Daily Technical Report

January 21, 2013

Sensex (20039) / NIFTY (6064)

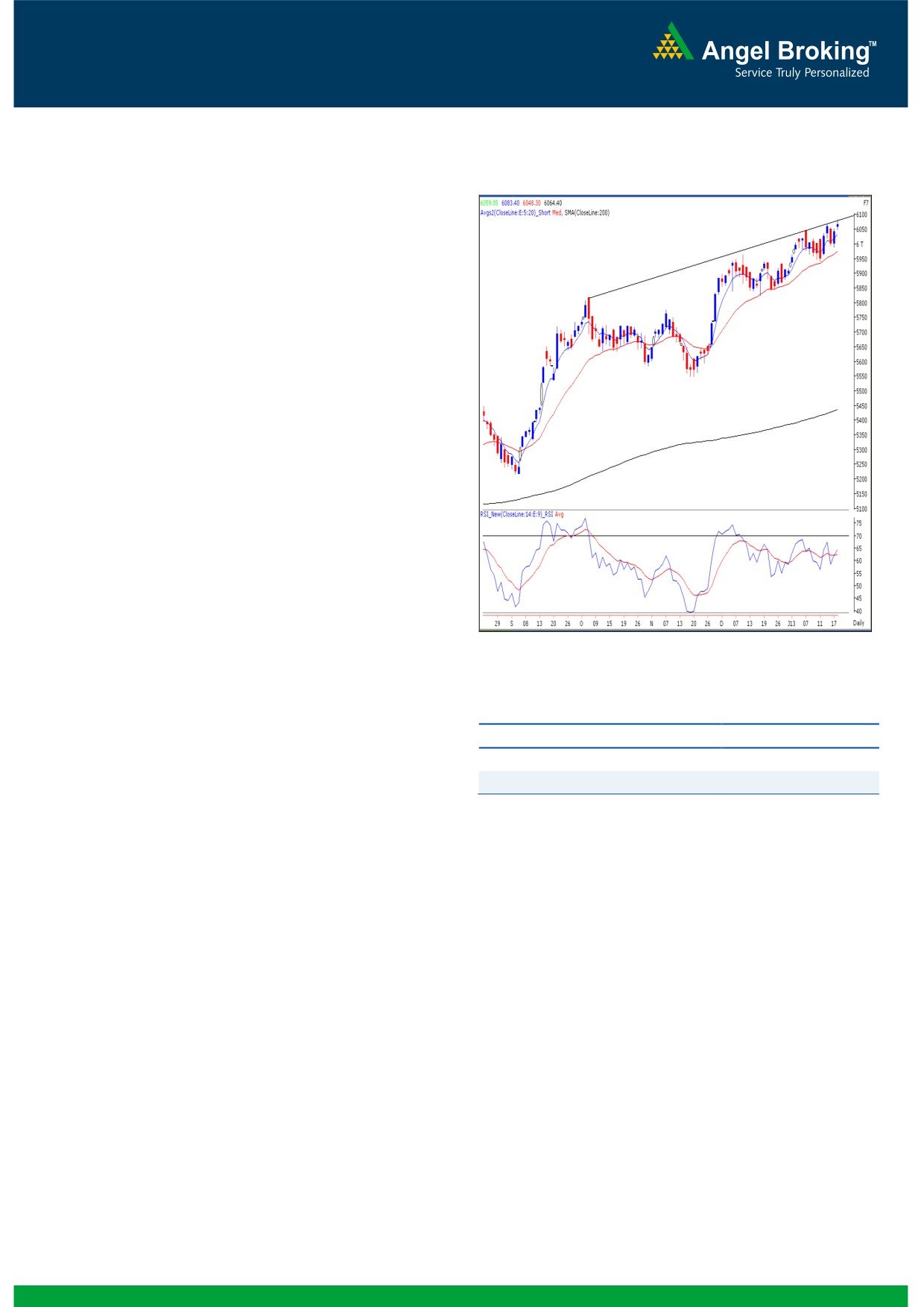

Exhibit 1: Nifty Daily Chart

On Friday, once again Oil & Gas counters climbed almost

7-10% and helped our benchmark indices to close above the

psychological level of 20000. However, the overall market

breadth was weak since the advance to decline ration was

strongly in favor of declining counters (A=971 D=1331).

