Daily Technical Report

February 11, 2013

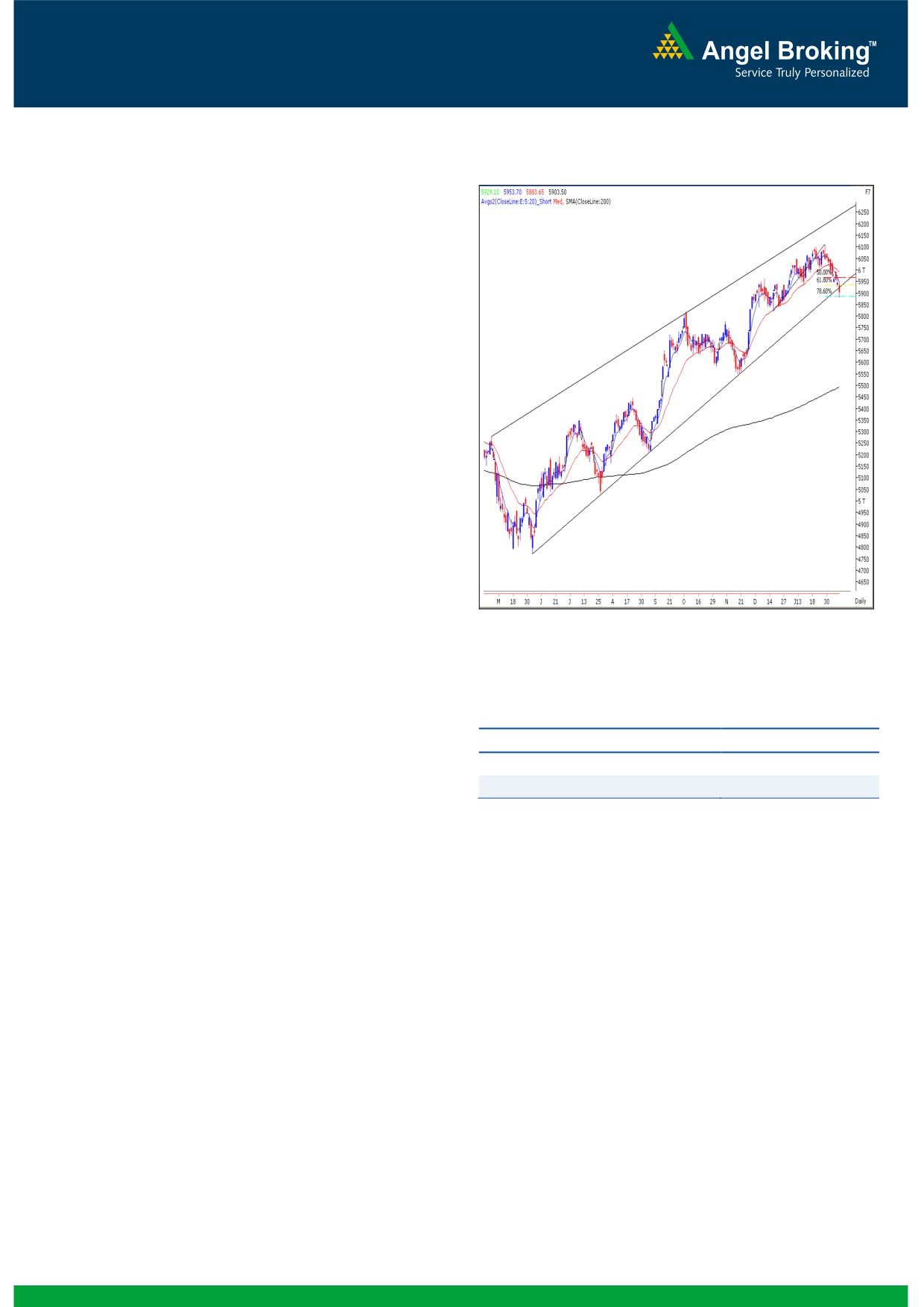

Exhibit 1: Nifty Daily Chart

Sensex (19485) / NIFTY (5904)

On Friday, in line with our expectations, markets traded with

a negative bias and benchmark indices breached the

psychological levels of 19500 / 5900 to close near the day’s

low. Metal, PSU and Realty counters contributed heavily in

the fall. However, IT, Teck and Capital Goods counters

counters provided descent support to the markets. The

advance to decline ratio was strongly in favor of declining

Formation

The ’20-day EMA’ and the ’20-week EMA’ are placed at

19768 / 5990 and 19160 / 5813 levels, respectively.

