Daily Technical Report

October 22, 2012

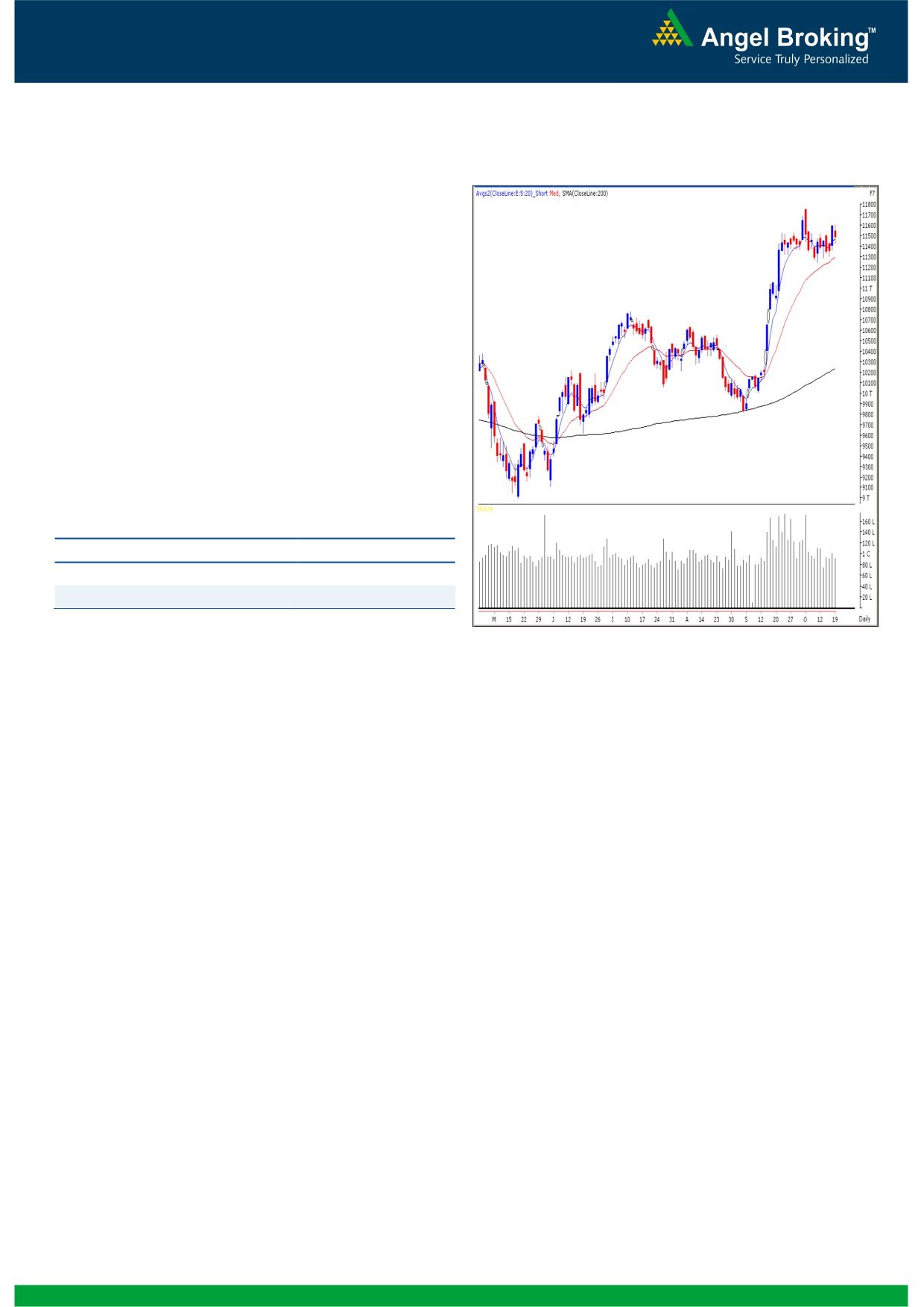

Exhibit 1: Nifty Daily Chart

Sensex (18682) / NIFTY (5684)

On Friday, our benchmark indices pared their previous day’s

gains on the back of profit booking and sharp depreciation

in currency. However, indices still remained in the same

range of 5630 - 5730 and closed below 5700 mark.

Sectors like Power, Metal and Consumer Goods ended as

major losers whereas defensive counters like FMCG and

Consumer Durables closed in green. The advance to decline

ratio was in favor of declining counters (A=1275 D=1586)

Formation

The ’20-day EMA’ and the ’20-week EMA’ are placed at

18617/ 5654 and 17919/ 5434 levels, respectively.

The monthly ‘RSI’ oscillator is moving higher from the 50

mark and the positive in ADX (9) indicator is intact.

The negative crossover in weekly ‘Stochastic’ oscillator is

still intact.

At present, the value of Daily ‘RSI’ oscillator is 56.38.

The RSI trading above the 50 mark shows strength of the

current up trend.

