Technical & Derivatives Report

September 29, 2016

Sensex (28293) / Nifty (8745)

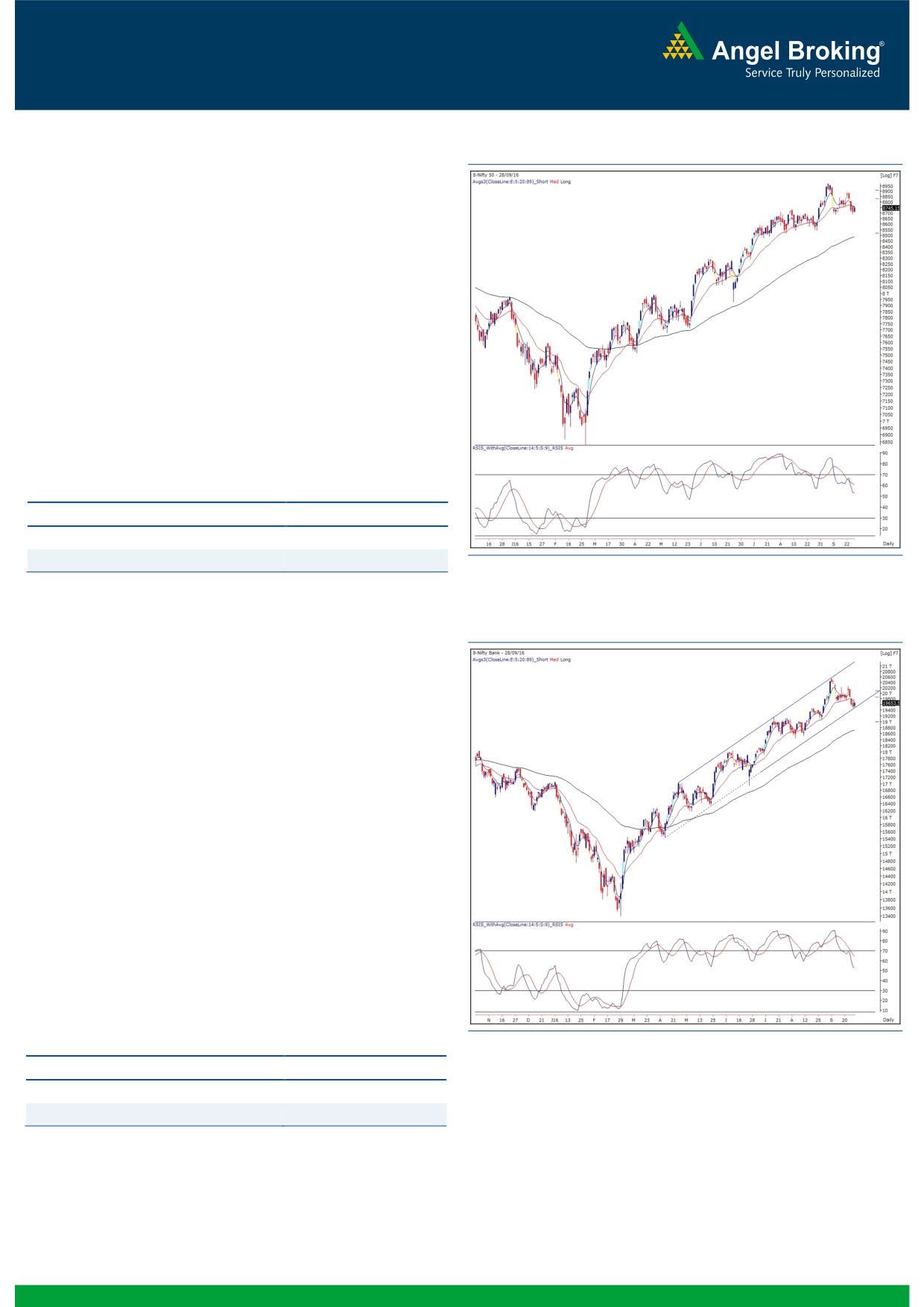

Exhibit 1: Nifty Daily Chart

Yesterday's session opened on a flat note owing to mixed global

cues. Subsequently, we witnessed some consolidation in the

market followed by a decent up move in the second half. As a

result, the Nifty managed to close with nearly half a percent

gains.

