Daily Technical Report

September 20, 2012

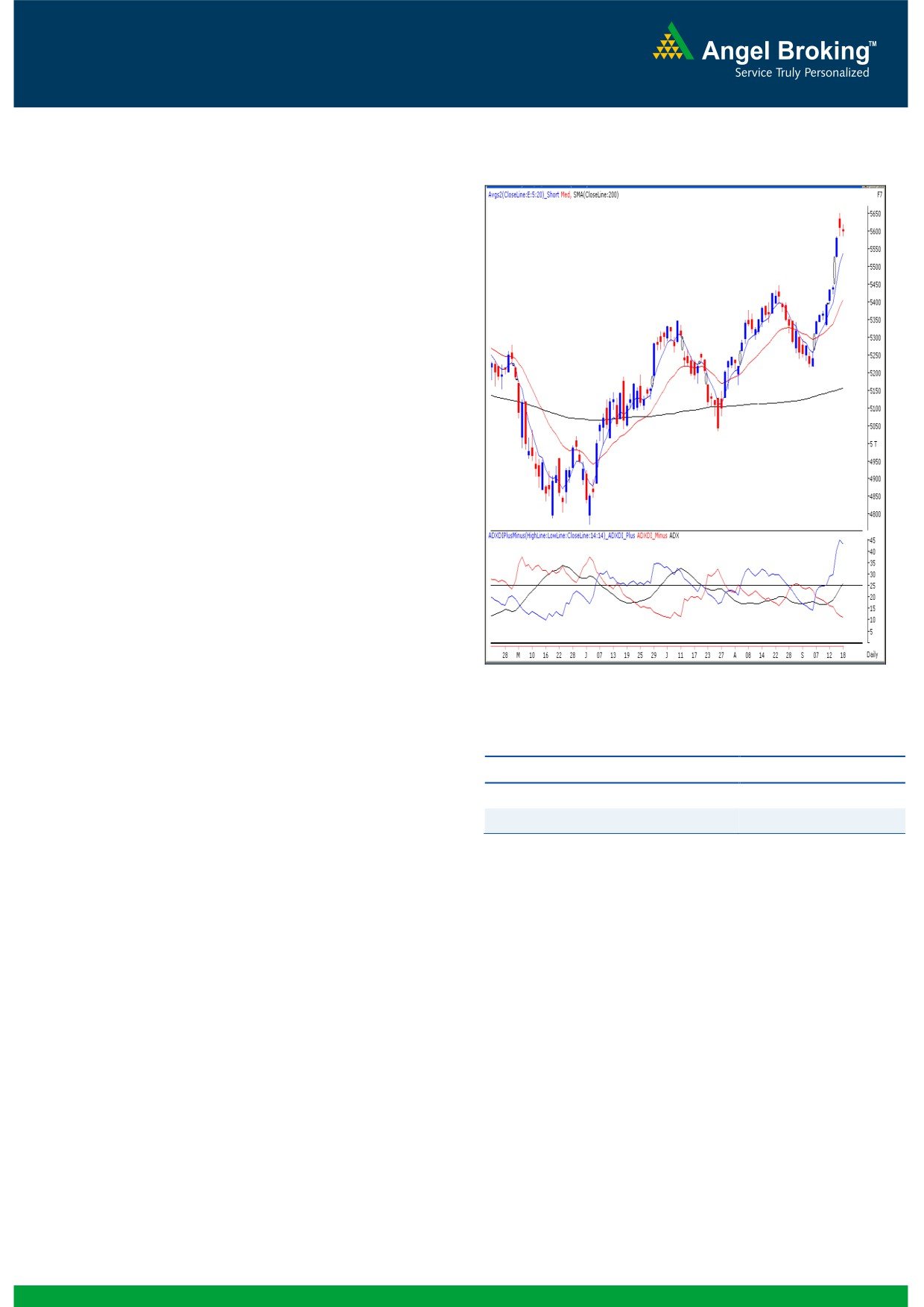

Exhibit 1: Nifty Daily Chart

Sensex (18496) / NIFTY (5600)

On Tuesday our markets opened quietly in-line with other

Asian bourses and traded in a narrow range throughout the

session to close exactly at the 5600 mark. On sectoral front

we witnessed a sharp rally in Banking counters (especially

the beaten down mid-cap PSU banks), Consumer Goods

and Power counters; whereas Oil & Gas, IT and Healthcare

sectors corrected on Tuesday’s session. The advance to

decline ratio was strongly in favor of advancing counters

Formation

The ’20-day EMA’ and the ’20-week EMA’ are placed at

17763 / 5361 and 17380 / 5261 levels, respectively.

