Technical & Derivatives Report

March 29, 2016

Sensex (24966) / Nifty (7615)

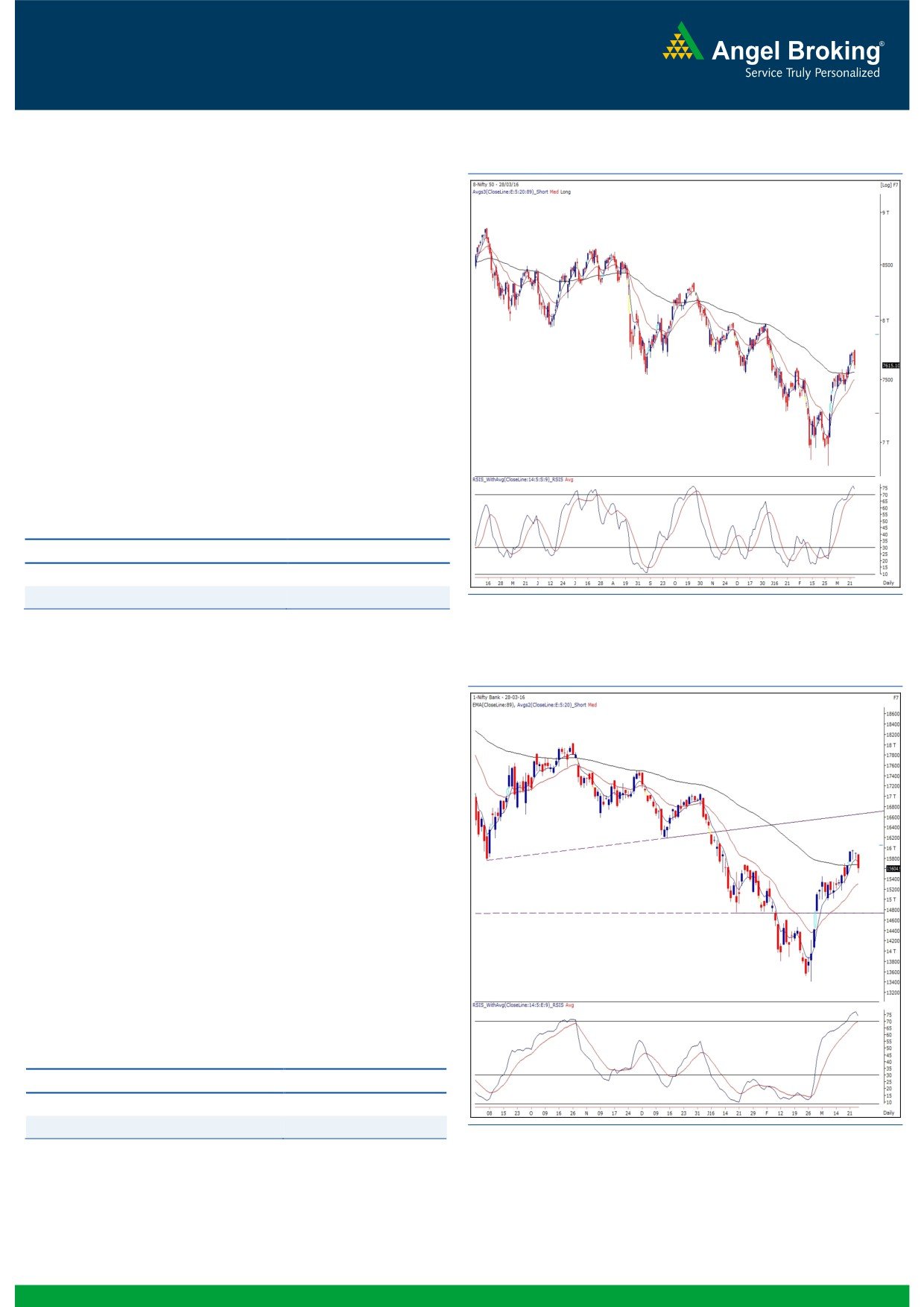

Exhibit 1: Nifty Daily Chart

After an extended weekend, yesterday's session opened with a

mildly positive bias. However, the early morning optimism was

very short lived as we witnessed a steady correction throughout

the day to end the session with more than a percent loss.

