Daily Technical Report

July 15 , 2013

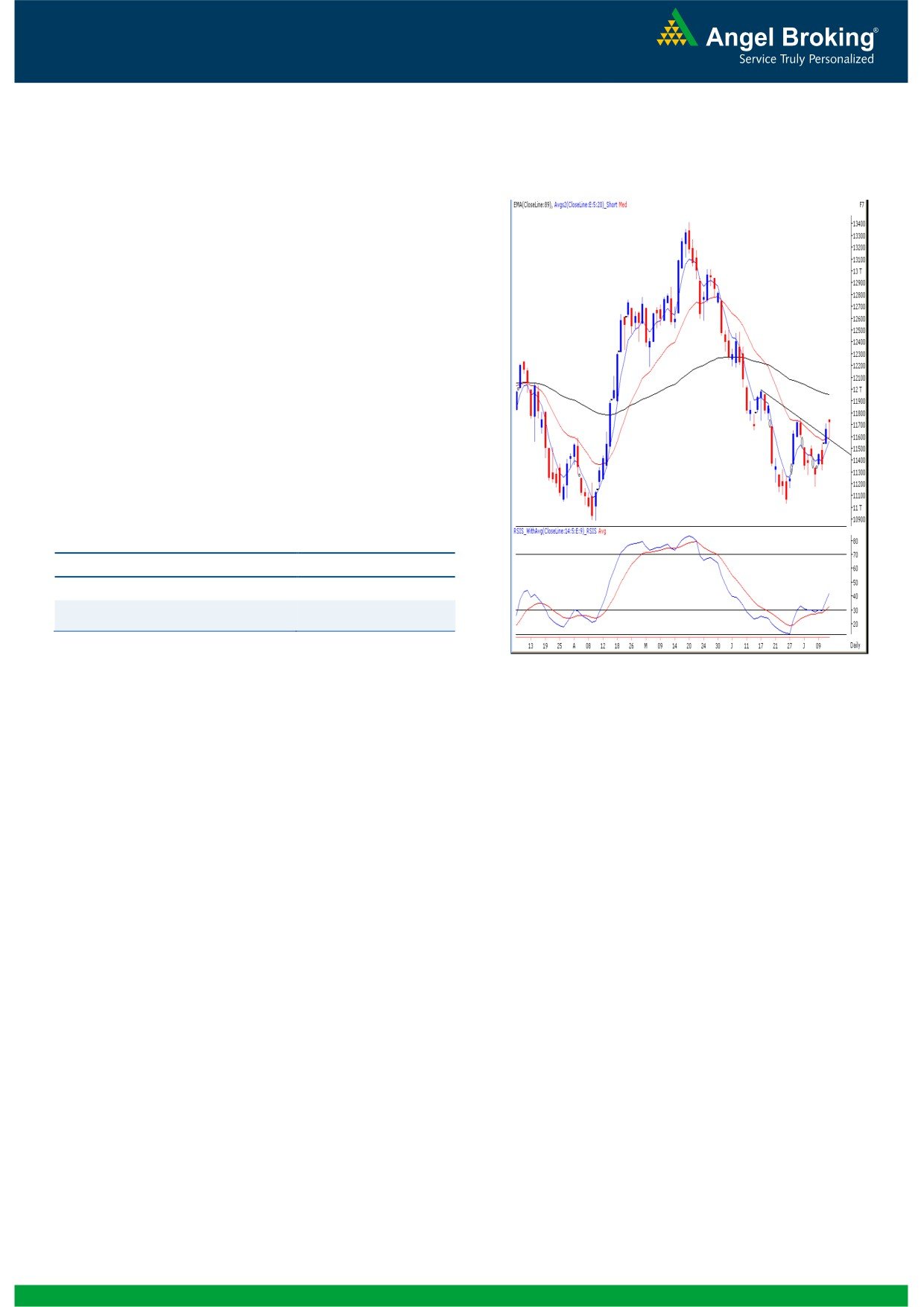

Exhibit 1: Nifty Daily Chart

Sensex (19958) / NIFTY (6009)

On Friday, our benchmark indices opened higher on

account of better-than-expected 1QFY2014 results of IT

giant, Infosys. Despite a minor corrective move, our markets

managed to inch higher during the latter part of the day and

as a result, indices closed almost at the highest point of the

week. On the sectoral front, the IT & TECH counters

dominated Friday’s gains; whereas the Consumer Durables,

Realty & PSU sectors ended on the losing side. The Advance

to Decline ratio was in the favor of declining counters.

Formation

The ’89-day EMA’ and the ’89-week EMA’ are placed at

19352 / 5854 and 18532 / 5607 levels respectively.

