Technical & Derivatives Report

November 30, 2016

Sensex (26350) / Nifty (8142)

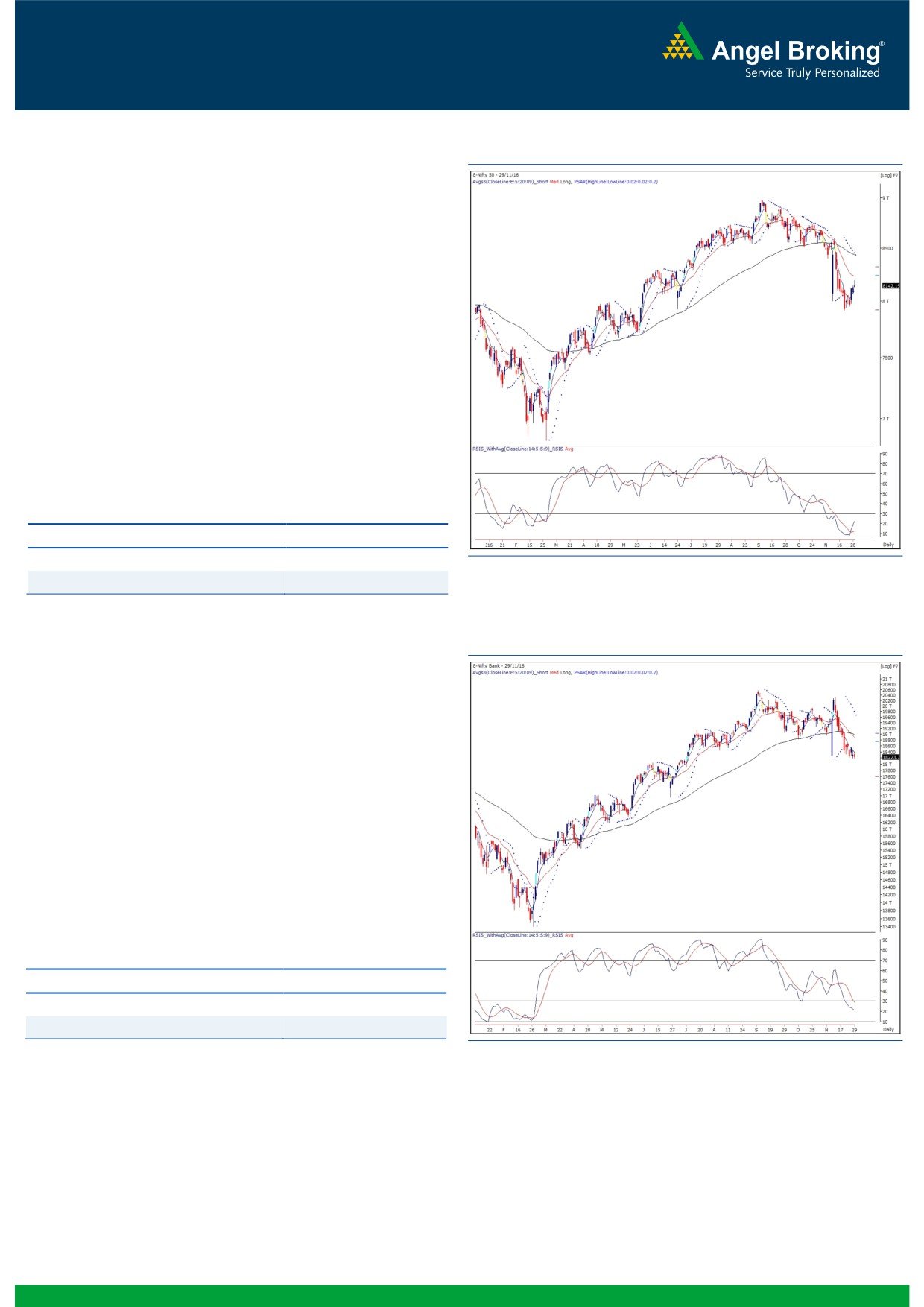

Exhibit 1: Nifty Daily Chart

Yesterday, we had a flat opening owing to mixed global cues.

