Technical & Derivatives Report

December 29, 2016

Sensex (26211) / Nifty (8035)

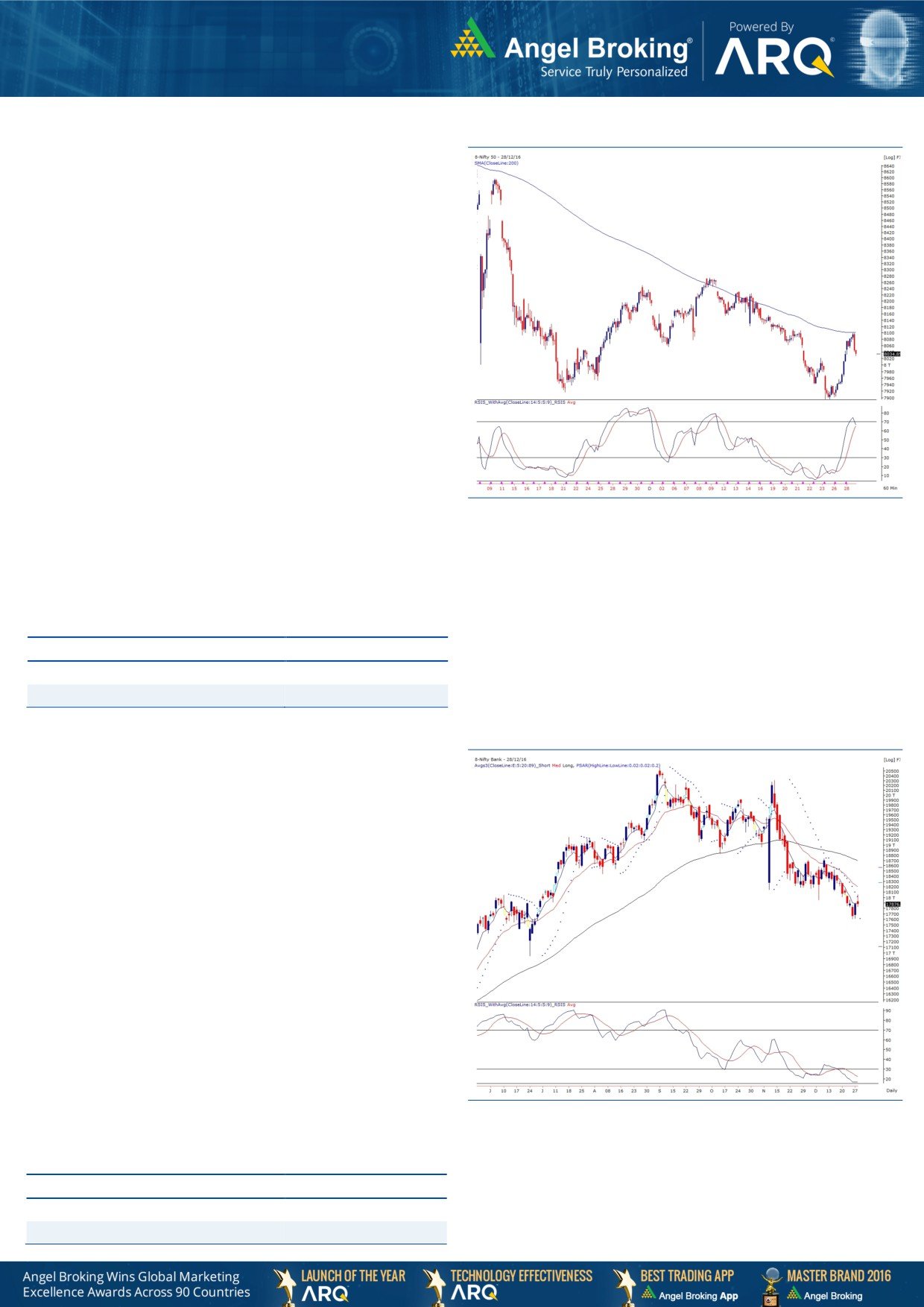

Exhibit 1: Nifty Daily Chart

A stunning intraday rally on Tuesday was followed by a positive

start with a marginal upside gap as indicated by the SGX Nifty.

