Daily Technical Report

November 08, 2012

Exhibit 1: Nifty Daily Chart

Sensex (18902) / NIFTY (5760)

Yesterday, yet again our benchmark indices opened on a flat

note in-line with other Asian bourses. Post the US Presidential

Election results our markets surged higher amidst all the

major global indices. In the process, market finally managed

to conquer the stiff resistance level of 18885 / 5729 and

eventually closed well inside the positive territory. Almost all

the sectors contributed in yesterday’s rally. Among them

Realty, Banking and IT counters were the major gainers;

whereas Oil & Gas was the only sector which ended with

marginal loss. The advance to decline ratio was strongly in

favor of advancing counters (A=1672 D=1205) (Source -

Formation

The ’20-day EMA’ and the ’20-week EMA’ are placed at

18650 / 5669 and 18134 / 5502 levels, respectively.

The monthly ‘RSI’ oscillator is moving higher from the 50

mark and the positive in the ADX (9) indicator is intact.

The negative crossover in the weekly ‘Stochastic’

oscillator is still intact.

Source: Falcon:

The daily momentum oscillators and ‘3 & 8 EMA’ are

now signaling a positive crossover.

Actionable points:

The 38.2% and 50% Fibonacci Retracement levels of the

rise from 17250 to 19138 / 5216 to 5815 are placed at

View for the day

Neutral

18416 / 5586 and 18194 / 5515, respectively.

Resistance Levels

5778 - 5816

Trading strategy:

Support levels

5711- 5679

The much awaited breakout from the resistance level of

18885 / 5729 was finally seen during yesterday’s session. As

expected, all the positive technical evidences came into effect

and as a result, we witnessed a decent intraday rally

throughout the session. However the European as well as

American markets have slumped in yesterday’s trading

session as the focus now shifts to the fiscal cliff’s debate in

US. Considering these developments, we may witness

negative opening in our market in today’s session. On the

downside, the support levels are seen at 18786 - 18683 /

5711 - 5679. In the next few sessions we expect the market

to slump back into the range of 5630 to 5730, before any

decisive move on either side can be seen.