Subsequently, the index picked up a strong momentum in the

upward direction to move towards the 8200 mark. However, we

saw a corrective move towards the fag end to end the session with

marginal gains.

Although, our market is facing some resistance at higher level, we

would continue with our optimistic view in the near term. We

expect the index to gradually move towards 8250 - 8300 levels;

whereas on the lower side, 8120 - 8080 would act as a strong

support zone for the market. Going forward, we expect stock

specific bounce to continue in the market and hence, traders

should look for a buying opportunity in individual stocks that have

hammered down in the recent past and are trading around their

strong supports.

Key Levels

Support 1 - 8120

Resistance 1 - 8250

Support 2 - 8080

Resistance 2 - 8300

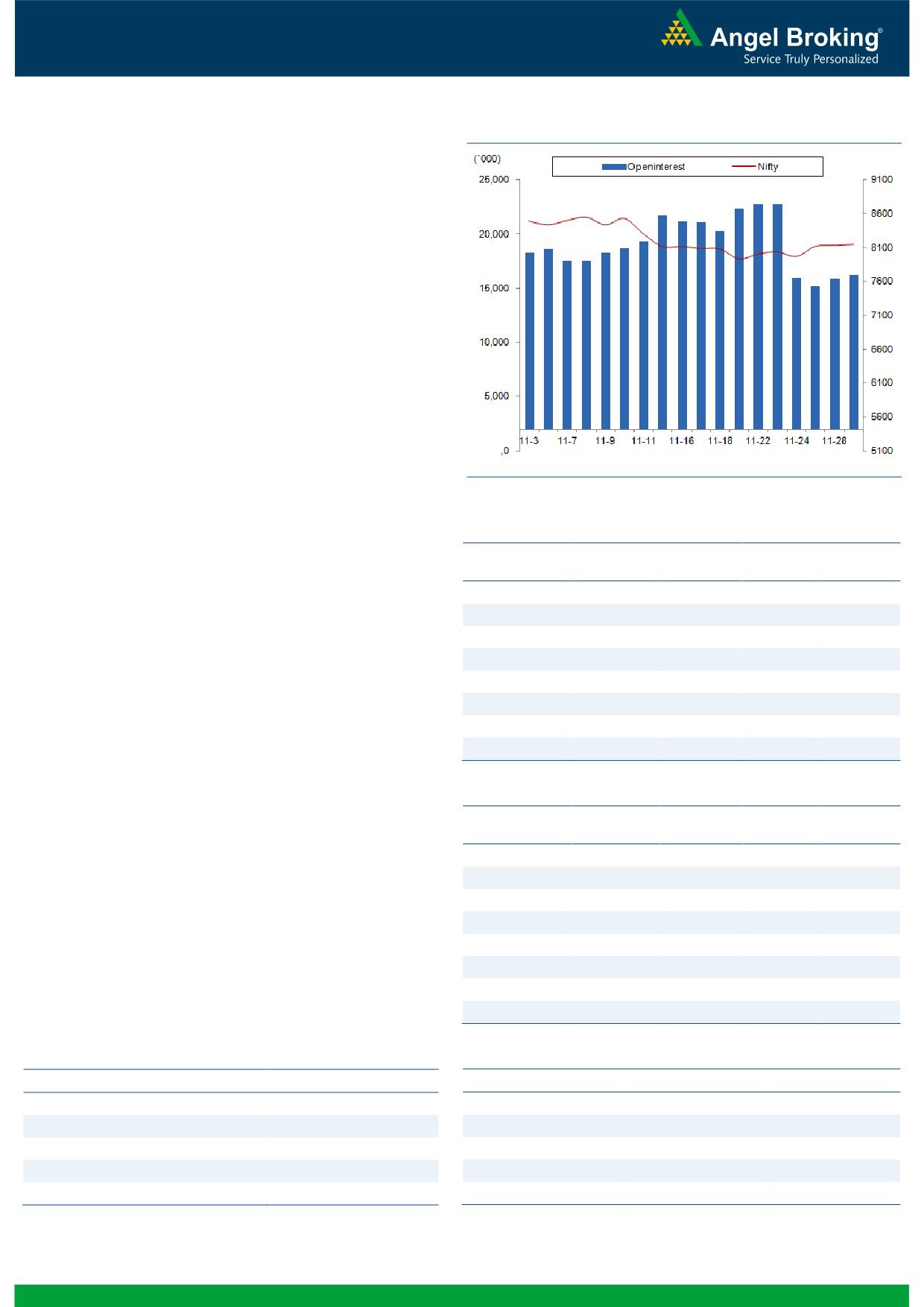

Nifty Bank Outlook - (18224)