Yesterday, we clearly saw an underperformance from our

markets as compared to its peers across the globe. The index

shrugged off positive cues from the major Asian bourses and

kept on descending throughout the session. In fact, some of

the index constituents sinked brutally on back of heavy profit

booking. It seems the mentioned resistance level of 7750

proved its significance as the Nifty started this correction after

posting a high of 7744 in the initial trades. Going forward,

traders are advised not to remain short on the index as we are

observing a strong support zone of 7600 - 7580 levels. On

the flipside, 7680 - 7750 is likely to act as a strong resistance.

Key Levels

Support 1 - 7600

Resistance 1 - 7680

Support 2 - 7580

Resistance 2 -

7750

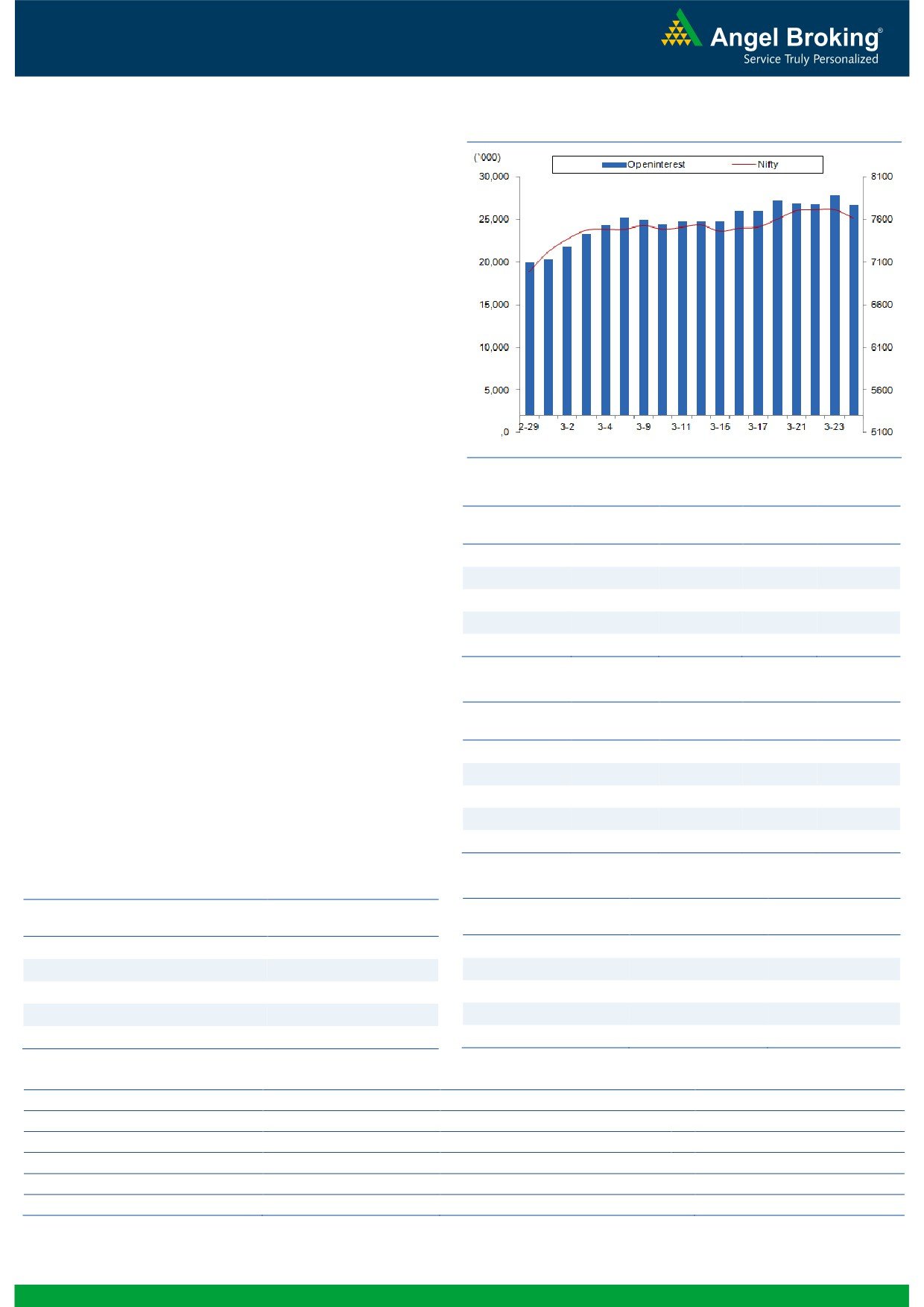

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (15605)

Along with the broader market sell off, the Nifty Bank index

too corrected in yesterday's trading session and ended with

losses of 1.78% over its previous close.

In our previous report, we had mentioned that the near term

support for the index is in the range of 15670 - 15735, which

was breached during yesterday's session. This could lead to

some profit booking in the index in the near term. However,

there is no clear evidence of a trend reversal on the daily

chart. This indicates that this down move probably could just

be a correction within a short term upmove. Traders are hence

advised to trade with a stock specific approach and wait for

further developments to happen on the index front. The

intraday support for the banking index is placed around

15470 - 15450; whereas, resistance is seen around 15775 -

15857.