It seems that 8700 is acting as sheet anchor for the Nifty at least

for the current expiry. But, we do not want get carried by this

move, in fact would interpret this bounce as a selling opportunity.

For the coming session, 8790 - 8820 would act as a resistance

zone and we maintain our view that it’s a matter of time that the

Nifty would slide below the recent support level of 8688 to test

8640 - 8600 levels. Until we do not see any clear reversal sign,

our strategy would remain sell on rise in the market.

Key Levels

Support 1 - 8688

Resistance 1 - 8790

Support 2 - 8640

Resistance 2 - 8820

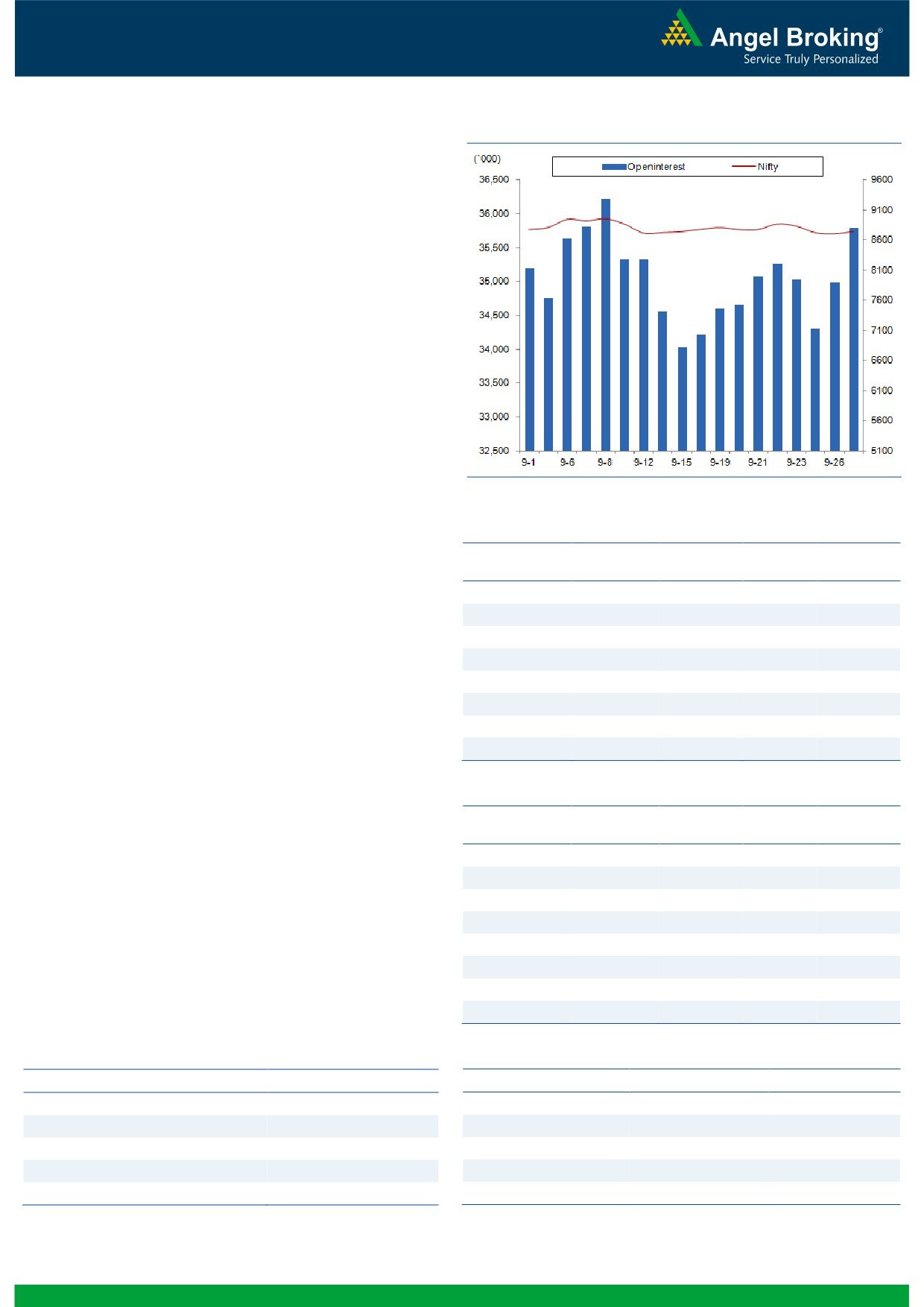

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19654)

