Technical & Derivatives Report

May 30, 2016

Sensex (26654) / Nifty (8157)

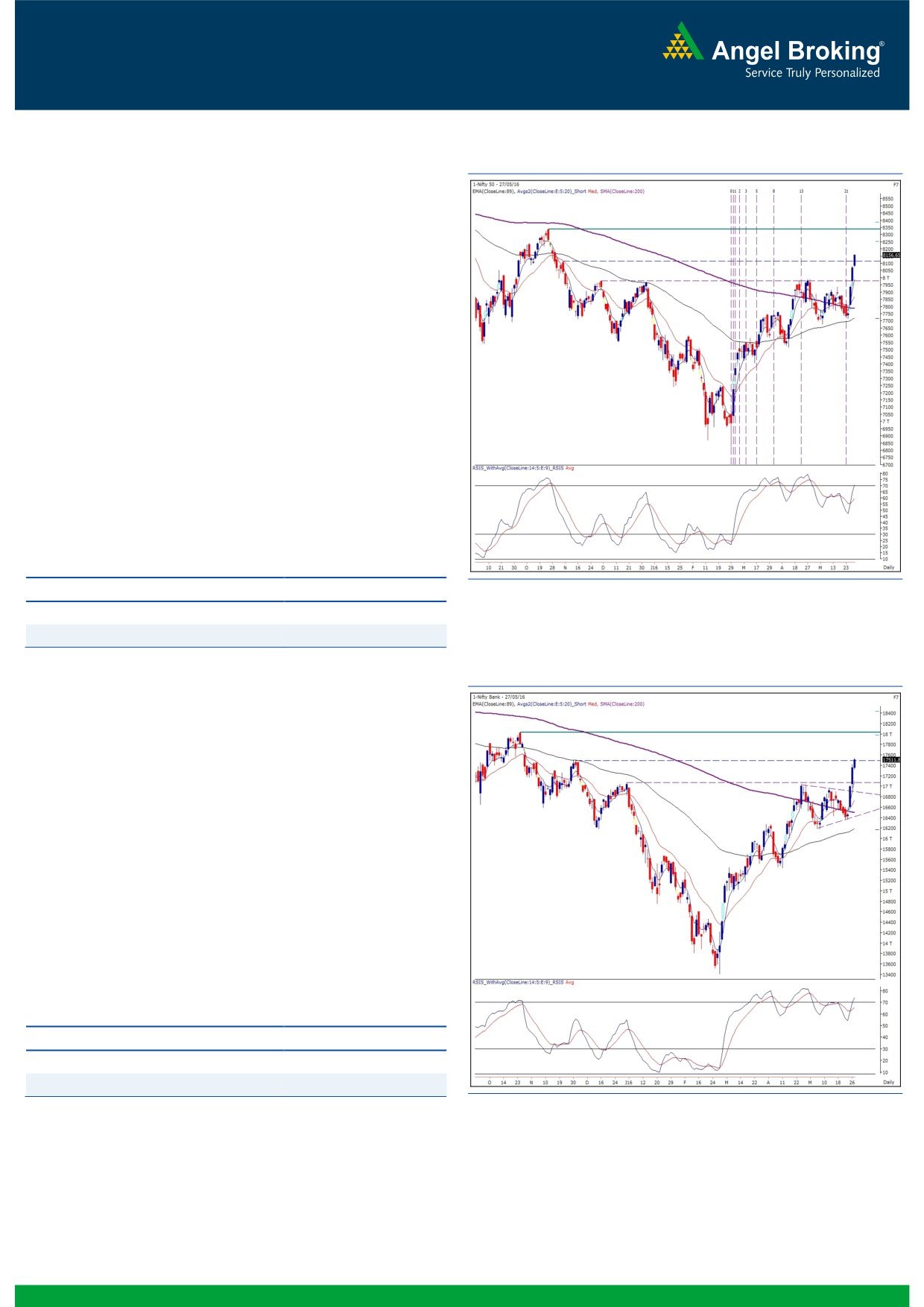

Exhibit 1: Nifty Daily Chart

In Friday’s trading session, the Nifty index continued its positive

momentum and ended the session with gains of 1.08%.

