Daily Technical Report

July 12 , 2013

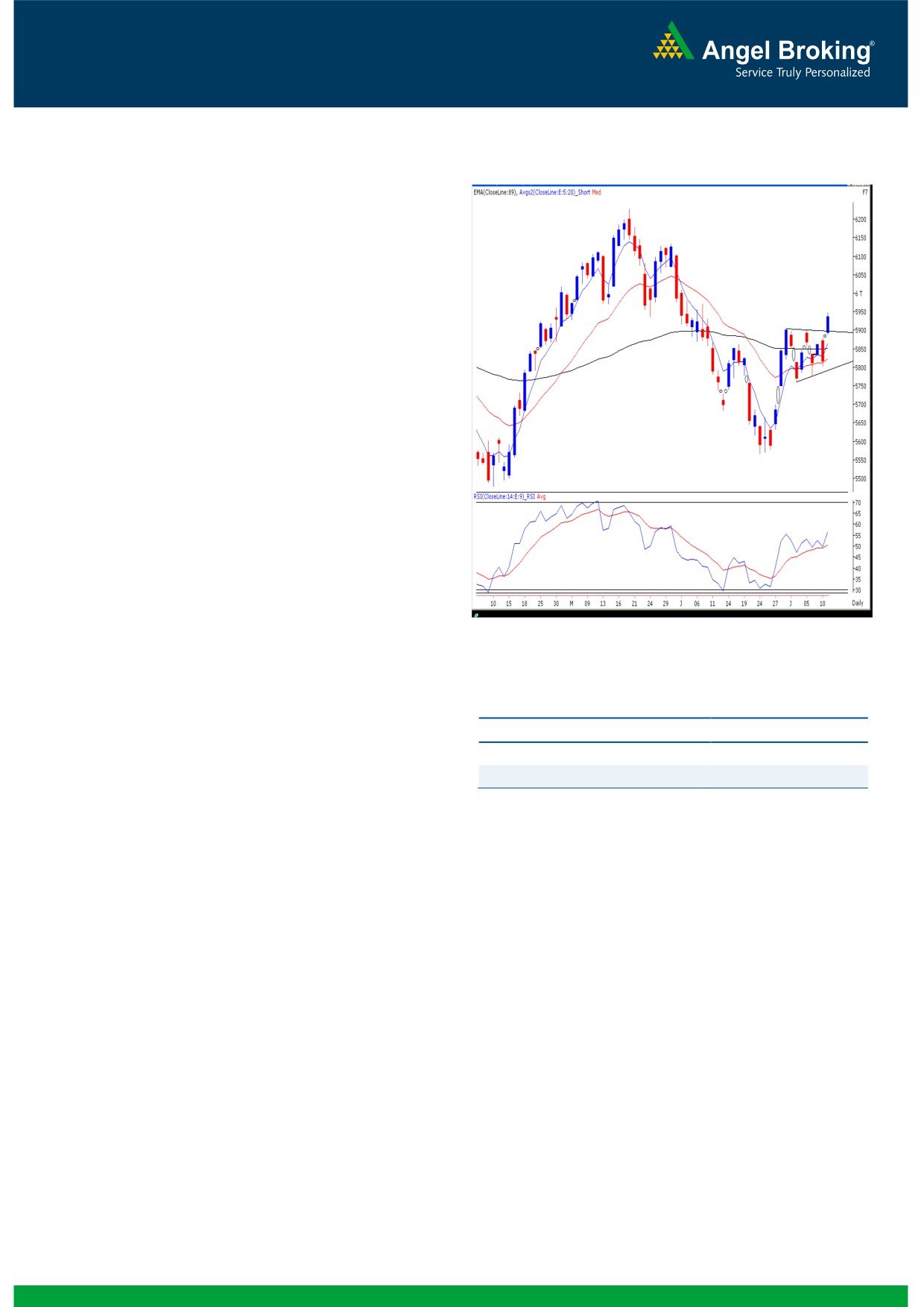

Exhibit 1: Nifty Daily Chart

Sensex (19676) / NIFTY (5935)

Yesterday, our benchmark indices opened substantially

higher as indicated by the SGX Nifty early in the morning.

Markets then maintained their early gains and gradually

moved higher to end the session with massive gain of 2%.

The Metals, Banking and Reality counters outperformed

significantly whereas Consumer Durables faced selling

pressure. The cash segment volumes remained considerably

lower in spite of such a strong rally in the markets. The

advance to decline ratio was strongly in the favor of

advancing counters (A=1358 D=974)

(Source-

Formation

The ’89-day EMA’ and the ’89-week EMA’ are placed at

19338 / 5850 and 18526 / 5605 levels, respectively.

The ’20-day EMA’ and the ‘20-week EMA’ are placed at

19310/ 5823 and 19363 / 5859, respectively.

The weekly ‘RSI’ and ‘Stochastic’ oscillators are positively

Source: Falcon:

poised.