Yesterday, the Nifty Bank index opened on a flat note and started

moving higher from initial trades. The banking index continued to

make higher highs and eventually ended the session with gains of

0.69 percent over its previous close. The PSU Banking space has

shown tremendous outperformance as the Nifty PSU Bank index

posted the gains of 2.45 percent.

As indicated in our yesterday’s report that the Nifty Bank index is

trading near its support of 100% extension levels (19410) of the

recent corrective move from

20576 to

19732 and

78.6%

retracement of the previous up move. A mentioned level coincides

with the lower end of the rising channel on daily chart. Though

we had seen some pull back in Nifty Bank index, we advise

traders not to form aggressive long positions as we expect the

support to be breached, sooner or later. The intraday support for

the Nifty Bank index are placed around 19500 and 19410;

whereas, resistance are seen around 19700 and 19830.

Key Levels

Support 1 - 19500

Resistance 1 - 19700

Support 2 - 19410

Resistance 2 - 19830

1

Technical & Derivatives Report

September 29, 2016

Comments

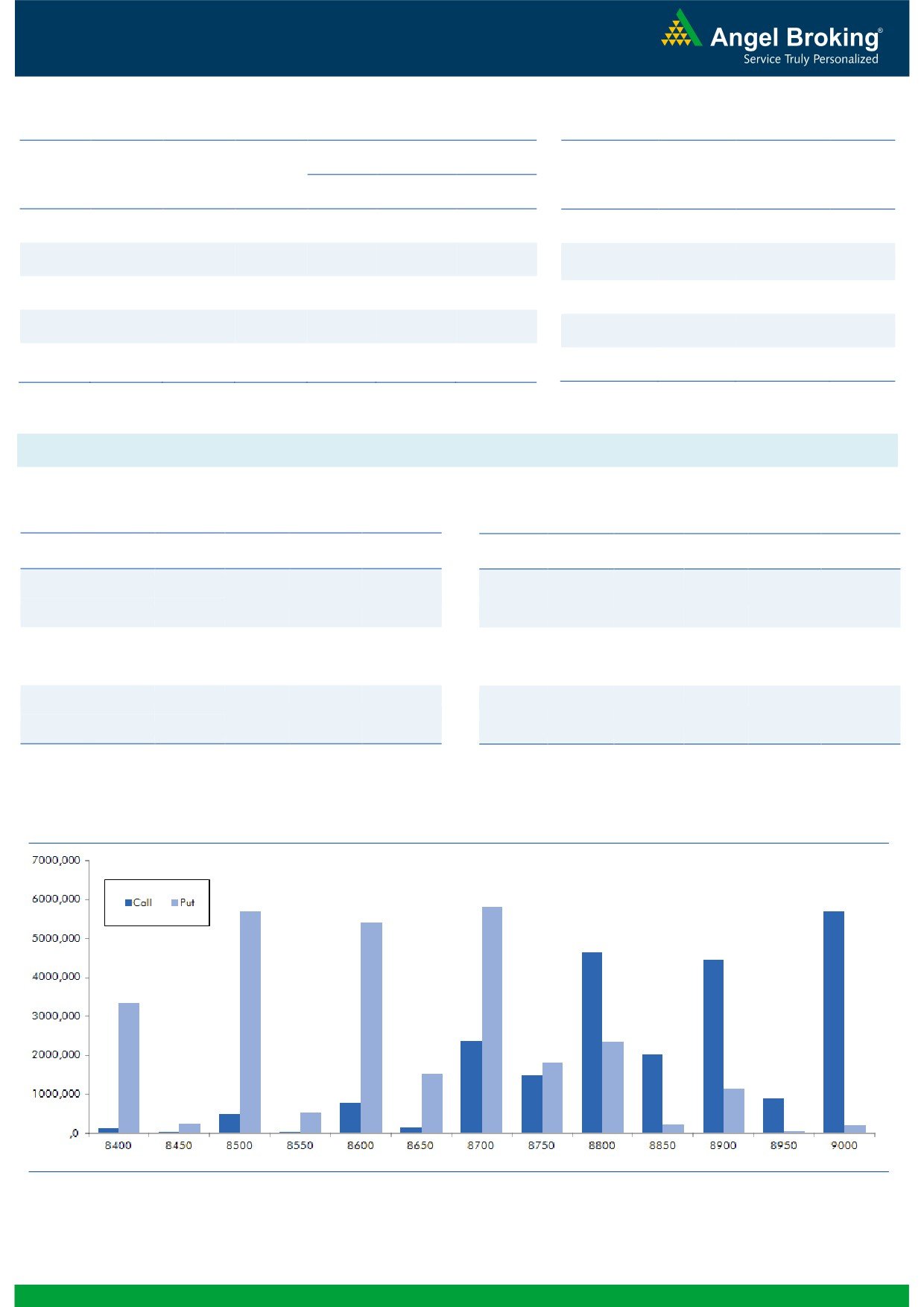

Nifty Vs OI

The Nifty futures open interest has increased by 2.31%

BankNifty futures open interest has decreased by 10.27%

as market closed at 8745.15 levels.

The Nifty September future closed with a premium of

13.30, against the premium of 10.15 points in last

trading session. The October series closed at a premium

of 57.80 points.

The Implied Volatility of at the money options has

decreased from 14.15% to 13.62%. At the same time,

the PCR-OI of Nifty has increased from 1.06 to 1.11.

The total OI of the market is Rs. 3,31,431/- cr. and the

stock futures OI is Rs. 92,581/- cr.

Few of the liquid counters where we have seen high cost