Key Levels

Support 1 - 15450

Resistance 1 - 15775

Support 2 - 15320

Resistance 2 - 15857

1

Technical & Derivatives Report

March 29, 2016

Comments

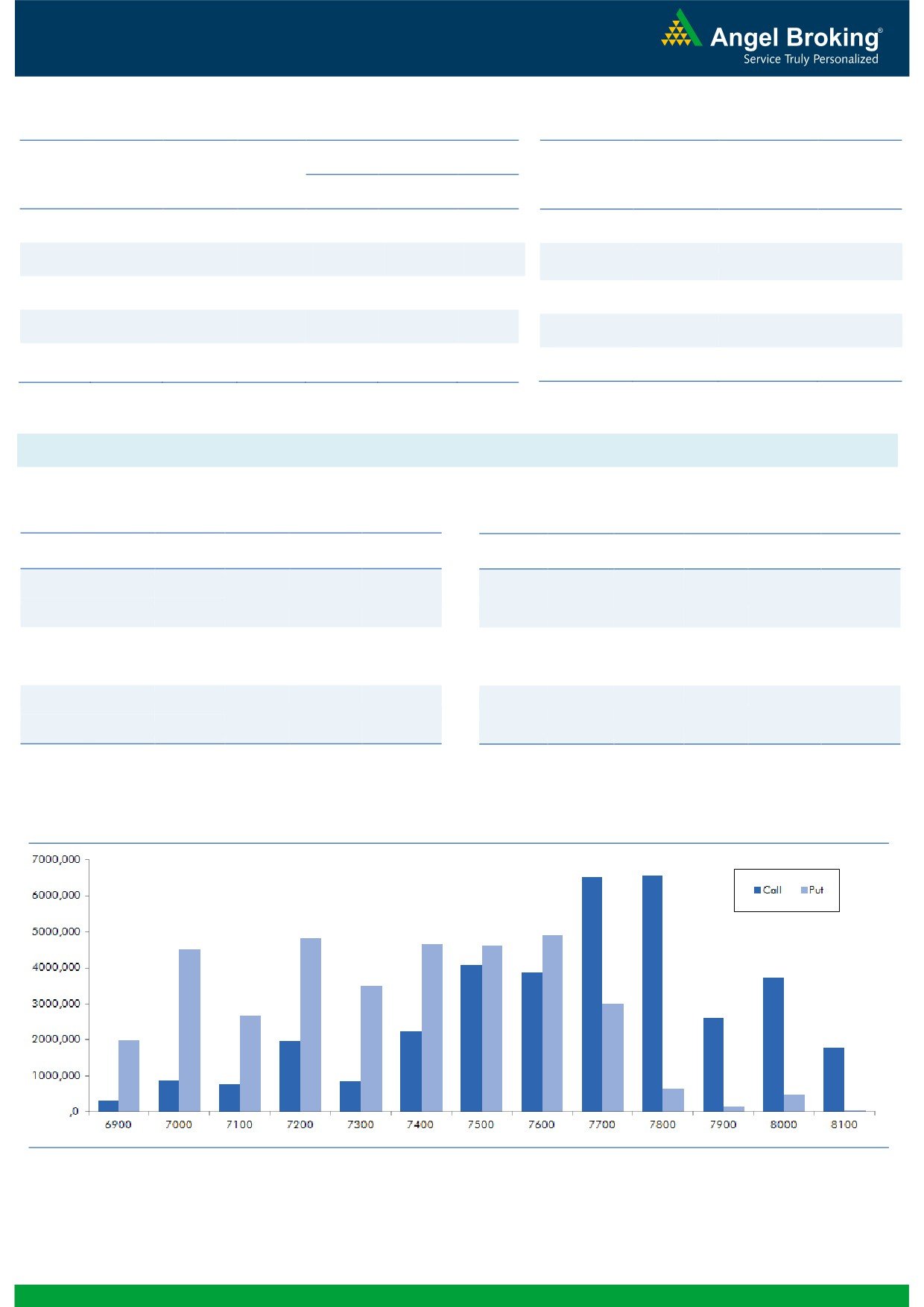

Nifty Vs OI

The Nifty futures open interest has decreased by 4.22%

BankNifty futures open interest has decreased by 8.96%

as market closed at 7615.10 levels.

The Nifty March future closed at a premium of 23.50

points against a premium of 19.80 points. The April

series closed at a premium of 72.00 points.

The Implied Volatility of at the money options has

increased from 10.93% to 17.39%.

The total OI of the market is Rs. 2,51,660/- cr. and the

stock futures OI is Rs. 59,037 /- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, JISLJALEQS, INDUSINDBK,

SRF and BANKBARODA.

Views

OI Gainers

Despite Nifty correcting more than 100 points yesterday,

OI

PRICE

SCRIP

OI

PRICE

FIIs bought significantly in cash segment. They bought

CHG. (%)

CHG. (%)

KPIT

1528000

24.03

144.15

0.14

equities to the tune of Rs. 2043 crores. While in Index

BAJAJ-AUTO

1699000

21.22

2360.55

-0.05

Futures, they sold of worth Rs.

161 crores with

considerable fall in OI, suggesting mix of both long

M&MFIN

15294000

19.43

237.35

-1.15

unwinding and short covering in last trading session.

AMBUJACEM

7394100

16.05

230.50

0.66

In Index Options front, FIIs sold of worth Rs. 295 croresng.com

L&TFH

34376000

15.29

63.20

-0.24

