Daily Technical Report

March 11, 2013

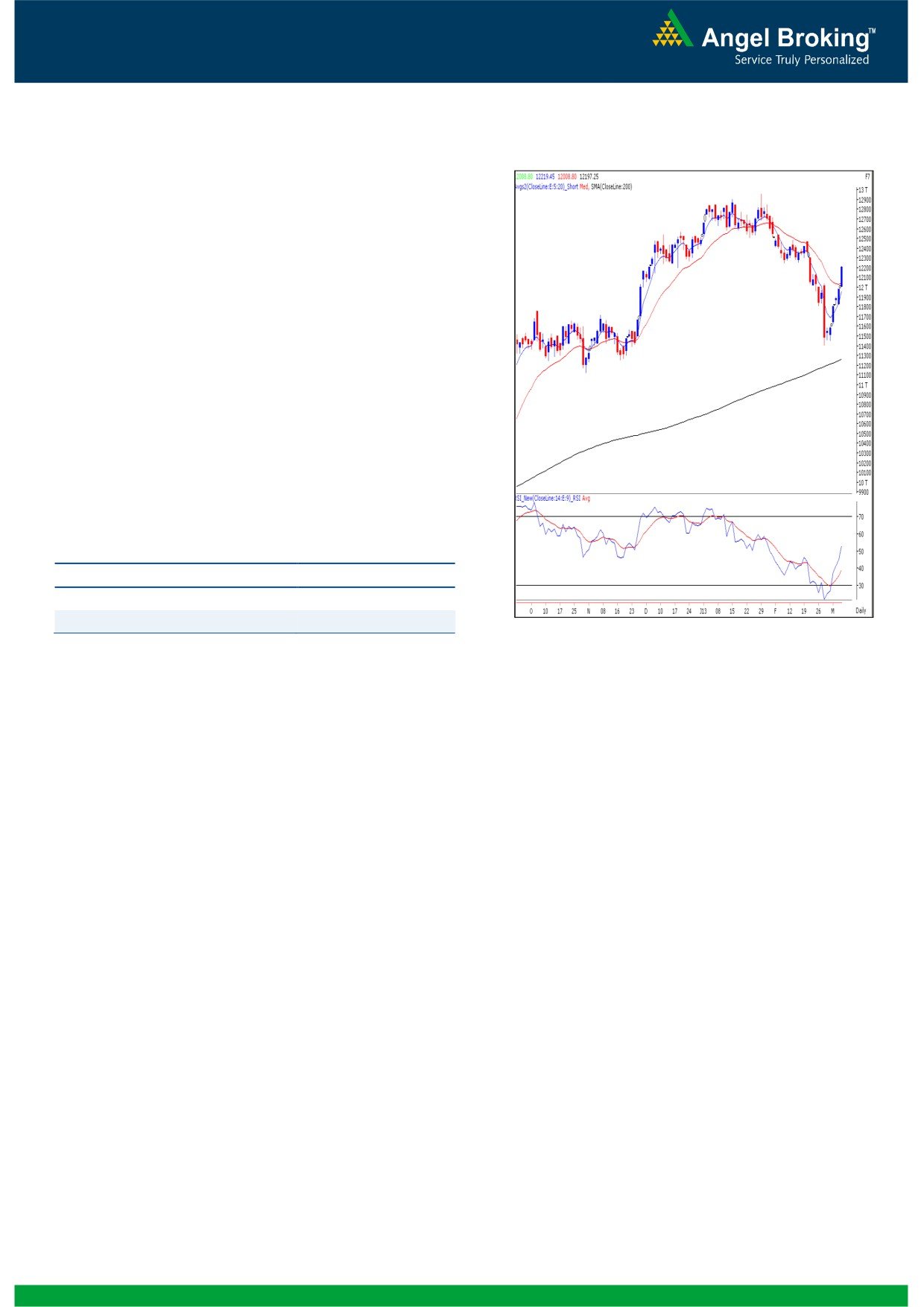

Exhibit 1: Nifty Daily Chart

Sensex (19683) / NIFTY (5946)

On Friday, indices opened on with an upside gap in line with

other global indices and traded in a narrow range during

first half of the session. However, buying interest during the

second half led the index to close near day’s high. During

the day, most of the sectors ended on the gaining side except

for IT and Teck which ended on a losing side. The advance

to decline ratio was in favor of advancing counters (A=1734

Formation

The ’20-day EMA’ and the ’20-week EMA’ are placed at

19348 / 5850 and 19224 / 5826 levels, respectively.

The weekly chart exhibits a ‘Bullish Engulfing’ pattern but

the monthly chart exhibits a ‘Bearish Engulfing’ pattern.

