Daily Technical Report

February 04, 2013

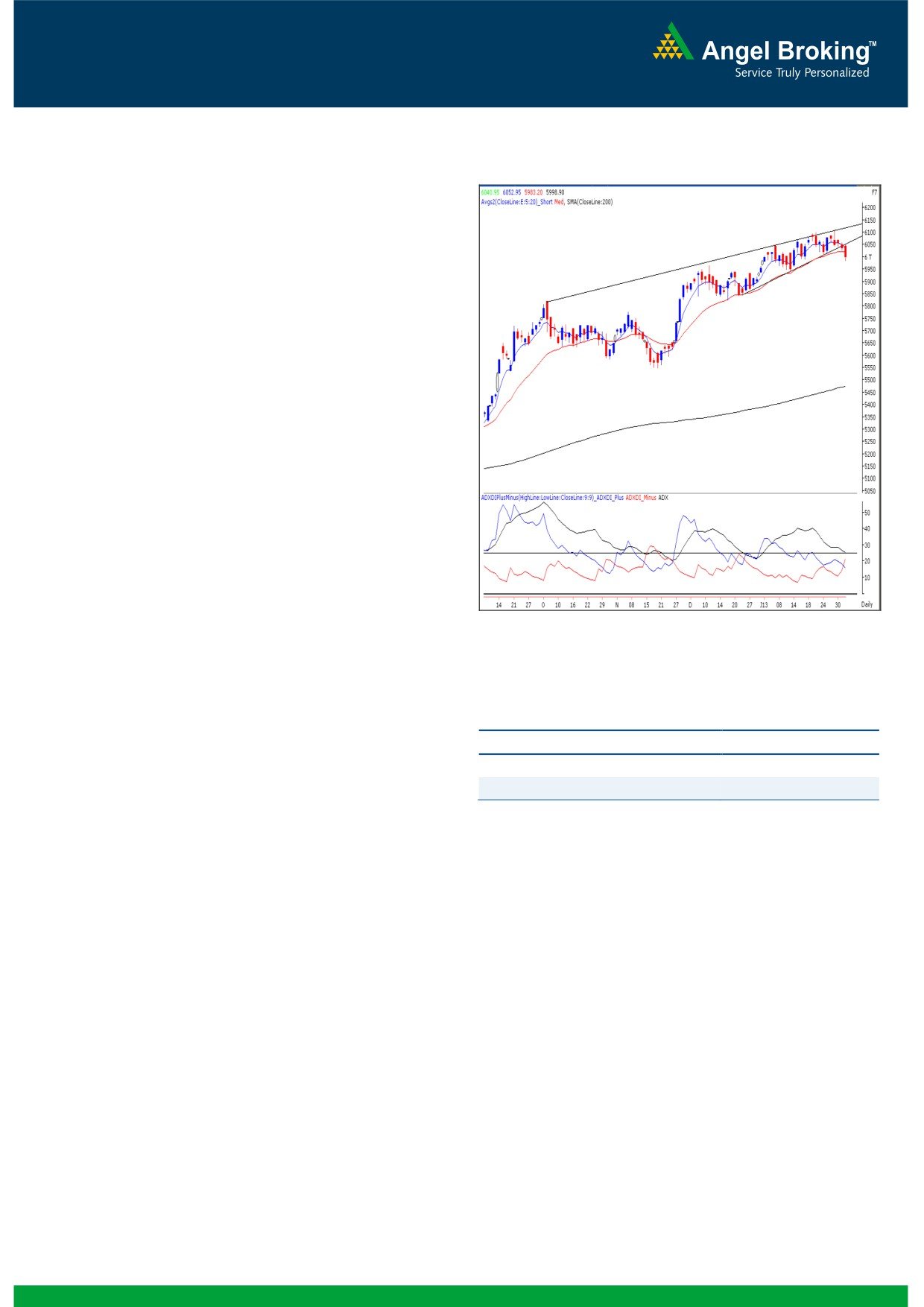

Exhibit 1: Nifty Daily Chart

Sensex (19781) / NIFTY (5999)

On Friday, the benchmark indices initially moved upwards

towards the resistance levels of 20050 / 6070. This move

can be termed as a pullback of the ‘Trend line Breakdown’

mentioned in Thursday’s report. As expected, indices faced

selling pressure at higher levels and the pace of the fall

picked up in the late afternoon trade which led the indices

(Nifty) to close below the psychological level of 6000. During

the session, the Realty, Auto and Banking counters were the

biggest losers; whereas the Consumer Durables, Healthcare

and FMCG sectors outperformed the market. The advance to

decline ratio was strongly in favor of declining counters

Formation

The ’20-day EMA’ and the ’20-week EMA’ are placed at

19870 / 6019 and 19128 / 5804 levels, respectively.

On the daily chart, the benchmark indices are facing

resistance near the ‘Upward Sloping Trend Line’ drawn

Source: Falcon:

by joining the highs of October 5, 2012 and January

18, 2012.

