Daily Technical Report

May 07, 2013

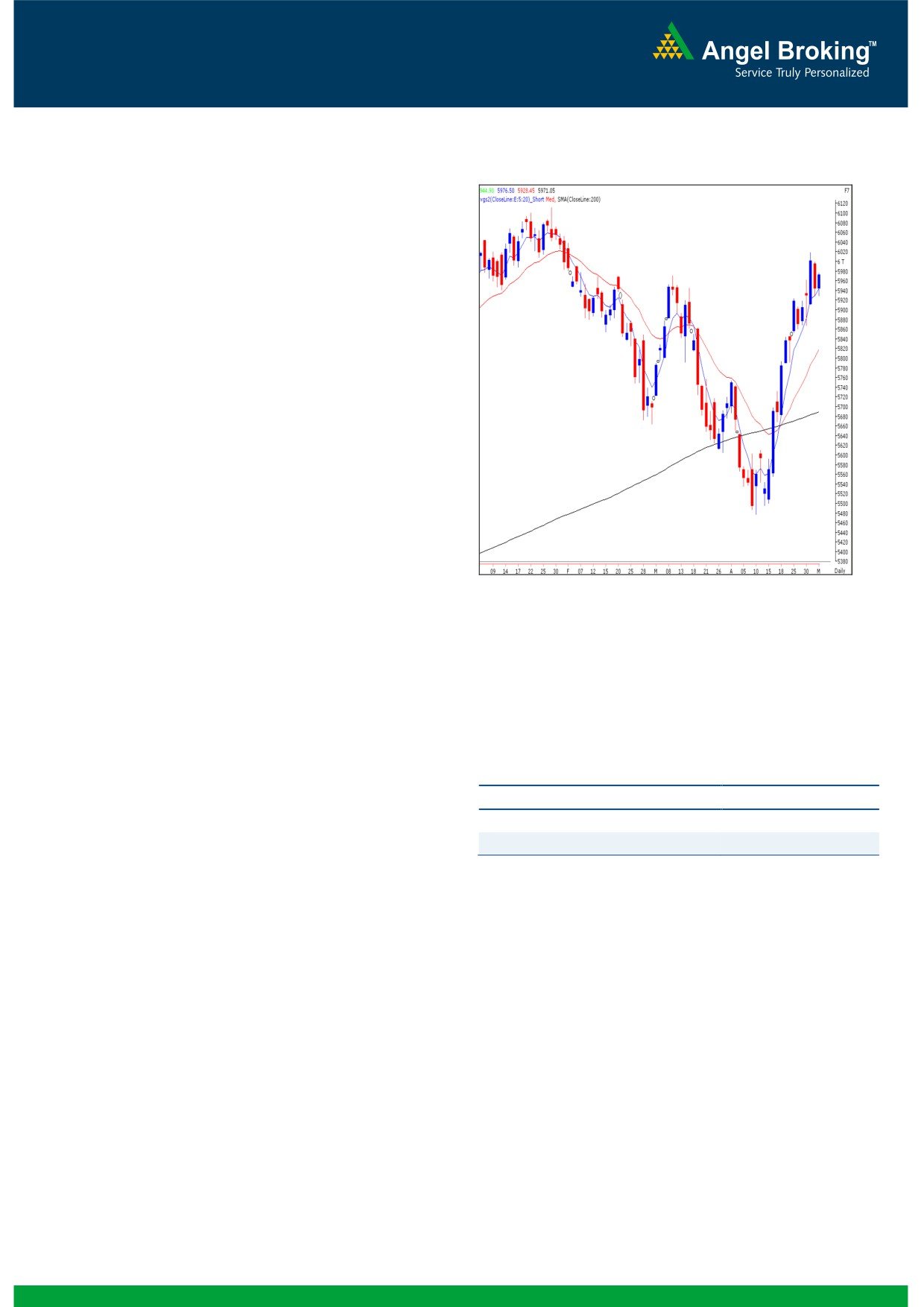

Exhibit 1: Nifty Daily Chart

Sensex (19674) / NIFTY (5971)

The opening session of the week started off on a flat note in-

line with quiet mood across the globe. Indices then oscillated

within the narrow trading range of about half a percent for

most part of the session. For the day, Metal, IT and Teck

counters ended on a gaining side whereas FMCG stocks

ended in the red. The advance to decline ratio was in favor

of advancing counters (A=1339 D=1006) (Source-

Formation

The ’20-week EMA’ and the ’20-day EMA’ are placed at

19145/ 5802 and 19172/ 5818 levels, respectively.

The ’89-day EMA’ and the ‘200-day SMA’ are placed at

19118/ 5792 and 18763 / 5689, respectively.

The weekly ADX (9) indicator and the ‘RSI-Smoothened’

Source: Falcon:

oscillator have signaled a positive crossover.

The 78.60%Fibonacci retracement levels of the fall from

20204 / 6112 to 18144 / 5477 is placed at 19762 /

5976.

Actionable points:

Trading strategy:

For the second consecutive session, indices oscillated within

View

Bearish Below 5928

the price range of Thursday’s session. However, unlike

Expected Target

5880 - 5867

Friday’s session, the price action was narrower and indices

Resistance Levels

6020

traded with positive bias for the most part of the session.