with some fall in OI. In call options, 7650-7750 strikes

added decent build-up with rise in implied volatility. This

OI Losers

indicated some buying took place in these call options,

OI

PRICE

SCRIP

OI

PRICE

expecting Nifty to show strength from its immediate

CHG. (%)

CHG. (%)

support of 7600 levels. While in put options, we witness

RELINFRA

7120100

-9.47

522.70

-2.58

good amount of unwinding in 7700 strike. Maximum OI

SIEMENS

1330400

-7.92

1071.55

-2.11

in current series is visible in 7800 call and 7600 put

CEATLTD

1296400

-6.51

1052.50

-2.16

options. Rollover in Nifty is at 29.67% and of BankNifty is

GODREJCP

243200

-6.32

1326.45

1.61

at 22.58%.

BANKINDIA

16527000

-6.25

93.25

-3.47

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

TITAN

55.85

NIFTY

0.96

0.95

HINDALCO

73.89

BANKNIFTY

0.96

0.79

SUNPHARMA

36.72

SBIN

0.80

0.52

PIDILITIND

31.66

LUPIN

0.33

0.45

ADANIPOWER

49.49

ICICIBANK

1.22

0.82

Strategy Date

Symbol

Strategy

Status

February 29, 2016

RELIANCE

Ratio Bull Call Spread

Active

March 07, 2016

BHEL

Long Call Ladder

Active

March 14, 2016

NIFTY

Ratio Bull Call Spread

Not Activated

March 21, 2016

BANKNIFTY

Long Call

Active

March 28, 2016

NIFTY

Ratio Bull Call Spread

Active

2

Technical & Derivatives Report

March 29, 2016

FII Statistics for 28-March 2016

Turnover on 28-March 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

3582.68

3743.60

(160.92)