Actionable points:

The weekly ‘RSI’ momentum oscillator as well as the

Daily ‘ADX (9)’ indicator are now signaling a negative

View

Bearish below 5983

crossover.

Expected Targets

5940 - 5897

The ‘Hanging Man’ Japanese Candlestick pattern on the

Resistance Levels

6053 - 6112

weekly chart has been confirmed.

Trading strategy:

Last week, despite a favorable outcome from the RBI’s

In this scenario, indices are likely to slide towards their next

Monetary Policy, indices struggled to sustain at higher levels.

support levels of

19596

-

19406

/

5940

-

5897.

Strong selling pressure near the week’s high ultimately

Conversely, this week’s high of 20204 / 6112 would now act

dragged indices lower to close marginally below last week’s

as resistance in the coming trading session. Only a

low

19884

/

6007. This has confirmed the bearish

sustainable move above this level would negate the bearish

implication of the ‘Hanging Man’ Japanese candlestick

implication of the ‘Hanging Man’ pattern.

pattern mentioned in our previous report. Also, our

We advise traders to trade with strict stop losses and any

benchmark indices have also managed to close below the

intraweek bounce can be used as exit opportunity for existing

’20-day EMA’ for the first time after November 26, 2012.

long positions.

This is also a sign of weakness. In addition there is a

negative crossover in weekly ‘RSI’ momentum oscillators and

the daily ‘ADX (9)’ indicator. Considering all the negative

technical evidences, we expect continuation of the negative

momentum in the coming week as well.

1

Daily Technical Report

February 04, 2013

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (12606)

On Friday, the index opened on a pessimistic note and

selling pressure throughout the day led the index to close at

the mentioned support level of 12606. However the index

continues to trade in the mentioned range of 12500 -

13000 since the past few sessions. At this juncture the

momentum oscillators on the hourly chart are placed in

extreme oversold zone and a minor positive move in the first

half of the session cannot be ruled out. Within the mentioned

range, 12550 - 12509 levels are likely to act as support and

12703 - 12775 are likely to act as resistance for the day.

Actionable points:

View

Neutral

Resistance levels

12703 - 12775

Support Levels

12550 - 12509

Source: Falcon:

2

Daily Technical Report

February 04, 2013

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

19,598

19,690

19,828

19,920

20,058

NIFTY

5,942

5,970

6,012

6,040

6,081

BANKNIFTY

12,481

12,544

12,643

12,706

12,806

ACC

1,305

1,312

1,322

1,329

1,340

AMBUJACEM

193

196

201

204

208

ASIANPAINT

4,484

4,513

4,534

4,563

4,584

AXISBANK

1,475

1,493

1,504

1,521

1,532

BAJAJ-AUTO

2,008

2,032

2,054

2,078

2,101

BANKBARODA

856

862

869

875

882

BHARTIARTL

314

322

334

342

354

BHEL

211

218

224

231

237

BPCL

405

414

420

429

435

CAIRN

323

325

327

328

330

CIPLA

404

409

412

417

420

COALINDIA

345

351

355

361

365

DLF

256

262

270

276

284

DRREDDY

1,905

1,925

1,942

1,962

1,979

GAIL

337

340

344

347

351

GRASIM

2,973

2,992

3,006

3,026

3,040

HCLTECH

674

681

689

696

704

HDFC

764

771

781

787

797

HDFCBANK

632

636

640

645

649

HEROMOTOCO

1,779

1,795

1,810

1,825

1,840

HINDALCO

110

112

115

116

119

HINDUNILVR

458

461

467

471

476

ICICIBANK

1,145

1,158

1,181

1,194

1,216

IDFC

165

166

169

170

173

INFY

2,725

2,748

2,775

2,798

2,825

ITC

303

306

308

311

313

JINDALSTEL

407

412

418

423

429

JPASSOCIAT

80

82

84

86

89

KOTAKBANK

657

664

675

683

693

LT

1,512

1,522

1,539

1,550

1,566

LUPIN

595

603

614

622

633

M&M

871

878

889

897

907

MARUTI

1,562

1,586

1,604

1,628

1,646

NTPC

155

156

157

158

160

ONGC

322

327

335

340

348

PNB

880

890

903

913

926

POWERGRID

109

110

111

111

112

RANBAXY

444

446

450

452

456

RELIANCE

876

885

892

901

909

RELINFRA

509

513

518

522

527

SBIN

2,371

2,392

2,422

2,443

2,473

SESAGOA

179

181

185

188

192

SIEMENS

629

636

647

654

664

SUNPHARMA

713

716

720

724

728

TATAMOTORS

251

266

283

299

316

TATAPOWER

100

101

102

103

104

TATASTEEL

392

396

404

409

416

TCS

1,338

1,343

1,347

1,353

1,357

ULTRACEMCO

1,611

1,724

1,826

1,939

2,040

WIPRO

403

405

409

412

416

3

Daily Technical Report

February 04, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4