Indices have now confirmed a weekly ‘Higher Top -

Higher Bottom’ formation.

The daily ‘RSI’ momentum oscillator on weekly chart is

still showing strength.

The weekly chart depicts an “Upward Sloping Trend

Line” breakout above 17973 / 5449 level.

The ADX (14) indicator on the Daily chart shows

Source: Falcon:

possibility of further strength in the coming sessions. The

+ DI (positive directional index) is moving upwards

Actionable points:

supported by the ADX line, which has now moved up to

26.14 level. The ADX rise from 15 to 25 indicates that

View

Neutral

the uptrend is strengthening and positive momentum is

Resistance Levels

5653 - 5702

likely to accelerate further in the coming trading

sessions.

Support Levels

5585 - 5550

Trading strategy:

After a strong rally, it is normal for the markets to show some

signs of consolidation. In line with expectations, the daily

chart now depicts a "Narrow Range" body formation, which

indicates that the bulls are taking a breather. Going forward

if our indices sustain below Tuesday's low of 18469 / 5586,

then we may witness a further correction towards the next

support level of 18380 / 5550. However, the continuous rise

in the daily ADX (14) indicator (moved up from 23.60 to

26.14) signifies that the current up trend will strengthen

further as time passes. Hence, we continue to maintain our

positive stance on the market and expect indices to move

towards their higher targets of 18945 - 19132 / 5702 -

5741 levels over the next few sessions.

Traders are advised to adopt a buy on dips strategy and

have a stock specific approach with strict stop losses on

trading positions.