of carry are JINDALSTEL, JPASSOCIAT, ANDHRABANK,

DISHTV and NHPC.

Views

OI Gainers

FIIs were net buyer in both equity cash and Index Futures

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

segment. They bought equities worth Rs. 79 crores.

APOLLOHOSP

703200

19.67

1357.60

0.05

While, they were net buyers in index future worth Rs. 135

CESC

1852400

18.26

623.40

0.67

crores with rise in OI, indicating blend of both long and

ANDHRABANK

22560000

17.81

59.95

1.52

short build-up in last trading session. www.angelbroking.com

HDIL

30472000

15.01

84.70

1.93

On Index Options front, FIIs bought to the tune of

HINDZINC

5238400

13.84

230.65

0.79

Rs. 1430 crores with rise in OI. In call options, 8850

MRF

61110

13.42

49736.70

6.57

strike added some build-up, followed by unwinding in

DABUR

6902500

11.33

278.10

-1.56

8700 and 8800 strikes. While in put options, 8700 and

8750 strike added huge open interest and we believe

NMDC

21120000

9.97

110.00

3.48

these are FIIs long positions. However, some unwinding

was seen in 8800 strike. Highest OI in September series

OI Losers

is placed at 9000 call and 8500 put option.

OI

PRICE

SCRIP

OI

PRICE

From last few trading sessions, we are witnessing good

CHG. (%)

CHG. (%)

SINTEX

37933500

-12.09

81.65

1.74

amount of profit booking and some fresh short formation

STAR

2561000

-11.34

1056.55

1.11

in Index Futures. Most of the long formed since August

ZEEL

8089900

-10.38

549.40

3.15

series are still intact. Hence, we believe Nifty may attract

UNIONBANK

15596000

-10.33

146.25

3.36

further profit booking, which may lead September Series

to expire near 8650-8700 levels. Traders are suggested

JPASSOCIAT

200532000

-9.90

11.20

0.90

to buy 8800 put to trade for today’s expiry.

