Daily Technical Report

July 22 , 2013

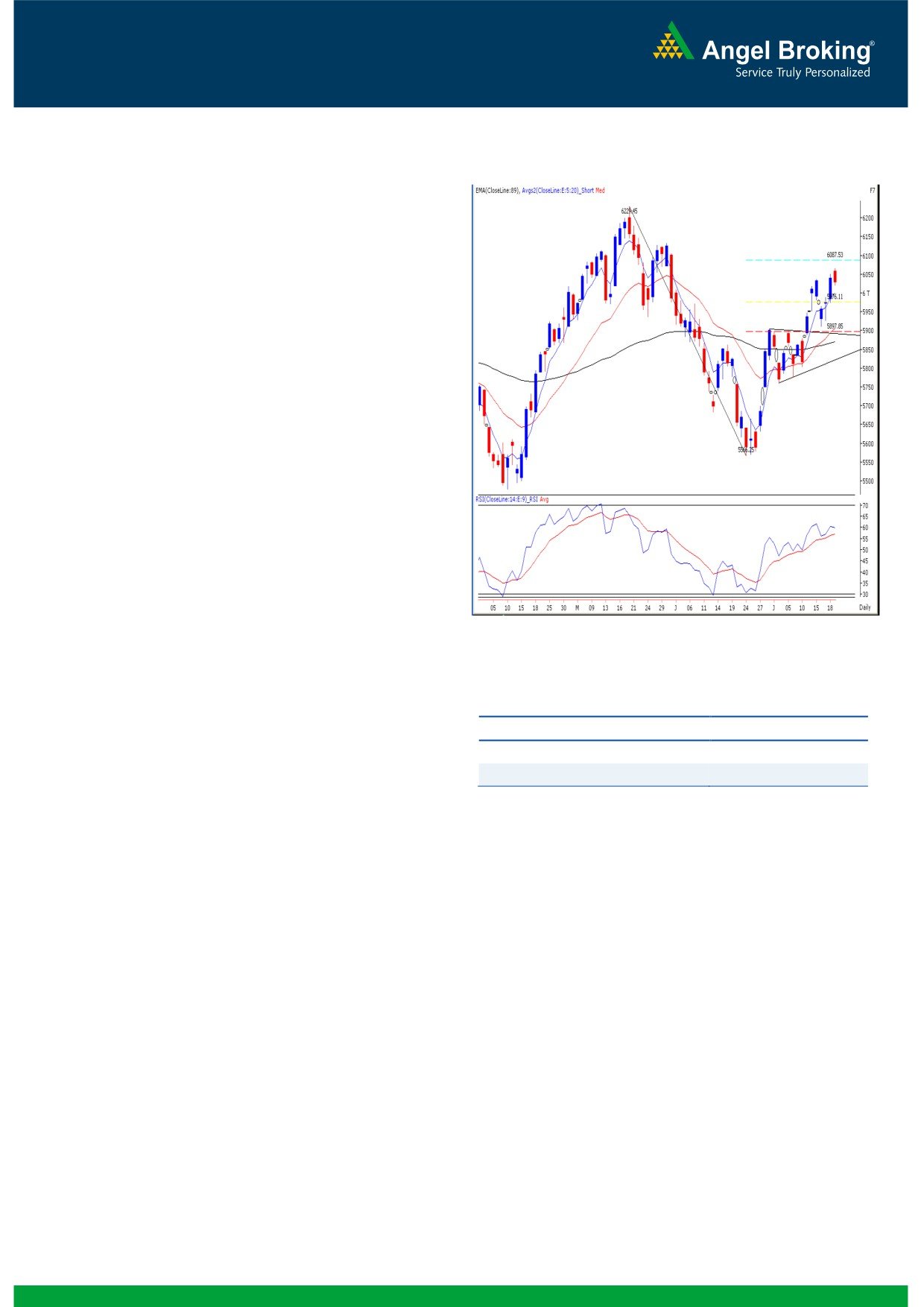

Exhibit 1: Nifty Daily Chart

Sensex (20150) / NIFTY (6029)

Yesterday, our benchmark indices opened slightly on the

higher side considering mixed global cues. During the first

half, indices traded within a narrow band. However, we

witnessed minor profit booking towards the fag end of the

session, which led to a close in negative territory. During the

session, the IT, Auto and Oil & gas counters remained in the

positive territory; whereas the Capital Goods, Banking and

Realty sectors once again ended on a pessimistic note. The

Advance to Decline ratio was in favor of declining counters.

