Technical & Derivatives Report

January 03, 2017

Sensex (26595) / Nifty (8180)

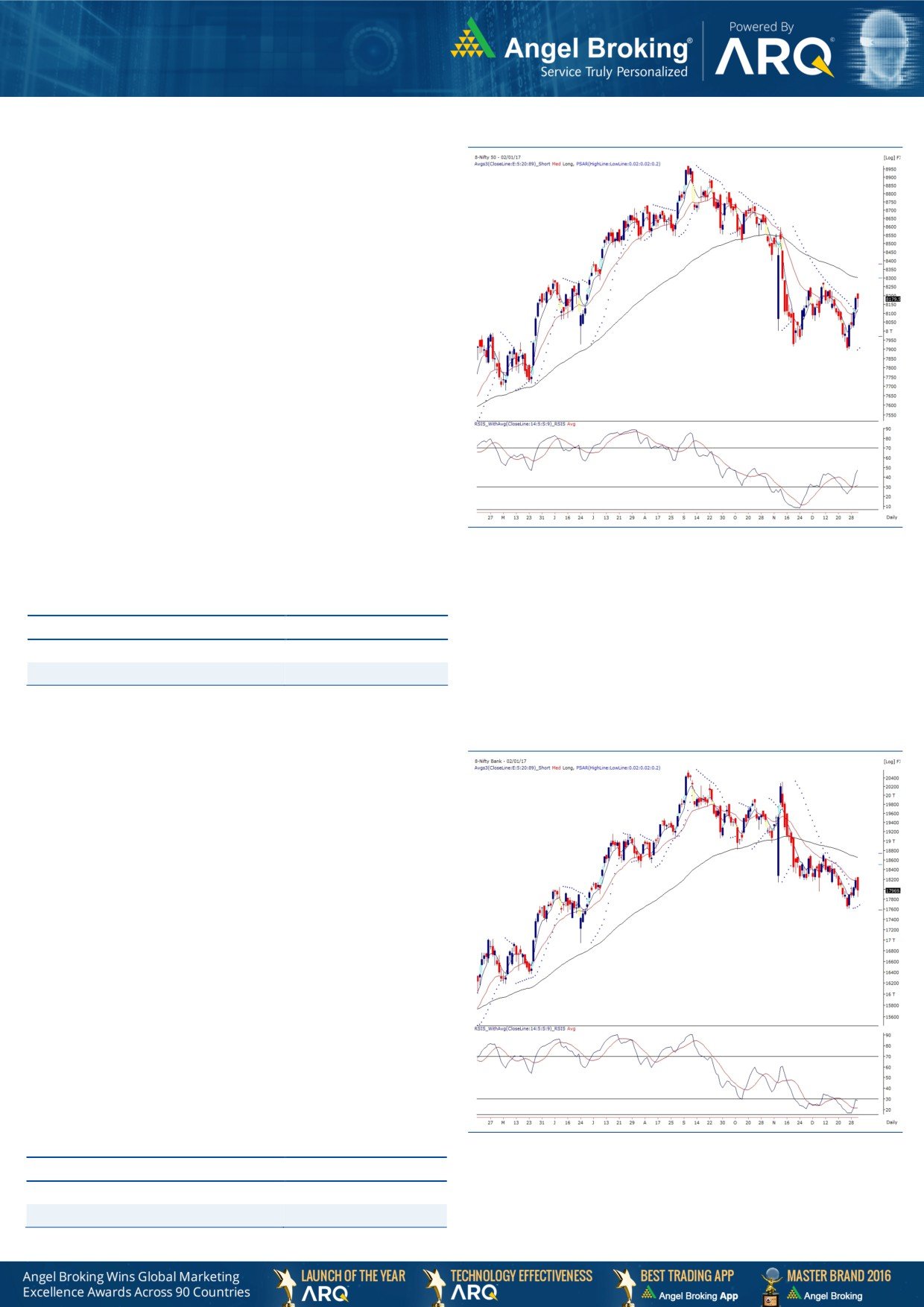

Exhibit 1: Nifty Daily Chart

The opening session of the new calendar year started with a

marginal upside gap, however, the lead was very short lived as

we witnessed a sharp decline in first couple of hours. Post the

midsession, we saw index resuming its last week’s optimism and

as a result, the Nifty managed to recover its lost ground

throughout the second half to end the session with negligible loss.