It was a remarkable week for our markets as we witnessed the

second biggest weekly gains in the calendar year 2016. The Nifty

has now confirmed a breakout from the ‘Inverse Head and

Shoulder’ pattern and thus, we expect this momentum to continue

towards the next major resistance of 8336. On the downside, if

we go by the ‘Change of Polarity’ rule, the neckline level of 8000

- 7950 would now act as a strong support zone. We reiterate that

traders shouldn't be expecting any immediate reversal in the

ongoing upward momentum because given the strong optimism

that the market is riding on, there is a tendency of even minor

intraday dips getting bought into. After such a sharp move, it

would be difficult for those who have missed this move to initiate

fresh positions in the index considering the risk - reward ratio. But

there is still room to earn by concentrating on individual stocks

which may now offer potential trades on the long side.

Key Levels

Support 1 - 8115

Resistance 1 - 8210

Support 2 - 8077

Resistance 2 - 8242

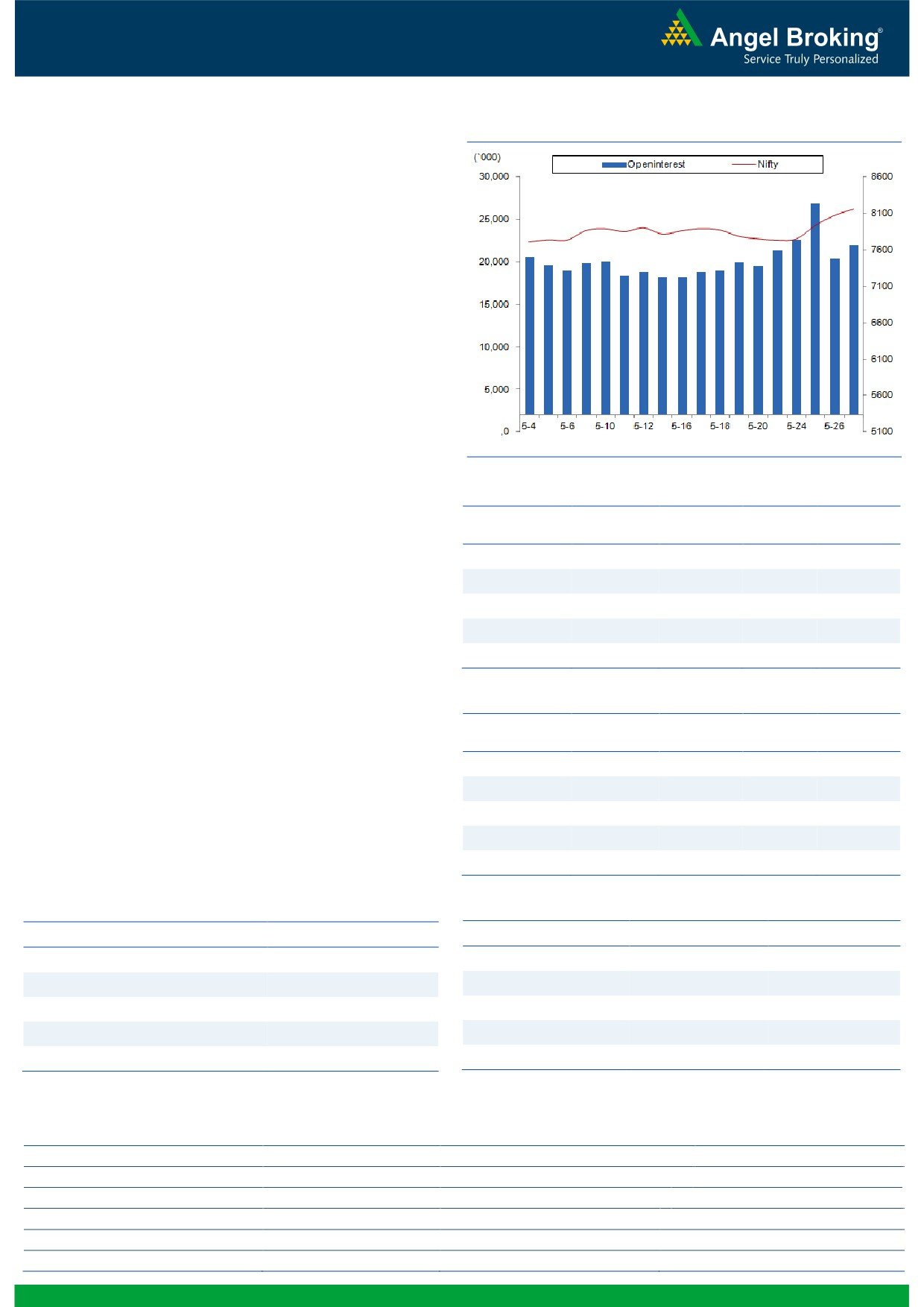

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (17512)

The Nifty Bank index continued the positive momentum and

ended the session with gains of 0.88% over its previous day's

close.

In the week gone by, the index moved in line of our expectation

and gained over 6%. The positive momentum, which picked up

post breach of the resistance zone of

17000-17080, still

continues with index heavyweights moving higher. Traders are

advised to continue to hold the long positions till the trend

remains intact. The stock specific moves within the sector still

provide opportunity to earn by trading on long side with proper

risk management. The near term support for the index is placed

around 17300 and 17070 whereas resistances are seen around

17690 and 17780.