Other than the Oil & Gas sector, PSU and Power counters

were the highest gainers. The IT, Teck and Auto counters

Formation

The ’20-day EMA’ and the ’20-week EMA’ are placed at

19692 / 5975 and 18949 / 5753 levels, respectively.

On the daily chart, the benchmark indices are facing

resistance near the ‘Upward Sloping Trend Line’ drawn

by joining the highs of October 5, 2012 and December

11, 2012.

We are also observing a ‘Negative Divergence’ in the

daily ‘RSI’ momentum oscillator.

Source: Falcon:

The advance decline ratio was in the favor of declining

Actionable points:

counters for 4 out of the 5 sessions of the week.

View

Neutral

Trading strategy:

Resistance Levels

6083 - 6125

Support Levels

6026 - 5988

Positive steps taken by the Government during the week led

to a decent intraweek rally in our benchmark indices. Partial

This is specifically different from what is seen in a bull

deregulation of diesel prices was seen as a landmark

market. We thus continue to remain cautious and advise

development on the reforms front and as a result, the market

traders to reduce their long positions and book partial profits

managed to eventually close above the psychological level of

in individual large cap counters near to the 19950 - 20100

20000 / 6000 for the first time after December 31, 2010.

/ 6070 - 6125 mark. Last week’s low of 19596 / 5940

However strong ‘Negative Divergence’ in the daily ‘RSI’

remains to be a key support in the coming trading sessions.

momentum oscillator indicates that buying at these levels is

A breach of this level may trigger pessimism in the market

not justified. In addition, although our domestic markets

and in such a scenario, we expect a corrective move towards

have closed almost at the highest point of the week, the rally

the next support levels of 19406 - 19221 / 5897 - 5842.

is not a broad based one (Negative advance decline ratio)

and has been led by individual stocks.

1

Daily Technical Report

January 21, 2013

Bank Nifty Outlook - (12680)

