Technical & Derivatives Report

November 29, 2016

Sensex (26350) / Nifty (8127)

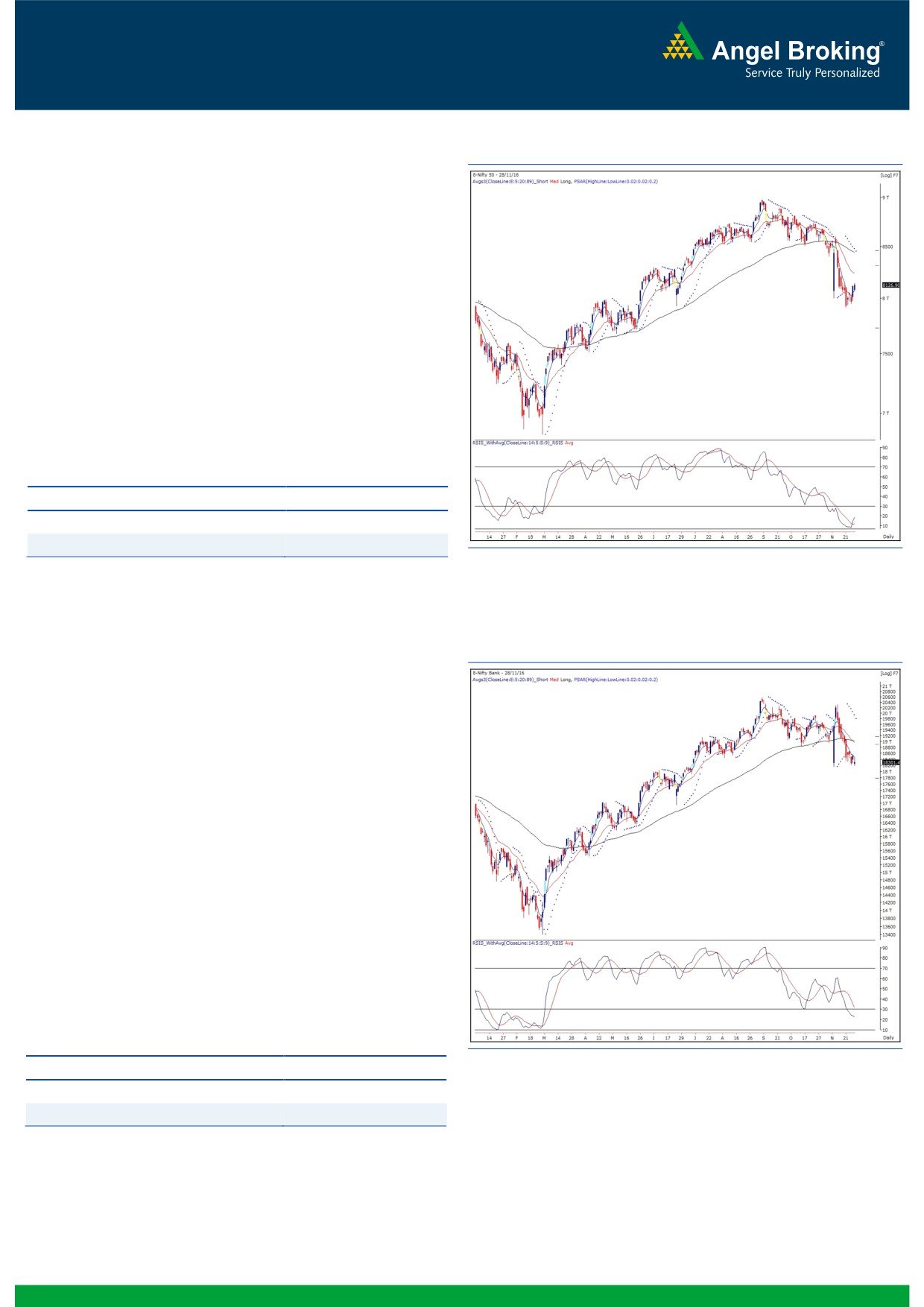

Exhibit 1: Nifty Daily Chart

A strong opening of new derivatives (December) series on Friday

was followed by a weak start for the week on the back of RBI’s

announcement on CRR over the weekend. However, other

heavyweight pockets like, the IT and FMCG held out well to pull

the index back above 8100 to end the session with marginal

gains.