Exhibit 2: Nifty Bank Daily Chart

The Nifty Bank index continued to underperform as compared to

the benchmark index and ended the session with loss of 0.42

percent.

In our yesterday's outlook, we had mentioned that the Nifty Bank

index has not been able to close above the '5 DEMA' during the

recent corrective move. The mentioned average is now placed

around

19385 and only on a close above the mentioned

average, one can expect a pullback move in the index. Until then,

we continue to advise traders to remain light on positions in the

index and trade on stock specific moves. The intraday supports

for the Nifty Bank index are placed around 18143 and 18050

whereas resistances are seen around 18385 and 18475.

Key Levels

Support 1 - 18143

Resistance 1 - 18385

Support 2 - 18050

Resistance 2 - 18475

1

Technical & Derivatives Report

November 30, 2016

Comments

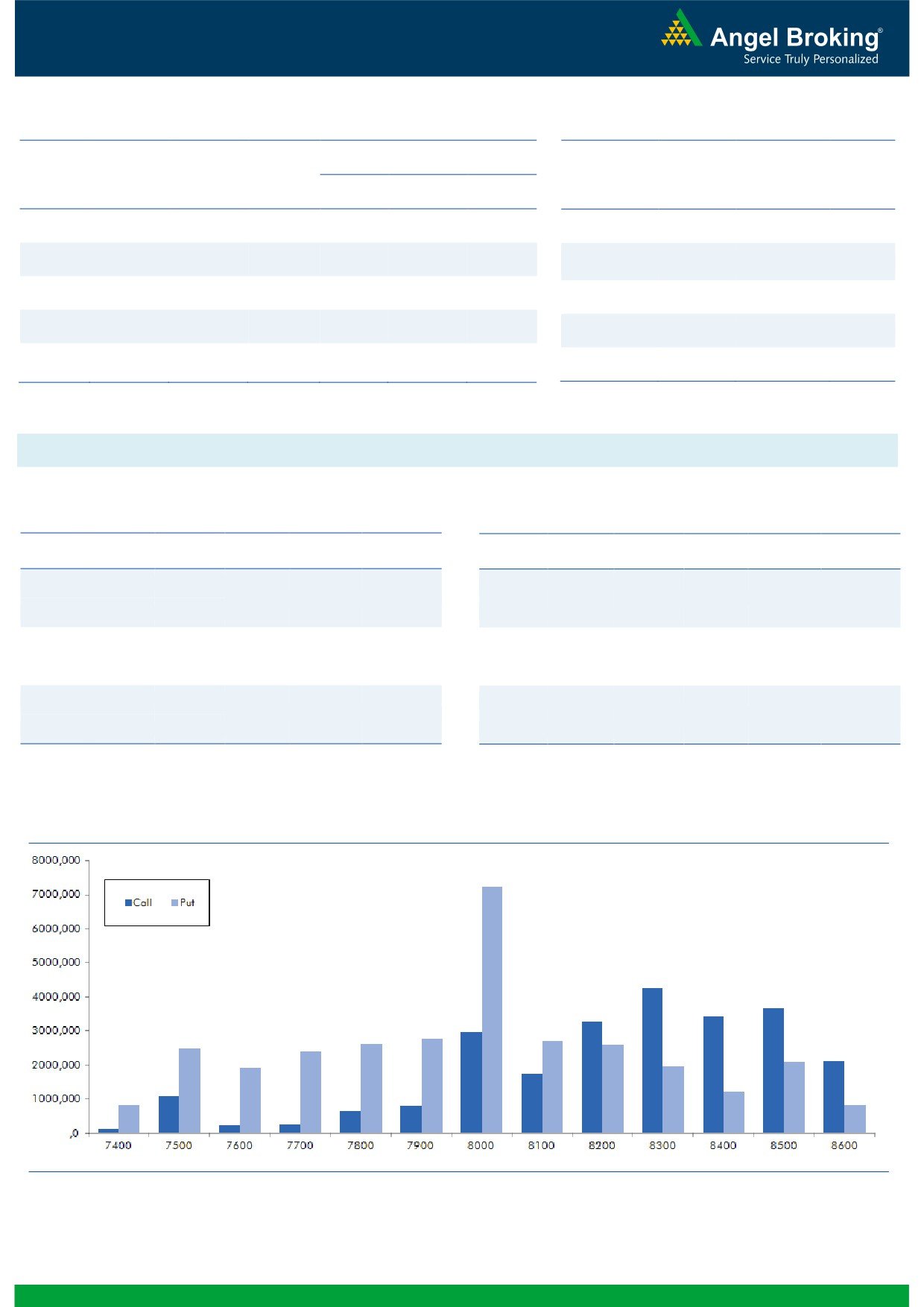

Nifty Vs OI

The Nifty futures open interest has increased by 1.97%

BankNifty futures open interest has increased by 7.61%

as market closed at 8142.15 levels.

The Nifty December future closed with a premium of

29.90 against the premium of 23.70 points in last

trading session. The January series closed at a premium

of 60.05 points.

The Implied Volatility of at the money options has

decreased from 15.36% to 14.38%. At the same time,

the PCR-OI of Nifty has increased from 1.01 to 1.03

levels.

The total OI of the market is Rs. 2,20,712/- cr. and the

stock futures OI is Rs. 65,034/- cr.

Few of the liquid counters where we have seen high cost

of carry are IFCI, POWERGRID, NHPC, NMDC and

DCBBANK.

OI Gainers

Views

OI

PRICE

FIIs continue to sell in cash market segment to the tune of

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

Rs. 715 crores. While, in index futures, they were net

OIL

1130500

15.25

417.30

-2.55

buyers worth Rs. 615 crores with good amount of rise in

IGL

1256200

12.40

829.60

-1.29

open interest, indicating fresh long formation in previous

GODREJCP

478800

7.26

1419.60

-1.52

trading session.