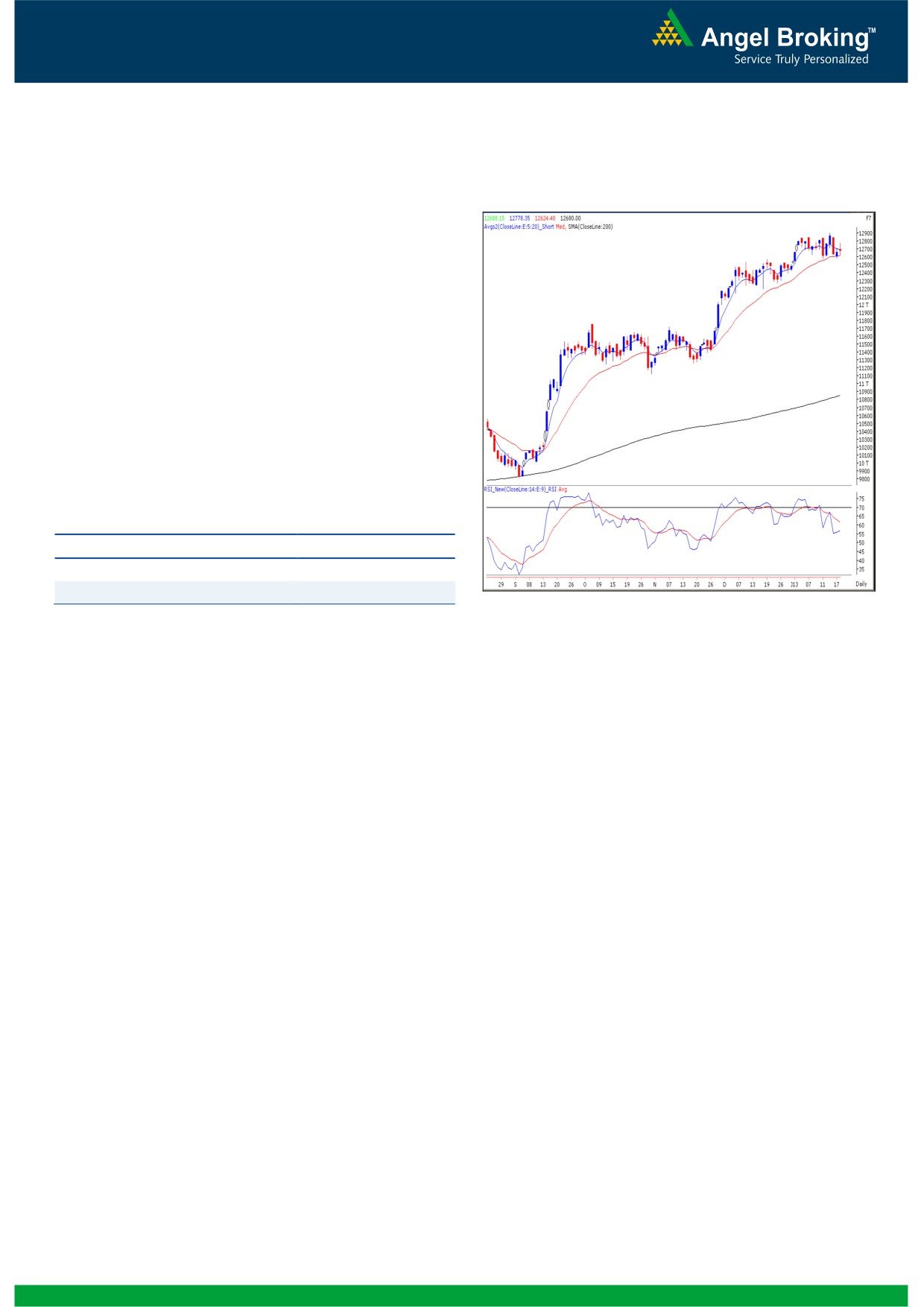

Exhibit 2: Bank Nifty Daily Chart

On Friday, we witnessed yet another range bound trading

session for the Bank Nifty. The index remained subdued

since the overall market focus was on few select large cap

counters in oil and gas space. At this juncture, we continue to

witness Negative divergence on the daily charts and thus

reiterate our view that a breach of the 12582 level, which

coincides with the 20 day moving average, would trigger

short term pessimism in the index. In this scenario, we may

witness a fall towards the 12477 / 12394 levels. On the

upside 12780 - 12908 levels are likely to act as resistance

for the day.

Actionable points:

View

Bearish Below 12582

Expected Targets

12477 - 12394

Resistance Levels

12780 - 12908

Source: Falcon:

