Daily Technical Report

July 18 , 2013

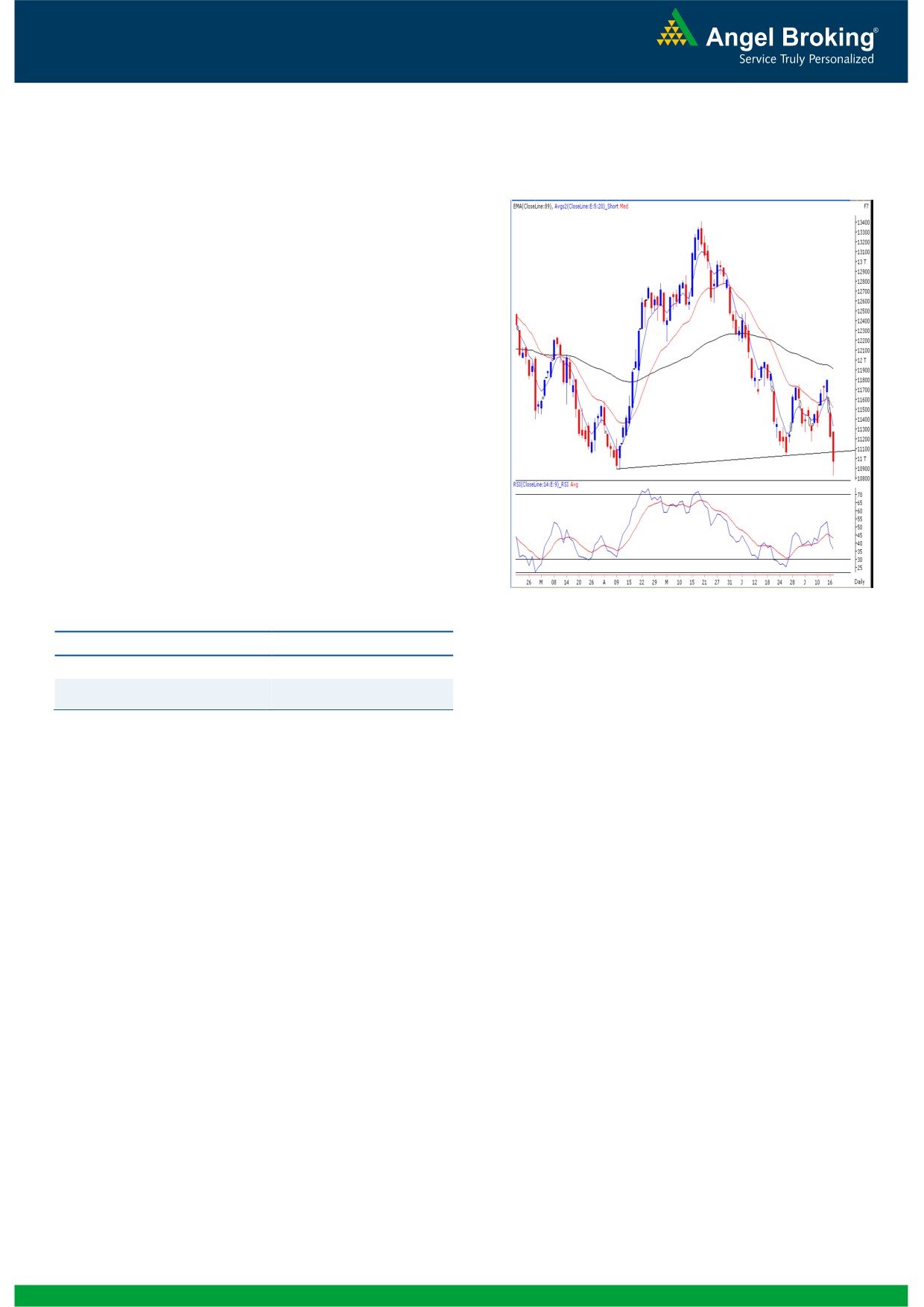

Exhibit 1: Nifty Daily Chart

Sensex (19949) / NIFTY (5973)

Yesterday, our benchmark indices opened marginally higher

in-line with quiet global cues. Indices then moved within the

narrow range throughout the first half and eventually slipped

nearly a percent lower immediately post midsession.

However, buying in defensive counters pulled indices higher

from the negative territory. Undoubtedly the session was

dominated by FMCG counters, HUL and ITC. The Consumer

Durables and IT counters too supported the Index; whereas

the Banking, Metal and Auto sectors were continued to show

significant weakness. The Advance to Decline ratio was in

favor of declining counters. (A=992 D=1322) (Source-

Formation

The ’89-day EMA’ and the ’89-week EMA’ are placed at

19391 / 5863 and 18564 / 5615 levels respectively.

The ’20-day EMA’ and the ‘20-week EMA’ are placed at

19519 / 5878 and 19443 / 5876, respectively.