The daily ‘ADX

(14)’ indicator and the weekly

Source: Falcon:

‘Stochastic’ momentum oscillator is now signaling a

positive crossover.

The level of the weekly ‘RSI’ momentum oscillator has

now bounced back sharply to 58.20 after dropping

Actionable points:

below the 50 mark.

Indices have closed above the ‘Downward Sloping Trend

View

Neutral

Line’, drawn by joining two significant highs of 21109 /

Resistance Levels

5971 - 5991

6339 (high of November 05, 2010 weekly candle) and

Support levels

5883

19137 / 5816 (high of October 05, 2012 weekly

candle).

This bullish pattern is now supported

by the positive

crossover in the daily ‘ADX (14)’ indicator and the weekly

‘Stochastic’ oscillator. Also, last week we had mentioned that

Trading strategy:

the weekly ‘RSI’ momentum oscillator has moved below the

Indices have now finally broken the losing streak after six

50 mark. Nevertheless, this week it has managed to jump

consecutive red candles. The market movement over the last

back convincingly to close above the 58 level. This indicates

two weeks can be described as a tug of war between the

possibility of a further upside move if indices sustain above

bulls and the bears. Indices could not sustain below the

19706 / 5953. In this scenario, the markets may rally

weekly low and bounced back sharply to nullify the impact of

towards 19768 - 19865 / 5991 - 6025 or even re-test the

previously mentioned negative technical evidences. This

recent swing high of 20204 / 6112. On the flipside, the ’89-

intra-week rally has resulted in formation of a ‘Bullish

day EMA’ and the ’20-day EMA’ would now provide decent

Engulfing’ pattern on the weekly chart. As mentioned in our

support to the markets. These are placed at 19250 / 5830

previous report, it can be now concluded that indices have

and 19348 / 5850, respectively. A sustainable move below

precisely taken a support at the ‘Downward Sloping Trend

19195 / 5795 would once again trigger pessimism in the

Line’ (please refer exhibit 1).

market.

