Daily Technical Report

January 07, 2013

Sensex (19784) / NIFTY (6016)

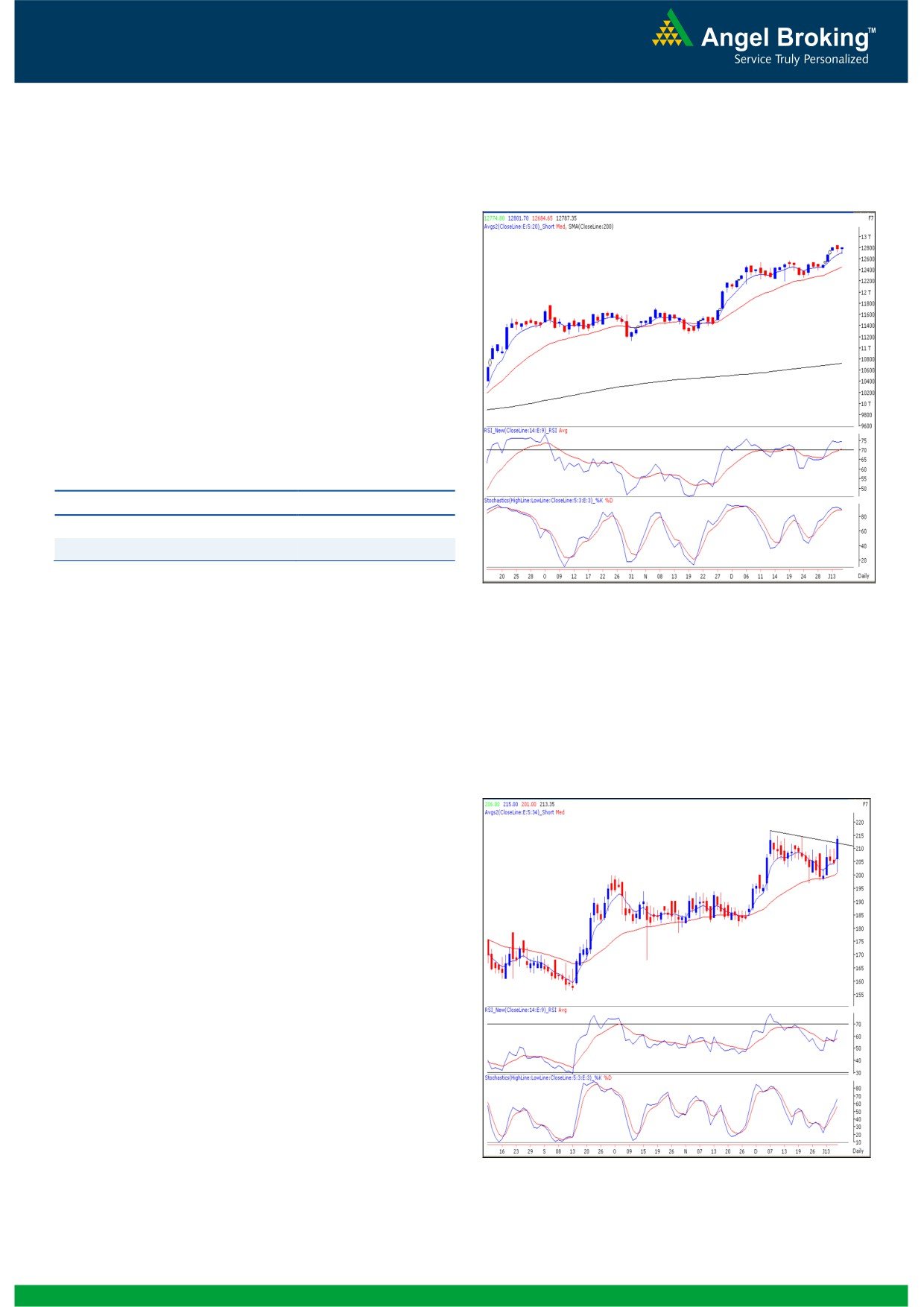

Exhibit 1: Nifty Daily Chart

On Friday, our markets witnessed a flat opening and then

tested the mentioned support level of 19693 / 5986 in the

initial hour of the trading session. However, the Oil and Gas

counters lead from the front in later half as markets closed

near days high, above the 6000 mark. On the other hand

Metal, FMCG and Auto counters remained under pressure.

The advance to decline ratio was marginally in favor of

advancing counters (A=1521 D=1435) (Source

-

Formation

The ’20-day EMA’ and the ’20-week EMA’ are placed at

19423 / 5906 and 18747 / 5696 levels, respectively.

On the daily chart, the benchmark indices are facing

resistance near the ‘Upward Sloping Trend Line’ drawn

by joining the highs of October 5, 2012 and December

11, 2012.