Key Levels

Support 1 - 17300

Resistance 1 - 17690

Support 2 - 17070

Resistance 2 - 17780

1

Technical & Derivatives Report

May 30, 2016

Comments

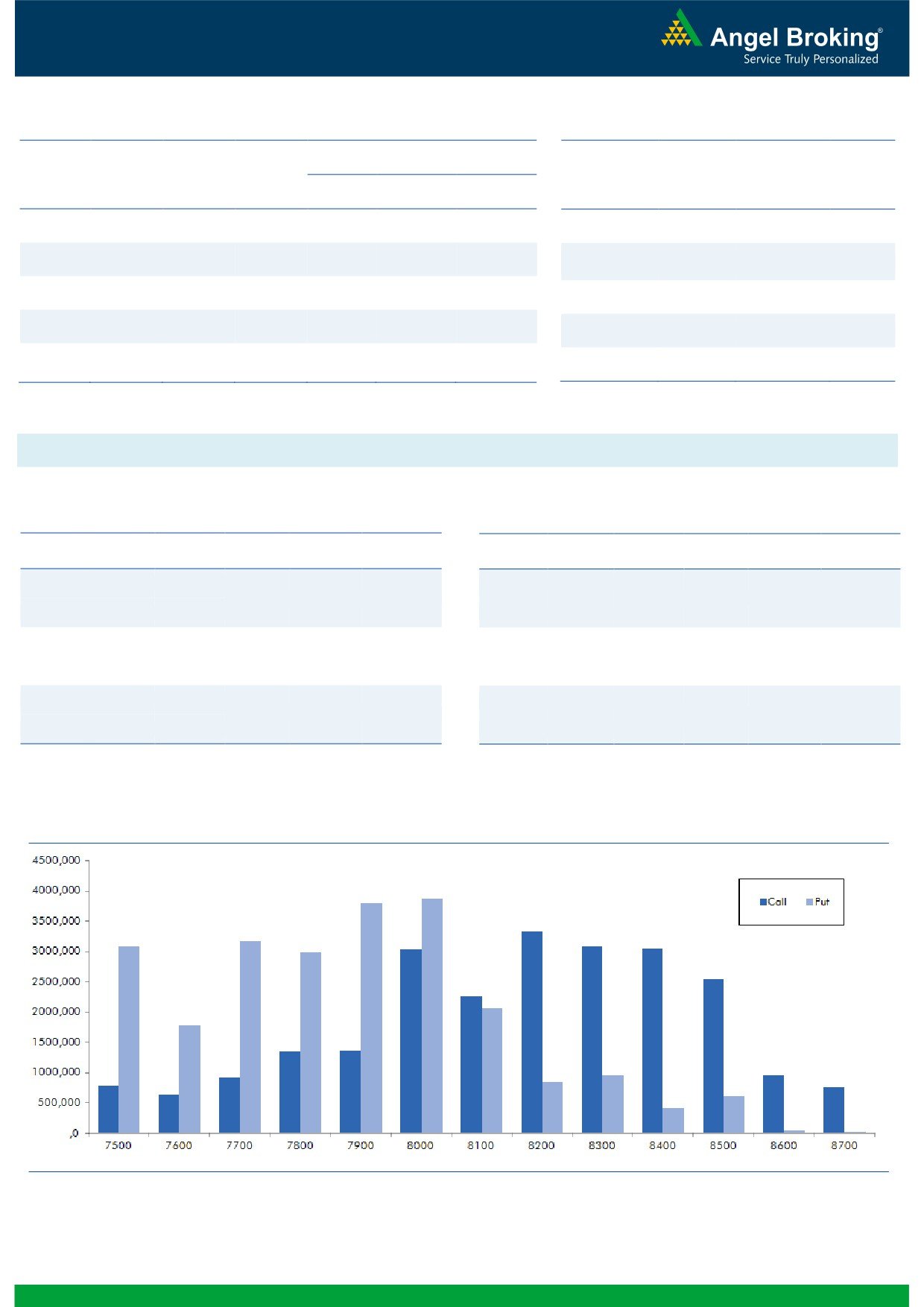

Nifty Vs OI

The Nifty futures open interest has increased by 8.00%

BankNifty futures open interest has increased by 7.07%

as market closed at 8156.65 levels.

The Nifty June future closed with a premium of 15.80

points against flat closing in previous session. The July

series closed at a premium of 35.35 points.

The Implied Volatility of at the money options has

increased from 13.37% to 13.63%.

The total OI of the market is Rs. 1,88,116/- cr. and the

stock futures OI is Rs. 60,331/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, SYNDIBANK, GMRINFRA,

NHPC and UNITECH.

Views

Nifty continued to show strength in Friday’s session, FIIs

OI Gainers

too participated in a big way. In cash market segment,

OI

PRICE

they bought to the tune of Rs. 480 crores. While in Index

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

Futures, they continue buying significantly of Rs. 2162

BPCL

5539200

29.43

1005.25

7.66

crores with huge amount of rise in OI, indicating huge

CUMMINSIND

1200000

27.96

789.30

-1.27

long formation.

IOC

7260000

23.94

416.70

2.72

On the other hand in options front, they were net buyers

BIOCON

3009600

22.97

705.65

6.59

worth Rs. 1909 crores with rise in open interest. In call

options, 8400-8500 call options were active and added

CANBK

9399000

20.12

192.50

-1.28

good amount of OI. We believe FIIs are continuously

forming longs in call options expecting further strength.

OI Losers

While in put options, 7900-8100 strikes added good

OI

PRICE

SCRIP

OI

PRICE

amount of OI, which may be blend of long and short

CHG. (%)

CHG. (%)

formation. Maximum build-up in June series is visible in

SUNTV

3562000

-6.75

384.80

1.10

8200 call and of put options has shifted from 7500 to

SAIL

41304000

-6.50

43.05

5.00

8000 strike.

MOTHERSUMI

11596500

-4.62

280.10

1.43

Seeing the quantum of buying in last three trading

RELIANCE

24562000

-4.52

980.40

2.65

sessions, we believe Nifty may continue to show strength,

RPOWER

43944000

-4.46

52.70

7.33

one can expect Nifty breaching 8300 levels in near term.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