Although, market remained in pressure for quite some time

during the session, the individual stocks had shown good traction.

This indicates that if the banking conglomerates stabilize in the

forthcoming session, we may expect the Nifty trading in a positive

territory. We continue with our optimistic view on the market and

reiterate the possibility of testing 8250 - 8300 levels. On the

flipside, 8080 - 8020 would now be seen an immediate support

levels.

Key Levels

Support 1 - 8080

Resistance 1 - 8250

Support 2 - 8020

Resistance 2 - 8300

Nifty Bank Outlook - (18301)

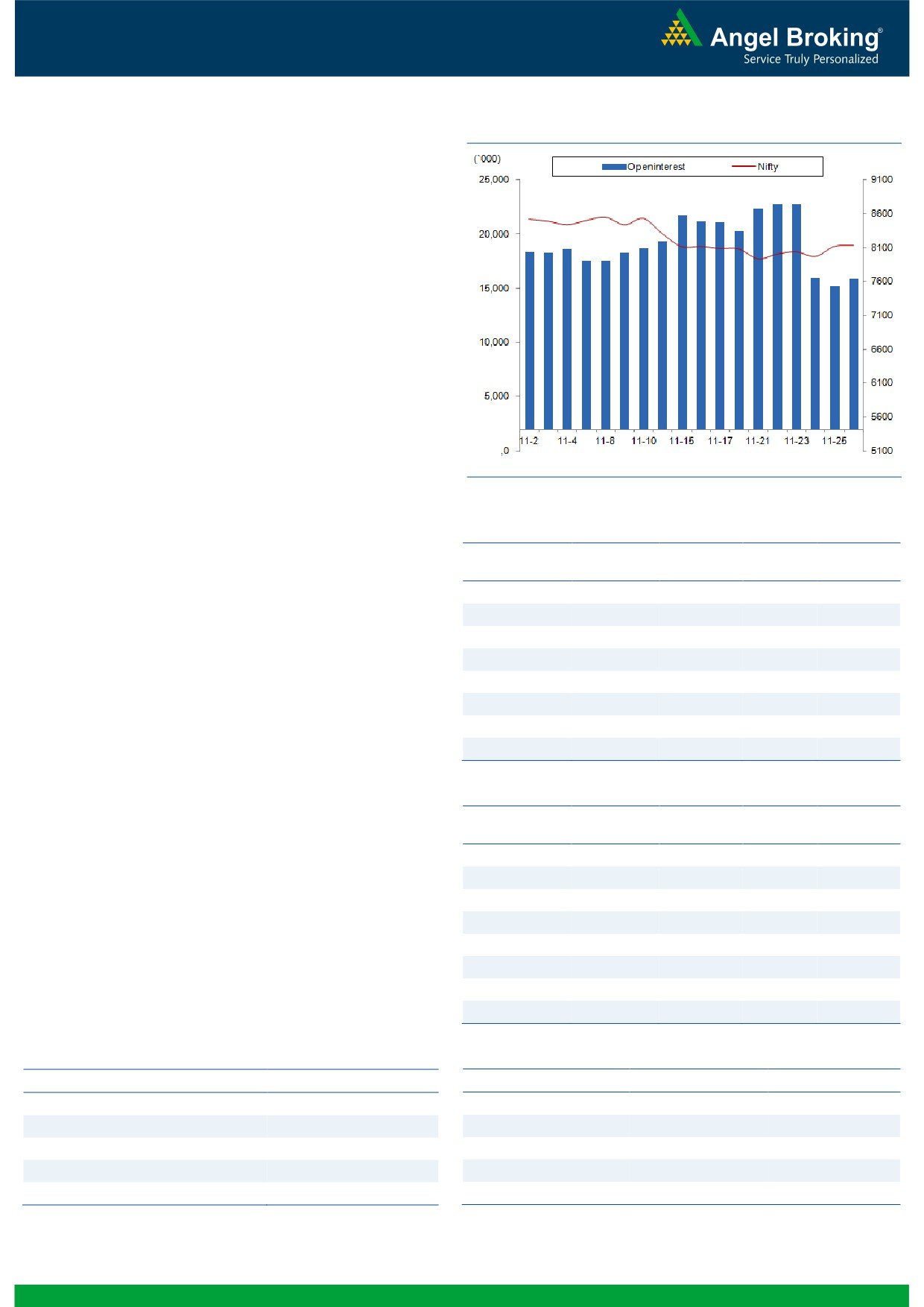

Exhibit 2: Nifty Bank Daily Chart

In yesterday's trading session, the Nifty Bank opened on a

negative note. The index then consolidated in a narrow range

throughout the session and ended the day with loss of 1.11

percent over its previous session's close.

The Nifty Bank index has been underperforming the broader

benchmark index since last few sessions. If we observe the daily

chart, the index has been unable to close above the '5 DEMA'

since last 10 trading sessions. Hence, for any pullback move, it is

necessary for the index to sustain above the mentioned average

which is placed around 18465. Although the downside for the

index seems to be limited in near term, traders are advised to

keep a tab on the above-mentioned level for anticipating a

pullback move. Till then, we continue to advise traders to remain

light on positions and trade on stock specific moves. The intraday

support for the Nifty bank index are placed around 18143 and

18050 whereas resistances are seen around 18465 and 18670.