Subsequently, we saw some follow up buying during the mid-

session to surpass the intraday hurdle of 8060. However, as

expected, the

‘200 SMA’ on hourly chart acted as a stiff

resistance; resulting into a sharp decline of 70 points after posting

a high of 8100.55. Eventually, the Nifty ended the volatile session

around the previous day’s close.

Yesterday’s tail end correction was slightly on cards considering

a steep rally of 200 points in such a short span and importantly,

8100 coincided with the psychological as well as technical level.

Going ahead, looking at the hourly chart structure, we interpret

this decline as a corrective move of the rally from 7893.80 to

8100.55 and thus, we expect 8022 - 8000 to provide a decent

support. On the other hand, the December F & O series is going

to expire today and hence, breaking 8100 would be a daunting

task for the market. However, having said that sooner or later we

expect the index to surpass this hurdle to extend the bounce back

rally. We advise traders to stay optimistic and continue with a

stock centric approach.

Key Levels

Support 1 - 8000

Resistance 1 - 8100

Support 2 - 7955

Resistance 2 - 8140

Nifty Bank Outlook - (17877)

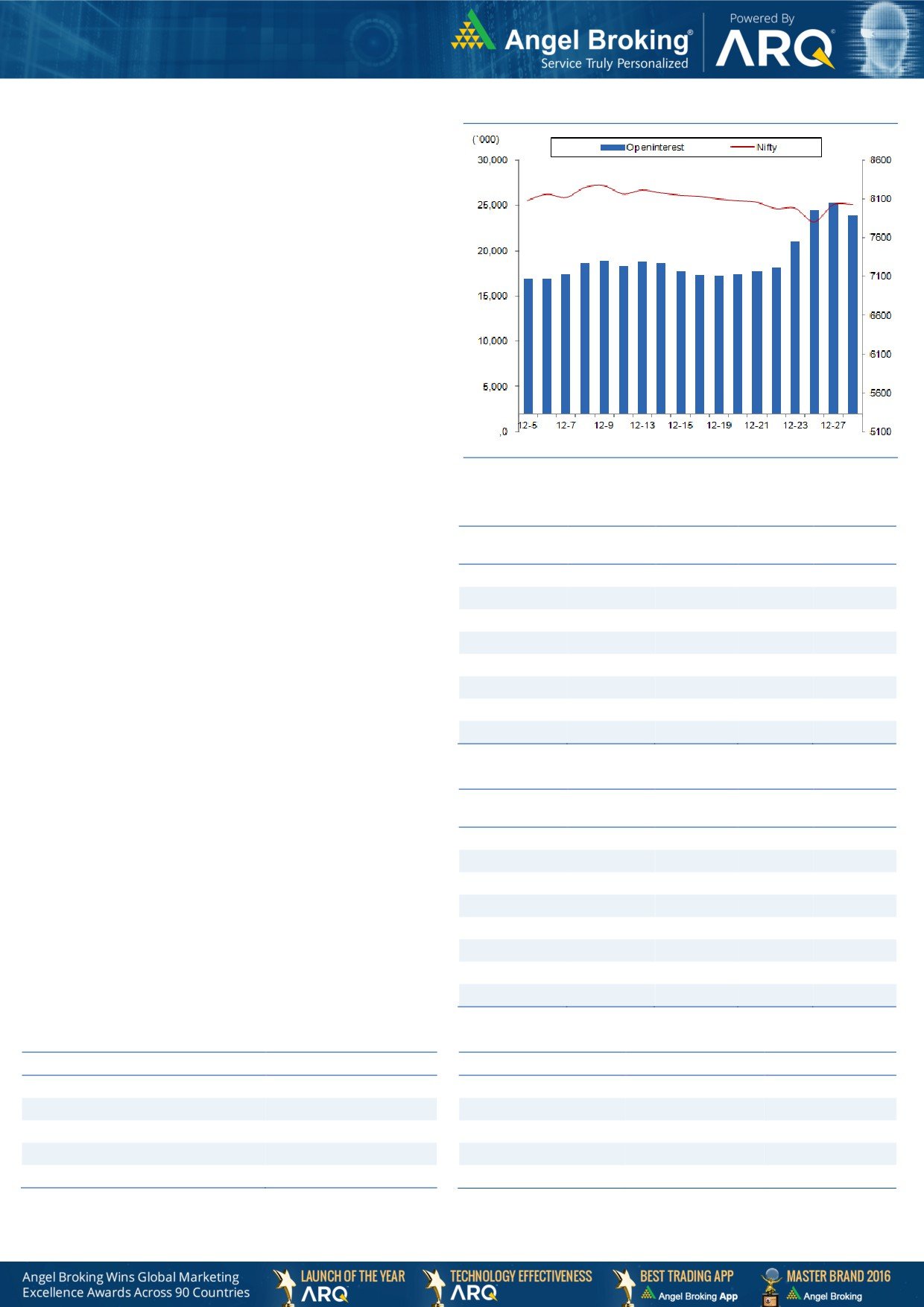

Exhibit 2: Nifty Bank Daily Chart

The Nifty Bank index continued its previous session's positive

momentum and rallied higher during the day. However, a sharp

sell-off post 2 p.m. led to the index erasing the gains and the

Nifty Bank ended the session on a flat note.

The index rallied higher near our mentioned target of 18075

(yesterday's high 18059.65). The mentioned level, which was the

'89EMA' on hourly chart acted as resistance which resulted in the

last hour's corrective move. Although the indices were flat, the

overall market breadth at end of the day yesterday was positive.

Also, the Nifty Bank index has strong support around 17600

(weekly 89EMA). Thus, for short term, 17600 - 18075 can be

expected as the trading range and breakout of the range can

then lead to a directional momentum. Traders are advised to

trade on stock specific move keeping a tab on the mentioned

levels. The intraday supports for the index are placed around

17780 and 17600 whereas resistances are seen around 18075

and 18125.