SUNPHARMA

37.02

NIFTY

0.99

0.81

HINDPETRO

53.63

BANKNIFTY

1.05

0.84

BPCL

50.82

SBIN

1.01

0.60

BIOCON

42.38

LT

1.07

0.75

RPOWER

48.83

RELIANCE

0.83

0.68

Strategy Date

Symbol

Strategy

Status

2

Technical & Derivatives Report

May 30, 2016

FII Statistics for 27-May 2016

Turnover on 27-May 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

4854.25

2691.77

2162.48

281850

16906.85

11.27

292711

17013.27

-47.56

FUTURES

FUTURES

INDEX

INDEX

33648.50

31739.14

1909.36

783886

47644.47

9.74

2418868

146127.93

-74.79

OPTIONS

OPTIONS

STOCK

6365.50

5351.40

1014.10

981776

48310.54

1.28

STOCK

FUTURES

746720

37165.80

-53.91

FUTURES

STOCK

STOCK

4063.97

3947.81

116.16

35754

1746.60

2066.91

OPTIONS

427814

20769.14

-31.37

OPTIONS

TOTAL

48932.22

43730.13

5202.09

2083266

114608.46

7.46

TOTAL

3886113

221076.15

-69.42

Nifty Spot = 8156.65

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8200

121.85

Buy

8100

108.40

43.85

56.15

8243.85

32.15

67.85

8067.85

Sell

8300

78.00

Sell

8000

76.25

Buy

8200

121.85

Buy

8100

108.40

75.10

124.90

8275.10

55.10

144.90

8044.90

Sell

8400

46.75

Sell

7900

53.30

Buy

8300

78.00

Buy

8000

76.25

31.25

68.75

8331.25

22.95

77.05

7977.05

Sell

8400

46.75

Sell

7900

53.30

Note: Above mentioned Bullish or Bearish Spreads in Nifty (June Series) are given as an information and not as a recommendation.

