Daily Technical Report

April 23, 2013

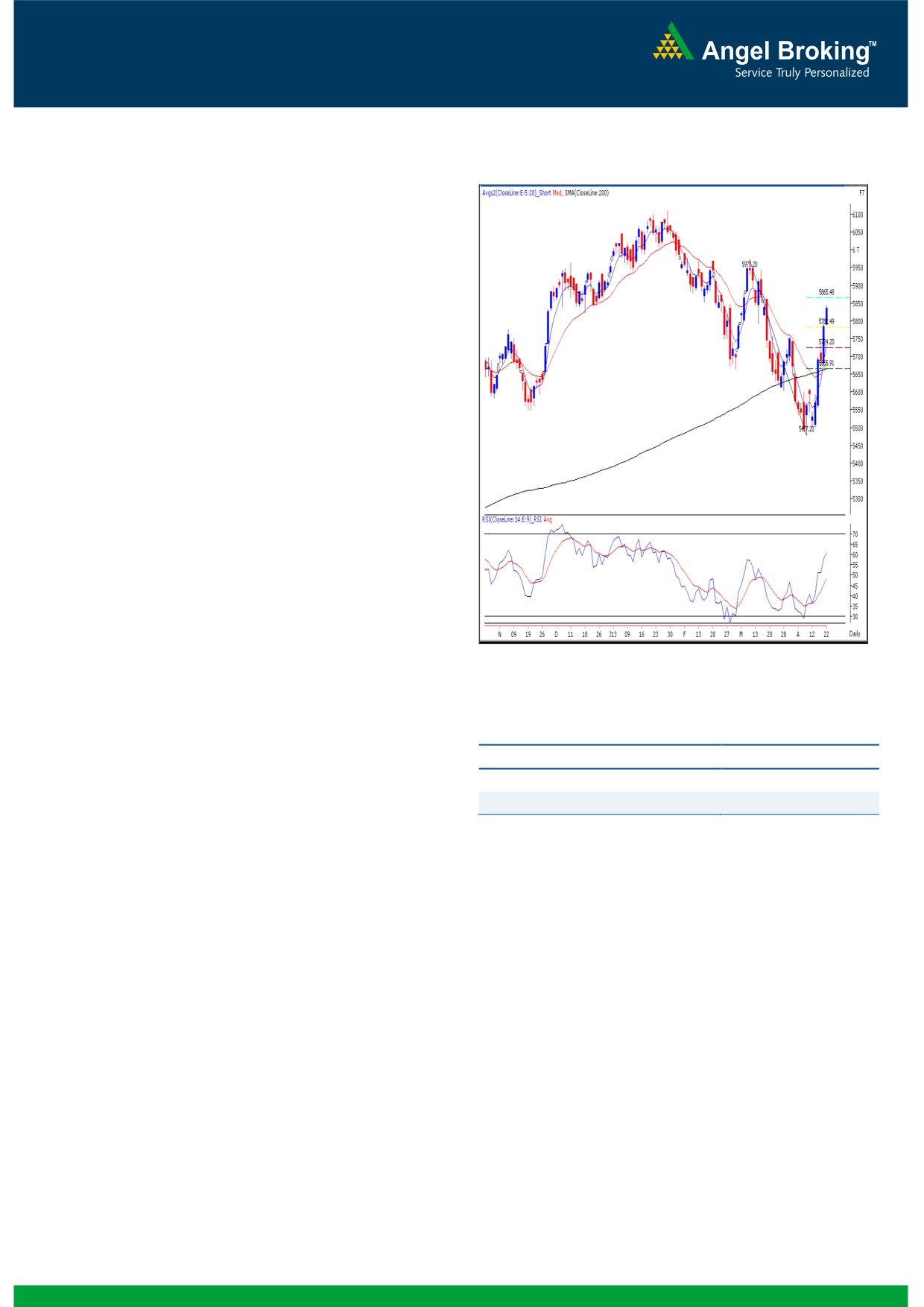

Exhibit 1: Nifty Daily Chart

Sensex (19170) / NIFTY (5834)

The first session of the week opened on a flat note in-line

with quiet mood across the globe. Subsequently Indices

inched higher through the session and a sharp up move

towards the fag end led to close almost at the highest point

of the day. During the day, once again banking stocks led

the rally along with Consumer Durables and Capital Goods

counters; whereas IT sector remained under pressure. The

advance to decline ratio was strongly in favor of advancing

Formation

The ’20-week EMA’ and the ’20-day EMA’ are placed at

19012 / 5756 and 18723 / 5662 levels, respectively.