1

Daily Technical Report

November 08, 2012

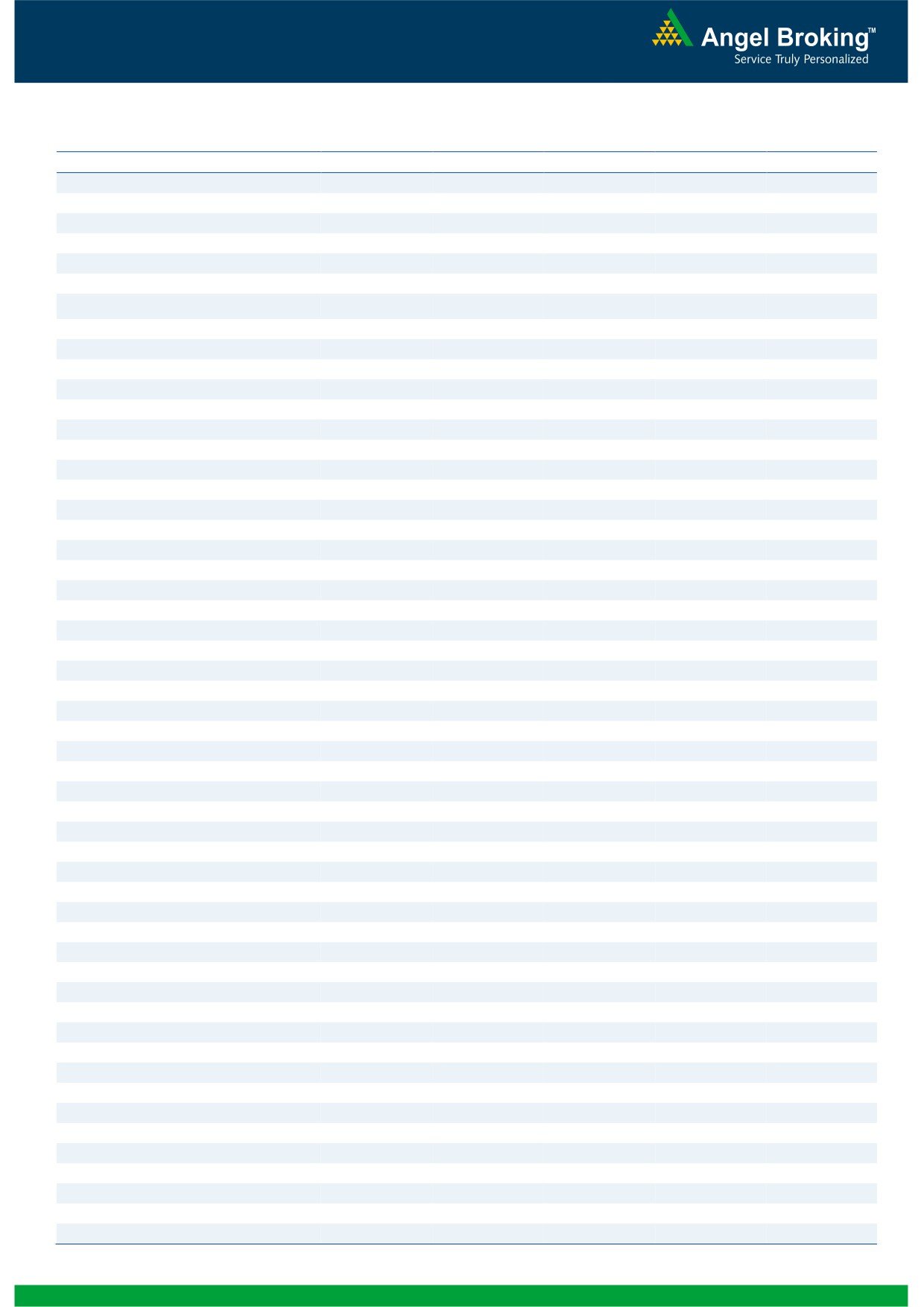

Exhibit 2: Bank Nifty Hourly Chart

Bank Nifty Outlook - (11666)

Yesterday, Bank Nifty opened on an optimistic note and

gained strength as the day progressed to close with a gain

of 1.10%. The index faced resistance near 127% Fibonacci

retracement of the fall from on 11600 - 11125 and

formed a “Bearish Engulfing” pattern on the hourly chart.

In addition we are also witnessing negative placement of

momentum oscillators “RSI” and “Stochastic” on the hourly

chart coupled with overbought condition of momentum

oscillator “RSI - Smoothened”. Looking at these technical

indicators we believe a correction in the index can be

expected if the index sustains below the 11648 level. In

this scenario the index is likely to drift lower towards the

11566 - 11468 levels. On the upside 11728 - 11774

levels are likely to act as resistance for the day.

Actionable points:

View for the day

Neutral

Resistance Levels

11728 - 11774

Support Levels

11566 - 11468

Source: Falcon:

2

Daily Technical Report

November 08, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

18,700

18,801

18,887

18,989

19,075

NIFTY

5,684

5,722

5,750

5,788

5,816

BANKNIFTY

11,435

11,550

11,635

11,750

11,834

ACC

1,450

1,461

1,471

1,482

1,491

AMBUJACEM

214

216

217

219

221

ASIANPAINT

4,066

4,093

4,119

4,146

4,172

AXISBANK

1,202

1,217

1,230

1,246

1,259

BAJAJ-AUTO

1,831

1,846

1,860

1,875

1,889

BANKBARODA

731

755

770

793

809

BHARTIARTL

262

267

274

278

285

BHEL

229

233

236

239

242

BPCL

338

339

340

341

343

CAIRN

326

329

331

333

335

CIPLA

389

393

397

401

405

COALINDIA

345

347

349

351

354

DLF

203

207

210

214

217

DRREDDY

1,755

1,774

1,792

1,812

1,830

GAIL

359

362

365

369

371

GRASIM

3,303

3,352

3,384

3,434

3,465

HCLTECH

601

609

615

622

628

HDFC

769

784

795

810

821

HDFCBANK

633

636

641

644

649

HEROMOTOCO

1,899

1,923

1,943

1,967

1,987

HINDALCO

111

112

113

115

116

HINDUNILVR

523

529

533

538

542

ICICIBANK

1,071

1,082

1,091

1,102

1,111

IDFC

158

162

165

170

173

INFY

2,359

2,382

2,398

2,421

2,437

ITC

286

288

289

291

293

JINDALSTEL

378

383

389

393

399

JPASSOCIAT

85

90

92

96

98

KOTAKBANK

620

625

629

634

638

LT

1,635

1,652

1,668

1,685

1,701

LUPIN

577

583

586

592

596

M&M

904

912

920

928

936

MARUTI

1,434

1,451

1,464

1,481

1,495

NTPC

166

168

169

171

172

ONGC

265

266

267

268

269

PNB

742

759

771

788

801

POWERGRID

118

119

120

121

121

RANBAXY

539

545

550

556

561

RELIANCE

794

797

801

805

809

RELINFRA

473

479

486

492

498

SBIN

2,139

2,178

2,204

2,243

2,269

SESAGOA

174

175

177

178

180

SIEMENS

696

701

707

712

718

SUNPHARMA

692

696

701

705

709

TATAMOTORS

263

266

270

273

277

TATAPOWER

102

103

104

105

107

TATASTEEL

393

397

401

406

409

TCS

1,317

1,324

1,329

1,336

1,341

ULTRACEMCO

1,990

2,007

2,018

2,035

2,046

WIPRO

363

365

368

371

374

3

Daily Technical Report

November 08, 2012

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4