Yesterday, we saw an attempt of breaking 8200 on Nifty; but, it

was a bit feeble in the opening trades. However, a smart recovery

in the second half was so encouraging; leading to a positive

crossover in ‘5 & 20 EMA’ combination on daily chart. In

addition, on the oscillator front, the ‘RSI-Smoothened’ has

confirmed a ‘1-2-3’ pattern, which is an indication of breaking a

recent swing high of 8274.95 quite soon. Going ahead, we

maintain our optimistic stance on the market and expect the Nifty

to move towards 8229 - 8274 in the forthcoming session. On the

flipside, 8133 - 8100 are now likely to provide a decent support.

We are now seeing lot of trading opportunities in individual stocks

and hence, traders are advised to focus on such developments to

fetch higher returns.

Key Levels

Support 1 - 8133

Resistance 1 - 8229

Support 2 - 8100

Resistance 2 - 8274

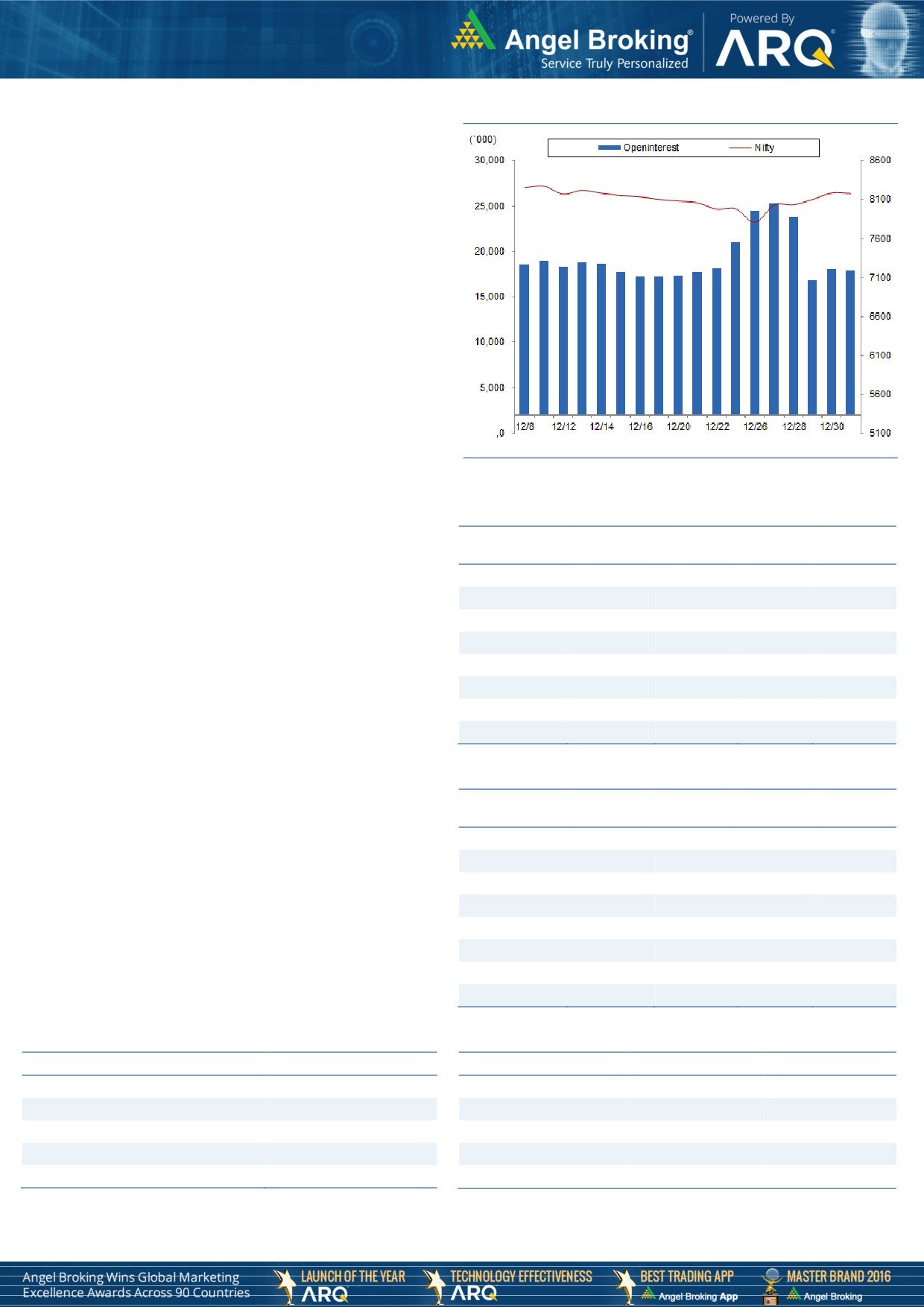

Nifty Bank Outlook - (17970)

Exhibit 2: Nifty Bank Daily Chart

In yesterday's trading session, the Nifty Bank index

underperformed the broader indices and ended the session on a

negative note inspite of the positive market breadth. Post

opening, the index resisted around

18250, tad below the

resistance of 18260 which we had mentioned in yesterday's

report. As also highlighted earlier, the Nifty Bank index has

strong support around 17600 whereas resistance is seen around

18260 (hourly

200 SMA). The index will show directional

movement only on breakout of the mentioned range of 17600-

18260. However, due to the recent low at the mentioned support

and the positive market breadth, there is higher probability that

the index will breach the mentioned resistance and head higher in

near term. Hence, traders are advised to trade with positive bias

and initiate positional buying on dips with stop loss below 17600.

The intraday supports for the Nifty Bank index are placed around

17829 and 17600; whereas resistances are seen around 18260

and 18440.