Source: Falcon:

The 38.2% and 50% Fibonacci Retracement levels of the

Actionable points:

rise from 17250 to 19138 / 5216 to 5815 are placed at

18416 / 5586 and 18194 / 5515, respectively.

View for the day

Neutral

Trading strategy:

Resistance Levels

5729 - 5757

Broadly speaking, at this juncture the markets are in a

Support Levels

5633

narrow trading range of 18886 to 18535 / 5729 to 5633.

Only a sustainable breakout / breakdown on either side

A fresh set of buyers would enter the market only if our indices

would give clarity of the near term trend. During the week,

sustain above 18886 / 5729. In this scenario, we can expect

we observed that indices have a strong support zone of ’20-

our indices to move towards 18973 - 19138 / 5757 - 5816.

day EMA’, which also coincides with the lower level of

A move beyond 19138 / 5816 would negate the negative

mentioned trading range. Going forward, the impact of

implication of the "Bearish Engulfing" candlestick pattern and

negatively poised weekly ‘Stochastic’ oscillator would be seen

further optimistic targets open up.

if indices sustain below 18535 / 5633. This may trigger near

term pessimism in the market and as a result, Indices may

slide towards 18416 / 5586 and 18194 / 5515, which are

38.2% and 50% Fibonacci Retracement levels of the rise

from 17250 to 19138 / 5216 to 5815. On the flip side, the

daily ‘RSI’ oscillator is consistently moving above the

50

mark. This signifies strength in the current intermediate

degree trend, which is bullish.

1

Daily Technical Report

October 22, 2012

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (11491)

On Friday, Bank Nifty opened on a flat note and trimmed

some gains of Thursday’s session to close with a loss of

nearly 1%. Since the past four weeks we are witnessing a

consolidation in the range of 11745 - 11245. Going

forward, clarity of trend will emerge only when the Bank

Nifty moves out of the mentioned trading range. Within

the range 11515 - 11536 levels are likely to act as

resistance and 11418 - 11364 levels are likely to act as

support in coming trading session. We advise positional

traders to wait for a few sessions before a clear pattern or

a trading opportunity can be spotted.

Actionable points:

View for the day

Neutral

Resistance Levels

11515 - 11745

Support Levels

11418 - 11364

Source: Falcon:

2

Daily Technical Report

October 22, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

18,530

18,606

18,688

18,764

18,846

NIFTY

5,634

5,659

5,685

5,711

5,737

BANKNIFTY

11,326

11,408

11,507

11,590

11,688

ACC

1,376

1,392

1,413

1,429

1,451

AMBUJACEM

201

204

206

209

211

ASIANPAINT

3,845

3,863

3,893

3,912

3,942

AXISBANK

1,175

1,189

1,200

1,213

1,224

BAJAJ-AUTO

1,746

1,759

1,777

1,790

1,808

BANKBARODA

773

785

797

809

821

BHARTIARTL

259

263

265

270

272

BHEL

236

239

244

247

251

BPCL

331

335

341

346

352

CAIRN

325

330

335

339

345

CIPLA

353

356

360

363

368

COALINDIA

349

351

356

358

362

DLF

200

203

206

209

211

DRREDDY

1,679

1,692

1,703

1,716

1,727

GAIL

348

354

362

369

376

GRASIM

3,346

3,379

3,434

3,467

3,521

HCLTECH

582

594

601

613

620

HDFC

742

748

755

760

767

HDFCBANK

622

625

630

633

638

HEROMOTOCO

1,796

1,823

1,839

1,866

1,882

HINDALCO

112

114

116

117

119

HINDUNILVR

559

563

568

572

578

ICICIBANK

1,035

1,046

1,061

1,072

1,087

IDFC

148

150

153

155

158

INFY

2,351

2,367

2,382

2,398

2,413

ITC

287

292

296

301

304

JINDALSTEL

398

403

410

415

422

JPASSOCIAT

91

92

94

95

97

KOTAKBANK

619

624

630

635

641

LT

1,605

1,619

1,635

1,650

1,666

LUPIN

566

569

575

579

585

M&M

811

817

828

834

845

MARUTI

1,352

1,361

1,371

1,380

1,391

NTPC

165

165

167

168

169

ONGC

272

276

278

282

284

PNB

808

816

826

833

843

POWERGRID

118

119

120

120

121

RANBAXY

529

534

544

550

559

RELIANCE

793

798

804

809

815

RELINFRA

497

503

510

515

523

SBIN

2,211

2,235

2,257

2,280

2,303

SESAGOA

166

168

169

171

173

SIEMENS

678

683

689

693

699

SUNPHARMA

677

686

693

702

709

TATAMOTORS

263

266

270

273

277

TATAPOWER

103

104

106

107

108

TATASTEEL

401

404

409

412

416

TCS

1,265

1,277

1,294

1,307

1,324

ULTRACEMCO

1,972

1,991

2,021

2,040

2,069

WIPRO

339

342

346

348

352

3

Daily Technical Report

October 22, 2012

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4