www.angelbroking.com

CANBK

7200000

6.95

311.85

0.48

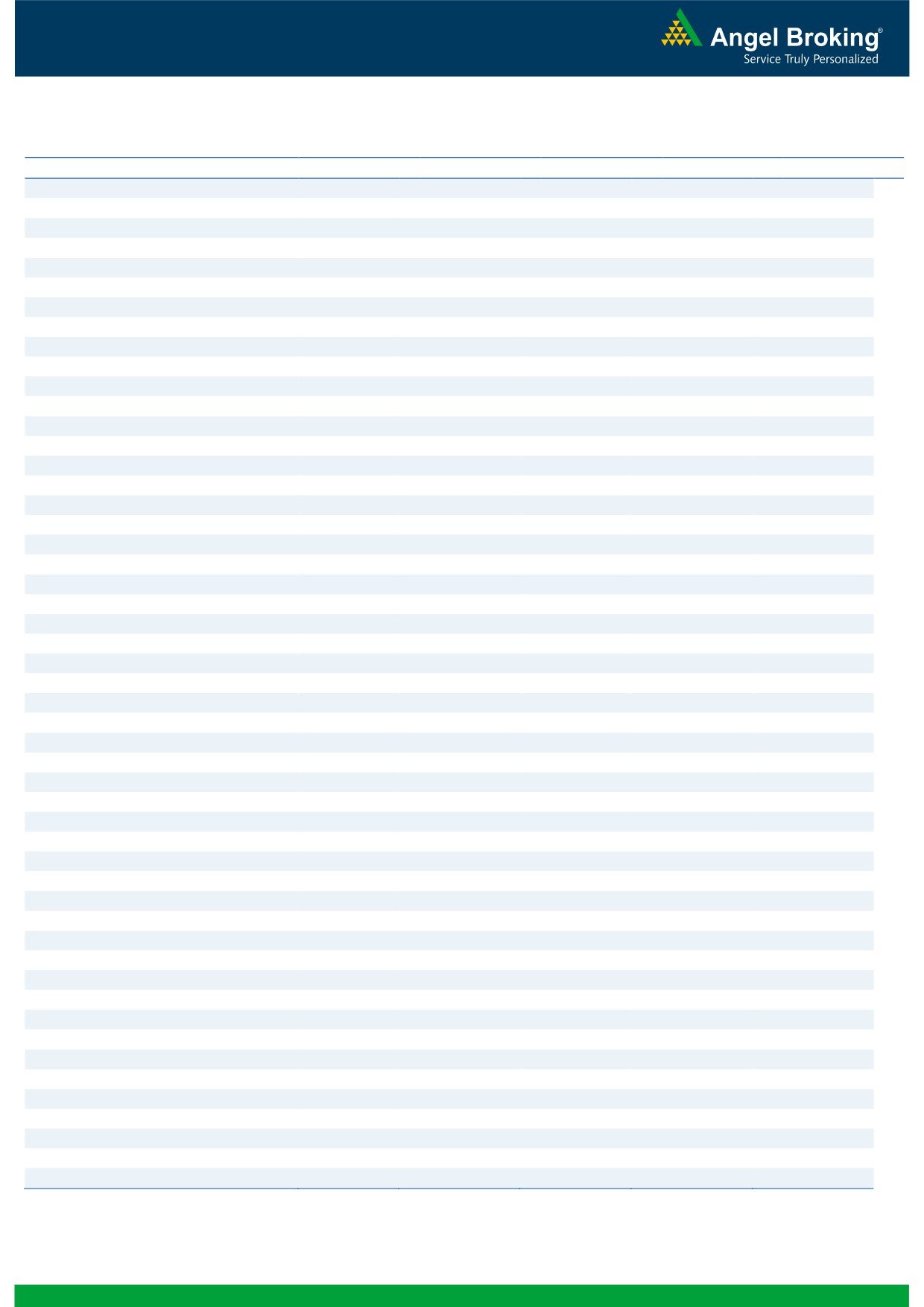

In Index options segment, FIIs were net buyers of Rs.

PAGEIND

37000

6.94

12779.05

-0.58

1426 crores with rise in open interest. In call option,

IBULHSGFIN

8918400

6.72

730.50

2.68

8200-8300 strikes added some fresh positions. While,

JSWENERGY

27088000

5.98

59.65

3.47

good amount of open interest addition was witnessed in

GLENMARK

2261000

5.94

891.35

-1.86

8200 put option. Highest OI in December series is visible

in 8300 call and 8000 put option.

OI Losers

Despite market being under pressure in second half of

OI

PRICE

yesterday’s session, FIIs were net buyers in Index Futures.

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

While, in Stock Futures they continue their buying streak.

GODREJIND

1369500

-9.51

385.15

4.19

However, in BankNifty options, we continue seeing good

AMBUJACEM

13525000

-5.40

205.95

0.66

amount of build-up in 17000 & 17500 put options which

NIITTECH

600500

-4.61

426.80

0.64

are mostly long positions. Taking into consideration the

HINDZINC

7856000

-4.40

282.85

-0.91

above data, we believe traders should remain cautious

HINDUNILVR

4330200

-4.03

836.15

-0.49

as BankNifty may underperform market due to which

SUNTV

6900000

-3.44

465.95

0.78

Nifty may find difficult to bounce back to higher levels.