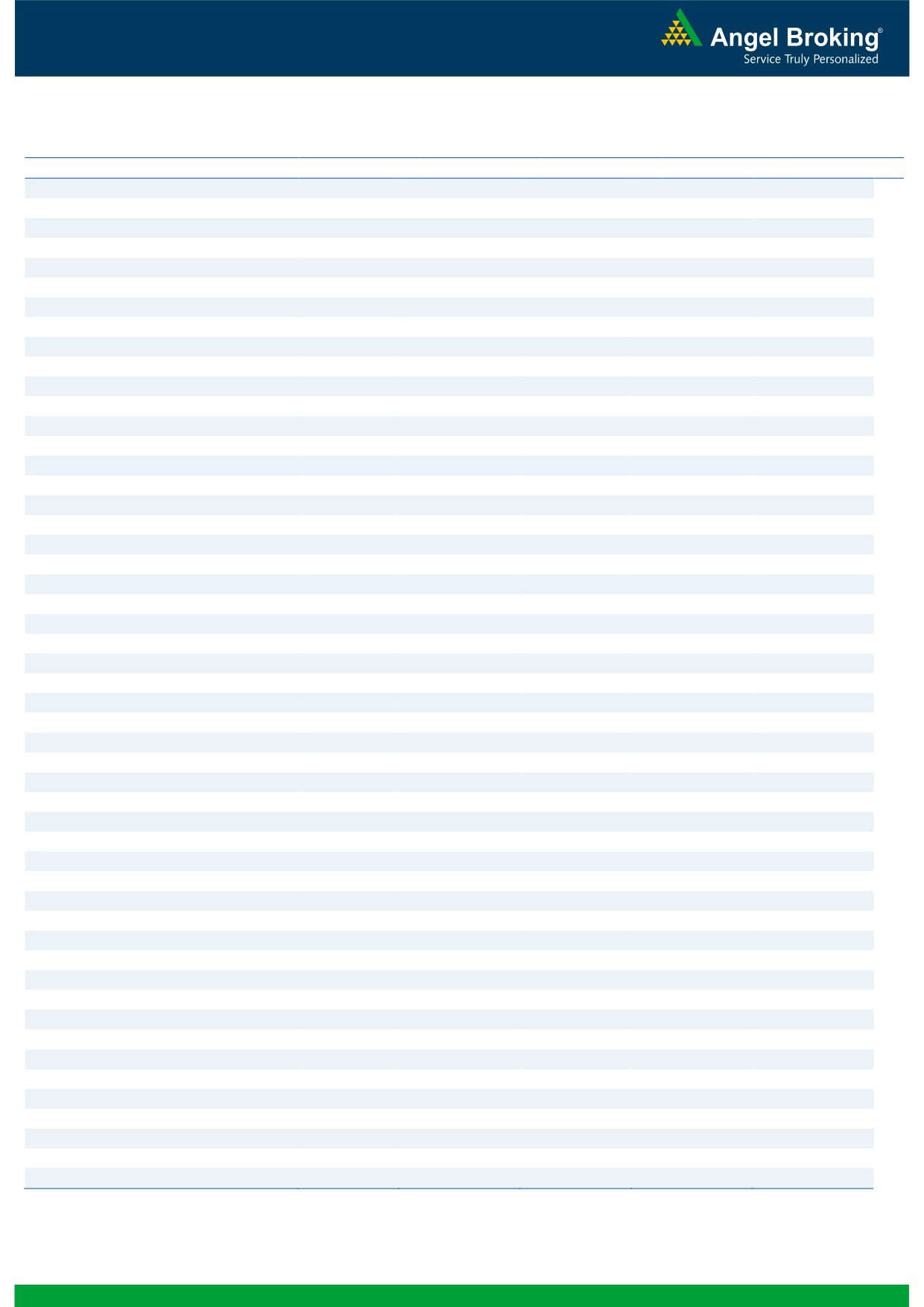

Nifty Put-Call Analysis

3

Technical & Derivatives Report

May 30, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,489

1,507

1,520

1,538

1,551

ADANIPORTS

182

187

190

195

198

AMBUJACEM

223

227

229

233

235

ASIANPAINT

980

988

995

1,004

1,010

AUROPHARMA

729

746

759

776

789

AXISBANK

500

507

516

523

532

BAJAJ-AUTO

2,449

2,506

2,544

2,601

2,639

BANKBARODA

132

135

138

141

144

BHEL

123

126

129

131

135

BPCL

915

960

992

1,037

1,070

BHARTIARTL

345

348

353

356

361

INFRATEL

381

383

388

390

394

BOSCH

21,440

21,670

21,884

22,115

22,329

CIPLA

464

469

474

478

483

COALINDIA

278

280

282

284

286

DRREDDY

3,047

3,081

3,110

3,144

3,173

EICHERMOT

18,282

18,512

18,656

18,886

19,029

GAIL

373

376

381

384

389

GRASIM

4,304

4,333

4,359

4,387

4,414

HCLTECH

736

747

753

764

770

HDFCBANK

1,171

1,179

1,185

1,192

1,198

HDFC

1,196

1,223

1,246

1,273

1,296

HEROMOTOCO

2,941

2,968

2,989

3,016

3,037

HINDALCO

90

91

92

93

94