The ’89-week EMA’ and the ‘200-day SMA’ are placed

at 18203 / 5506 and 18657 / 5656, respectively.

The ’89-day EMA’ and the ‘200-day SMA’ are placed at

19044 / 5764 and 18674 / 5661, respectively.

The ‘Lower Top - Lower Bottom’ formation on the weekly

Source: Falcon:

chart is still intact.

The weekly momentum oscillators and daily ‘5 & 20

Actionable points:

EMA’ have signaled a positive crossover.

View

Neutral

The 61.8% Fibonacci retracement level of the fall from

Resistance levels

5850 - 5870

20204 / 6112 to 18144 / 5477 is placed at 19416 /

Support level

5789

5870.

Trading strategy:

On the downside, yesterday’s low of 18989 / 5789 would

Yesterday, as expected, indices continued to progress higher

act as immediate support level for the market. Only a

after breaking Thursday’s high of 19061 / 5794 and moved

sustainable move below this support would trigger intraday

beyond our immediate target of 19200 / 5815. Indices are

pessimism in the market. In this scenario, indices may test

now gradually moving towards the mentioned resistance

18950 / 5765 level.

level of 19416 / 5870, which is the 61.80% Fibonacci

retracement level of the fall from 20204 / 6112 to 18144 /

5477. Hence, we maintain our view that traders to book

partial profits around this level and trade with strict stop

losses for the remaining positions. However, in case of

extreme optimism, if the indices manage to stay above

19416 / 5870 levels, then they may even test 19755 / 5971.