The Nifty has broken down from the ‘Upward Sloping

Channel’ (as shown in the chart).

The weekly ‘RSI Smoothened’ is now signaling a

negative crossover.

Source: Falcon:

The ‘Hanging Man’ Japanese Candlestick pattern on the

weekly chart is intact.

Actionable points:

Trading strategy:

View

Bearish Below 5883

In-line with our expectations, markets experienced strong

Expected Targets

5842 - 5800

negative momentum throughout the week. During the week,

Resistance Levels

5953 - 5979

indices precisely met with the mentioned targets of 19596 -

19406 / 5940 - 5897. The news flow continued to be

Considering the Channel pattern breakdown and negative

negative during the week as the Government lowered the

placement of weekly momentum oscillators, we can infer that

GDP growth projections to the lowest level in a decade. The

indices may experience a severe correction in the coming

sharp fall during the last half an hour on Friday has now

week if they manage to sustain below this week’s low of

confirmed a breakdown of the ‘Upward Sloping Channel’ on

19414 / 5883. In this scenario, we may witness a corrective

the daily chart. (Please refer exhibit 2). Please note that the

move towards 19000 - 18870 / 5800 - 5735 levels. On the

Sensex has not yet confirmed a breakdown of the ‘Upward

flipside, 19648 - 19768 / 5953 - 5991 levels would act as

Sloping Channel’ pattern. Also Indices have now precisely

strong resistance for our benchmark indices.

tested 78.6% Fibonacci retracement level of the rise from

19149 / 5823 (low on December 18, 2012) to 20204 /

6112 (high on January 29, 2013).