Formation

The ’89-day EMA’ and the ’89-week EMA’ are placed at

19423/ 5870 and 18568 / 5616 levels, respectively.

The ’20-day EMA’ and the ‘20-week EMA’ are placed at

19632 / 5906 and 19462 / 5882, respectively.

The weekly momentum oscillators are still positively

poised.

Source: Falcon:

The 78.60% Fibonacci retracement level of the fall from

20444 / 6229 to 18467/ 5566 is placed at 20021 /

6088.

Actionable points:

Trading strategy:

View

Neutral

The market has ended in the positive territory for the fourth

Resistance Levels

6067 - 6088

consecutive week, although the movement was slightly range

Support Levels

6020 - 5974

bound as compared to the previous week. In-line with our

expectation mentioned in the previous weekly report, our

benchmark indices have almost met our mentioned targets

of the 78.60% Fibonacci retracement level of the fall from

20444 / 6229 to 18467 / 5566 which is placed at 20021 /

6088 (the Sensex has even crossed the

20021 level).

Considering the current momentum and the positive

placement of weekly momentum oscillators, we expect our

benchmark indices to test 20308 - 20444 / 6134 - 6230 if

they sustain above this week’s high of 20257 / 6067. On the

flipside, the concluded week’s low of 19649 / 5910 would

act as a crucial support in the coming trading sessions. Any

sustainable move below this level would apply brakes on the

current optimism. The bellwether indices might then test the

daily ’89-EMA’ level of 19423 / 5870. Traders should take

note that the benchmark indices are being led by a small list

of stocks which have a significant weight on the benchmark

indices.