Key Levels

Support 1 - 17780

Resistance 1 - 18075

Support 2 - 17600

Resistance 2 - 18125

Technical & Derivatives Report

December 29, 2016

Comments

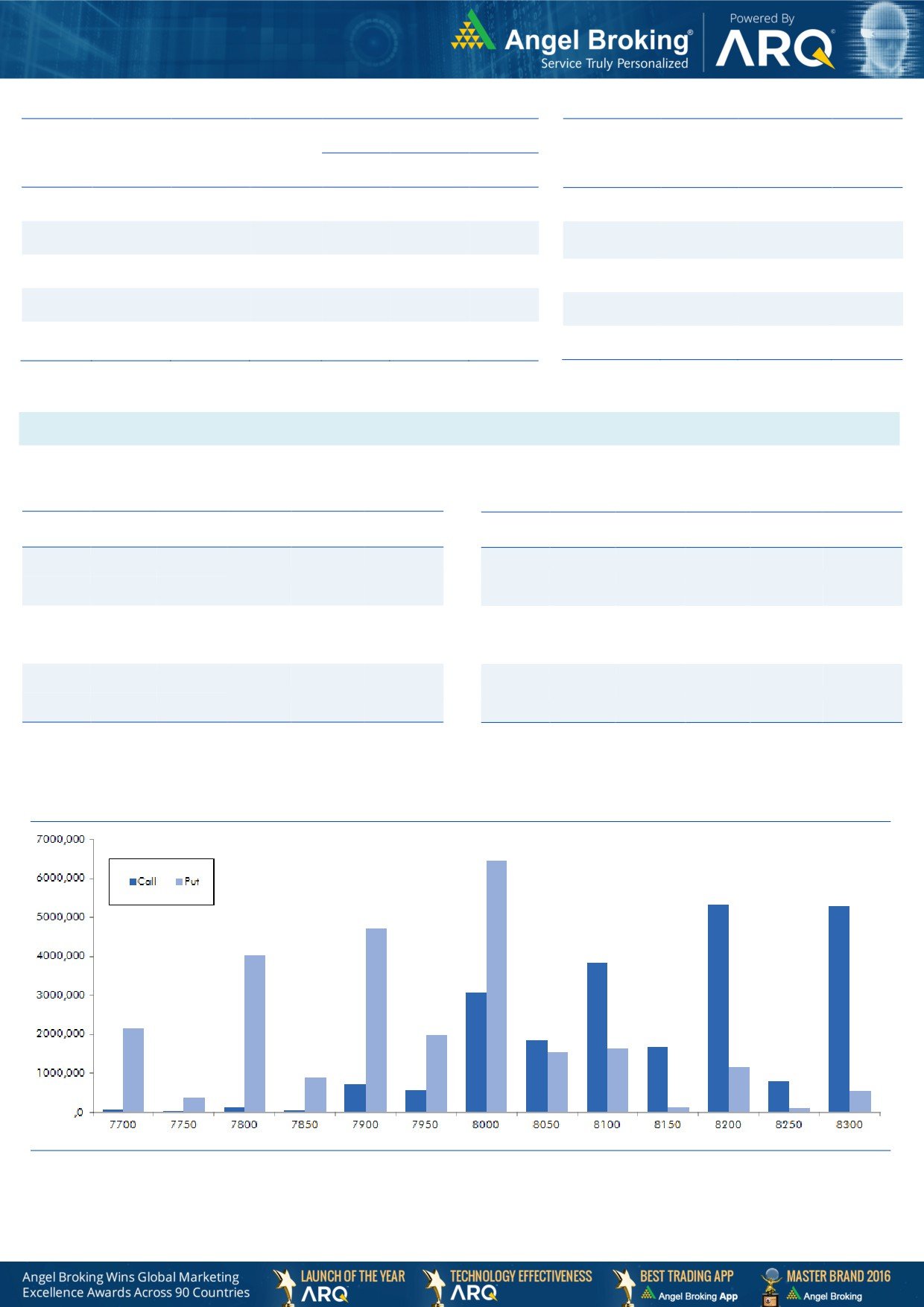

Nifty Vs OI

The Nifty futures open interest has decreased by 5.70%

BankNifty futures open interest has decreased by 2.22%

as market closed at 8034.85 levels.

The Nifty December future closed with a discount of 3.50

against the discount of

1.50 points in last trading

session. The January series closed at a premium of

21.40 points.

The Implied Volatility of at the money options has

increased from 14.45 % to 14.86%. At the same time,

the PCR-OI of Nifty has increased from 0.95 to 0.96

levels.

The total OI of the market is Rs. 2,90,813/- cr. and the

stock futures OI is Rs. 74,652/- cr.

Few of the liquid counters where we have seen high cost

of carry are GMRINFRA, IBREALEST, MINDTREE,

JUSTDIAL and SYNDIBANK.

Views

OI Gainers

FIIs continued their selling streak in cash segment; they

OI

PRICE

SCRIP

OI

PRICE

sold equities worth Rs. 527 crores. While, in index

CHG. (%)

CHG. (%)

M&MFIN

13852500

26.30

261.70

2.23

futures, they were net buyer to the tune of Rs. 1628

SOUTHBANK

65700000

13.88

19.05

-1.30

crores with fall in open interest, indicating short covering

took place in yesterday’s trading session.