Key Levels

Support 1 - 18143

Resistance 1 - 18465

Support 2 - 18050

Resistance 2 - 18670

1

Technical & Derivatives Report

November 29, 2016

Comments

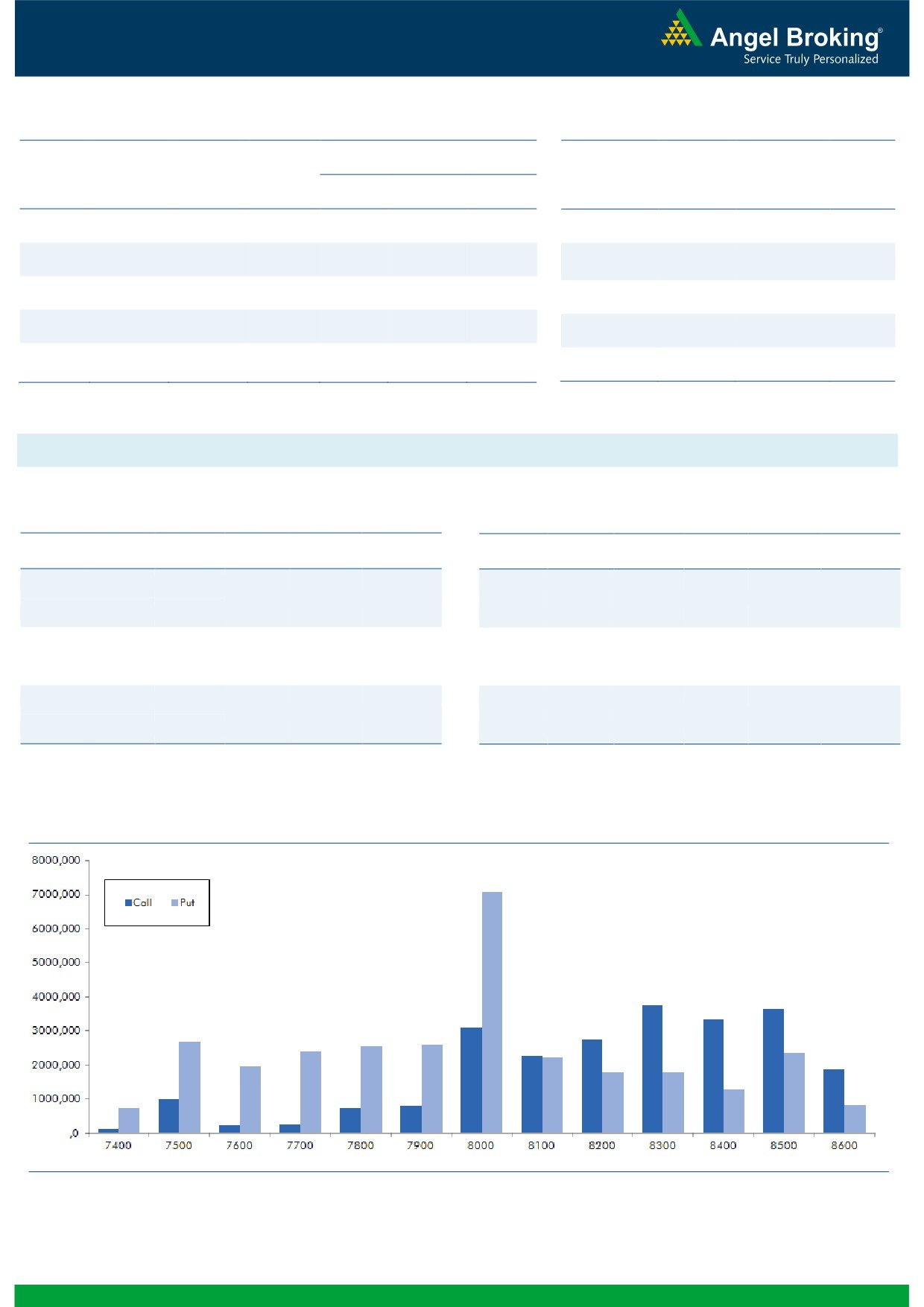

Nifty Vs OI

The Nifty futures open interest has increased by 4.65%

BankNifty futures open interest has decreased by 0.13%

as market closed at 8126.90 levels.

The Nifty December future closed with a premium of

23.70 against the premium of 12.05 points in last

trading session. The January series closed at a premium

of 50.00 points.

The Implied Volatility of at the money options has

increased from 14.74% to 15.36%. At the same time, the

PCR-OI of Nifty has increased from 1.00 to 1.01 levels.

The total OI of the market is Rs. 2,11,035/- cr. and the

stock futures OI is Rs. 64,199/- cr.

Few of the liquid counters where we have seen high cost

of carry are GMRINFRA, ADANIENT, ANDHRABANK,

JPASSOCIAT and HEXAWARE.

Views

OI Gainers

FIIs continue to sell in cash market segment to the tune of

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

Rs.

1436 crores. While, in index futures, they sold

BEL

1511100

23.82

1393.45

6.25

marginally with good amount of rise in open interest,

ICIL

3771500

20.42

156.55

9.78

indicating blend of both long and short formation in

NHPC

22221000

13.99

28.00

2.56

previous trading session.

www.angelbroking.com

