Daily Technical Report

March 04, 2013

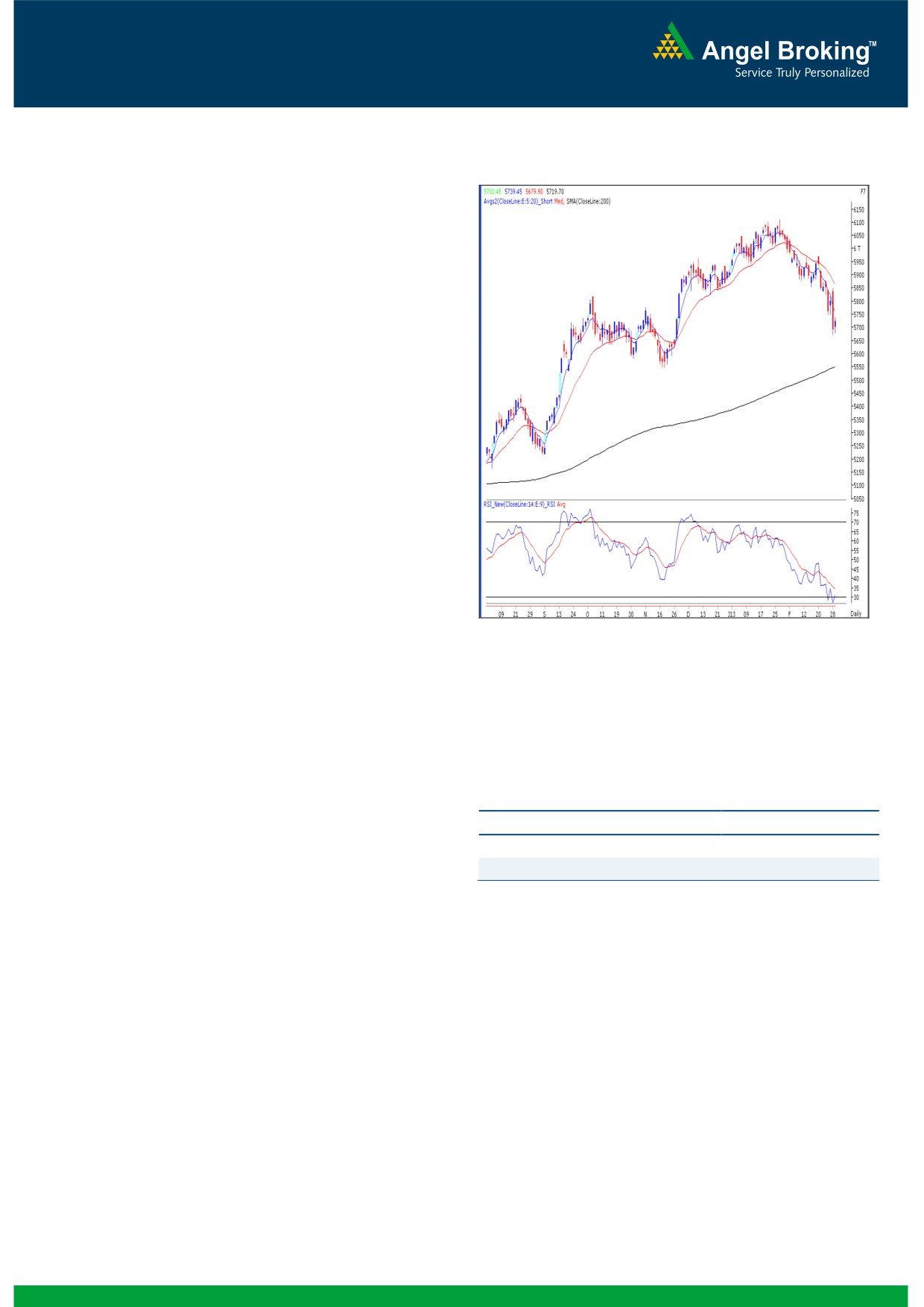

Exhibit 1: Nifty Daily Chart

Sensex (18919) / NIFTY (5720)

On Friday, our benchmark indices opened on a flat note and

traded in a narrow range to close marginally above the

5700 mark. During the day, Consumer Durables, capital

Goods and Auto counters ended on a winning streak

whereas Realty ended on the losing side. The advance to

decline ratio was strongly in favor of declining counters

Formation

The ’20-day EMA’ and the ’20-week EMA’ are placed at

19372 / 5863 and 19175 / 5813 levels, respectively.

