Technical & Derivatives Report

October 28, 2016

Sensex (27916) / Nifty (8615)

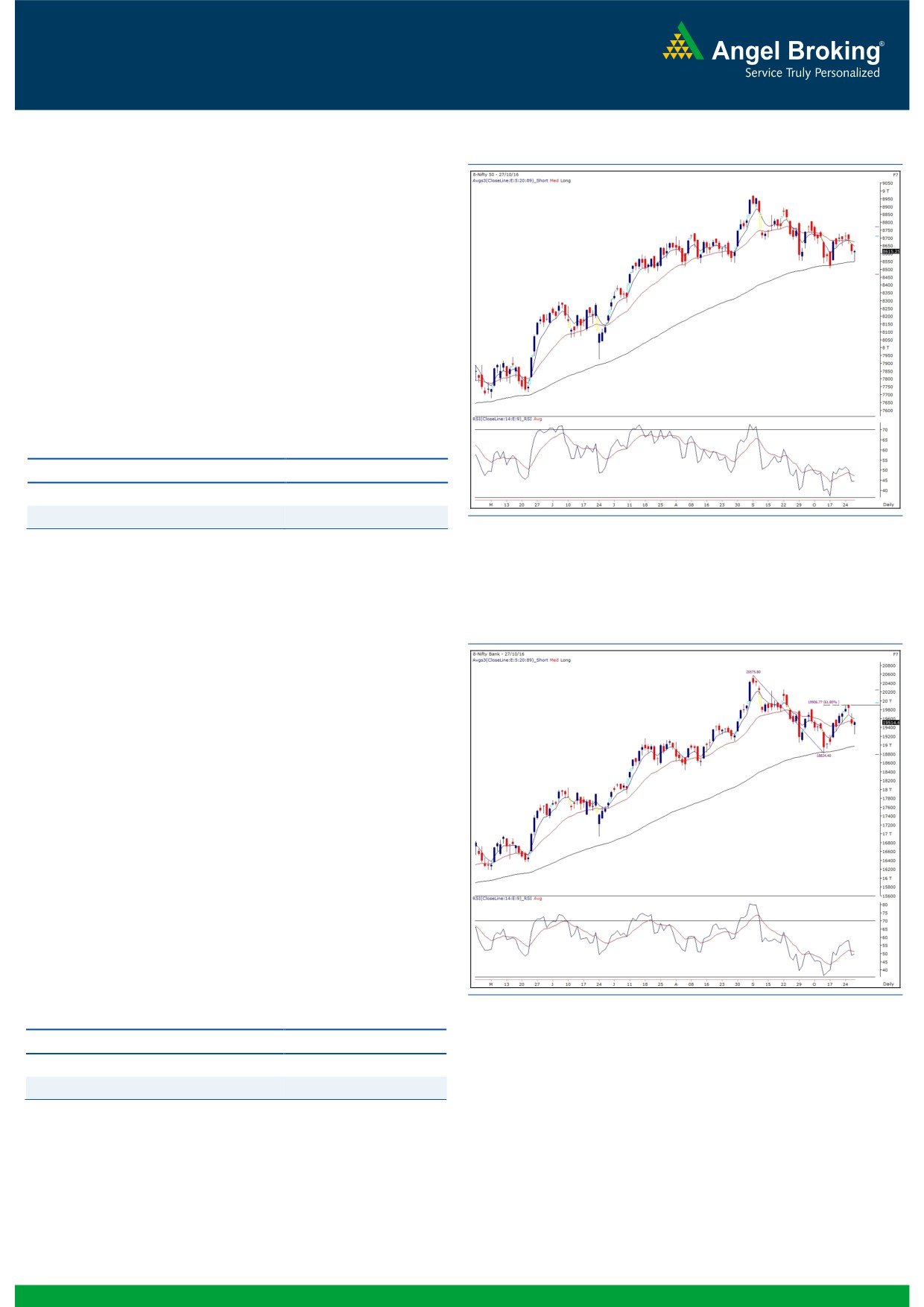

Exhibit 1: Nifty Daily Chart

The opening tick during yesterday's session was slightly inside the

negative territory. However, the selling pressure aggravated

during the first half and as a result, the Nifty corrected towards

our mentioned support level of 8550. However, we witnessed a

v-shaped recovery towards the fag end to reclaim the 8600 mark.

This recovery has resulted into a formation of 'Dragonfly Doji'

pattern on daily chart. A sustainable move above its high may

lead to an extended bounce in the index. However, we believe

that the Nifty may probably face a strong resistance around 8640

- 8660 levels. On the downside, 8580 - 8550 would be seen as

immediate support levels.

