Daily Technical Report

April 08, 2013

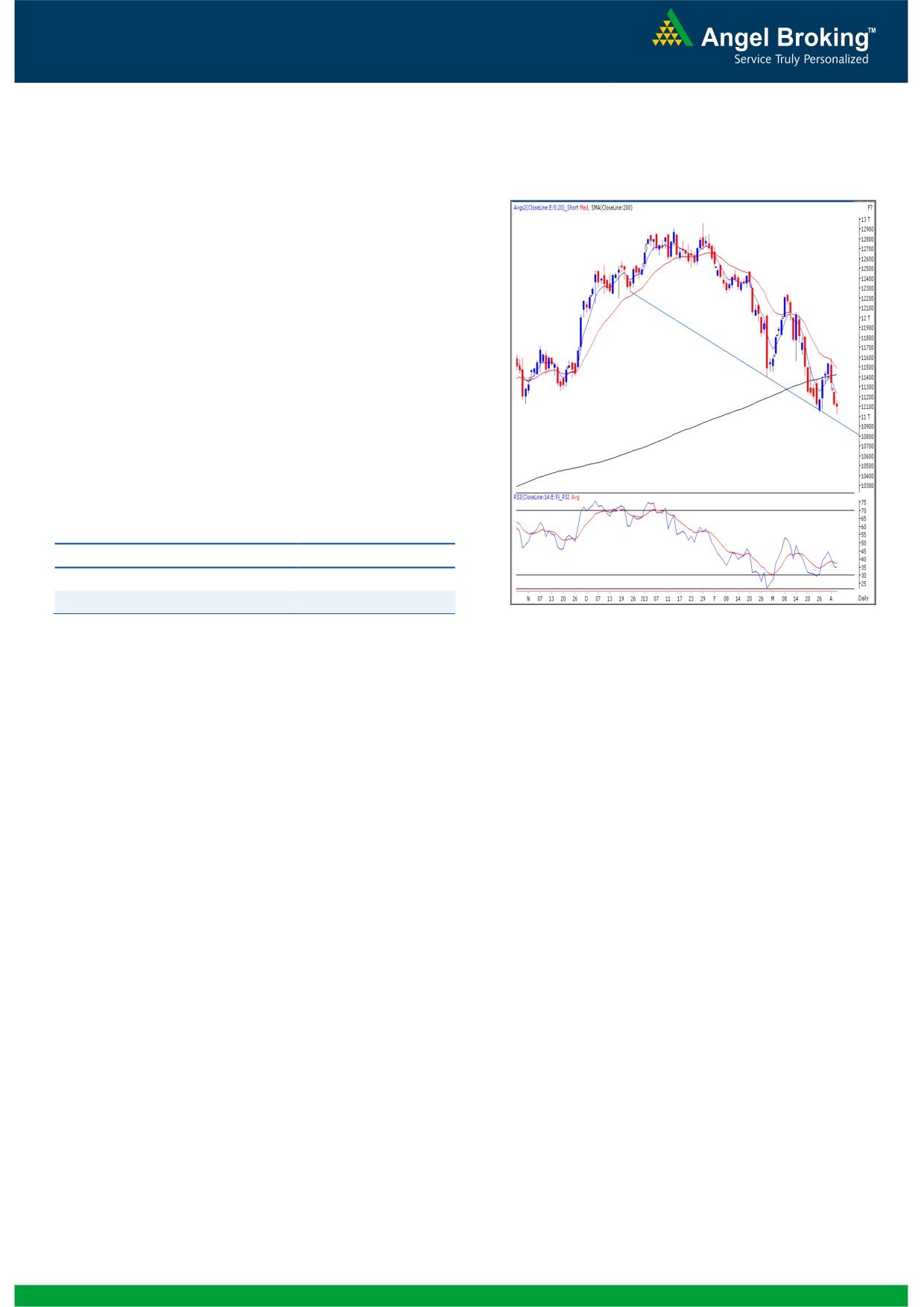

Exhibit 1: Nifty Daily Chart

Sensex (18450) / NIFTY (5553)

On Firday, indices opened on a pessimistic note and traded

with extreme volatility throughout the sesszion to close

marginally above the

5550 mark. FMCG, Consumer

Durables, and Capital Goods stocks were among the major

losers whereas Oil & Gas, Auto and Metal Counters ended

with gains. The advance to decline ratio was in favor of

advancing counters (A=1422 D=1306) (Source-

Formation

The ’20-week EMA’ and the ’20-day EMA’ are placed at

19094 / 5777 and 18941 / 5717 levels, respectively.