The weekly ‘RSI’ and ‘Stochastic’ oscillators are positively

Source: Falcon:

poised.

The 61.8% and 78.60% Fibonacci retracement levels of

Actionable points:

the fall from 20444 / 6229 to 18467/ 5566 are placed

at 19689 / 5976 and 20021 / 6088, respectively.

View

Neutral

The daily chart depicts a ‘Bullish Pennant’ pattern

Support Levels

5904 - 5879

breakout.

Resistance Level

5990 - 6038

Trading strategy:

Yesterday’s price action can be perfectly described as a ‘Tug-

of-War’ between the bulls and the bears. Indices recovered

smartly after posting a low of 19778 / 5927. Going forward,

we continue to mention the trading range of 20073 / 6038

to 19640 / 5904. Yesterday’s high of 19983 / 5990 would

act as an immediate intraday resistance for our market. For

any higher targets, indices need to break recent high of

20063 / 6038 which would push indices towards the near

term target of 20200 / 6088. On the flipside, 19640 -

19505 / 5904 - 5879 remains to be a strong support band

for our market. A fall below these levels would mean that all

long positions should be squared off as further lower levels

may be eventually tested. We reiterate that traders should

stick to individual stocks movement and avoid taking undue

risks.

1

Daily Technical Report

July 18, 2013

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (10972)

Yesterday, the Bank Nifty too opened slightly higher in-line

with our benchmark indices but traded with strong pessimism

throughout the session. As expected and mentioned in

yesterday’s report, the index went on to test the recent bottom

of

11033 and even managed to close below the

psychological mark of 11000. On the daily chart, we are now

observing that the Bank Nifty has broken down from the

‘Upward Sloping Trend Line’ drawn by joining 10888 (low on

April 10, 2013) and 11033 (low on June 26, 2013). Hence,

going forward, if Bank Nifty sustains below yesterday’s low of

10829, then it may slide further to test 10782 - 10640 levels.

On the upside,

11033

-

11264 levels would act as

immediate resistance for Bank Nifty in coming trading

session.

Actionable points:

Source: Falcon:

View

Bearish below 10829

Expected targets

10782 - 10640

Resistance Level

11264

2

Daily Technical Report

July 18, 2013

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

19,699

19,824

19,903

20,028

20,108

NIFTY

5,900

5,937

5,963

6,000

6,026

BANKNIFTY

10,588

10,780

11,022

11,214

11,456

ACC

1,244

1,259

1,272

1,287

1,300

AMBUJACEM

197

202

205

209

212

ASIANPAINT

4,737

4,874

4,953

5,091

5,170

AXISBANK

1,144

1,169

1,202

1,227

1,261

BAJAJ-AUTO

1,863

1,886

1,903

1,926

1,943

BANKBARODA

529

538

555

565

581

BHARTIARTL

303

310

319

325

334

BHEL

178

180

184

186

190

BPCL

328

335

342

349

355

CAIRN

287

291

298

302

308

CIPLA

394

400

406

412

417

COALINDIA

283

287

291

295

300

DLF

160

163

165

167

169

DRREDDY

2,275

2,293

2,313

2,331

2,351

GAIL

312

317

324

329

336

GRASIM

2,711

2,745

2,784

2,818

2,857

HCLTECH

864

869

879

885

894

HDFC

791

804

816

830

842

HDFCBANK

631

647

664

680

697

HEROMOTOCO

1,652

1,669

1,691

1,708

1,731

HINDALCO

99

100

102

104

106

HINDUNILVR

587

636

668

717

748

ICICIBANK

943

962

987

1,005

1,030

IDFC

121

124

127

130

133

INDUSINDBK

425

439

456

470

486

INFY

2,720

2,736

2,747

2,762

2,774

ITC

357

363

367

372

376

JINDALSTEL

206

210

215

219

224

JPASSOCIAT

48

49

51

52

53

KOTAKBANK

692

702

710

719

727

LT

945

957

972

983

998

LUPIN

865

870

876

881

887

M&M

843

868

901

926

960

MARUTI

1,387

1,404

1,418

1,435

1,450

NMDC

101

102

105

106

109

NTPC

142

145

147

150

152

ONGC

292

297

300

304

307

PNB

605

613

622

630

639

POWERGRID

109

110

111

112

113

RANBAXY

325

329

334

338

343

RELIANCE

897

906

912

921

927

RELINFRA

351

360

372

380

392

SBIN

1,763

1,785

1,812

1,834

1,861

SESAGOA

144

148

151

154

158

SUNPHARMA

1,086

1,099

1,115

1,129

1,145

TATAMOTORS

277

281

286

290

295

TATAPOWER

88

90

91

92

93

TATASTEEL

235

239

246

250

258

TCS

1,630

1,654

1,670

1,694

1,709

ULTRACEMCO

1,892

1,916

1,944

1,968

1,996

3

Daily Technical Report

July 18, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4