The monthly chart exhibits a ‘Bearish Engulfing’ pattern.

The monthly momentum oscillators are signaling a

negative crossover.

The level of the weekly ‘RSI’ momentum oscillator has

now dropped below the 50 mark.

Source: Falcon:

Indices have closed marginally above the ‘Downward

Sloping Trend Line’, drawn by joining two significant

highs of 21109 / 6339 (high of November 05, 2010

weekly candle) and 19137 / 5816 (high of October 05,

2012 weekly candle).

Actionable points:

Trading strategy:

View

SELL BELOW 5672

For the sixth consecutive week, our benchmark indices have

Expected target

5600

closed in the negative territory. As mentioned in our January

Resistance levels

5740 - 5766

25, 2013 weekly report, the bearish impact of the ‘Hanging

Man’ (at market top) Japanese candlestick pattern is now

clearly seen. Indices have now finally broken down below

On the contrary, indices have now precisely closed above the

the 19149 / 5823 mark, which has been acting as a crucial

support level of the ‘Downward Sloping Trend Line’ (please

support level. This level also coincides with the ’89-day EMA’

refer exhibit

1). Hence, the impact of all the above

and the ’20-week EMA’. Since the February month is over,

mentioned negative technical evidences would be seen once

the monthly chart now depicts a ‘Bearish Engulfing’ pattern.

indices sustain below this week’s low of 18793 / 5671. In

This pattern has a bearish implication but needs a

this scenario, indices are likely to fall towards 18450 -

confirmation. In addition, the monthly momentum oscillators

18255 / 5600 - 5548 levels. On the flipside, this week’s

are signaling a negative crossover. Also, the weekly ‘RSI’

high of 19412 / 5879 would now act as a crucial resistance

momentum oscillator has now sneaked below the 50 mark.

in the coming week. Only a move beyond this level may

RSI level dropping below 50 from the upside is an additional

nullify the impact of negative technical evidences. With such

sign of caution for the bulls.

a move the markets may rally towards 19768 - 19865 /

5991 - 6025 levels.