The last two daily candles resemble a ‘Hanging Man’

Japanese candlestick pattern.

Source: Falcon:

Trading strategy:

Actionable points:

Quite similar to last year, this year too, the first week resulted

View

Neutral

in positive gains as the Nifty witnessed a weekly closing

Resistance Levels

6021 - 6070

above the 6000 mark for the first time after December 31,

2010. The benchmark indices have now managed to cross

Support Levels

5981 - 5960 - 5935

their near term hurdles of 19613 (Sensex) and 5965 (Nifty).

At this juncture, we are observing that these are facing a

Any sustainable move beyond 19798 / 6021 would negate

resistance near the ‘Upward Sloping Trend Line’ (drawn by

the pattern and the indices then may rally towards 19950 /

joining the highs of October 5, 2012 and December 11,

6070. Traders should consider reducing long positions and

2012). Also, the daily chart now depicts two consecutive

partial profit booking in individual large cap counters near to

candles which resemble a ‘Hanging Man’. As mentioned in

the 6070 - 6125 mark.

our Friday’s daily report, the said pattern has a negative

implication and needs a confirmation in the form of prices

closing below the low of the pattern. Considering the overall

positive sentiment across the globe and bullish higher degree

charts, we don’t expect a complete reversal of the existing

bull trend, although a minor corrective move cannot be ruled

out. Hence, a closing below 19679 / 5981 would confirm

the ‘Hanging Man’ pattern and indices may slide towards

19624 - 19509 / 5960 - 5935 levels.

1

Daily Technical Report

January 07, 2013

Bank Nifty Outlook - (12787)