Key Levels

Support 1 - 17829

Resistance 1 - 18260

Support 2 - 17600

Resistance 2 - 18440

Technical & Derivatives Report

January 03, 2017

Comments

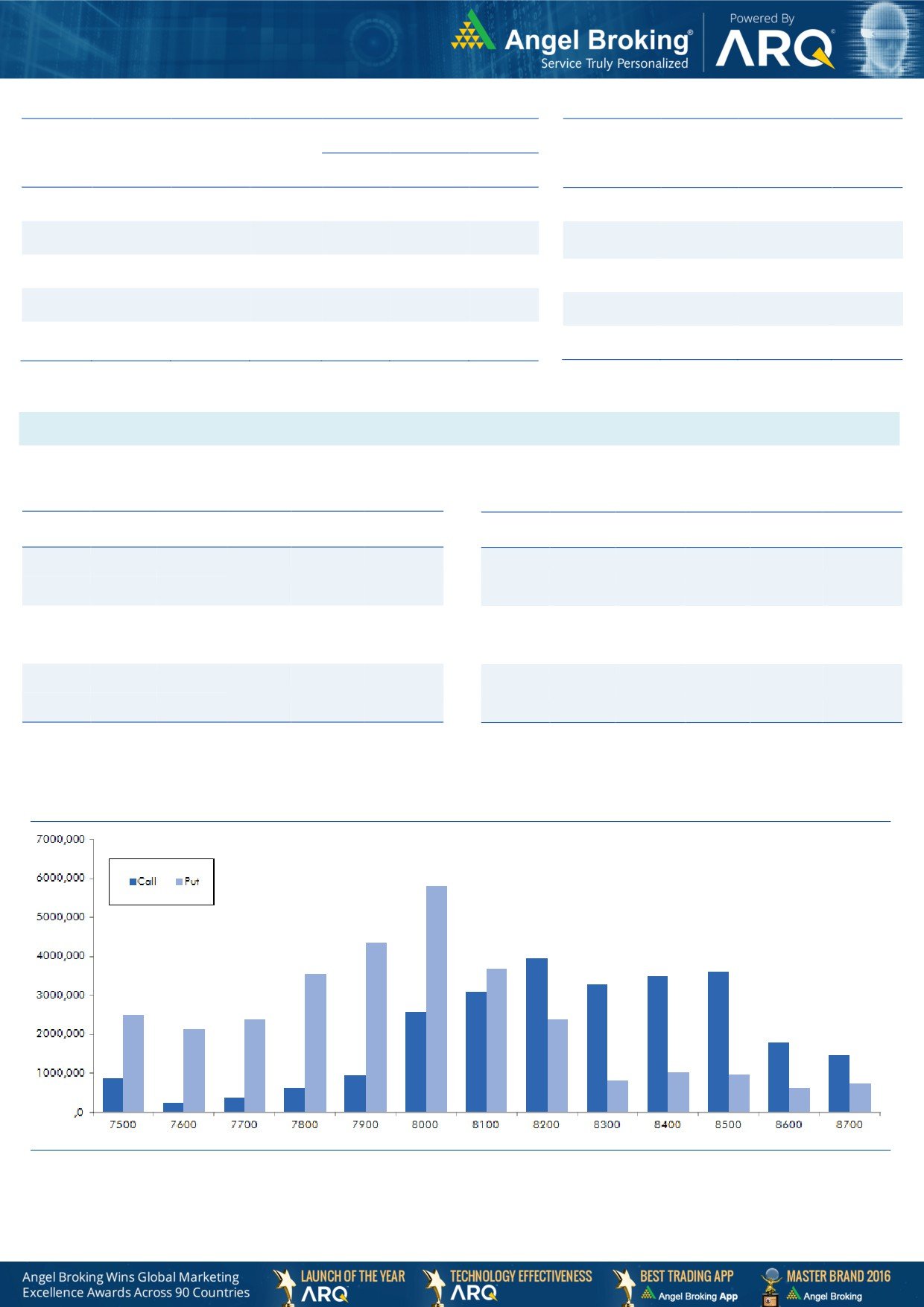

Nifty Vs OI

The Nifty futures open interest has decreased by 0.08%

BankNifty futures open interest has increased by 11.50%

as market closed at 8179.50 levels.

The Nifty January future closed with a premium of 12.60

points against the premium of 1.60 points in last trading

session. The February series closed at a premium of

36.95 points.

The Implied Volatility of at the money options has

increased from 13.27 % to 13.88%. At the same time,

the PCR-OI of Nifty has increased from 1.05 to 1.06

levels.

The total OI of the market is Rs. 2,21,153/- cr. and the

stock futures OI is Rs. 68,852/- cr.

Few of the liquid counters where we have seen high cost

of carry are GMRINFRA, IFCI, FEDERALBNK,

TV18BRDCST and PTC.

Views

OI Gainers

FIIs were net sellers in cash market segment and index

OI

PRICE

futures. They sold equities worth Rs. 261 crores. While, in

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

index futures, they were net sellers to the tune of Rs. 461

LICHSGFIN

8503000

37.54

532.55

-4.92

crores with some fall in open interest, indicating some

SBIN

78228000

17.67

244.75

-2.06

long unwinding in previous trading session.