RCOM

112980000

-9.56

47.90

-0.21

L&TFH

47943000

-9.42

92.55

1.87

CEATLTD

1414700

-9.21

1247.00

4.96

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

MRF

50.94

NIFTY

1.11

0.90

IDFC

55.98

BANKNIFTY

1.04

0.92

EICHERMOT

36.28

RELIANCE

0.70

0.67

CAIRN

39.76

AXISBANK

0.40

0.47

FEDERALBNK

39.21

YESBANK

0.70

0.57

2

Technical & Derivatives Report

September 29, 2016

FII Statistics for 28, September 2016

Turnover on 28, September 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

5368.18

5233.40

134.78

490848

32840.14

2.78

346340

24153.62

-12.87

FUTURES

FUTURES

INDEX

INDEX

51627.78

50197.36

1430.43

1457926

98101.39

2.68

6346728

444447.95

13.39

OPTIONS

OPTIONS

STOCK

25440.56

25797.15

(356.59)

1024230

68217.83

1.30

STOCK

FUTURES

1316873

91869.11

22.45

FUTURES

STOCK

STOCK

6472.80

6342.81

129.99

125136

8755.98

(2.25)

OPTIONS

470534

34877.99

13.87

OPTIONS

TOTAL

88909.32

87570.72

1338.61

3098140

207915.33

2.03

TOTAL

8480475

595348.67

13.32

Nifty Spot = 8745.15

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8700

62.50

Buy

8800

50.55

53.40

46.60

8753.40

41.40

58.60

8758.60

Sell

8800

9.10

Sell

8700

9.15

Buy

8700

62.50

Buy

8800

50.55

61.65

138.35

8761.65

48.95

151.05

8751.05

Sell

8900

0.85

Sell

8600

1.60

Buy

8800

9.10

Buy

8700

9.15

8.25

91.75

8808.25

7.55

92.45

8692.45

Sell

8900

0.85

Sell

8600

1.60

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

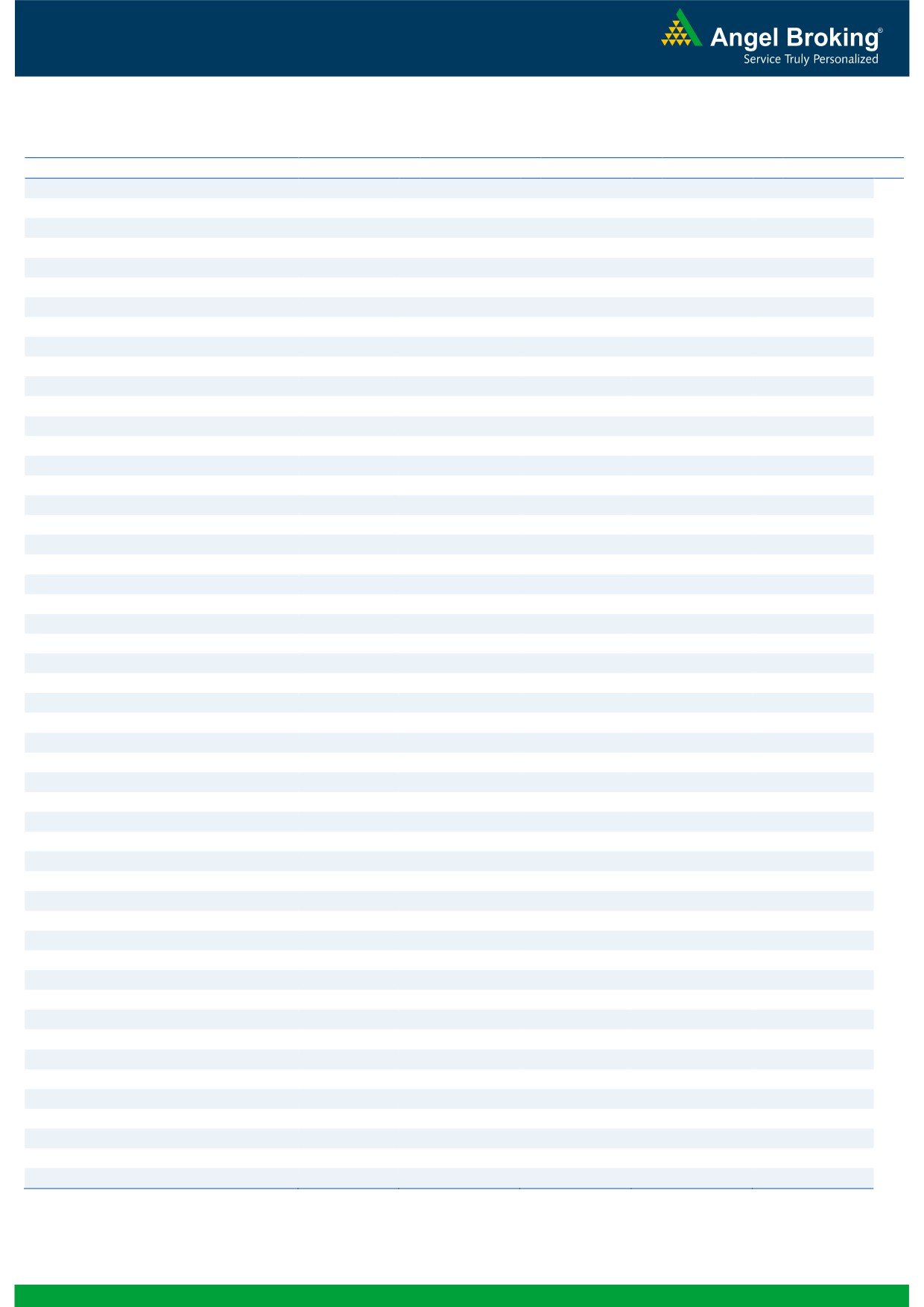

Nifty Put-Call Analysis

3

Technical & Derivatives Report

September 29, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,594

1,605

1,614

1,625

1,634

ADANIPORTS

258

265

268

275

278

AMBUJACEM

255

258

260

263

265

ASIANPAINT

1,181

1,187

1,194

1,200

1,207

AUROPHARMA