1

Daily Technical Report

September 20, 2012

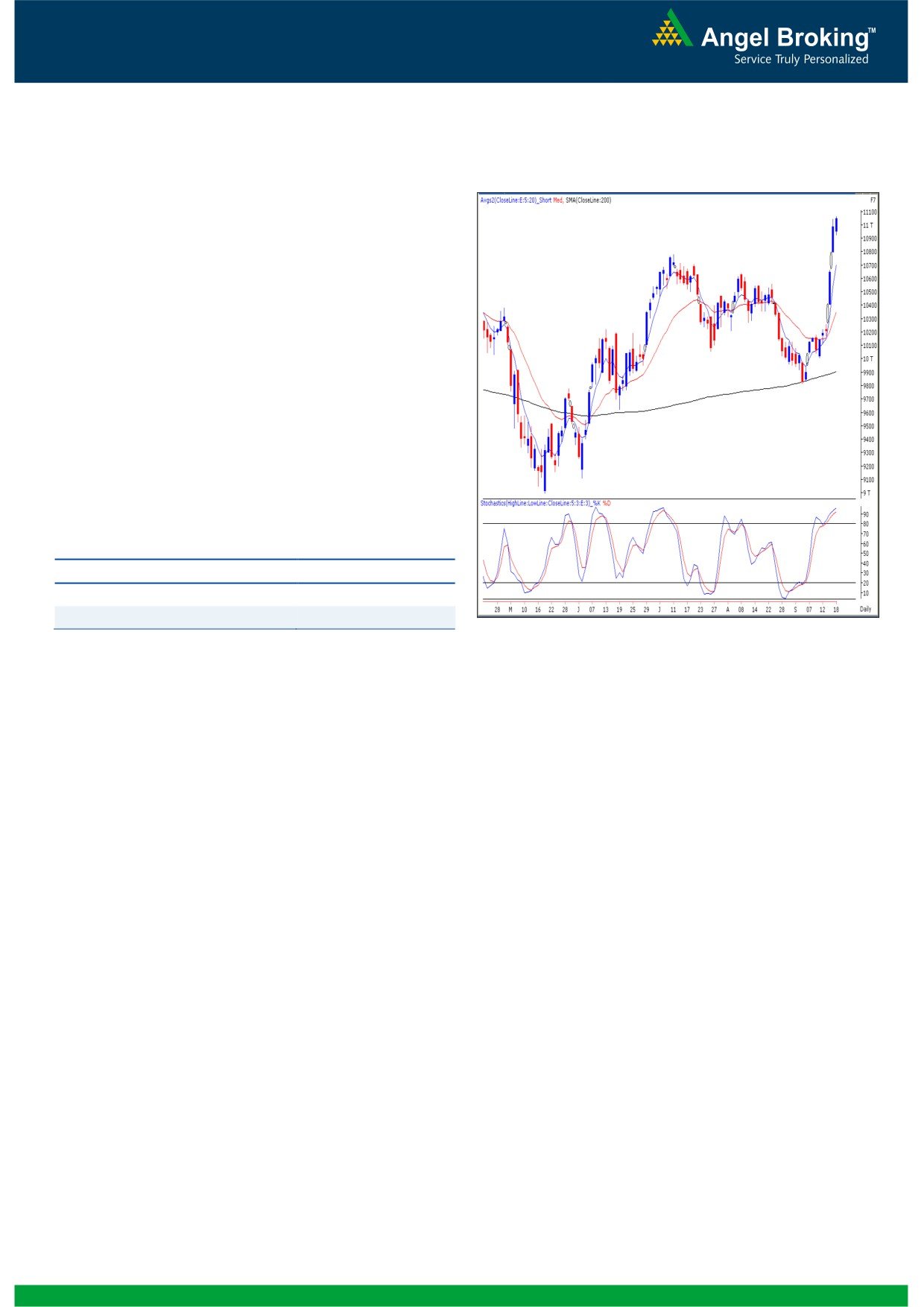

Bank Nifty Outlook - (11044)

Exhibit 2: Bank Nifty Daily Chart

On Tuesday, Bank Nifty opened on a flat note and traded in

a narrow range throughout the session to close with a

nominal gain of 0.56%. While the overall index remained

flat for the day, individual stocks in the PSU midcap banking

space rallied significantly. The “Negative Divergence” in

“RSI” momentum oscillator on the hourly chart mentioned in

our previous report is still intact. In addition the “Stochastic”

momentum oscillator on the daily chart continues to be in

overbought condition. As there is no major change in the

chart structure we reiterate our view that a minor pull back or

consolidation in the index cannot be ruled out. Thus on the

downside 10962 - 10867 are likely to act as support and

11065 - 11141 are likely to act as resistance in coming

trading session.

Actionable points:

View

Neutral

Resistance Levels

11065 - 11141

Support Levels

10816 - 10711

Source: Falcon:

2

Daily Technical Report

September 20, 2012

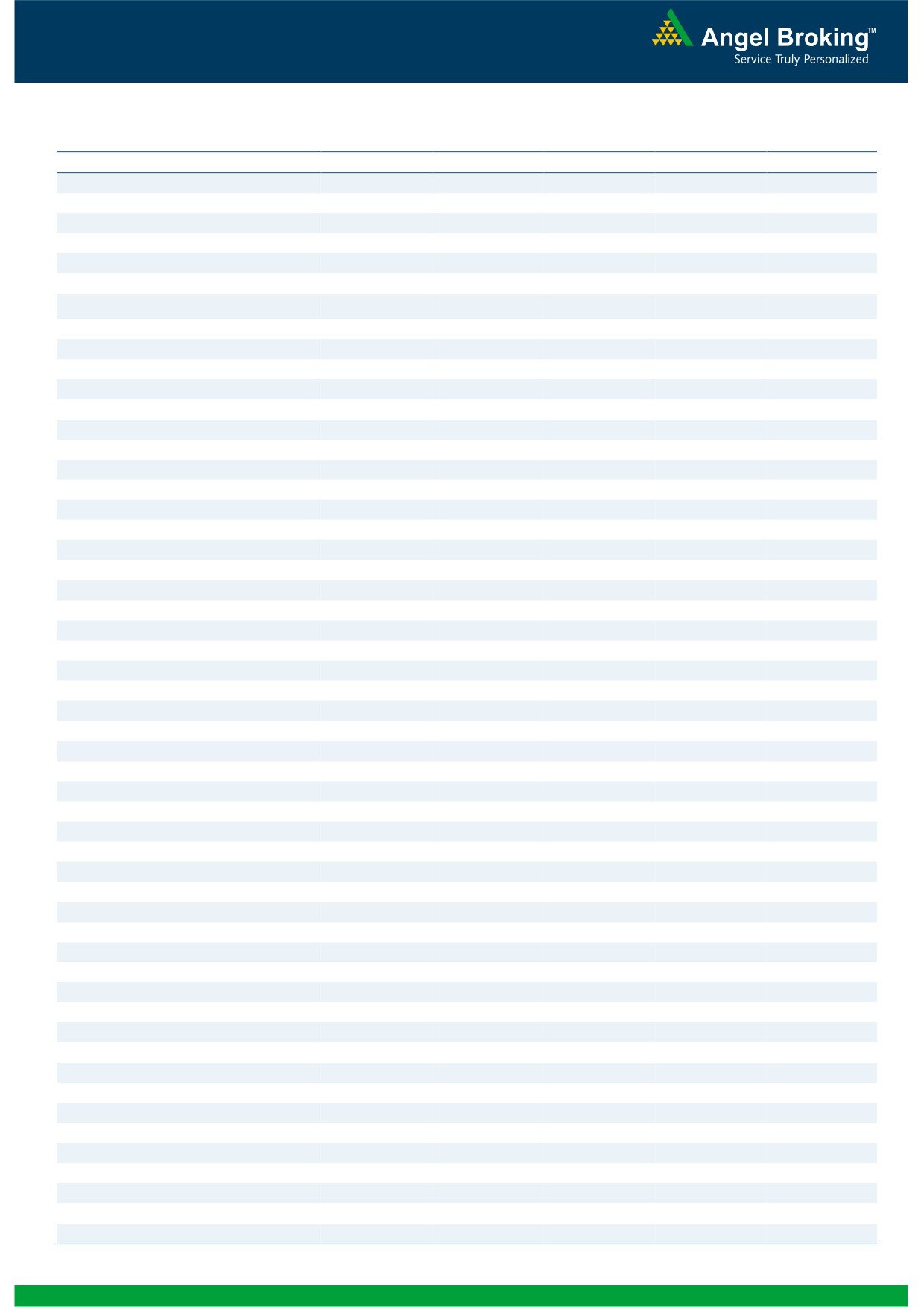

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

18,404

18,450

18,515

18,561

18,626

NIFTY

5,568

5,584

5,602

5,618

5,636

BANKNIFTY

10,868

10,956

11,010

11,098

11,153

ACC

1,350

1,359

1,370

1,380

1,391

AMBUJACEM

188

190

192

194

196

ASIANPAINT

3,846

3,873

3,899

3,926

3,952

AXISBANK

1,030

1,052

1,069

1,090

1,107

BAJAJ-AUTO

1,725

1,737

1,746

1,758

1,767

BANKBARODA

716

731

740

755

764

BHARTIARTL

263

266

268

271

274

BHEL

209

217

222

229

234

BPCL

330

334

339

342

347

CAIRN

340

345

354

359

368

CIPLA

357

361

368

371

378

COALINDIA

366

371

375

380

384

DLF

222

224

228

230

234

DRREDDY

1,646

1,661

1,675

1,690

1,704

GAIL

372

380

385

392

397

GRASIM

3,051

3,080

3,110

3,140

3,169

HCLTECH

557

566

571

579

584

HDFC

747

761

770

784

792

HDFCBANK

599

602

607

610

615

HEROMOTOCO

1,878

1,904

1,924

1,950

1,970

HINDALCO

112

113

115

116

117

HINDUNILVR

523

528

533

537

543

ICICIBANK

1,034

1,042

1,049

1,056

1,063

IDFC

144

146

149

151

154

INFY

2,558

2,580

2,599

2,621

2,640

ITC

248

251

255

258

261

JINDALSTEL

382

394

401

413

420

JPASSOCIAT

74

77

79

82

84

KOTAKBANK

580

590

600

610

621

LT

1,522

1,538

1,550

1,566

1,578

M&M

781

790

798

807

816

MARUTI

1,254

1,265

1,279

1,290

1,303

NTPC

162

164

167

170

173

ONGC

277

279

281

283

285

PNB

726

765

786

824

846

POWERGRID

115

117

118

119

121

RANBAXY

515

521

527

533

540

RELIANCE

838

847

860

869

883

RELINFRA

503

508

513

518

523

SAIL

85

87

88

90

91

SBIN

2,026

2,088

2,122

2,184

2,219

SESAGOA

172

174

176

178

181

SIEMENS

670

677

682

689

694

STER

100

101

102

104

105

SUNPHARMA

657

665

675

683

692

TATAMOTORS

269

271

275

277

281

TATAPOWER

96

97

99

100

101

TATASTEEL

401

403

406

409

412

TCS

1,260

1,280

1,312

1,332

1,365

WIPRO

358

364

374

380

391

3

Daily Technical Report

September 20, 2012

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4