Daily Technical Report

October 01, 2012

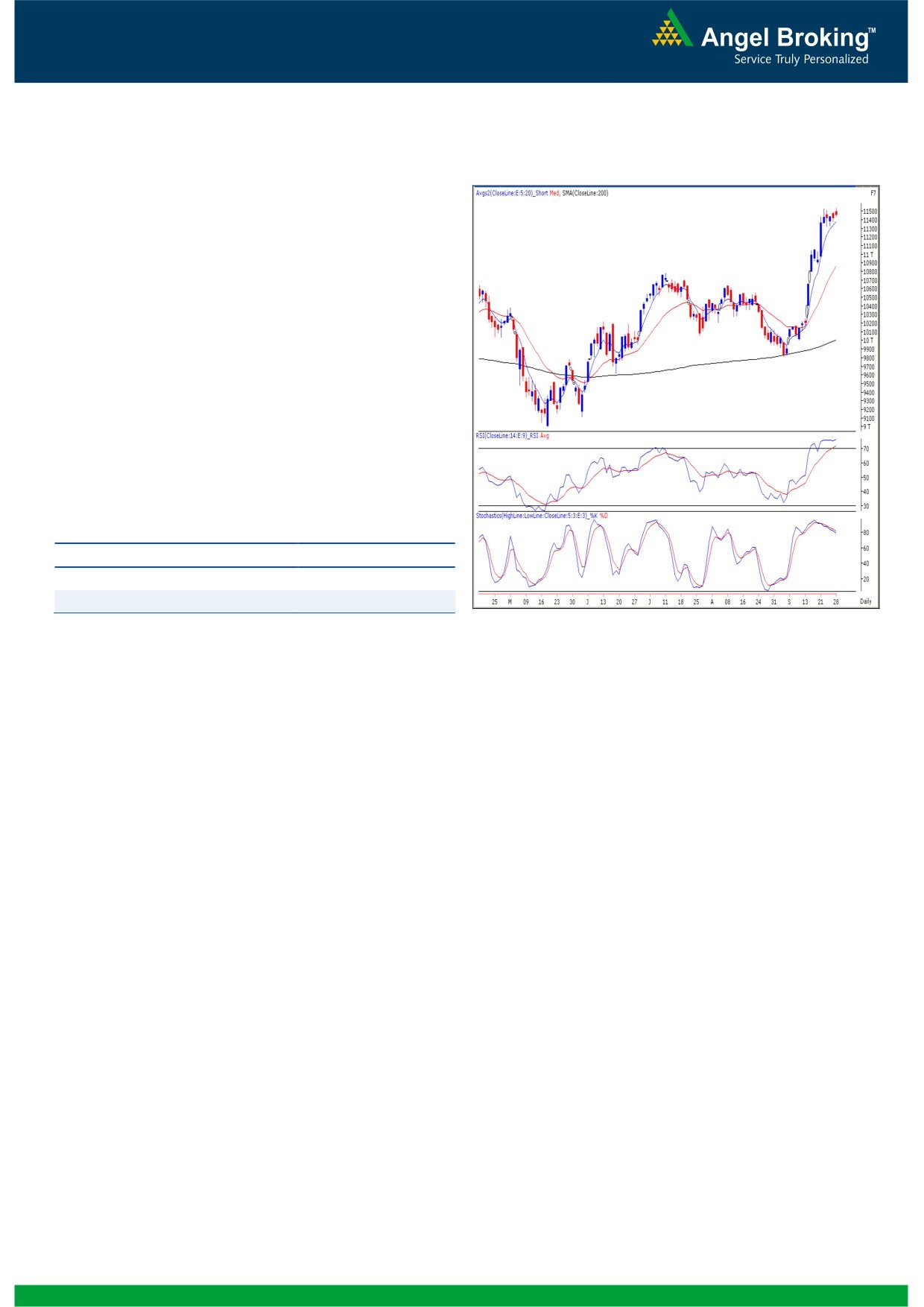

Exhibit 1: Nifty Daily Chart

Sensex (18763) / NIFTY (5703)

On Friday, the October series started on a positive note

where our benchmark indices closed above the psychological

5700 mark. The rally was mainly lead by Auto, Consumer

Durables and FMCG counters; whereas Realty was the only

sector in red. The action was mainly seen in the mid and

small cap stocks while the large caps remained relatively

subdued. The advance to decline ratio was in favor of

advancing counters (A=1644 D=1248) (Source

-

Formation

The ’20-day EMA’ and the ’20-week EMA’ are placed at

18265 / 5535 and 17625 / 5340 levels, respectively.

The monthly ‘RSI’ oscillator is moving higher from the 50

mark and the ADX (9) indicator is now signaling a

positive crossover.

The weekly chart depicts a ‘Narrow Range’ body

formation.