1

Daily Technical Report

April 23, 2013

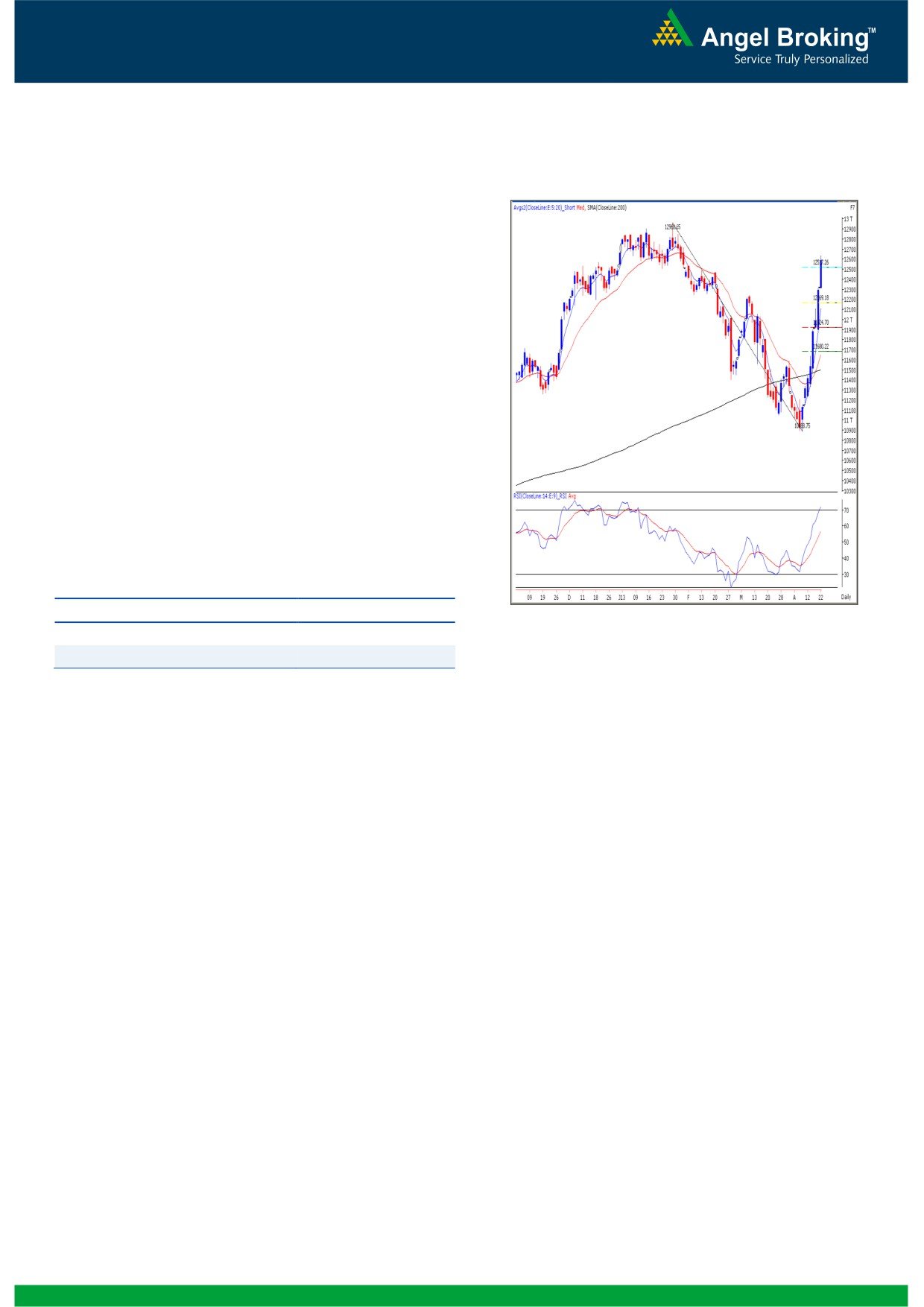

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (12576)

Yesterday, Bank Nifty too opened on a flat note in-line with

the benchmark indices. The Bank Nifty has played a vital role

in the up move seen in our market over the past 5 - 6

trading sessions. As expected, the index continued to show its

dominance and rallied towards the mentioned target of

12515. We are now observing that the momentum

oscillators in hourly and daily chart have entered an extreme

overbought territory. Hence, the possibility of sideways

movement or correction cannot be ruled out. On the upside,

index may face resistance around the 12638 mark whereas

yesterday's low of 12317 would act as a key support in

coming trading session. Traders are advised to book profits

in all long positions and remain on the sidelines. Buying at

current levels is not justified as the risk reward ratio is not

favorable.

Actionable points:

View

Neutral

Source: Falcon:

Resistance level

12638

Support Levels

12430 - 12317

2

Daily Technical Report

April 23, 2013

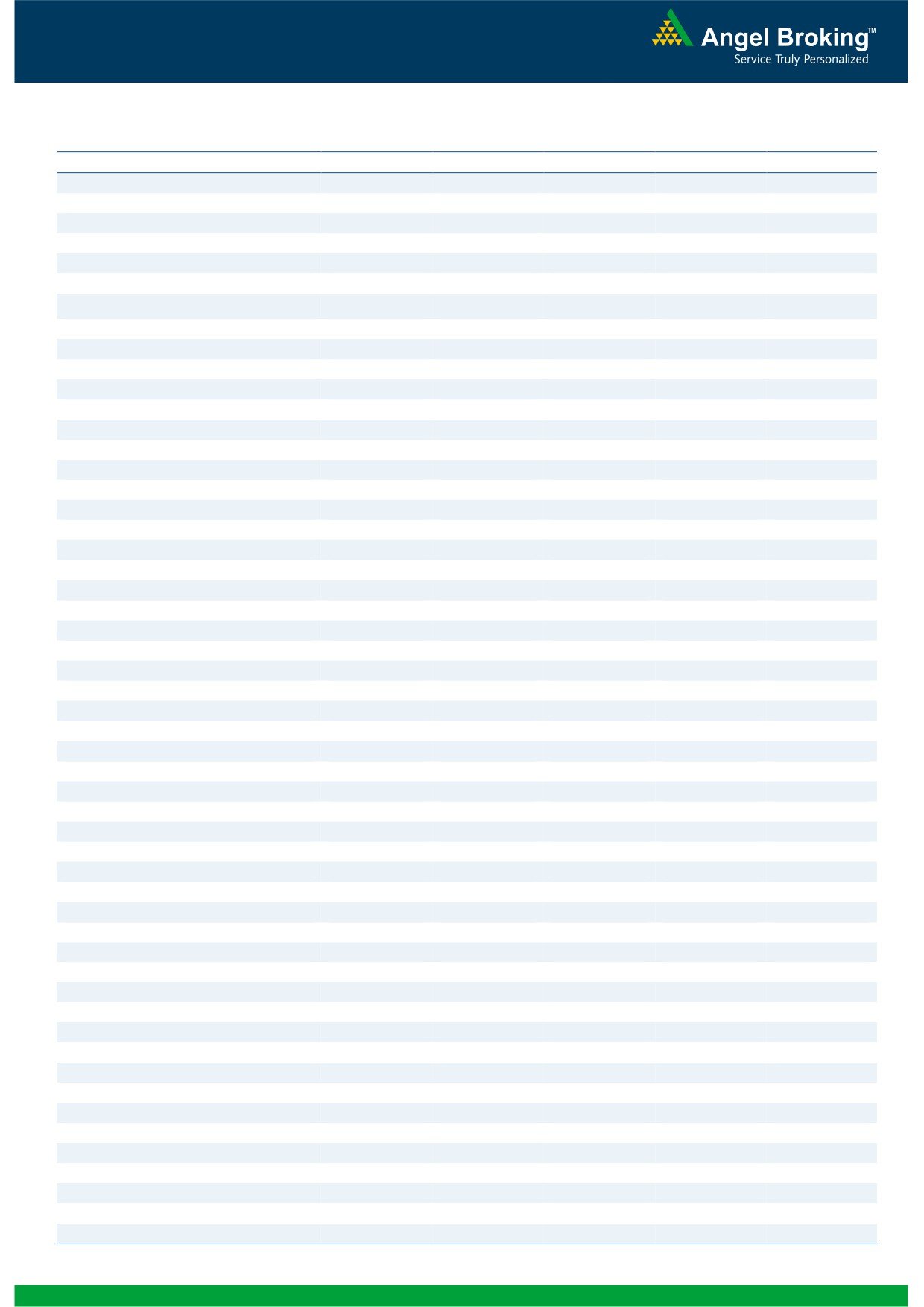

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

18,906

19,038

19,122

19,253

19,337

NIFTY

5,768

5,801

5,823

5,856

5,878

BANKNIFTY

12,190

12,383

12,511

12,704

12,831

ACC

1,196

1,206

1,218

1,228

1,240

AMBUJACEM

184

186

188

190

193

ASIANPAINT

4,539

4,593

4,667

4,721

4,794

AXISBANK

1,403

1,422

1,453

1,472

1,503

BAJAJ-AUTO

1,707

1,735

1,775

1,803

1,844

BANKBARODA

684

692

698

705

712

BHARTIARTL

296

298

302

304

308

BHEL

184

188

190

193

196

BPCL

398

407

414

423

431

CAIRN

288

290

294

296

300

CIPLA

391

394

399

403

408

COALINDIA

295

304

309

318

323

DLF

238

244

249

256

260

DRREDDY

1,838

1,862

1,883

1,908

1,929

GAIL

329

332

334

338

340

GRASIM

2,783

2,809

2,837

2,863

2,891

HCLTECH

699

710

727

738

755

HDFC

808

822

831

844

853

HDFCBANK

664

681

692

709

719

HEROMOTOCO

1,487

1,509

1,526

1,549

1,565

HINDALCO

92

94

95

97

98

HINDUNILVR

478

480

484

486

490

ICICIBANK

1,098

1,123

1,142

1,167

1,185

IDFC

154

157

160

162

165

INDUSINDBK

442

454

463

475

484

INFY

2,184

2,214

2,254

2,284

2,323

ITC

311

314

316

319

321

JINDALSTEL

332

337

340

345

349

JPASSOCIAT

73

75

76

78

80

KOTAKBANK

657

667

673

683

690

LT

1,456

1,495

1,517

1,556

1,578

LUPIN

665

674

680

689

695

M&M

865

879

896

910

928

MARUTI

1,512

1,526

1,540

1,554

1,568

NMDC

122

125

127

130

132

NTPC

143

146

148

151

152

ONGC

322

325

330

333

338

PNB

755

768

778

791

801

POWERGRID

104

107

109

111

113

RANBAXY

439

446

455

462

470

RELIANCE

771

780

788

797

804

RELINFRA

349

366

376

392

402

SBIN

2,278

2,302

2,331

2,356

2,385

SESAGOA

148

150

151

154

155

SUNPHARMA

901

914

929

942

958

TATAMOTORS

279

282

285

288

291

TATAPOWER

94

95

95

96

96

TATASTEEL

298

302

305

310

313

TCS

1,402

1,414

1,437

1,448

1,472

ULTRACEMCO

1,813

1,842

1,887

1,916

1,961

3

Daily Technical Report

April 23, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4