856

863

873

879

889

AXISBANK

537

543

547

553

557

BAJAJ-AUTO

2,850

2,882

2,903

2,935

2,957

BANKBARODA

161

165

167

171

173

BHEL

139

142

143

145

147

BPCL

605

611

615

621

625

BHARTIARTL

306

314

319

326

331

INFRATEL

350

357

362

368

373

BOSCH

22,345

22,767

23,044

23,466

23,742

CIPLA

597

601

607

611

617

COALINDIA

322

325

331

334

339

DRREDDY

3,165

3,183

3,205

3,223

3,245

EICHERMOT

24,059

24,923

25,484

26,348

26,909

GAIL

370

373

376

378

382

GRASIM

4,778

4,829

4,864

4,916

4,950

HCLTECH

784

790

796

802

808

HDFCBANK

1,284

1,290

1,295

1,301

1,306

HDFC

1,409

1,416

1,424

1,431

1,439

HEROMOTOCO

3,421

3,436

3,460

3,475

3,499

HINDALCO

145

151

155

161

164

HINDUNILVR

870

879

890

898

909

ICICIBANK

257

259

261

262

264

IDEA

78

80

82

84

85

INDUSINDBK

1,191

1,206

1,216

1,232

1,241

INFY

1,029

1,034

1,038

1,043

1,047

ITC

243

245

247

249

251

KOTAKBANK

771

777

784

790

798

LT

1,425

1,441

1,454

1,469

1,482

LUPIN

1,499

1,508

1,518

1,528

1,538

M&M

1,359

1,368

1,379

1,388

1,399

MARUTI

5,479

5,500

5,528

5,549

5,577

NTPC

151

152

153

153

154

ONGC

243

247

250

254

257

POWERGRID

175

177

178

180

181

RELIANCE

1,073

1,082

1,095

1,104

1,117

SBIN

245

249

253

257

260

SUNPHARMA

757

761

767

771

778

TCS

2,403

2,413

2,425

2,435

2,448

TATAMTRDVR

332

336

341

346

350

TATAMOTORS

525

533

539

546

553

TATAPOWER

74

75

76

77

77

TATASTEEL

363

372

377

386

391

TECHM

433

437

443

447

453

ULTRACEMCO

3,874

3,923

3,955

4,004

4,036

WIPRO

479

481

483

485

487

YESBANK

1,234

1,253

1,264

1,282

1,293

ZEEL

517

533

542

558

567

4

Technical & Derivatives Report

September 29, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5