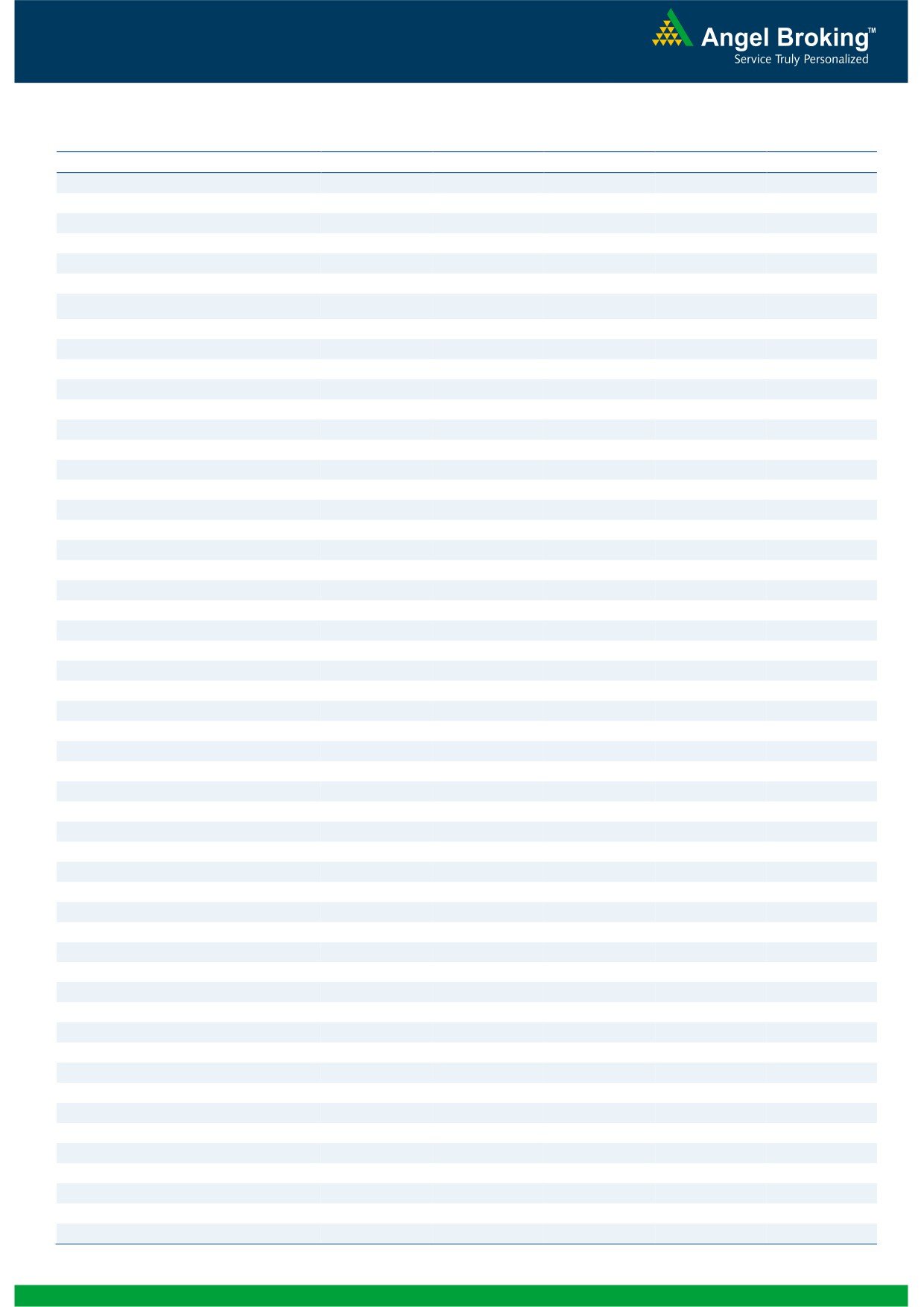

Exhibit 2: Bank Nifty Daily Chart

On Friday, the Bank Nifty once again opened on a flat note

and traded in a narrow range throughout the session.

Considering the placement of the momentum oscillators on

the daily chart we believe that the sideways consolidation in

the range of 12684 to 12838 is likely to continue for the next

few sessions. A close below the 12684 level may result in a

further correction towards 12615 - 12563 levels. The overall

bias for the index remains positive and any downward move

in the index should not be termed as a change in trend.

Actionable points:

View

Neutral

Resistance Levels

12808 - 12838

Support Levels

12684 - 12615

Source: Falcon:

Exhibit 3: IL&FS TRANSPORTATION NETWORK

Stock Recommendation

IL&FS TRANSPORTATION NETWORK

Action

: Buy

Last Close

: ` 213.35

Stop-Loss

: ` 202

Target

: ` 235

JUSTIFICATION - On daily chart the stock has given a

trend line breakout at ` 212 with significant rise in volumes.

In addition the momentum oscillators on the daily and

weekly chart are positively poised. Hence we advise buying

the stock in the range of ` 214 - ` 208 for a target of ` 235

in coming 5 - 7 trading sessions.

Source: Falcon:

2

Daily Technical Report

January 07, 2013

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

19,636

19,710

19,754

19,828

19,871

NIFTY

5,967

5,992

6,006

6,031

6,045

BANKNIFTY

12,641

12,714

12,758

12,831

12,875

ACC

1,415

1,425

1,436

1,446

1,457

AMBUJACEM

203

204

206

208

210

ASIANPAINT

4,361

4,381

4,401

4,421

4,441

AXISBANK

1,362

1,370

1,379

1,387

1,396

BAJAJ-AUTO

2,181

2,193

2,205

2,217

2,229

BANKBARODA

871

878

885

891

898

BHARTIARTL

323

325

328

329

332

BHEL

234

238

241

245

248

BPCL

358

366

373

381

387

CAIRN

321

329

334

343

348

CIPLA

411

414

418

420

424

COALINDIA

355

360

362

366

369

DLF

232

235

237

240

241

DRREDDY

1,866

1,878

1,886

1,898

1,906

GAIL

350

361

368

378

385

GRASIM

3,120

3,155

3,185

3,219

3,249

HCLTECH

623

629

632

638

642

HDFC

821

829

837

846

854

HDFCBANK

667

673

679

685

691

HEROMOTOCO

1,859

1,874

1,884

1,899

1,909

HINDALCO

129

131

132

134

135

HINDUNILVR

526

530

533

538

541

ICICIBANK

1,158

1,170

1,177

1,190

1,197

IDFC

178

181

183

185

187

INFY

2,323

2,336

2,346

2,359

2,368

ITC

278

280

282

285

287

JINDALSTEL

448

453

459

464

470

JPASSOCIAT

99

100

101

102

103

KOTAKBANK

640

645

652

656

663

LT

1,611

1,619

1,628

1,636

1,645

LUPIN

598

601

606

609

614

M&M

924

933

938

947

952

MARUTI

1,529

1,537

1,548

1,556

1,567

NTPC

157

158

159

160

160

ONGC

274

280

284

289

294

PNB

884

896

903

915

923

POWERGRID

113

114

115

116

116

RANBAXY

508

511

516

519

524

RELIANCE

849

855

860

866

871

RELINFRA

538

542

547

552

557

SBIN

2,434

2,461

2,477

2,503

2,519

SESAGOA

197

199

202

204

206

SIEMENS

680

686

691

697

702

SUNPHARMA

722

729

733

740

744

TATAMOTORS

310

313

316

318

321

TATAPOWER

108

109

110

111

112

TATASTEEL

424

429

435

440

446

TCS

1,274

1,286

1,294

1,307

1,314

ULTRACEMCO

1,984

2,013

2,031

2,060

2,078

WIPRO

395

399

402

406

409

3

Daily Technical Report

January 07, 2013

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4