HDFC

10697500

11.03

1222.75

-3.40

On Index Options front, FIIs bought worth Rs. 1658

NIITTECH

538500

10.80

429.10

0.76

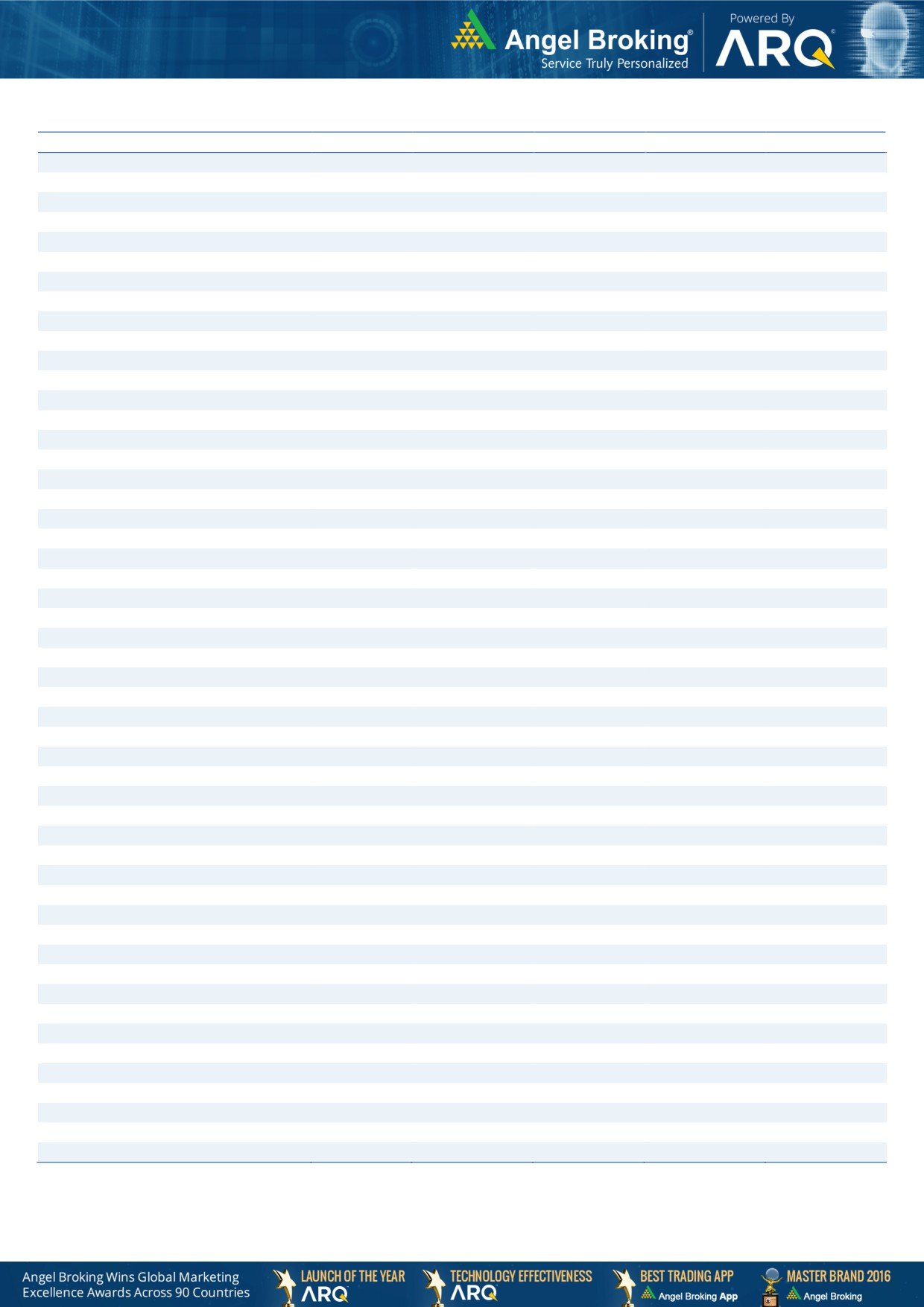

crores with rise in OI. In call options, we hardly saw any

MARUTI

2289300

10.58

5478.95

2.84

relevant activity. On the other hand, in put options, out-

BANKBARODA

37898000

9.93

149.50

-2.42

the-money strike 7500 added some build-up. Maximum

JETAIRWAYS

6020000

9.69

364.10

4.76

OI in January series is placed at 8200 call and 8000 put

CEATLTD

1339800

9.62

1184.45

1.74

options.

Yesterday, the overall market was quite volatile due to

OI Losers

which IV’s jumped higher. FIIs continued their selling

OI

PRICE

streak in equities and they also unwounded some of their

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

longs in Index Futures. We observed that in yesterday’s

BAJAJ-AUTO

1316500

-4.24

2601.75

-1.44

trading session, stock specific buildup in large cap stocks

JISLJALEQS

37422000

-2.58

89.10

0.68

was on the higher side than that of Nifty. Counters like

IDBI

27648000

-1.96

69.30

-0.43

SBIN, HDFC, MARUTI, BANKBARODA and INDUSINDBK

JUBLFOOD

2181500

-1.89

851.70

1.20

added huge open interest. At current juncture, traders

COALINDIA

9705300

-1.82

297.55

0.63

should look for more of stock specific trades rather than

ULTRACEMCO

2542200

-1.74

3351.45

3.69

forming aggressive positions in Index.