1

Daily Technical Report

March 11, 2013

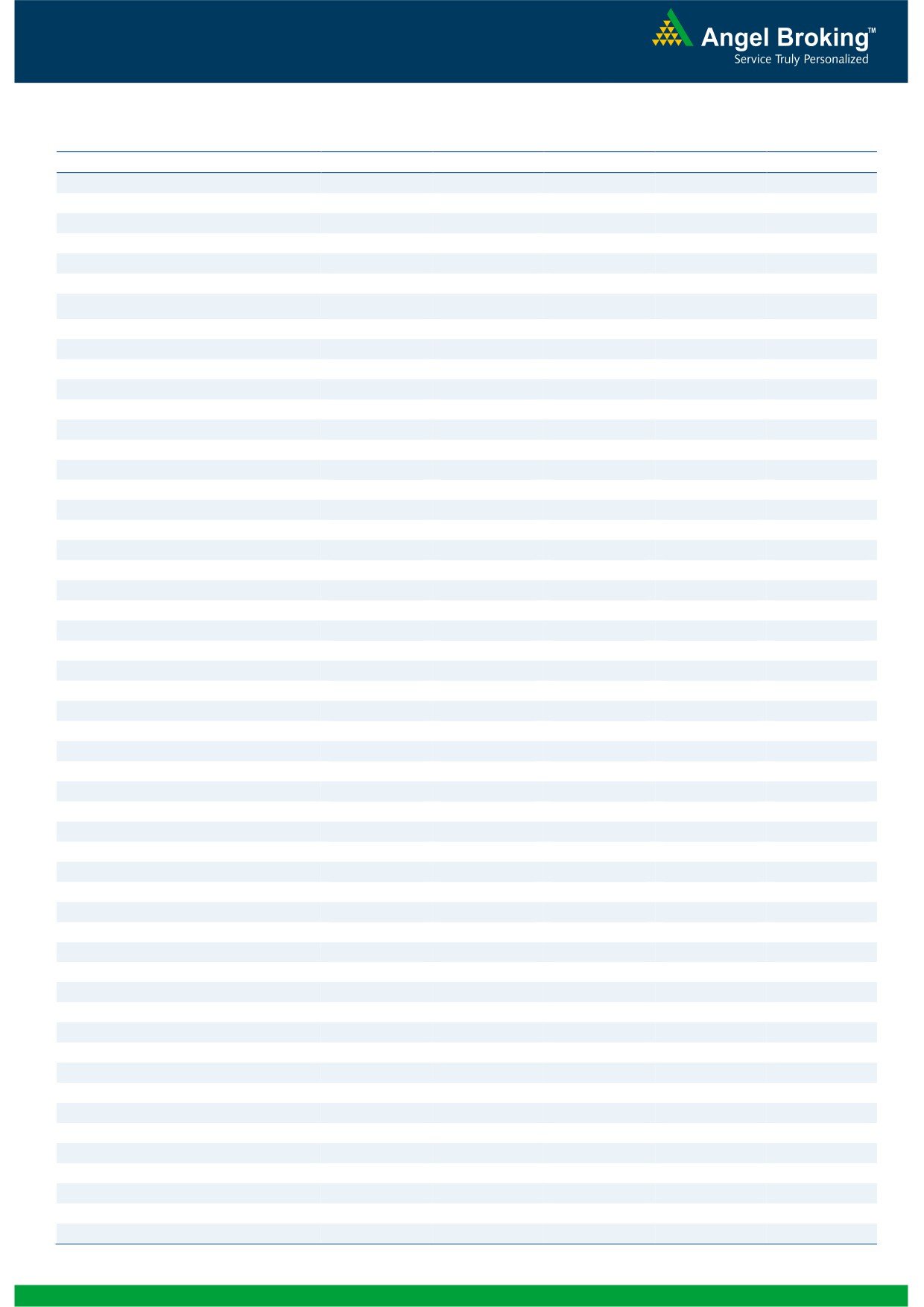

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (12197)

On Friday, Bank Nifty opened with an upside gap and

gained strength as the day progressed to close near the

highest point of the day. At this juncture we are witnessing

a ‘Bullish Engulfing’ candle stick pattern on the weekly

chart which is a bullish reversal pattern. In addition the

momentum oscillators on the daily and weekly chart are

positively poised indicating the possibility of further upside

in coming weeks. However, looking at the extreme

overbought conditions on momentum oscillators on the

hourly chart some consolidation or a minor pullback in the

index cannot be ruled out. On the upside 12301 - 12350

levels are likely to act as resistance and 12040 - 12000

levels are likely to act as support for the day.

Actionable points:

View

Neutral

Resistance levels

12301 - 12350

Support Levels

12040 - 12000

Source: Falcon:

2

Daily Technical Report

March 11, 2013

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

19,394

19,539

19,622

19,767

19,851

NIFTY

5,857

5,902

5,927

5,971

5,997

BANKNIFTY

11,931

12,064

12,142

12,275

12,352

ACC

1,244

1,254

1,265

1,275

1,287

AMBUJACEM

184

185

189

191

194

ASIANPAINT

4,553

4,610

4,649

4,706

4,745

AXISBANK

1,394

1,400

1,409

1,416

1,425

BAJAJ-AUTO

1,954

1,984

2,003

2,033

2,052

BANKBARODA

719

726

731

737

743

BHARTIARTL

318

320

323

326

329

BHEL

204

206

207

209

210

BPCL

384

395

402

412

419

CAIRN

297

301

304

308

311

CIPLA

384

388

390

394

397

COALINDIA

310

315

319

325

328

DLF

269

274

278

283

287

DRREDDY

1,763

1,791

1,810

1,838

1,858

GAIL

329

335

339

345

349

GRASIM

2,991

3,010

3,030

3,049

3,069

HCLTECH

759

766

775

782

790

HDFC

776

794

805

824

835

HDFCBANK

637

647

654

664

670

HEROMOTOCO

1,690

1,717

1,742

1,768

1,793

HINDALCO

98

100

101

103

104

HINDUNILVR

430

434

437

441

443

ICICIBANK

1,110

1,125

1,134

1,148

1,157

IDFC

152

156

159

163

165

INFY

2,940

2,955

2,972

2,987

3,004

ITC

290

294

296

300

303

JINDALSTEL

342

355

362

375

382

JPASSOCIAT

74

76

77

79

80

KOTAKBANK

640

658

668

686

696

LT

1,440

1,469

1,489

1,518

1,538

LUPIN

588

596

601

609

614

M&M

884

894

900

911

917

MARUTI

1,382

1,405

1,440

1,463

1,498

NTPC

143

146

148

151

154

ONGC

318

322

325

329

332

PNB

800

807

813

820

826

POWERGRID

107

109

109

111

112

RANBAXY

393

398

402

407

412

RELIANCE

834

843

849

857

863

RELINFRA

421

427

432

438

443

SBIN

2,159

2,184

2,202

2,227

2,244

SESAGOA

162

164

167

169

172

SIEMENS

504

518

527

542

551

SUNPHARMA

807

812

818

823

829

TATAMOTORS

297

300

304

308

311

TATAPOWER

97

98

99

99

100

TATASTEEL

348

354

358

363

367

TCS

1,564

1,573

1,585

1,594

1,605

ULTRACEMCO

1,852

1,876

1,898

1,922

1,943

WIPRO

437

441

449

453

460

3

Daily Technical Report

March 11, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4