The ’89-week EMA’ and ‘200 Day SMA’ are placed at

18200 / 5500 and 18556 / 5640, respectively.

Source: Falcon:

The ‘Lower Top Lower Bottom’ formation on weekly

chart is still intact.

Actionable points:

Trading strategy:

The bulls finally had to surrender this week, as the

View

Neutral

benchmark indices gave a weekly closing below the

Resistance levels

5577 - 5605

psychological level of 18500 / 5600, which is for the first

Support levels

5500

time after November 16, 2012’s weekly candle. Indices are

now approaching the next support level at the weekly ’89-

The charts of global markets too appear weak and may add

EMA’ placed around 18200 / 5500 level. The momentum

on to the prevailing negative sentiment. A fall below 18200 /

oscillators on the daily charts are extremely oversold and the

5500 may reinforce selling pressure in the market. In this

possibility of a bounce thus cannot be ruled out. However,

scenario, we may witness a continuation of the concluded

week’s pessimism, possibly leading indices to slide towards

one must remember that to time the bounce will be difficult;

17976 / 5441 levels, or even further down. We advise

traders looking to initiating long positions should wait for the

traders to stay light on the positions and follow strict stop

indices to cross the Friday’s high of 18525 / 5577. Only a

losses. Initiating fresh short positions on the index at current

sustainable move beyond this level may push markets higher

levels is not recommended as the risk - reward ratio is not

to test the next resistance levels placed at 18727 - 18960 /

favorable and may incur losses.

5645 - 5720. On the other hand the ‘Lower Top - Lower

Bottom’ formation on the weekly chart is still intact and the

momentum on the down side is quite strong.