Considering price movement in hourly chart, indices may

trade with positive bias only if they sustain above 19695 /

5977 level. In this case, an intraday up move towards 19792

/ 6020 can be expected. On the flipside, it is important to

note that the markets have now made a higher low for 12

consecutive trading sessions. A fall and close below the low

of 19550 / 5928 may result in a bout of profit booking in

the market. Traders with a positional trading perspective are

advised to book profits in their long positions and wait for

declines.

1

Daily Technical Report

May 07, 2013

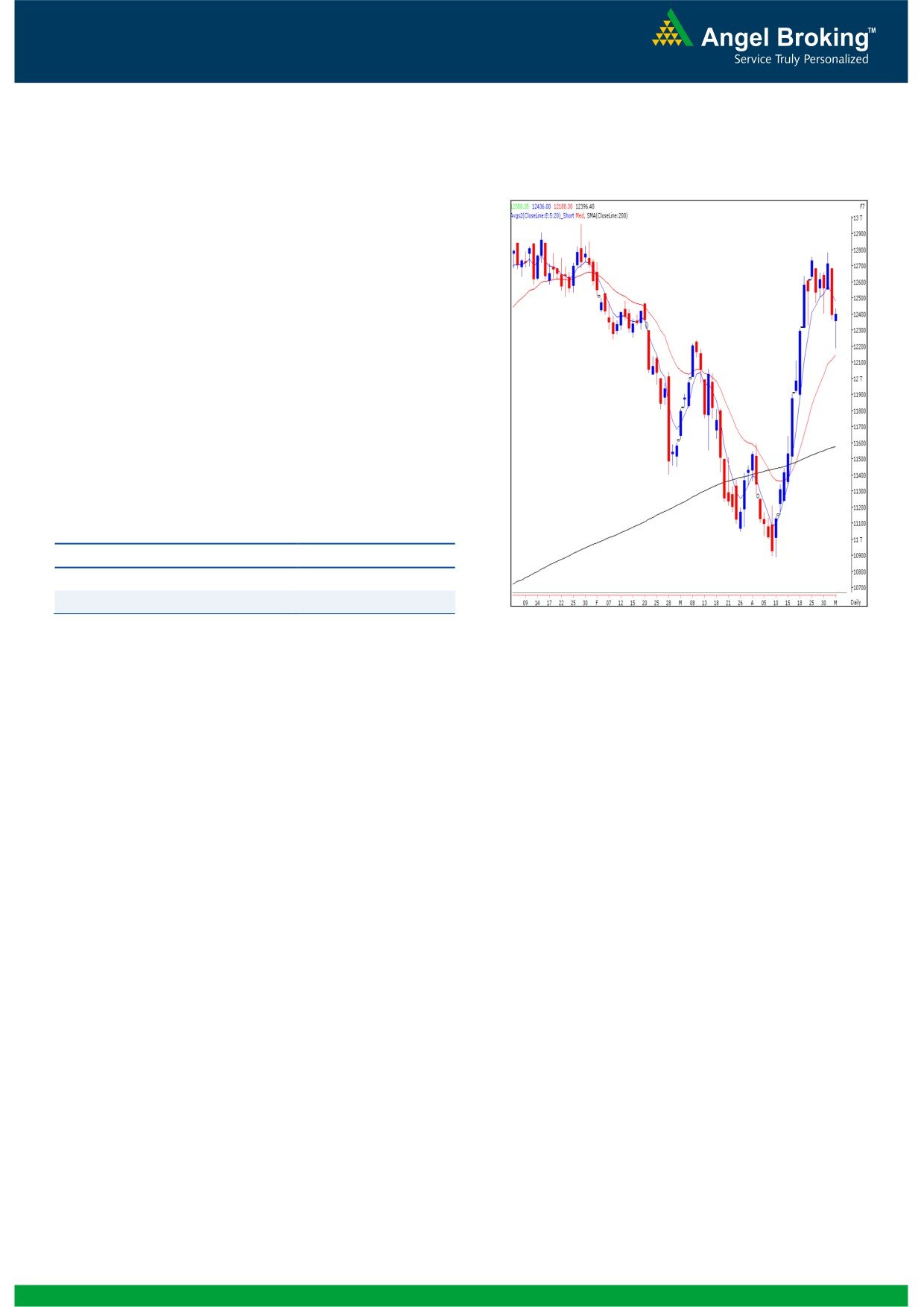

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (12396)

Yesterday, Bank Nifty opened on a flat note and immediately

fell below the support level of 12313. As mentioned we

witnessed selling pressure in the index and the Bank Nifty

nearly tested the ’20 - day EMA’ during the first hour of

trade. However, a gradual recovery from this support level

led the index to close near the initial opening level. We are

now witnessing a ‘Spinning Top’ candlestick pattern on the

daily chart indicating indecisiveness at current levels.

However, the “RSI - Smoothened” indicator has given a

negative crossover. For the day, 12486 - 12556 levels are

likely to act as resistance levels whereas 12250 - 12144 are

likely to act as support.

Actionable points:

View

Neutral

Resistance levels

12486 - 12556

Support Levels

12250 - 12144

Source: Falcon:

2

Daily Technical Report

May 07, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4