1

Daily Technical Report

March 04, 2013

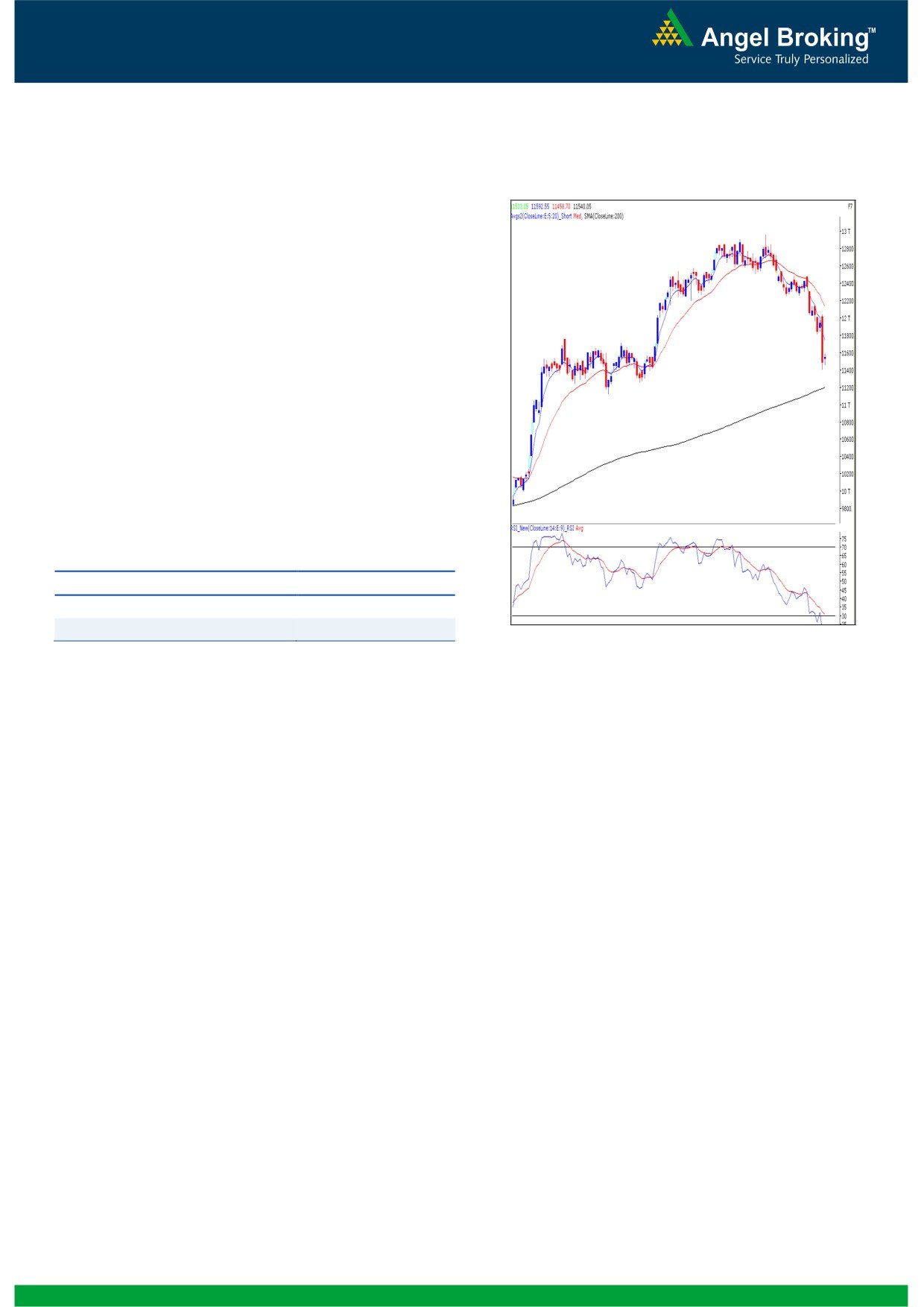

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (11540)

On Friday, Bank Nifty opened on a flat note and traded in

a narrow range throughout the session to close near the

initial opening level. As there is no major change in the

chart structure we reiterate our view that creation of fresh

short positions at current level is not advisable. The

momentum oscillators on the daily chart continue to be

oversold territory and hence further consolidation or a

relief rally in the index cannot be ruled out. For the day

11593 - 11810 levels are likely to act as resistance and

11392 - 11256 levels are likely to act as support. Traders

holding short position in the index should maintain a stop

loss of 11810.

Actionable points:

View

Neutral

Resistance Levels

11593 - 11810

Support levels

11392 - 11256

Source: Falcon:

2

Daily Technical Report

March 04, 2013

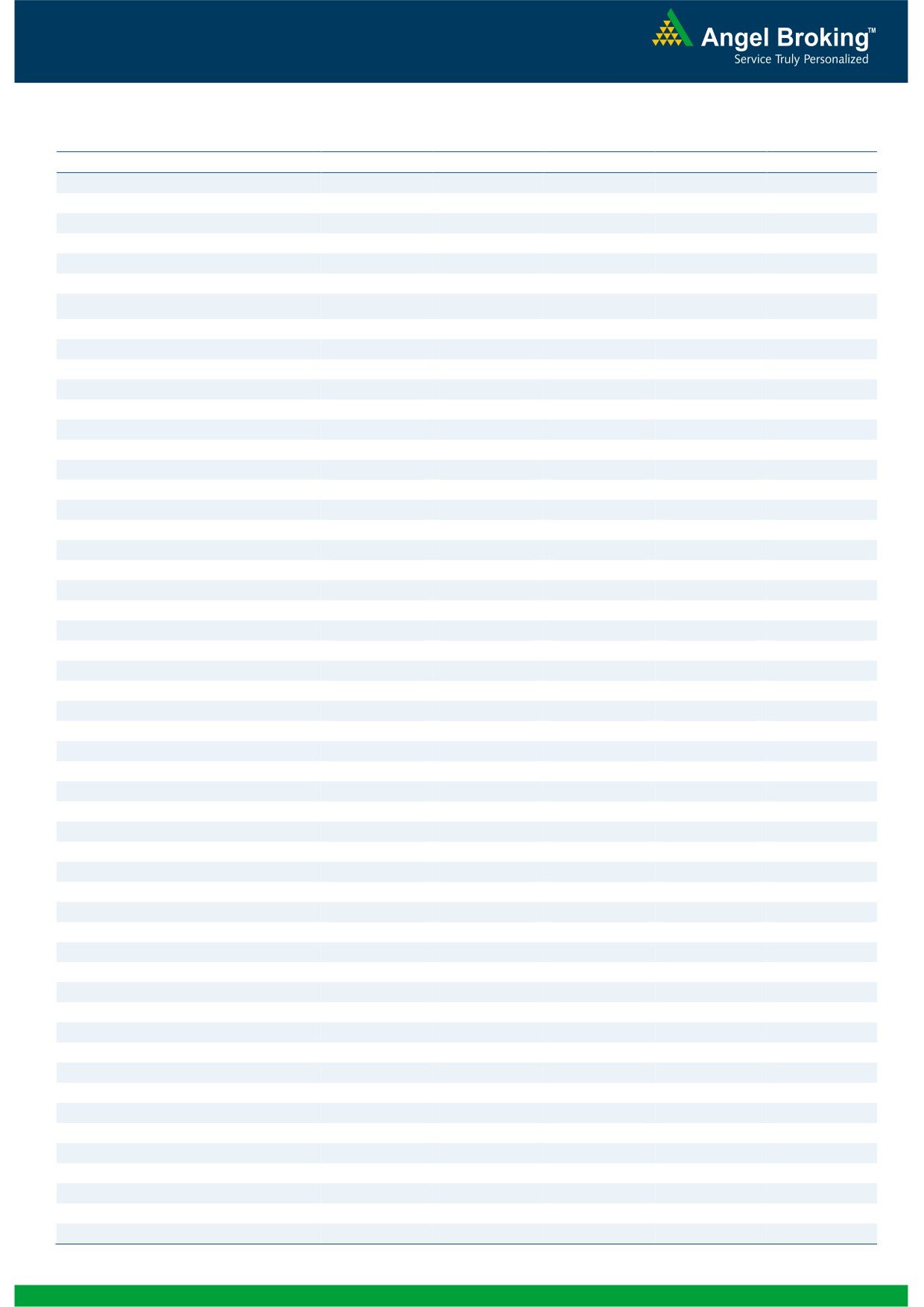

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

18,741

18,830

18,909

18,998

19,077

NIFTY

5,653

5,687

5,713

5,746

5,773

BANKNIFTY

11,397

11,468

11,530

11,602

11,664

ACC

1,234

1,251

1,265

1,282

1,297

AMBUJACEM

187

190

192

195

197

ASIANPAINT

4,223

4,291

4,338

4,406

4,453

AXISBANK

1,294

1,329

1,354

1,388

1,413

BAJAJ-AUTO

1,911

1,969

2,006

2,065

2,101

BANKBARODA

676

692

707

724

739

BHARTIARTL

297

304

315

322

334

BHEL

196

199

201

203

206

BPCL

367

376

382

392

398

CAIRN

288

290

293

295

298

CIPLA

347

359

365

377

383

COALINDIA

306

310

315

319

323

DLF

245

252

265

272

285

DRREDDY

1,693

1,718

1,745

1,769

1,796

GAIL

325

328

331

335

338

GRASIM

2,861

2,918

2,962

3,019

3,064

HCLTECH

709

716

723

729

736

HDFC

746

762

772

788

799

HDFCBANK

610

616

623

629

636

HEROMOTOCO

1,590

1,619

1,643

1,671

1,696

HINDALCO

97

98

99

100

101

HINDUNILVR

433

443

450

460

466

ICICIBANK

1,037

1,047

1,057

1,066

1,076

IDFC

139

143

146

150

153

INFY

2,853

2,883

2,922

2,953

2,992

ITC

284

288

293

296

301

JINDALSTEL

342

350

359

367

375

JPASSOCIAT

67

70

71

74

75

KOTAKBANK

646

650

655

659

664

LT

1,351

1,376

1,393

1,418

1,435

LUPIN

557

576

587

606

617

M&M

851

869

881

899

911

MARUTI

1,334

1,379

1,408

1,453

1,482

NTPC

146

148

149

152

153

ONGC

300

307

313

321

327

PNB

768

778

792

802

815

POWERGRID

102

105

107

110

112

RANBAXY

365

375

381

391

396

RELIANCE

798

804

811

817

824

RELINFRA

407

420

431

444

455

SBIN

2,045

2,066

2,088

2,109

2,130

SESAGOA

150

152

155

157

160

SIEMENS

483

489

500

507

518

SUNPHARMA

776

788

797

809

819

TATAMOTORS

276

282

288

294

299

TATAPOWER

91

94

96

99

102

TATASTEEL

335

338

343

346

350

TCS

1,487

1,495

1,505

1,513

1,523

ULTRACEMCO

1,836

1,861

1,890

1,915

1,944

WIPRO

415

418

422

425

429

3

Daily Technical Report

March 04, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4