TV18BRDCST

93925000

12.78

36.40

1.11

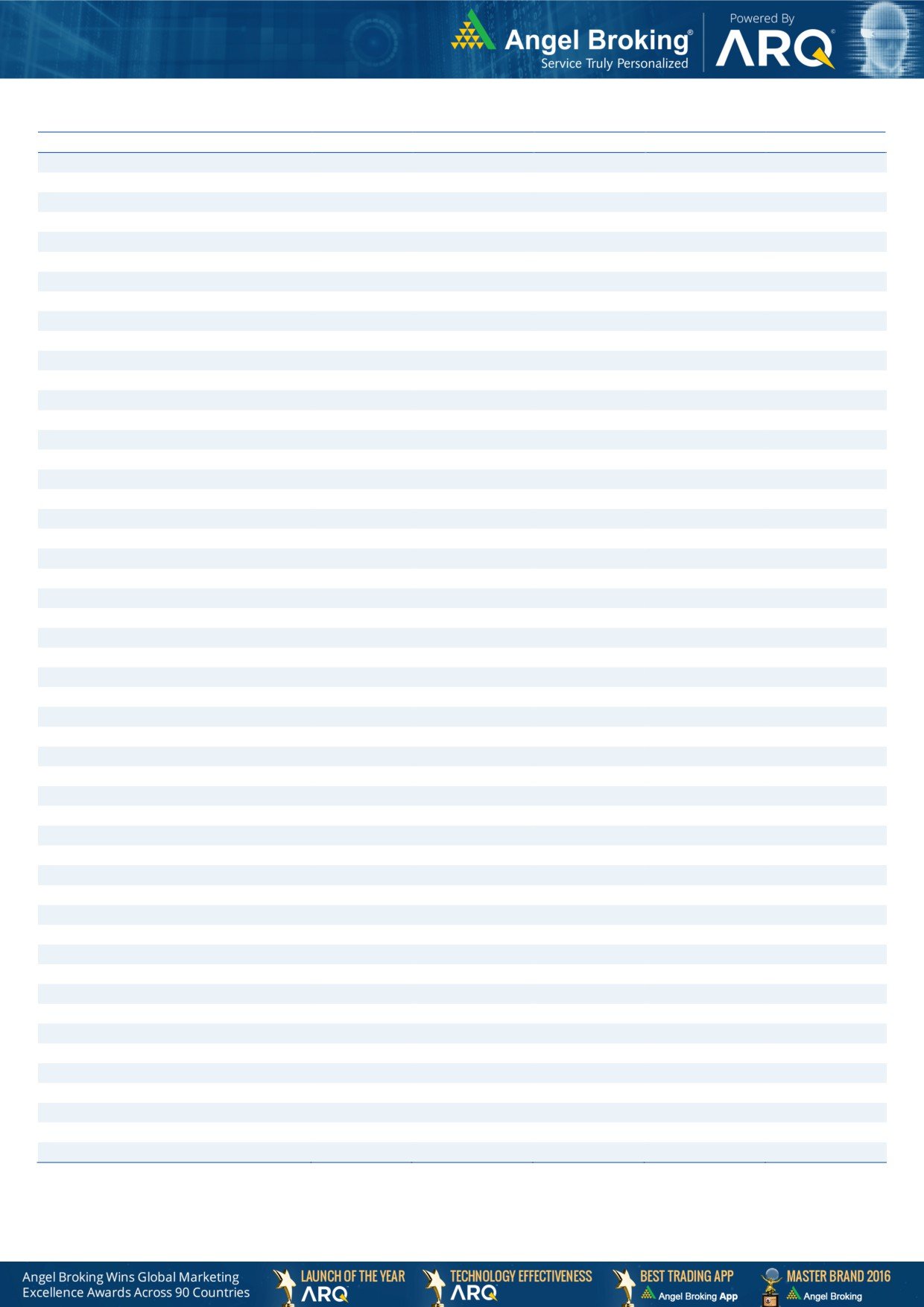

On Index Options front, FIIs bought of worth Rs. 285

CANBK

17253000

12.37

263.40

-1.51

crores with rise in OI. In call options, 8150 and 8050

ORIENTBANK

17460000

12.10

104.05

-1.14

strikes added some positions, followed by unwinding in

JINDALSTEL

48960000

9.43

67.85

1.50

7900 and 8000 strikes. On the other hand in put

FEDERALBNK

59653000

9.38

65.25

1.32

options, 8000 and 8050 strikes added good amount of

CONCOR

776000

8.76

1091.55

-0.68

positions. While, good amount of unwinding was also

visible in 7900 put option. Maximum OI in November

OI Losers

series is placed at 8200 call and 8000 put options.

OI

PRICE

SCRIP

OI

PRICE

Yesterday, we witness good amount of short covering in

CHG. (%)

CHG. (%)

Index Futures from FIIs desk. While, they continue writing

CEATLTD

1592500

-20.32

1129.55

-1.31

8050-8100 call options. Thus, looking at the options

BHARATFIN

10351000

-18.43

574.70

10.72

data, it seems Nifty may find difficult to sustain above

CUMMINSIND

618000

-14.24

812.40

1.82

these levels which may lead December series expire on a

PETRONET

4078500

-12.38

365.50

2.14

flat note. Hence, traders are suggested to avoid

JPASSOCIAT

156332000

-10.89

7.55

2.03

aggressive position for expiry and those traders who are

GODREJIND

1683000

-10.17

411.75

0.62

long in Index can rollover their positions for next series.