The ’20-day EMA’ and the ‘20-week EMA’ are placed at

19371 / 5841 and 19390 / 5866, respectively.

The weekly ‘RSI’ and ‘Stochastic’ oscillators are positively

poised.

Source: Falcon:

The 61.8% and 78.60% Fibonacci retracement levels of

the fall from 20444 / 6229 to 18467/ 5566 are placed

Actionable points:

at 19689 / 5976 and 20021 / 6088, respectively.

View

Neutral

The daily chart depicts a ‘Bullish Pennant’ pattern

Support Levels

5904 - 5879

breakout.

Resistance Level

6019 - 6088

Trading strategy:

For the first half of the week, our benchmark indices traded

within the range of 19640 - 19147 / 5904 - 5760 as

mentioned in our previous report. The breakout above

19640 / 5904 has now confirmed a ‘Bullish Pennant’

(please refer exhibit 2) pattern. The theoretical target of this

pattern also coincides with the 78.6% Fibonacci retracement

level placed at 20021 / 6088 (the target is computed by

adding length of the pole to the lowest point of the pennant).

Considering the positive placement of weekly momentum

oscillators, a test of the 20254 / 6134 levels is also possible

if the indices manage to stay above 20021 / 6088. On the

flipside, if indices breach Friday’s low of 19785 / 5951, then

we may witness a correction towards 19640 - 19500 / 5904

- 5879. These levels should ideally provide decent support

for our benchmark indices. An important point to note is that

the rally of the last 2 days has been led only by selective

large cap counters and the broader market has shown no

movement. We advise traders to adopt a stock-centric

approach and avoid taking undue risks.