327277

18181.72

(9.03)

399016

21723.60

37.72

FUTURES

FUTURES

INDEX

INDEX

29675.33

29970.51

(295.18)

1539694

86466.17

(0.85)

5064302

283697.30

18.03

OPTIONS

OPTIONS

STOCK

14507.19

16294.61

(1787.42)

1064647

48796.95

1.36

STOCK

FUTURES

1003282

47217.92

64.04

FUTURES

STOCK

STOCK

2852.15

3048.70

(196.55)

100813

4636.71

1.96

OPTIONS

368121

18002.48

9.36

OPTIONS

TOTAL

50617.35

53057.42

(2440.07)

3032431

158081.55

(0.96)

TOTAL

6834721

370641.30

22.98

Nifty Spot = 7615.10

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7600

63.20

Buy

7600

28.85

44.35

55.65

7644.35

19.20

80.80

7580.80

Sell

7700

18.85

Sell

7500

9.65

Buy

7600

63.20

Buy

7600

28.85

58.80

141.20

7658.80

25.15

174.85

7574.85

Sell

7800

4.40

Sell

7400

3.70

Buy

7700

18.85

Buy

7500

9.65

14.45

85.55

7714.45

5.95

94.05

7494.05

Sell

7800

4.40

Sell

7400

3.70

Note: Above mentioned Bullish or Bearish Spreads in Nifty (March Series) are given as an information and not as a recommendation.

