Daily Technical Report

February 14, 2013

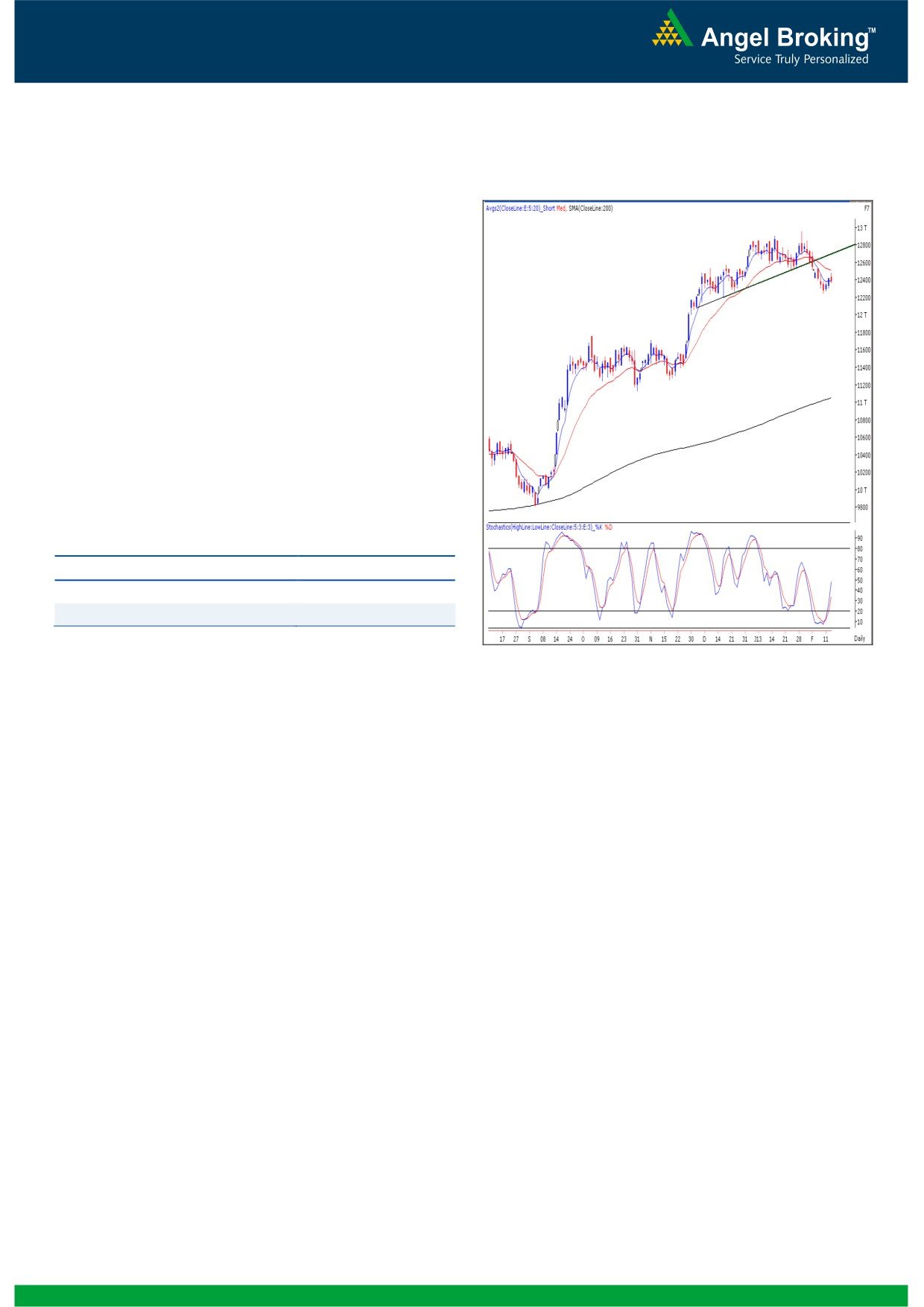

Exhibit 1: Nifty Daily Chart

Sensex (19608) / NIFTY (5933)

Yesterday, our benchmark indices opened with a gap and

then moved further higher during the initial hour of the

session to precisely test the '20-day EMA'. However, markets

pared down most of the early gains due to immense selling

pressure in the second half to eventually close with very

nominal gains. Power, Metals and Reality counters were

among the major losers in yesterday’s trading session.

Whereas IT and Teck stocks were on the gaining side. The

advance to decline ratio was strongly in favor of declining

Formation

The ’20-day EMA’ and the ’20-week EMA’ are placed at

19711 / 5972 and 19200 / 5824 levels, respectively.

The Nifty has broken down from the ‘Upward Sloping

Trendline’ (as shown in the chart).

The weekly ‘RSI Smoothened’ is now signaling a

negative crossover.

Source: Falcon:

Actionable points:

Trading strategy:

Tuesday strong closing followed by an optimistic opening

View

Bearish Below 5922

and indices carried this positive momentum throughout the

Expected Targets

5879 - 5840

first

half. Nevertheless, as expected, indices faced

Resistance Levels

5953 - 5979

tremendous resistance near '20-day EMA' placed at 19711 /

5972. Hence, we witnessed considerable correction post mid

- session. The daily chart now depicts a 'Narrow Range Body'

formation. The occurrence of said pattern near '20-day EMA'

indicates uncertainty among market participants. Going

forward, any sustainable move below yesterday's low of

19574 / 5922 may trigger further pessimism in the market.

In this scenario, indices may slide towards the recent swing

low of 19414 / 5879. On the flipside, any sustainable move

beyond yesterday's high of 19723 / 5970 would negate the

pattern and indices may then rally towards 19768 - 19865 /

5991 - 6025.

1

Daily Technical Report

February 14, 2013

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (12385)

Yesterday, Bank Nifty opened on a flat note and traded in a

narrow range during first half of the session. However, in

line with the benchmark indices selling pressure in the

second half led the index to close with a marginal loss of

0.16%. The ‘Inside day’ candlestick pattern mentioned in our

previous reports still hold it significance and will be negated

if the index closes below 12245 level. Thus going forward,

although the primary bias remains negative, we believe that

the ongoing consolidation is likely to continue so long as the

12245 level holds. On the upside 12500 - 12533 levels are

likely to act as resistance and 12337 - 12301 levels are

likely to act as support for the day.

Actionable points:

View

Neutral

Resistance Levels

12500 - 12533

Support Levels

12337 - 12301

Source: Falcon:

2

Daily Technical Report

February 14, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4