1

Daily Technical Report

February 11, 2013

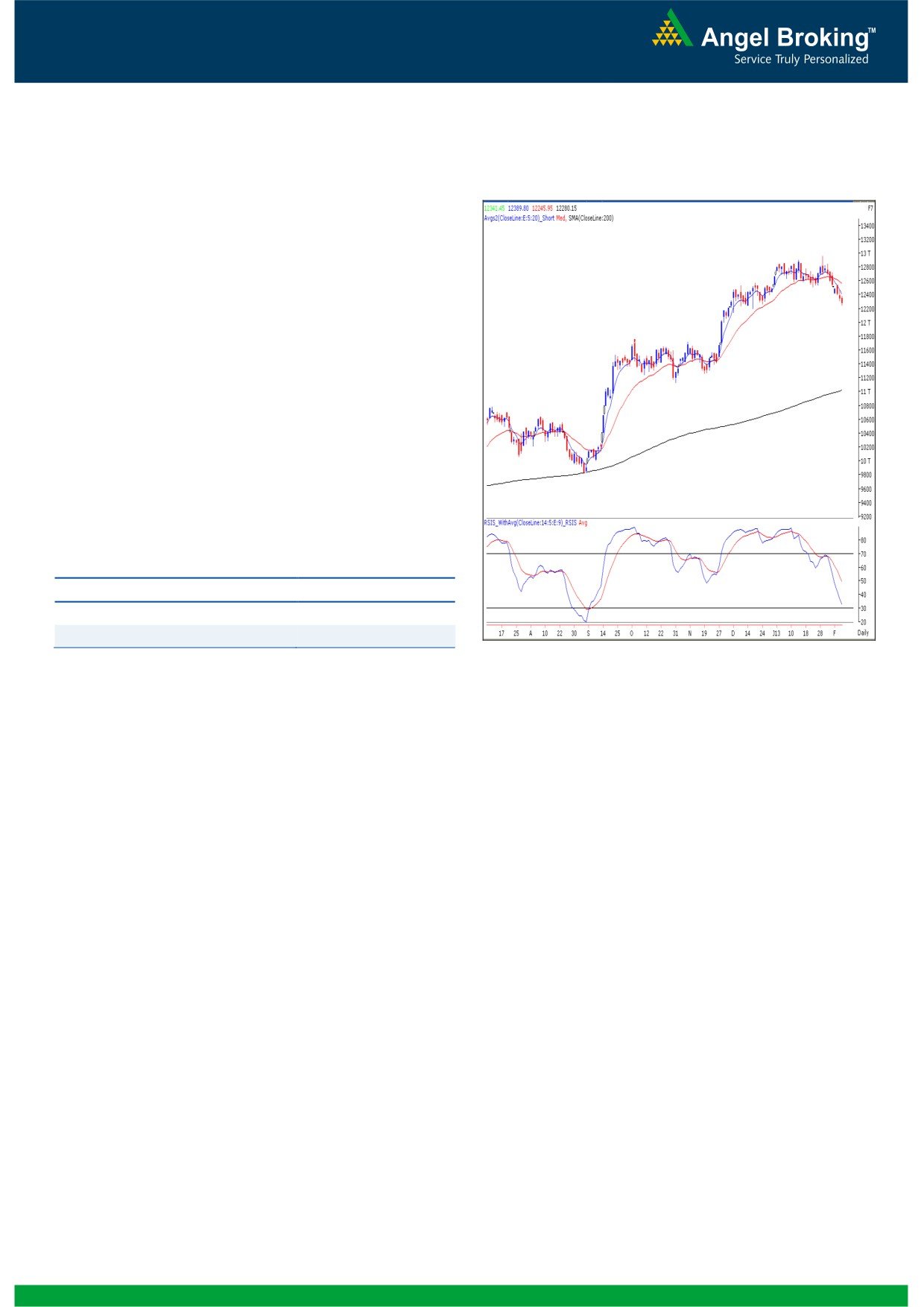

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (12280)

On Friday, Bank Nifty opened on a flat note and traded in a

narrow range during major part of the session. However,

during the last hour of trade selling pressure in banking

heavyweights like ICICI bank and SBI lead the index to close

with a loss of 0.56%. The momentum oscillators on the daily

and weekly chart are negatively poised. However, positive

divergence in “RSI” momentum oscillator on the hourly chart

mentioned in our previous report is still intact. Hence,

although the primary bias remains negative, the possibility of

bounce back or sideways consolidation in the index cannot

be ruled out. On the upside 12390 - 12475 levels are likely

to act as resistance and 12230 - 12197 levels may act as

support in the coming trading session.

Actionable points:

View

Neutral

Resistance Levels

12390 - 12475

Support Levels

12230 - 12197

Source: Falcon:

2

Daily Technical Report

February 11, 2013

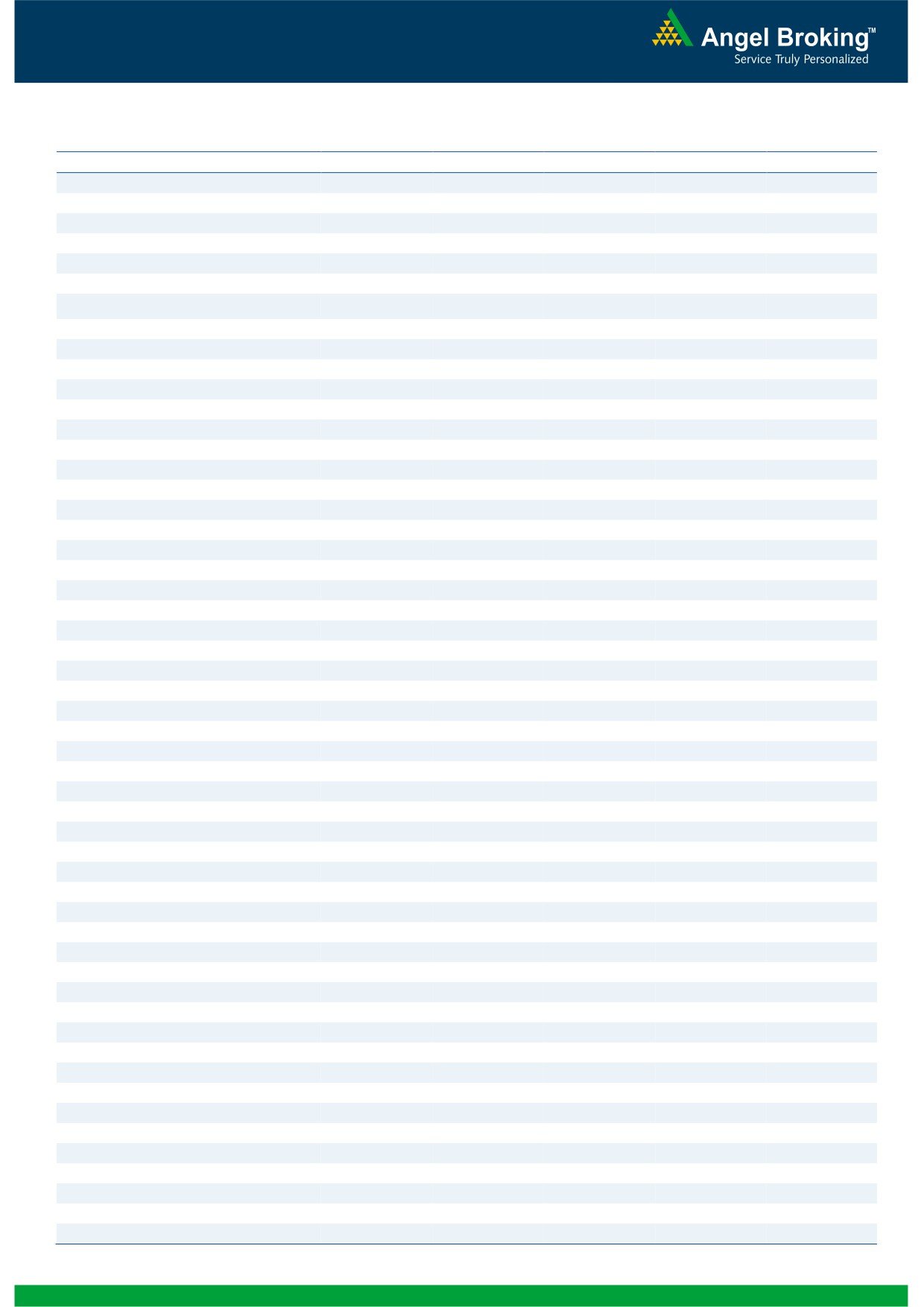

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

19,283

19,384

19,516

19,617

19,749

NIFTY

5,844

5,874

5,914

5,944

5,984

BANKNIFTY

12,161

12,221

12,305

12,365

12,449

ACC

1,271

1,287

1,311

1,327

1,351

AMBUJACEM

183

186

191

195

199

ASIANPAINT

4,432

4,478

4,557

4,603

4,683

AXISBANK

1,430

1,441

1,456

1,466

1,481

BAJAJ-AUTO

2,004

2,025

2,060

2,081

2,115

BANKBARODA

754

761

770

777

786

BHARTIARTL

313

318

321

326

329

BHEL

202

205

208

212

215

BPCL

393

397

404

409

416

CAIRN

308

311

317

320

326

CIPLA

370

375

384

390

399

COALINDIA

327

333

339

345

351

DLF

265

267

270

272

275

DRREDDY

1,815

1,835

1,868

1,888

1,920

GAIL

331

333

335

338

340

GRASIM

2,946

2,979

3,024

3,057

3,102

HCLTECH

661

666

671

676

681

HDFC

796

802

812

818

827

HDFCBANK

635

643

648

655

661

HEROMOTOCO

1,675

1,697

1,730

1,753

1,786

HINDALCO

105

108

111

113

116

HINDUNILVR

445

449

453

457

461

ICICIBANK

1,110

1,120

1,135

1,145

1,160

IDFC

158

160

162

164

166

INFY

2,748

2,769

2,793

2,813

2,837

ITC

295

299

302

306

310

JINDALSTEL

403

409

416

421

429

JPASSOCIAT

72

72

73

74

75

KOTAKBANK

666

672

681

687

695

LT

1,472

1,492

1,509

1,529

1,546

LUPIN

588

593

597

601

605

M&M

859

872

889

902

919

MARUTI

1,544

1,566

1,599

1,621

1,654

NTPC

144

146

148

150

153

ONGC

304

309

315

320

326

PNB

845

854

868

877

891

POWERGRID

109

110

112

113

114

RANBAXY

419

424

432

436

444

RELIANCE

848

856

865

873

882

RELINFRA

474

481

491

498

508

SBIN

2,235

2,261

2,302

2,327

2,369

SESAGOA

164

167

171

174

178

SIEMENS

608

612

618

622

629

SUNPHARMA

732

739

749

756

765

TATAMOTORS

278

282

288

292

299

TATAPOWER

95

96

97

98

99

TATASTEEL

380

384

389

393

398

TCS

1,363

1,393

1,415

1,445

1,467

ULTRACEMCO

1,821

1,853

1,898

1,930

1,975

WIPRO

398

405

410

418

423

3

Daily Technical Report

February 11, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4