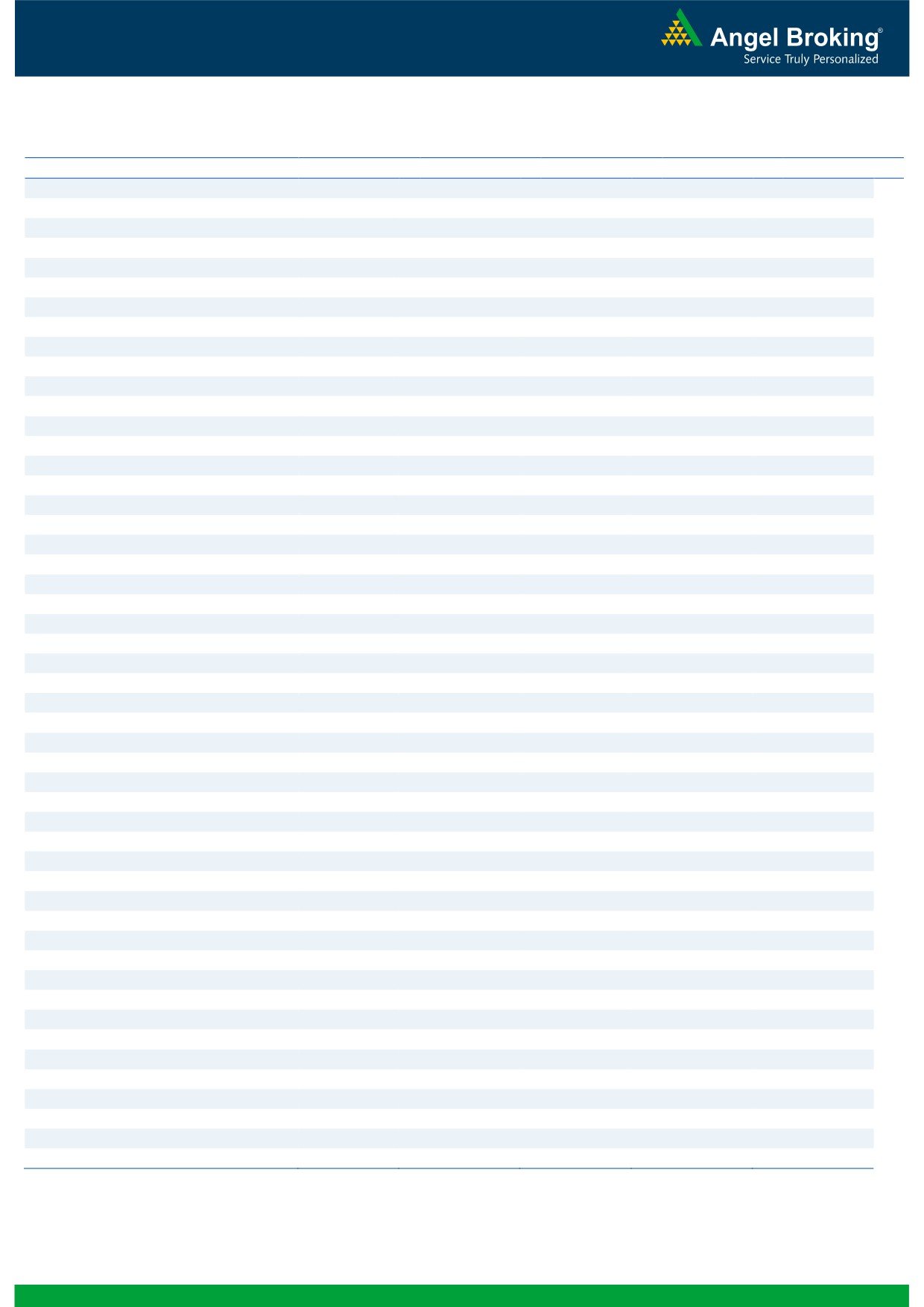

Nifty Put-Call Analysis

3

Technical & Derivatives Report

March 29, 2016

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,338

1,358

1,375

1,395

1,412

ADANIPORTS

227

231

237

242

247

AMBUJACEM

220

225

230

235

241

ASIANPAINT

834

840

849

854

863

AXISBANK

408

416

427

434

446

BAJAJ-AUTO

2,312

2,335

2,355

2,378

2,398

BANKBARODA

133

136

140

143

148

BHARTIARTL

338

344

353

358

367

BHEL

109

111

114

116

120

BOSCHLTD

19,722

20,085

20,362

20,725

21,003

BPCL

851

862

875

886

898

CAIRN

152

154

156

158

160

CIPLA

513

518

528

534

543

COALINDIA

288

291

295

297

301

DRREDDY

2,981

3,008

3,041

3,069

3,102

GAIL

353

355

359

361

365

GRASIM

3,702

3,744

3,776

3,818

3,849

HCLTECH

794

803

815

823

835

HDFC

1,117

1,130

1,150

1,163

1,183

HDFCBANK

1,036

1,042

1,047

1,053

1,059

HEROMOTOCO

2,799

2,823

2,857

2,881

2,915

HINDALCO

76

80

86

90

96

HINDUNILVR

851

857

867

873

883

ICICIBANK

218

222

228

232

238

IDEA

102

104

105

107

108

INDUSINDBK

894

905

922

932

949

INFY

1,171

1,188

1,213

1,229

1,254

ITC

315

319

324

328

334

KOTAKBANK

652

661

669

678

687

LT

1,169

1,188

1,217

1,236

1,265

LUPIN

1,453

1,474

1,511

1,532

1,569

M&M

1,220

1,232

1,249

1,261

1,278

MARUTI

3,534

3,587

3,682

3,735

3,830

NTPC

126

128

129

131

132

ONGC

209

211

215

218

221

PNB

79

81

83

84

87

POWERGRID

135

137

139

141

142

RELIANCE

1,007

1,013

1,023

1,030

1,039

SBIN

181

185

191

195

202

VEDL

81

84

91

94

101

SUNPHARMA

776

793

819

836

862

TATAMOTORS

353

358

367

372

381

TATAPOWER

59

60

62

62

64

TATASTEEL

284

292

305

313

326

TCS

2,428

2,451

2,484

2,507

2,540

TECHM

453

464

475

485

496

ULTRACEMCO

3,112

3,144

3,188

3,220

3,264

WIPRO

542

549

556

563

571

YESBANK

821

832

846

856

870

ZEEL

381

384

389

392

396

4

Technical & Derivatives Report

March 29, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5