1

Daily Technical Report

July 22, 2013

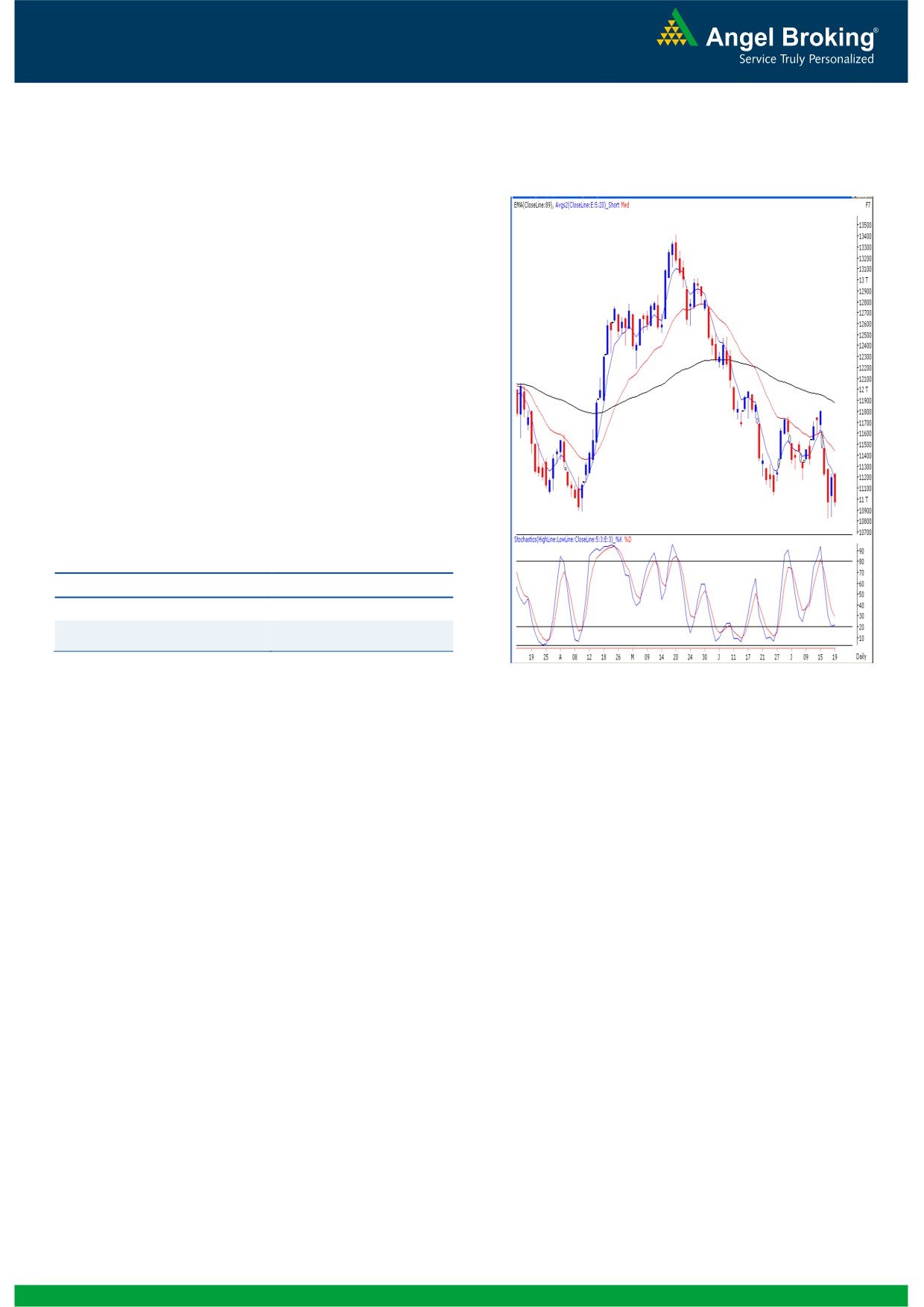

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (10974)

On Friday, the Bank Nifty too opened marginally higher in-

line with our benchmark indices. However, the index could

not manage to hold its previous day’s gains and immediately

headed lower to end the session with more than two percent

loss. The Bank Nifty chart structure is quite contradictory to

our benchmark indices. Any attempt of a recovery by the bulls

is met with supply pressure. Going forward, Wednesday’s low

of

10829 is the key support for the Bank Nifty. Any

sustainable move below this level may open up the

possibilities for new ’52-Week Lows’. In this scenario, it may

initially test 10782 - 10640 levels. On the flip side, the Bank

Nifty must first close above 11264 to indicate any signs of

recovery.

Actionable points:

View

Neutral

Resistance Level

11264

Support Levels

10829 - 10782

Source: Falcon:

2

Daily Technical Report

July 22, 2013

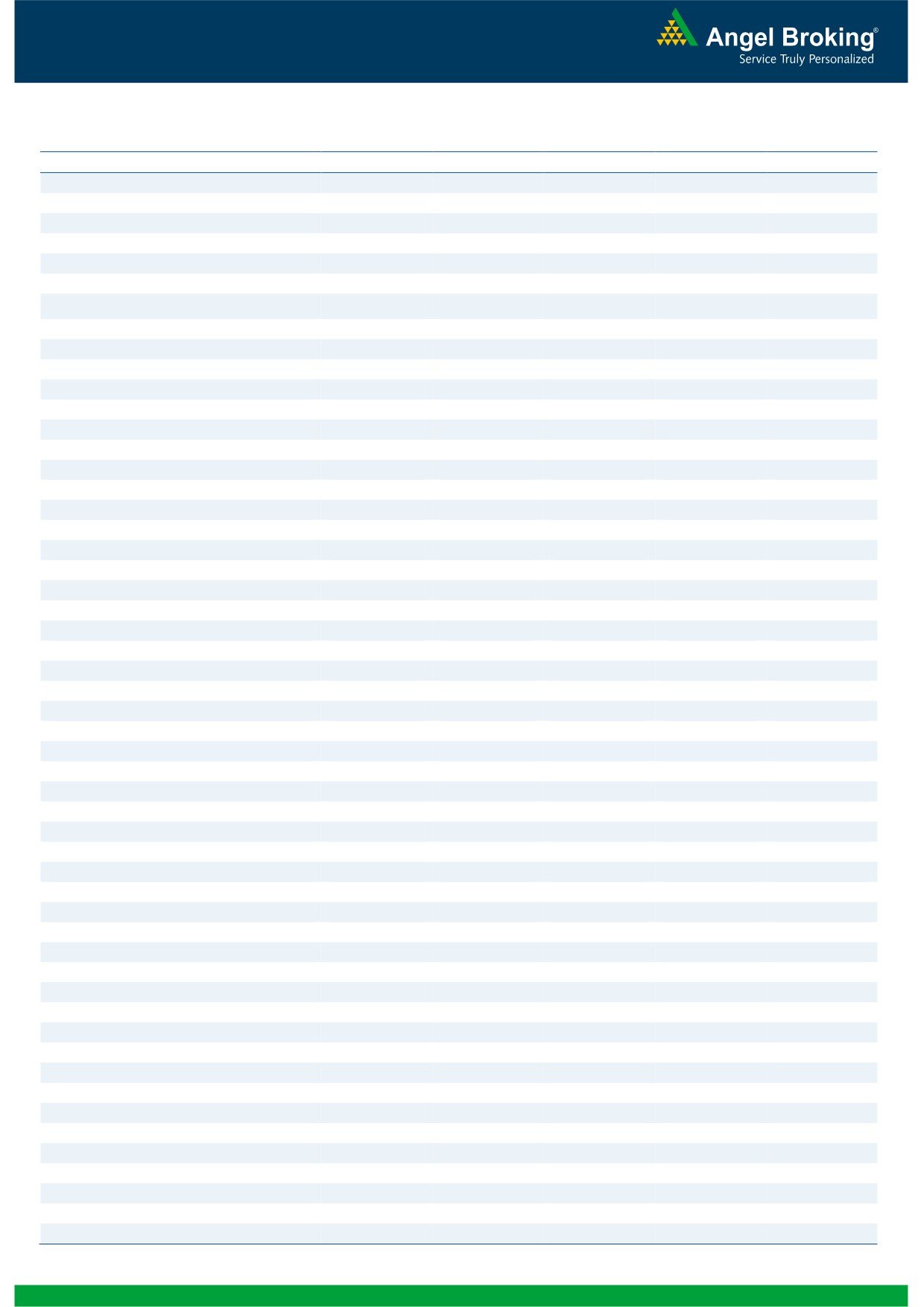

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

20,027

20,088

20,173

20,234

20,318

NIFTY

5,992

6,011

6,039

6,057

6,085

BANKNIFTY

10,745

10,859

11,049

11,163

11,352

ACC

1,250

1,263

1,274

1,286

1,297

AMBUJACEM

202

204

208

211

214

ASIANPAINT

5,090

5,128

5,188

5,225

5,285

AXISBANK

1,142

1,167

1,210

1,235

1,278

BAJAJ-AUTO

1,814

1,890

1,939

2,015

2,064

BANKBARODA

547

559

568

580

588

BHARTIARTL

312

321

327

336

343

BHEL

161

167

179

185

196

BPCL

337

342

346

350

354

CAIRN

302

305

308

311

314

CIPLA

404

410

414

420

424

COALINDIA

289

293

295

300

302

DLF

162

165

170

173

178

DRREDDY

2,301

2,323

2,344

2,367

2,388

GAIL

316

325

330

338

343

GRASIM

2,767

2,792

2,809

2,833

2,850

HCLTECH

849

870

889

911

929

HDFC

766

784

808

827

851

HDFCBANK

663

671

682

690

701

HEROMOTOCO

1,703

1,738

1,766

1,801

1,830

HINDALCO

102

103

104

105

106

HINDUNILVR

661

673

691

704

722

ICICIBANK

933

946

967

981

1,002

IDFC

121

124

126

128

131

INDUSINDBK

425

435

450

460

475

INFY

2,776

2,812

2,838

2,874

2,900

ITC

362

366

369

372

375

JINDALSTEL

200

205

212

217

223

JPASSOCIAT

48

49

50

51

52

KOTAKBANK

669

680

697

708

725

LT

953

963

976

987

1,000

LUPIN

883

891

899

908

916

M&M

852

866

882

896

912

MARUTI

1,419

1,435

1,449

1,465

1,478

NMDC

104

106

107

109

110

NTPC

140

142

145

147

149

ONGC

309

313

316

320

324

PNB

611

621

632

642

653

POWERGRID

110

111

111

112

112

RANBAXY

311

318

328

335

346

RELIANCE

907

915

922

930

936

RELINFRA

370

379

388

396

405

SBIN

1,783

1,797

1,813

1,827

1,843

SESAGOA

140

143

148

151

156

SUNPHARMA

1,041

1,060

1,093

1,113

1,146

TATAMOTORS

282

289

293

299

304

TATAPOWER

90

91

92

93

94

TATASTEEL

235

238

243

246

251

TCS

1,675

1,709

1,734

1,768

1,793

ULTRACEMCO

1,900

1,915

1,925

1,940

1,950

3

Daily Technical Report

July 22, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4