2

Daily Technical Report

January 21, 2013

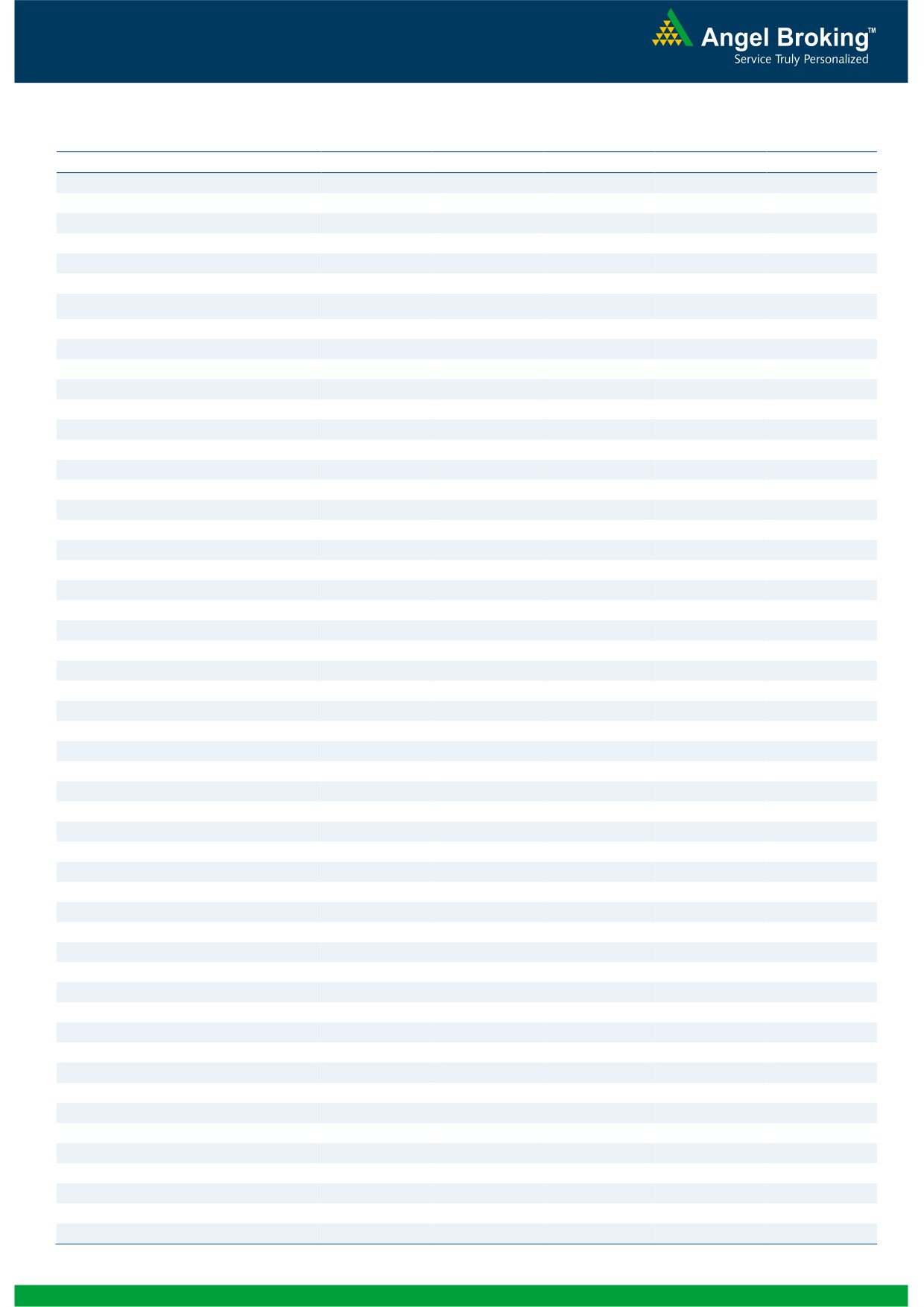

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

19,916

19,978

20,052

20,114

20,188

NIFTY

6,030

6,047

6,065

6,082

6,100

BANKNIFTY

12,540

12,610

12,694

12,764

12,848

ACC

1,318

1,332

1,349

1,363

1,380

AMBUJACEM

195

197

199

201

202

ASIANPAINT

4,232

4,271

4,315

4,354

4,398

AXISBANK

1,359

1,374

1,395

1,409

1,430

BAJAJ-AUTO

2,025

2,042

2,064

2,081

2,103

BANKBARODA

855

870

883

898

911

BHARTIARTL

341

345

349

353

357

BHEL

222

224

227

229

231

BPCL

393

414

426

447

459

CAIRN

329

333

340

343

350

CIPLA

405

408

410

413

415

COALINDIA

350

352

356

358

361

DLF

251

257

260

266

270

DRREDDY

1,850

1,871

1,903

1,923

1,956

GAIL

367

375

386

394

404

GRASIM

2,996

3,024

3,068

3,096

3,140

HCLTECH

691

699

708

715

724

HDFC

802

812

819

829

836

HDFCBANK

645

654

664

673

683

HEROMOTOCO

1,693

1,729

1,755

1,791

1,818

HINDALCO

121

122

123

124

126

HINDUNILVR

479

485

494

499

509

ICICIBANK

1,155

1,166

1,176

1,186

1,197

IDFC

172

174

175

177

179

INFY

2,759

2,774

2,792

2,806

2,824

ITC

282

285

287

290

293

JINDALSTEL

411

417

426

432

441

JPASSOCIAT

87

89

91

92

95

KOTAKBANK

615

622

626

634

638

LT

1,515

1,526

1,541

1,552

1,567

LUPIN

578

583

588

594

599

M&M

848

867

886

905

924

MARUTI

1,476

1,512

1,538

1,574

1,600

NTPC

154

159

162

167

170

ONGC

301

319

337

355

373

PNB

880

887

896

903

912

POWERGRID

111

113

114

116

118

RANBAXY

474

478

485

489

496

RELIANCE

879

890

896

907

914

RELINFRA

519

523

529

534

540

SBIN

2,456

2,474

2,496

2,514

2,535

SESAGOA

182

185

188

191

195

SIEMENS

647

652

656

661

665

SUNPHARMA

696

704

714

722

732

TATAMOTORS

323

326

329

332

335

TATAPOWER

104

106

107

109

111

TATASTEEL

408

411

417

421

427

TCS

1,324

1,337

1,352

1,365

1,380

ULTRACEMCO

1,861

1,885

1,905

1,929

1,949

WIPRO

366

382

411

426

455

3

Daily Technical Report

January 21, 2013

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4