Key Levels

Support 1 - 8580

Resistance 1 - 8640

Support 2 - 8550

Resistance 2 - 8660

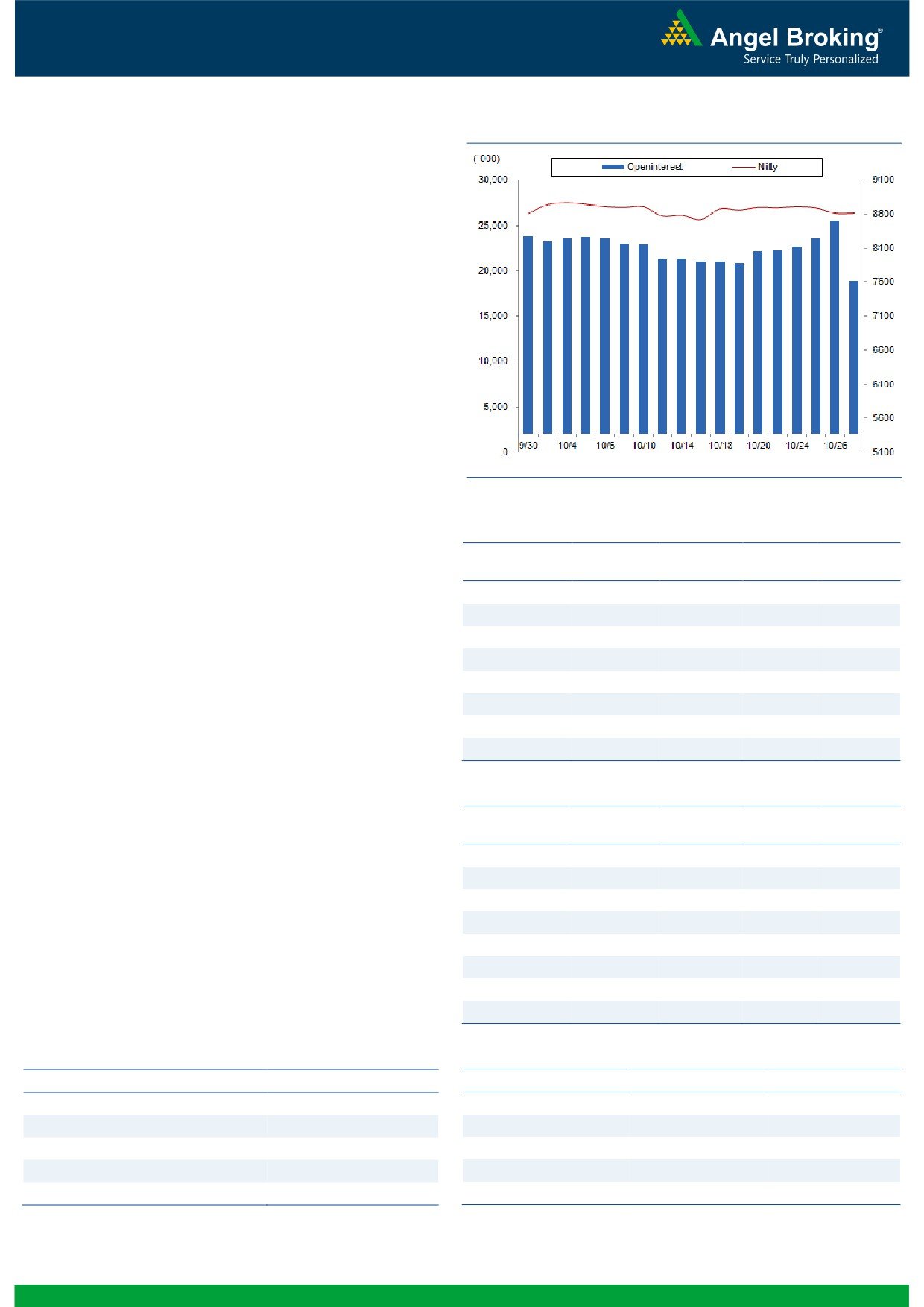

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19515)

Yesterday, the Nifty Bank index continued with its previous

session's bearish momentum as the index opened with marginal

loss and corrected sharply in initial hour of trades. The index then

consolidated in a narrow range for few hours and recovered the

losses in the concluding hour to post a positive closing.

The recent correction in Nifty Bank index was on our expected

lines as we had already initiated a 'Sell' call in the index future on

Tuesday. Yesterday, we witnessed a formation of 'Bullish Crab'

pattern on hourly chart, and thus, we suggested to book profits in

the short position. Going forward, the index may consolidate in a

range for couple of sessions before the next directional move.