ABIRLANUVO

3558400

-1.60

1295.60

0.82

MARICO

8091200

-1.36

255.10

-2.05

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

LICHSGFIN

43.57

NIFTY

1.06

0.93

HDFC

30.57

BANKNIFTY

0.91

0.89

M&M

32.24

SBIN

0.48

0.48

AMBUJACEM

36.81

INFY

0.80

0.58

IBULHSGFIN

40.83

SUNPHARMA

0.68

0.37

Technical & Derivatives Report

January 03, 2017

FII Statistics for January 02, 2017

Turnover on January 02, 2017

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

684.29

1145.51

(461.22)

162524

10234.60

(0.92)

209335

13846.53

12.13

FUTURES

FUTURES

INDEX

INDEX

28283.09

26625.18

1657.91

784462

48780.61

3.82

3089327

210569.88

37.80

OPTIONS

OPTIONS

STOCK

4331.34

4498.83

(167.48)

849750

51615.67

1.24

STOCK

FUTURES

450946

28814.66

8.31

FUTURES

STOCK

STOCK

2674.96

2652.24

22.72

26152

1619.99

30.32

226332

15165.06

16.25

OPTIONS

OPTIONS

TOTAL

35973.69

34921.77

1051.92

1822888

112250.86

2.46

TOTAL

3975940

268396.13

31.05

Nifty Spot = 8179.50

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8200

110.05

Buy

8100

82.45

46.20

53.80

8246.20

25.30

74.70

8074.70

Sell

8300

63.85

Sell

8000

57.15

Buy

8200

110.05

Buy

8100

82.45

77.40

122.60

8277.40

43.45

156.55

8056.55

Sell

8400

32.65

Sell

7900

39.00

Buy

8300

63.85

Buy

8000

57.15

31.20

68.80

8331.20

18.15

81.85

7981.85

Sell

8400

32.65

Sell

7900

39.00

Note: Above mentioned Bullish or Bearish Spreads in Nifty (January Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

Technical & Derivatives Report

January 03, 2017

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,331

1,341

1,349

1,360

1,368

ADANIPORTS

263

268

273

278

282

AMBUJACEM

207

211

213

217

219

ASIANPAINT

873

889

898

914

923

AUROPHARMA

654

665

672

683

690

AXISBANK

436

442

447

453

458

BAJAJ-AUTO

2,499

2,549

2,602

2,651

2,704

BANKBARODA

143

146

150

153

157

BHEL

120

121

122

124

125

BPCL

634

637

641

644

648

BHARTIARTL

300

305

309

314

318

INFRATEL

340

342

344

347

349

BOSCH

20,629

20,862

21,074

21,307

21,519

CIPLA

558

562

567

571

576

COALINDIA

294

297

300

303

306

DRREDDY

3,038

3,061

3,089

3,112

3,140

EICHERMOT

22,011

22,267

22,558

22,814

23,105

GAIL

429

432

437

440

445

GRASIM

854

864

870

880

886

HCLTECH

817

823

828

834

840

HDFCBANK

1,182

1,189

1,200

1,207

1,218

HDFC

1,176

1,197

1,234

1,255

1,293

HEROMOTOCO

2,954

2,992

3,031

3,069

3,107

HINDALCO

152

155

158

161

163

HINDUNILVR

815

820

824

829

833

ICICIBANK

244

248

252

256

260

IDEA

72

74

75

76

77

INDUSINDBK

1,063

1,075

1,095

1,107

1,127

INFY

991

996

1,004

1,010

1,018

ITC

237

239

241

243

244

KOTAKBANK

702

708

715

721

727

LT

1,339

1,350

1,359

1,369

1,379

LUPIN

1,464

1,485

1,497

1,518

1,531

M&M

1,148

1,189

1,211

1,252

1,274

MARUTI

5,196

5,331

5,403

5,538

5,609

NTPC

163

164

165

167

168

ONGC

191

191

192

193

194

POWERGRID

181

182

184

185

186

RELIANCE

1,065

1,075

1,082

1,093

1,100

SBIN

236

240

247

251

258

SUNPHARMA

620

627

634

641

647

TCS

2,340

2,351

2,363

2,374

2,386

TATAMTRDVR

293

301

305

313

317

TATAMOTORS

462

475

482

494

501

TATAPOWER

75

75

76

76

77

TATASTEEL

382

394

401

414

421

TECHM

480

484

490

494

501

ULTRACEMCO

3,271

3,321

3,350

3,400

3,429

WIPRO

466

469

473

476

481

YESBANK

1,115

1,130

1,146

1,161

1,177

ZEEL

445

449

453

457

461

Technical & Derivatives Report

January 03, 2017

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.