1

Daily Technical Report

July 15, 2013

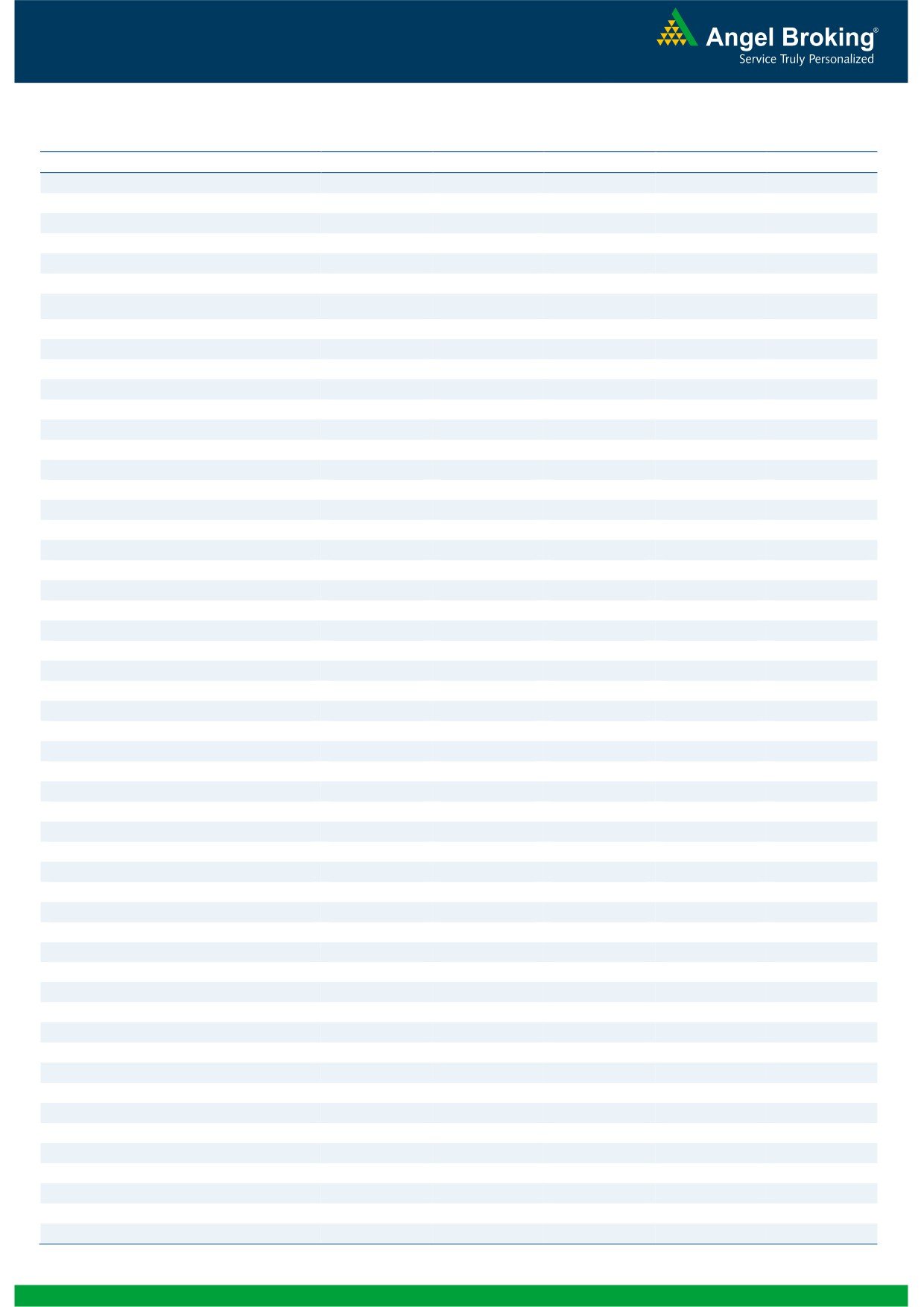

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (11723)

On Friday, the Bank Nifty opened with minor upside gap and

immediately slipped lower to test the hourly ’20 EMA’ level of

11600. As expected, this technical tool provided decent

support for the index and eventually, the index closed higher

on the back of buying seen during the second half the day. At

present, the 'Downward Sloping Trend Line' breakout

witnessed on Thursday is still intact. Considering positive

placement of daily ‘RSI-Smoothened’ oscillator, we are of the

opinion that if Bank Nifty sustains above 11753, then we are

likely to witness a rally towards 12018, which is the daily ’89-

EMA’ level. Conversely, Friday's low of 11589 would act as a

key support in coming trading session.

Actionable points:

View

Bullish above 11753

Resistance Level

12018

Support Level

11589

Source: Falcon:

2

Daily Technical Report

July 15, 2013

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

19,706

19,832

19,912

20,038

20,118

NIFTY

5,925

5,967

5,993

6,035

6,061

BANKNIFTY

11,531

11,627

11,685

11,781

11,839

ACC

1,212

1,227

1,241

1,256

1,270

AMBUJACEM

192

195

196

199

201

ASIANPAINT

4,732

4,779

4,839

4,887

4,947

AXISBANK

1,260

1,276

1,287

1,303

1,315

BAJAJ-AUTO

1,830

1,850

1,865

1,885

1,901

BANKBARODA

552

562

569

579

587

BHARTIARTL

293

299

303

309

313

BHEL

183

186

188

190

192

BPCL

333

338

342

347

351

CAIRN

286

289

292

295

297

CIPLA

385

395

401

411

417

COALINDIA

291

295

298

303

305

DLF

171

174

177

180

183

DRREDDY

2,216

2,283

2,321

2,387

2,425

GAIL

315

319

322

326

329

GRASIM

2,779

2,805

2,837

2,863

HCLTECH

841

852

858

869

876

HDFC

827

839

849

862

872

HDFCBANK

676

686

692

702

708

HEROMOTOCO

1,661

1,688

1,706

1,733

1,750

HINDALCO

99

101

102

103

105

HINDUNILVR

586

594

598

606

611

ICICIBANK

1,043

1,052

1,060

1,069

1,077

IDFC

129

132

134

137

139

INDUSINDBK

491

497

505

511

519

INFY

2,664

2,734

2,820

2,890

2,976

ITC

345

348

350

353

356

JINDALSTEL

217

220

222

225

226

JPASSOCIAT

50

51

53

54

56

KOTAKBANK

727

743

752

768

777

LT

947

971

985

1,010

1,024

LUPIN

848

859

867

878

887

M&M

879

893

909

923

939

MARUTI

1,397

1,423

1,464

1,489

1,530

NMDC

104

105

107

108

110

NTPC

140

143

145

148

150

ONGC

283

290

299

306

315

PNB

622

628

632

638

642

POWERGRID

107

109

110

111

112

RANBAXY

329

334

339

344

349

RELIANCE

859

874

885

901

912

RELINFRA

371

378

383

391

396

SBIN

1,860

1,876

1,898

1,915

1,937

SESAGOA

146

149

151

154

156

SUNPHARMA

1,080

1,094

1,105

1,119

1,130

TATAMOTORS

281

287

291

296

300

TATAPOWER

85

87

89

91

92

TATASTEEL

256

259

262

265

267

TCS

1,559

1,585

1,605

1,630

1,650

ULTRACEMCO

1,873

1,906

1,953

1,987

2,034

3

Daily Technical Report

July 15, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4