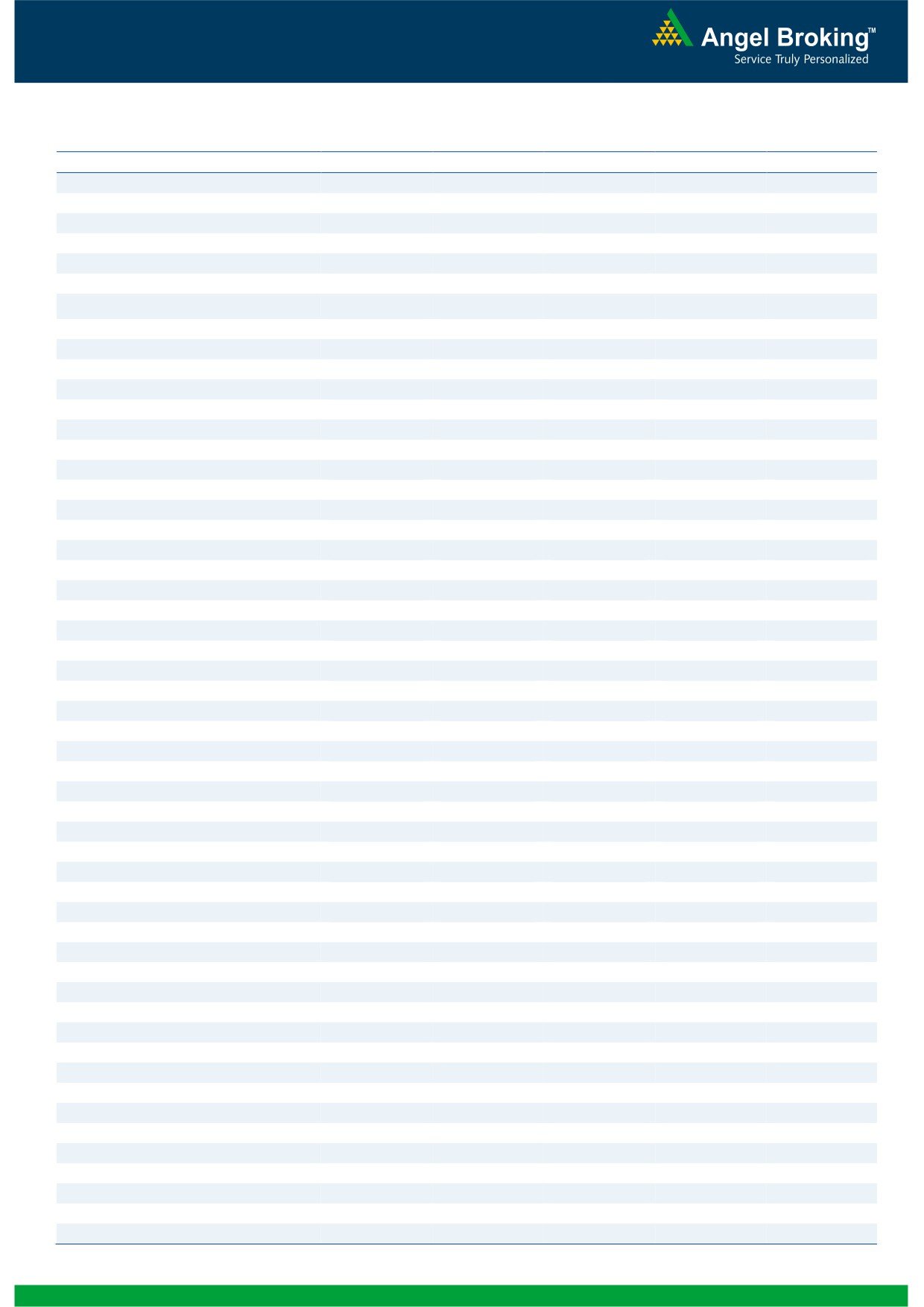

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

18,466

18,574

18,762

18,870

19,058

NIFTY

5,565

5,599

5,659

5,693

5,753

BANKNIFTY

10,924

11,025

11,199

11,300

11,474

ACC

1,139

1,147

1,159

1,167

1,178

AMBUJACEM

166

169

175

178

183

ASIANPAINT

4,769

4,824

4,913

4,968

5,056

AXISBANK

1,280

1,295

1,315

1,329

1,349

BAJAJ-AUTO

1,769

1,786

1,812

1,829

1,856

BANKBARODA

634

646

667

679

700

BHARTIARTL

281

285

291

295

301

BHEL

175

177

181

183

186

BPCL

363

368

373

378

384

CAIRN

271

274

280

283

289

CIPLA

376

378

382

384

388

COALINDIA

291

294

297

301

304

DLF

229

236

241

248

253

DRREDDY

1,709

1,738

1,767

1,795

1,824

GAIL

302

308

318

324

334

GRASIM

2,814

2,840

2,881

2,906

2,948

HCLTECH

754

761

767

773

779

HDFC

791

799

809

816

826

HDFCBANK

604

607

610

613

616

HEROMOTOCO

1,573

1,596

1,631

1,653

1,688

HINDALCO

85

86

89

91

94

HINDUNILVR

455

458

462

465

468

ICICIBANK

984

998

1,023

1,038

1,063

IDFC

133

136

142

145

150

INFY

2,818

2,835

2,850

2,868

2,882

ITC

297

300

304

307

311

JINDALSTEL

341

346

354

359

367

JPASSOCIAT

61

62

64

66

68

KOTAKBANK

618

625

636

643

655

LT

1,323

1,345

1,383

1,404

1,442

LUPIN

619

625

632

638

645

M&M

849

857

868

876

888

MARUTI

1,244

1,264

1,297

1,318

1,351

NTPC

138

140

143

145

147

ONGC

295

300

305

310

315

PNB

702

713

729

740

756

POWERGRID

102

103

104

105

105

RANBAXY

415

425

432

442

449

RELIANCE

791

800

812

821

833

RELINFRA

332

338

347

353

362

SBIN

2,007

2,032

2,079

2,105

2,151

SESAGOA

147

150

153

156

160

SIEMENS

542

548

556

563

571

SUNPHARMA

812

816

822

826

832

TATAMOTORS

265

268

272

275

279

TATAPOWER

93

94

96

97

99

TATASTEEL

303

309

319

324

334

TCS

1,518

1,531

1,541

1,554

1,565

ULTRACEMCO

1,845

1,854

1,865

1,874

1,885

WIPRO

423

427

434

438

445

3

Daily Technical Report

March 26, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4