Source: Falcon:

Trading strategy:

Actionable points:

As mentioned in the previous report, this September turned

out to be a memorable month for the bulls. One interesting

View

Neutral

observation to note would be that the price action in August

Resistance Levels

5720 - 5741

- September 2012 is very much identical with the move seen

Support Levels

5630 - 5580

in August -September

2010. Considering this monthly

closing, we can now infer that the monthly 'RSI' indicator is

More the time spent in this range, more bullish will be the chart

now heading upwards from the 50 mark. In addition, the

structure. This phenomenon is called as a ‘Time wise

ADX (9) indicator has signaled a positive crossover. The

correction’ and in this phase market participants get

combination of these technical tools signifies that the bulls

accustomed to new levels. This in turn results in the initially

are gaining the upper hand and reasonable upside can be

anticipated higher levels, now getting converted into a new

expected in coming months. At this juncture, there is

Normal. We reiterate our view that once the indices move

practically no change in the price structure except that the

beyond 19132 / 5741, then our markets are likely to rally

markets have consumed time. This is clear from the fact that

towards the next possible target of 19542 - 19812 / 5850 -

the weekly chart depicts a 'Narrow Range' body formation.

5945 and even the possibility of testing 6000 (Nifty) cannot be

The Indices have strong support near to 18291/ 5534 level.

ruled out.

Any decline towards these levels will be an opportunity to

buy. Traders should take a note that confidence amongst the

We continue to advise that traders should target stock specific

bulls and the probability of a strong bullish up move is

moves and trade with strict stop losses.

directly proportional to the amount of time spent in the zone

of 18800 - 18291 / 5700 - 5534.

1

Daily Technical Report

October 01, 2012

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (11457)

The Bank Nifty opened on an optimistic note on Friday and

traded in a narrow range throughout the session. At this

juncture the index is constantly taking support near the

hourly “20 EMA”. Looking at the price structure on the daily

as well as hourly charts, it can be said that a clear direction

is likely to emerge only after the index move out of the zone

of 11537 - 11320 levels. On the upside, a strong breakout

beyond 11537 along with increasing volumes will indicate a

bullish “Flag” breakout. However, a breach of 11320 will

indicate that further consolidation (Time and Price wise

correction) is likely to continue. For the day, index has

support at 11438 level whereas resistance is at 11537.

Actionable points:

View

Neutral

Resistance Levels

11537

Support Levels

11320 - 11210

Source: Falcon:

2

Daily Technical Report

October 01, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

18,606

18,684

18,777

18,856

18,948

NIFTY

5,656

5,679

5,707

5,731

5,759

BANKNIFTY

11,378

11,418

11,477

11,516

11,576

ACC

1,426

1,448

1,463

1,485

1,500

AMBUJACEM

199

200

202

204

206

ASIANPAINT

3,867

3,901

3,934

3,967

4,000

AXISBANK

1,119

1,127

1,139

1,148

1,159

BAJAJ-AUTO

1,791

1,811

1,830

1,850

1,870

BANKBARODA

771

785

793

807

816

BHARTIARTL

260

263

265

268

270

BHEL

240

243

248

251

256

BPCL

337

343

351

356

364

CAIRN

326

329

332

334

337

CIPLA

359

369

376

386

393

COALINDIA

347

353

361

368

376

DLF

224

229

237

241

249

DRREDDY

1,613

1,629

1,641

1,657

1,668

GAIL

376

379

384

388

392

GRASIM

3,222

3,268

3,308

3,354

3,395

HCLTECH

564

571

579

586

594

HDFC

756

765

772

781

788

HDFCBANK

622

625

630

634

638

HEROMOTOCO

1,848

1,864

1,887

1,904

1,927

HINDALCO

116

118

120

123

124

HINDUNILVR

531

539

544

551

556

ICICIBANK

1,042

1,051

1,062

1,070

1,082

IDFC

150

152

156

159

163

INFY

2,493

2,514

2,547

2,568

2,601

ITC

264

268

270

275

277

JINDALSTEL

414

421

432

439

450

JPASSOCIAT

80

81

83

84

86

KOTAKBANK

640

644

648

652

655

LT

1,569

1,583

1,601

1,615

1,634

M&M

845

855

864

874

882

MARUTI

1,325

1,338

1,354

1,367

1,383

NTPC

163

166

167

170

171

ONGC

275

278

280

283

284

PNB

823

832

841

849

859

POWERGRID

116

118

120

122

123

RANBAXY

519

524

529

535

540

RELIANCE

826

832

840

845

853

RELINFRA

519

528

545

554

570

SAIL

83

84

86

87

89

SBIN

2,196

2,218

2,248

2,270

2,300

SESAGOA

168

170

172

173

176

SIEMENS

701

705

709

713

717

STER

98

99

100

100

101

SUNPHARMA

664

680

690

706

716

TATAMOTORS

259

263

268

272

276

TATAPOWER

105

106

108

109

110

TATASTEEL

392

397

403

407

414

TCS

1,264

1,280

1,292

1,308

1,321

WIPRO

375

378

381

384

387

3

Daily Technical Report

October 01, 2012

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4