HINDUNILVR

844

852

859

868

875

ICICIBANK

233

237

243

247

253

IDEA

110

111

113

115

117

INDUSINDBK

1,092

1,098

1,105

1,111

1,118

INFY

1,217

1,231

1,245

1,259

1,273

ITC

352

356

360

364

368

KOTAKBANK

729

736

740

747

752

LT

1,436

1,455

1,471

1,491

1,507

LUPIN

1,436

1,458

1,497

1,519

1,557

M&M

1,307

1,320

1,341

1,355

1,376

MARUTI

4,062

4,104

4,133

4,175

4,204

NTPC

138

139

140

141

143

ONGC

207

210

215

217

222

POWERGRID

147

149

151

153

154

RELIANCE

939

957

967

985

995

SBIN

174

188

195

209

216

SUNPHARMA

776

801

814

839

852

TCS

2,538

2,556

2,568

2,585

2,597

TATAMTRDVR

267

269

271

274

276

TATAMOTORS

393

398

402

407

411

TATAPOWER

71

72

73

74

76

TATASTEEL

321

325

329

333

336

TECHM

529

533

537

540

544

ULTRACEMCO

3,201

3,225

3,240

3,264

3,279

WIPRO

538

542

546

550

554

YESBANK

1,005

1,015

1,028

1,039

1,052

ZEEL

438

446

450

458

462

4

Technical & Derivatives Report

May 30, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5