The 61.8% and 78.60% Fibonacci retracement levels of

Actionable points:

the fall from 20444 / 6229 to 18467/ 5566 are placed

at 19689 / 5976 and 20021 / 6088, respectively.

View

Neutral

Support Levels

5887 - 5904

The weekly chart now depicts a ‘Bullish Engulfing’

Resistance Level

5948 - 6011

pattern but the monthly chart shows a 'Bearish Engulfing"

Japanese candlestick pattern.

Trading strategy:

All the equity markets across the globe got a booster shot

after the Fed Reserve chairman Ben Bernanke announced

that the central bank is not in a hurry to raise short term

rates and that the accommodative monetary policy will be

here to stay for the foreseeable future. We witnessed a huge

gap opening in our market and a breakout beyond the stiff

resistance level of 19640 / 5904. The daily chart now

depicts a breakout from the 'Bullish Pennant' pattern.

Considering the current momentum and the positive

placement of weekly oscillators, we expect our market to rally

towards 19860 / 6011 if they sustain above yesterday’s high

of 19723 / 5948 levels. On the flipside, 19640 - 19598/

5904 - 5887 would act as support for our market. Traders

should bear in mind that the Infosys results and the IIP

numbers will be declared in today’s session. Thus traders

should stay light on positions and maintain strict stop losses

for their trades.

1

Daily Technical Report

July 12, 2013

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (11655)

Yesterday, the Bank Nifty too opened with nearly two percent

upside gap in-line with optimistic trading mood across the

globe. During the entire session, the Bank Nifty managed on

to the gains and to close well inside the positive territory. In

the process, the index has given a 'Downward Sloping Trend

Line' breakout as shown in the chart and also crossed the

daily '20 EMA' placed at 11567. Considering the positive

placement in daily momentum oscillators, we expect the Bank

Nifty to test its next resistance level of 11752. Conversely,

yesterday's low of 11541 would be key support in coming

trading session. A fall below this low would negate all

bullish possibilities in the near term and traders can use

this as a stop loss for their long positions.

Actionable points:

View

Neutral

Resistance Level

11752

Support Level

11541

Source: Falcon:

2

Daily Technical Report

July 12, 2013

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

19,368

19,522

19,623

19,777

19,878

NIFTY

5,863

5,899

5,924

5,960

5,985

BANKNIFTY

11,467

11,561

11,636

11,730

11,804

ACC

1,230

1,240

1,255

1,265

1,280

AMBUJACEM

194

196

197

199

201

ASIANPAINT

4,780

4,827

4,857

4,905

4,935

AXISBANK

1,266

1,277

1,288

1,299

1,311

BAJAJ-AUTO

1,852

1,864

1,876

1,889

1,901

BANKBARODA

557

563

569

574

580

BHARTIARTL

290

295

298

303

306

BHEL

182

184

187

189

191

BPCL

334

337

341

343

347

CAIRN

287

290

292

295

298

CIPLA

395

398

401

403

407

COALINDIA

288

293

298

303

308

DLF

175

177

178

180

182

DRREDDY

2,243

2,269

2,288

2,314

2,333

GAIL

314

317

320

324

327

GRASIM

2,797

2,819

2,847

2,869

HCLTECH

824

832

841

849

857

HDFC

826

840

849

863

871

HDFCBANK

658

671

679

691

699

HEROMOTOCO

1,633

1,665

1,690

1,722

1,747

HINDALCO

98

100

102

105

107

HINDUNILVR

590

596

599

605

609

ICICIBANK

1,037

1,047

1,061

1,071

1,084

IDFC

129

130

131

132

134

INDUSINDBK

497

504

510

517

524

INFY

2,480

2,504

2,534

2,558

2,588

ITC

343

348

351

357

360

JINDALSTEL

216

219

223

226

231

JPASSOCIAT

53

53

54

55

56

KOTAKBANK

721

733

743

755

765

LT

945

955

967

977

990

LUPIN

857

863

869

875

881

M&M

906

912

921

927

936

MARUTI

1,445

1,476

1,527

1,557

1,609

NMDC

104

105

107

108

110

NTPC

141

143

144

145

147

ONGC

297

301

304

308

311

PNB

618

624

632

638

646

POWERGRID

108

109

110

111

113

RANBAXY

334

338

344

349

355

RELIANCE

853

862

868

876

882

RELINFRA

374

378

382

386

391

SBIN

1,885

1,898

1,913

1,926

1,941

SESAGOA

140

145

148

153

157

SUNPHARMA

1,074

1,085

1,097

1,107

1,119

TATAMOTORS

278

281

286

290

295

TATAPOWER

86

87

88

89

90

TATASTEEL

256

258

262

265

268

TCS

1,502

1,533

1,552

1,583

1,602

ULTRACEMCO

1,958

1,969

1,979

1,990

1,999

3

Daily Technical Report

July 12, 2013

Research Team Tel: 022 - 30940000

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

4