CROMPGREAV

23160000

-9.60

58.60

2.63

IBREALEST

32540000

-9.56

70.90

1.50

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

MINDTREE

38.63

NIFTY

0.96

0.91

BHARATFIN

95.48

BANKNIFTY

1.09

0.96

BATAINDIA

28.52

SUNPHARMA

0.45

0.50

COALINDIA

28.92

SBIN

0.49

0.43

APOLLOTYRE

38.32

ICICIBANK

0.46

0.38

Technical & Derivatives Report

December 29, 2016

FII Statistics for December 28, 2016

Turnover on December 28, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

6826.77

5198.53

1628.24

269965

16667.86

(6.96)

410011

26227.70

19.25

FUTURES

FUTURES

INDEX

INDEX

55616.81

55332.06

284.75

1207687

74212.41

1.74

8349323

532837.03

43.49

OPTIONS

OPTIONS

STOCK

22772.97

21953.93

819.03

980748

57843.76

0.28

STOCK

FUTURES

1188595

72441.62

15.38

FUTURES

STOCK

STOCK

3720.08

3541.84

178.25

95262

5893.50

(0.52)

376833

25536.68

2.85

OPTIONS

OPTIONS

TOTAL

88936.63

86026.36

2910.27

2553662

154617.53

0.10

TOTAL

10324762

657043.03

36.61

Nifty Spot = 8034.85

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8000

42.55

Buy

8000

16.90

38.30

61.70

8038.30

13.45

86.55

7986.55

Sell

8100

4.25

Sell

7900

3.45

Buy

8000

42.55

Buy

8000

16.90

41.80

158.20

8041.80

15.80

184.20

7984.20

Sell

8200

0.75

Sell

7800

1.10

Buy

8100

4.25

Buy

7900

3.45

3.50

96.50

8103.50

2.35

97.65

7897.65

Sell

8200

0.75

Sell

7800

1.10

Note: Above mentioned Bullish or Bearish Spreads in Nifty (December Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

Technical & Derivatives Report

December 29, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,273

1,284

1,294

1,305

1,316

ADANIPORTS

264

266

269

271

274

AMBUJACEM

198

200

202

204

206

ASIANPAINT

858

867

878

887

899

AUROPHARMA

632

642

651

661

670

AXISBANK

432

436

442

446

452

BAJAJ-AUTO

2,606

2,620

2,637

2,650

2,668

BANKBARODA

147

149

151

152

154

BHEL

118

119

120

121

122

BPCL

606

611

615

620

624

BHARTIARTL

294

297

300

303

306

INFRATEL

326

332

339

345

352

BOSCH

19,680

19,926

20,206

20,452

20,732

CIPLA

554

558

565

569

576

COALINDIA

286

290

293

298

301

DRREDDY

2,999

3,034

3,073

3,108

3,147

EICHERMOT

20,602

20,743

20,872

21,013

21,142

GAIL

416

420

424

428

431

GRASIM

791

801

816

826

840

HCLTECH

796

802

810

815

823

HDFCBANK

1,174

1,180

1,188

1,194

1,202

HDFC

1,211

1,225

1,236

1,250

1,261

HEROMOTOCO

2,962

2,982

3,016

3,036

3,070

HINDALCO

149

151

155

157

160

HINDUNILVR

797

804

813

819

828

ICICIBANK

249

250

253

254

256

IDEA

69

70

71

72

73

INDUSINDBK

1,042

1,062

1,080

1,100

1,118

INFY

986

992

1,001

1,007

1,016

ITC

231

233

235

237

239

KOTAKBANK

704

708

714

718

723

LT

1,336

1,343

1,353

1,360

1,370

LUPIN

1,435

1,445

1,457

1,466

1,478

M&M

1,161

1,168

1,176

1,183

1,191

MARUTI

5,184

5,208

5,243

5,266

5,301

NTPC

159

160

161

162

163

ONGC

188

189

190

192

193

POWERGRID

177

178

181

182

185

RELIANCE

1,033

1,041

1,055

1,064

1,078

SBIN

244

246

249

251

254

SUNPHARMA

613

617

623

627

633

TCS

2,275

2,294

2,322

2,341

2,369

TATAMTRDVR

287

289

293

295

299

TATAMOTORS

458

461

465

467

471

TATAPOWER

73

73

74

75

75

TATASTEEL

382

385

390

393

397

TECHM

465

470

473

478

481

ULTRACEMCO

3,089

3,124

3,162

3,197

3,235

WIPRO

460

464

470

475

480

YESBANK

1,092

1,103

1,121

1,131

1,149

ZEEL

431

437

443

449

454

Technical & Derivatives Report

December 29, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.