MARUTI

2955450

11.17

4919.40

0.79

In Index options segment, FIIs were net buyers of Rs.

CEATLTD

936600

11.13

1197.70

2.72

1622 crores with rise in open interest. We hardly saw any

ENGINERSIN

5113500

10.02

294.05

4.72

meaningful build-up in Nifty options. However, 8300 call

HINDPETRO

18755100

9.45

479.85

4.15

and 8100 put options were comparatively active and

VEDL

46952000

9.01

228.65

2.90

they also added some positions. Highest OI in December

series has been shifted from 8500 to 8300 call option

and of put option remains intact at 8000 strike.

OI Losers

We continue witnessing mixed positions in Index Futures

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

by FIIs. While, in Stock Futures they continue their buying

CANBK

6732000

-7.31

310.35

-0.53

streak. In BankNifty options, we are seeing huge amount

PIDILITIND

1232000

-5.59

626.70

-0.37

of build-up in 17000 and 17500 put option. Large cap

TATAELXSI

1653600

-4.19

1266.20

1.90

banking counters like YESBANK, SBIN, BANKBARODA

DHFL

16251000

-3.85

241.65

1.21

and ICICIBANK added fresh short positions in yesterday’s

KPIT

3852000

-3.02

130.00

-1.07

trading session. Thus, traders should remain cautious as

TATACHEM

4924500

-2.55

477.40

2.24

BankNifty may underperform market due to which Nifty

may find difficult to bounce back to higher levels.