1

Daily Technical Report

April 08, 2013

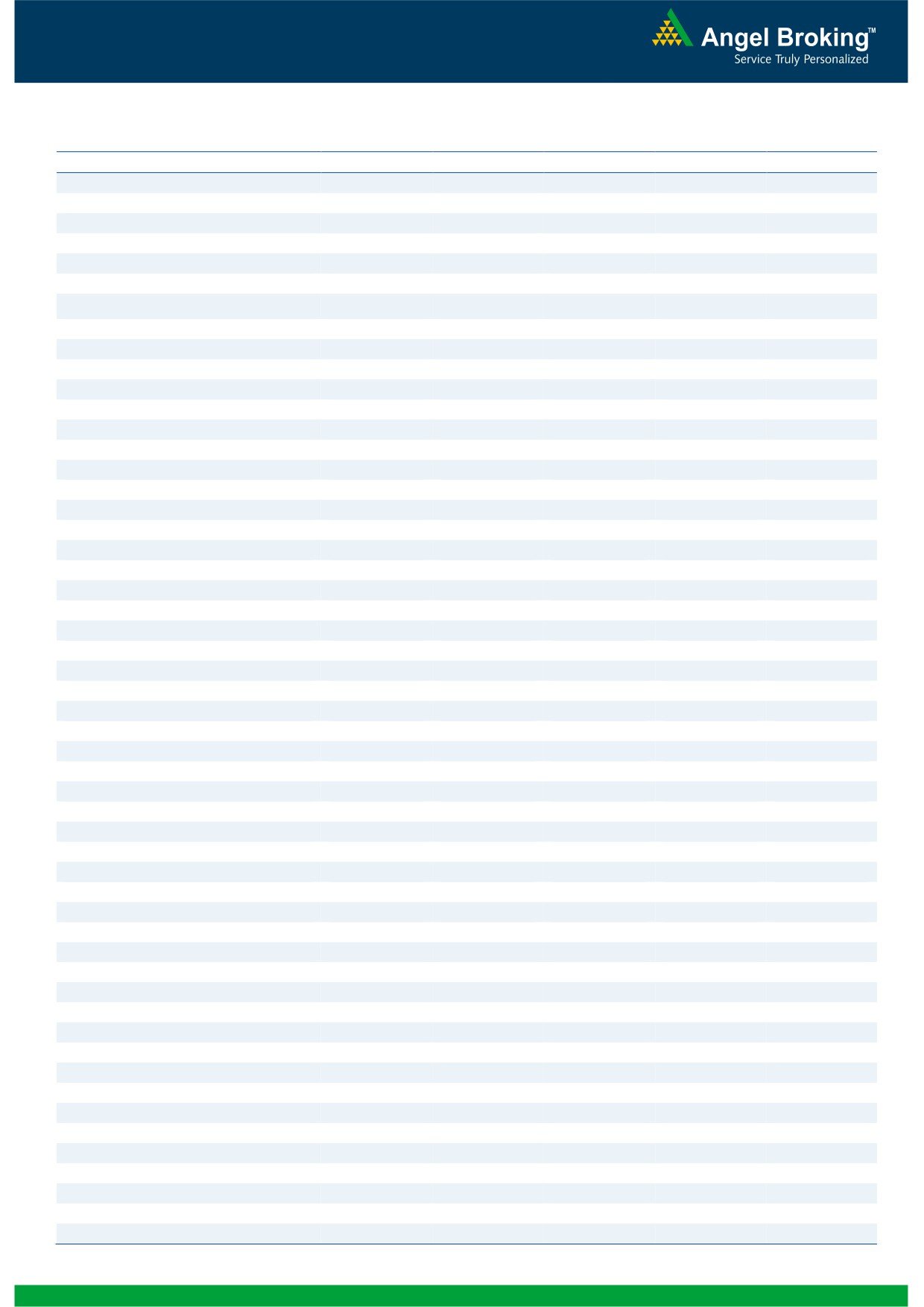

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (11099)

On Friday, Bank Nifty opened on a flat note and traded

in a narrow range throughout the session to close with a

loss of

0.25%. During the day the index slipped

marginally below the 11048 level, however manged to

give a close above it. We are now witnessing a ‘Spinning

Top’ candlestick pattern on the daily chart. The mentioned

pattern requires confirmation in the form of a close above

the 11168 level. A breach of 11021 level would drag the

index lower towards the 10970 - 10887 levels. On the

upside

11168

-

11254 levels are likely to act as

resistance for the day. The mentioned pattern will be

negated only if the index closes below 11021 the level.

Actionable points:

View

Neutral

Resistance Levels

11168 - 11254

Support Levels

11021 - 10970

Source: Falcon:

2

Daily Technical Report

April 08, 2013

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

18,319

18,385

18,455

18,521

18,591

NIFTY

5,512

5,533

5,555

5,575

5,598

BANKNIFTY

10,949

11,024

11,096

11,171

11,243

ACC

1,090

1,110

1,126

1,146

1,163

AMBUJACEM

159

162

165

168

171

ASIANPAINT

4,679

4,723

4,777

4,821

4,874

AXISBANK

1,200

1,215

1,232

1,247

1,264

BAJAJ-AUTO

1,644

1,672

1,697

1,726

1,750

BANKBARODA

646

651

656

661

667

BHARTIARTL

259

265

272

278

285

BHEL

174

176

178

180

183

BPCL

364

370

376

382

387

CAIRN

281

285

289

293

296

CIPLA

378

382

386

391

395

COALINDIA

302

306

310

314

318

DLF

224

228

235

239

245

DRREDDY

1,848

1,880

1,905

1,937

1,962

GAIL

306

311

317

322

327

GRASIM

2,672

2,694

2,716

2,738

2,760

HCLTECH

732

745

755

767

777

HDFC

748

759

775

786

801

HDFCBANK

607

614

620

627

633

HEROMOTOCO

1,415

1,448

1,468

1,501

1,521

HINDALCO

87

88

89

91

92

HINDUNILVR

465

469

471

475

478

ICICIBANK

974

986

997

1,010

1,021

IDFC

136

139

142

144

147

INDUSINDBK

394

398

401

405

409

INFY

2,823

2,844

2,872

2,893

2,921

ITC

284

288

294

297

303

JINDALSTEL

322

329

335

341

347

JPASSOCIAT

62

63

64

65

66

KOTAKBANK

624

630

636

642

647

LT

1,324

1,337

1,354

1,367

1,385

LUPIN

602

610

622

630

642

M&M

819

828

841

851

864

MARUTI

1,289

1,348

1,386

1,445

1,483

NMDC

119

122

127

130

135

NTPC

136

139

142

144

147

ONGC

304

309

312

317

321

PNB

701

711

720

729

738

POWERGRID

103

104

104

105

106

RANBAXY

435

442

448

456

462

RELIANCE

762

771

777

786

791

RELINFRA

321

326

332

337

343

SBIN

2,019

2,038

2,061

2,080

2,103

SESAGOA

144

147

149

152

154

SUNPHARMA

842

851

860

869

878

TATAMOTORS

247

251

256

260

266

TATAPOWER

94

94

95

96

97

TATASTEEL

299

304

308

314

318

TCS

1,472

1,485

1,497

1,510

1,523

ULTRACEMCO

1,714

1,743

1,766

1,795

1,818

3

Daily Technical Report

April 08, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4