MRF

24870

-3.15

49240.00

2.99

BEML

678500

-3.00

836.65

1.68

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

GODREJIND

37.15

NIFTY

1.03

0.97

BIOCON

39.94

BANKNIFTY

0.77

0.75

IDEA

46.39

SBIN

0.61

0.58

BHARATFIN

78.16

RELIANCE

0.62

0.43

MARUTI

42.72

ICICIBANK

0.48

0.40

2

Technical & Derivatives Report

November 30, 2016

FII Statistics for November 29, 2016

Turnover on November 29, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

2147.09

1531.71

615.38

166452

10501.52

7.31

212764

13942.89

-2.02

FUTURES

FUTURES

INDEX

INDEX

28502.02

27075.67

1426.35

905902

56238.04

4.44

2904584

197152.61

24.80

OPTIONS

OPTIONS

STOCK

6438.95

5605.63

833.33

820676

49892.36

0.98

STOCK

FUTURES

450142

29961.92

1.80

FUTURES

STOCK

STOCK

2357.12

2344.58

12.54

44562

2859.05

21.52

OPTIONS

216720

14917.15

1.46

OPTIONS

TOTAL

39445.19

36557.59

2887.60

1937592

119490.98

3.51

TOTAL

3784210

255974.58

18.32

Nifty Spot = 8142.15

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8200

120.40

Buy

8100

113.45

46.95

53.05

8246.95

28.55

71.45

8071.45

Sell

8300

73.45

Sell

8000

84.90

Buy

8200

120.40

Buy

8100

113.45

78.65

121.35

8278.65

50.60

149.40

8049.40

Sell

8400

41.75

Sell

7900

62.85

Buy

8300

73.45

Buy

8000

84.90

31.70

68.30

8331.70

22.05

77.95

7977.95

Sell

8400

41.75

Sell

7900

62.85

Note: Above mentioned Bullish or Bearish Spreads in Nifty (December Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

November 30, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,289

1,304

1,322

1,338

1,355

ADANIPORTS

262

270

275

282

287

AMBUJACEM

202

204

205

207

209

ASIANPAINT

922

940

954

972

985

AUROPHARMA

723

732

739

748

756

AXISBANK

455

460

468

473

480

BAJAJ-AUTO

2,610

2,637

2,662

2,689

2,714

BANKBARODA

158

160

163

164

167

BHEL

127

128

129

130

132

BPCL

632

638

648

654

663

BHARTIARTL

313

319

323

328

332

INFRATEL

359

364

369

374

379

BOSCH

18,905

19,538

19,933

20,566

20,961

CIPLA

559

564

569

574

579

COALINDIA

301

305

309

313

317

DRREDDY

3,141

3,165

3,184

3,207

3,226

EICHERMOT

19,908

20,601

21,020

21,714

22,133

GAIL

412

420

425

432

437

GRASIM

835

842

847

855

860

HCLTECH

792

799

806

813

821

HDFCBANK

1,166

1,173

1,183

1,189

1,199

HDFC

1,217

1,237

1,261

1,280

1,304

HEROMOTOCO

3,031

3,097

3,140

3,206

3,249

HINDALCO

171

173

177

179

183

HINDUNILVR

824

828

835

839

845

ICICIBANK

251

253

256

258

261

IDEA

77

78

79

80

81

INDUSINDBK

1,030

1,045

1,057

1,072

1,085

INFY

957

965

975

983

992

ITC

227

229

232

234

238

KOTAKBANK

737

740

746

750

756

LT

1,337

1,345

1,358

1,366

1,378

LUPIN

1,473

1,495

1,509

1,532

1,546

M&M

1,141

1,164

1,182

1,205

1,223

MARUTI

4,817

4,960

5,040

5,183

5,263

NTPC

160

162

163

165

166

ONGC

278

282

285

288

291

POWERGRID

187

188

190

191

193

RELIANCE

981

989

997

1,005

1,013

SBIN

249

251

254

255

258

SUNPHARMA

691

699

710

718

730

TCS

2,229

2,244

2,268

2,284

2,308

TATAMTRDVR

289

293

297

301

304

TATAMOTORS

444

452

459

467

474

TATAPOWER

71

72

73

73

74

TATASTEEL

402

405

411

415

421

TECHM

473

479

487

492

500

ULTRACEMCO

3,450

3,493

3,528

3,571

3,606

WIPRO

458

462

464

468

470

YESBANK

1,128

1,136

1,150

1,158

1,172

ZEEL

446

451

459

465

472

4

Technical & Derivatives Report

November 30, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5