LICHSGFIN

6048900

-2.52

540.80

0.72

CESC

1904100

-2.42

587.15

1.75

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

ADANIPOWER

68.18

NIFTY

1.01

0.87

BHARTIARTL

40.67

BANKNIFTY

0.78

0.75

BEL

43.37

SBIN

0.59

0.49

TATAPOWER

39.29

RELIANCE

0.59

0.40

HINDPETRO

41.62

ICICIBANK

0.46

0.42

2

Technical & Derivatives Report

November 29, 2016

FII Statistics for November 28, 2016

Turnover on November 28, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

2355.80

2478.69

(122.89)

155120

9758.08

8.87

214863

14230.93

-10.61

FUTURES

FUTURES

INDEX

INDEX

25943.12

24320.77

1622.35

867427

53758.24

8.00

2313751

157974.71

1.94

OPTIONS

OPTIONS

STOCK

6463.94

5711.13

752.80

812684

49119.18

0.91

STOCK

FUTURES

441315

29433.09

-8.74

FUTURES

STOCK

STOCK

2461.67

2439.63

22.04

36670

2320.78

34.13

OPTIONS

211613

14702.27

-3.43

OPTIONS

TOTAL

37224.52

34950.23

2274.30

1871901

114956.28

5.26

TOTAL

3181542

216340.99

-0.93

Nifty Spot = 8126.90

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8200

117.65

Buy

8100

127.95

44.65

55.35

8244.65

32.40

67.60

8067.60

Sell

8300

73.00

Sell

8000

95.55

Buy

8200

117.65

Buy

8100

127.95

75.00

125.00

8275.00

57.65

142.35

8042.35

Sell

8400

42.65

Sell

7900

70.30

Buy

8300

73.00

Buy

8000

95.55

30.35

69.65

8330.35

25.25

74.75

7974.75

Sell

8400

42.65

Sell

7900

70.30

Note: Above mentioned Bullish or Bearish Spreads in Nifty (December Series) are given as an information and not as a recommendation.

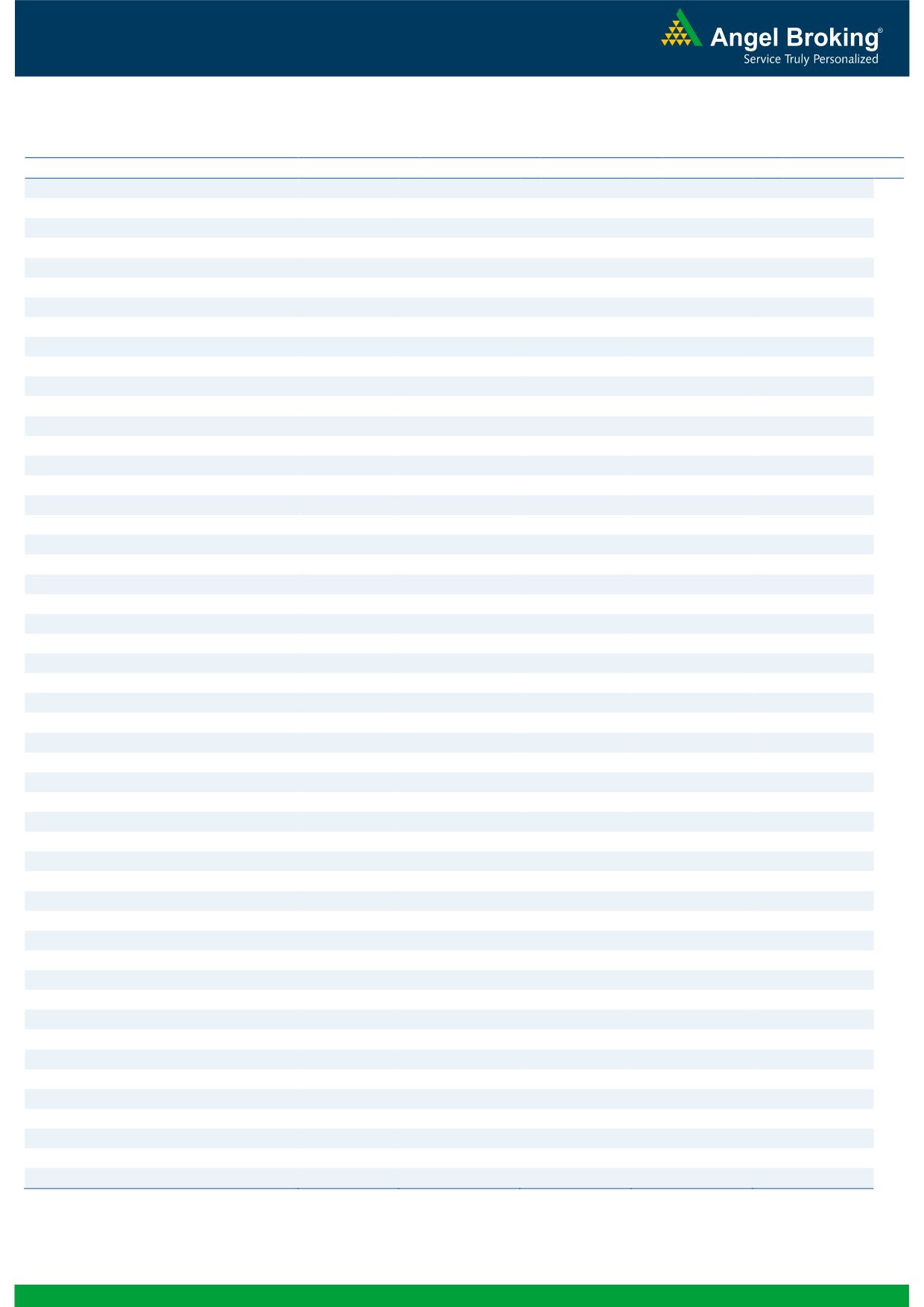

Nifty Put-Call Analysis

3

Technical & Derivatives Report

November 29, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,295

1,306

1,317

1,328

1,339

ADANIPORTS

260

266

270

277

281

AMBUJACEM

198

201

203

207

209

ASIANPAINT

911

924

946

959

981

AUROPHARMA

724

730

739

746

755

AXISBANK

454

464

471

480

487

BAJAJ-AUTO

2,585

2,611

2,638

2,664

2,691

BANKBARODA

159

161

163

165

167

BHEL

125

126

128

129

130

BPCL

628

640

652

663

675

BHARTIARTL

293

306

314

326

334

INFRATEL

350

357

362

368

373

BOSCH

18,676

19,042

19,266

19,632

19,856

CIPLA

563

567

572

576

581

COALINDIA

301

303

304

306

308

DRREDDY

3,145

3,159

3,175

3,189

3,204

EICHERMOT

19,638

19,926

20,288

20,576

20,938

GAIL

408

413

418

423

429

GRASIM

807

824

836

853

865

HCLTECH

782

794

803

815

823

HDFCBANK

1,166

1,175

1,187

1,196

1,208

HDFC

1,226

1,236

1,244

1,254

1,262

HEROMOTOCO

3,014

3,060

3,091

3,137

3,168

HINDALCO

175

177

180

181

184

HINDUNILVR

823

831

836

844

849

ICICIBANK

252

254

255

257

258

IDEA

72

74

75

77

78

INDUSINDBK

1,029

1,040

1,057

1,067

1,084

INFY

965

972

978

985

991

ITC

225

229

232

236

239

KOTAKBANK

730

740

746

757

763

LT

1,338

1,347

1,360

1,369

1,382

LUPIN

1,470

1,490

1,504

1,523

1,538

M&M

1,140

1,151

1,167

1,179

1,195

MARUTI

4,800

4,847

4,880

4,927

4,960

NTPC

158

161

163

166

168

ONGC

270

277

281

288

292

POWERGRID

183

187

191

195

199

RELIANCE

974

980

990

997

1,007

SBIN

243

248

253

258

263

SUNPHARMA

705

710

715

720

725

TCS

2,217

2,250

2,285

2,317

2,352

TATAMTRDVR

285

289

292

296

299

TATAMOTORS

446

450

455

460

465

TATAPOWER

69

71

72

74

75

TATASTEEL

398

402

407

411

416

TECHM

476

483

489

496

503

ULTRACEMCO

3,426

3,466

3,515

3,554

3,603

WIPRO

449

455

461

467

474

YESBANK

1,111

1,130

1,153

1,172

1,195

ZEEL

431

444

453

467

476

4

Technical & Derivatives Report

November 29, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5