Hence, intraday traders are advised to focus on stock specific

moves and trade with proper risk management. The immediate

supports for the Nifty Bank index are placed at 19330 and 19200

levels; whereas resistance is seen at 19650-19700 zone.

Key Levels

Support 1 - 19330

Resistance 1 - 19650

Support 2 - 19200

Resistance 2 - 19700

1

Technical & Derivatives Report

October 28, 2016

Comments

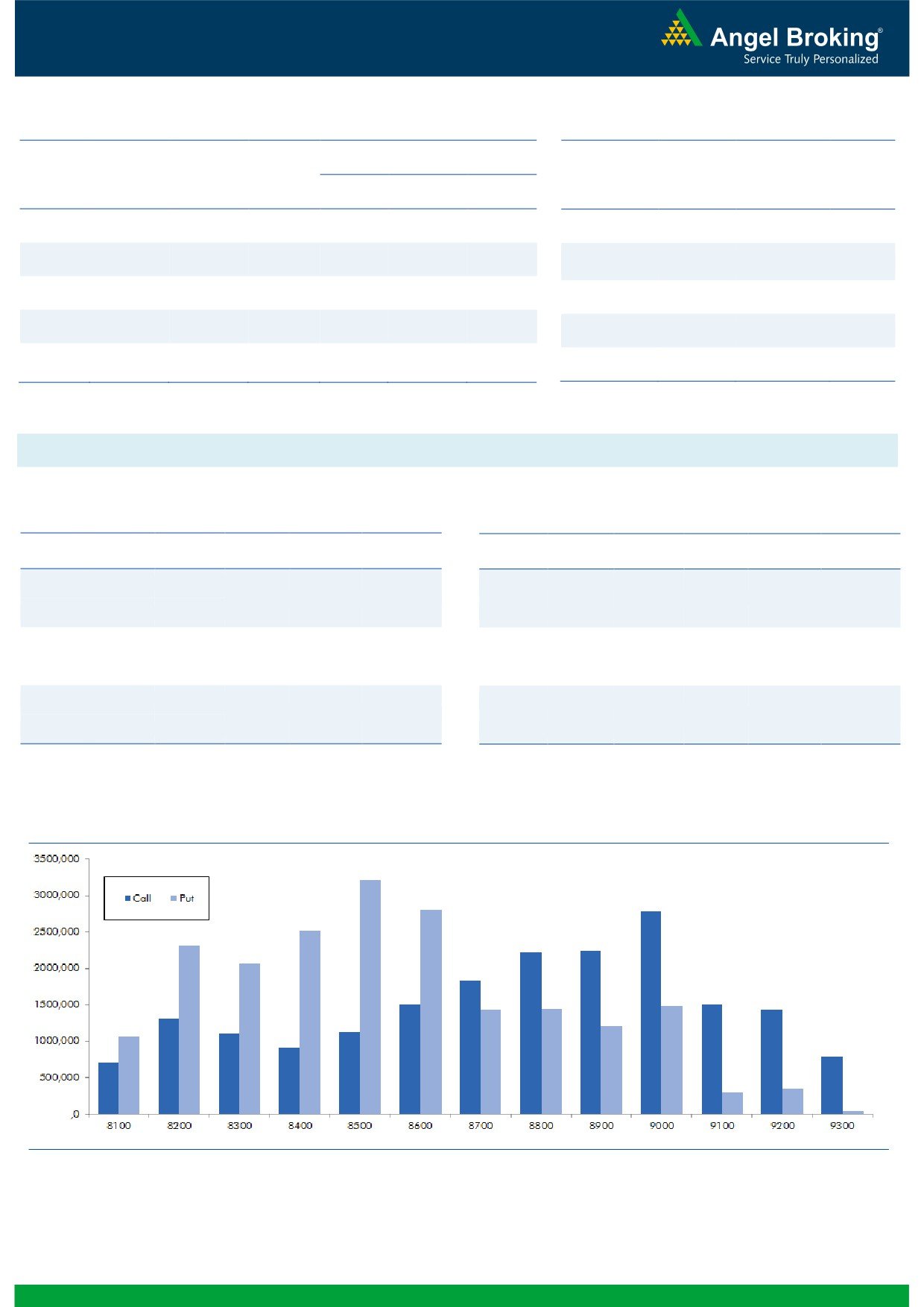

Nifty Vs OI

The Nifty futures open interest has decreased by 26.06%

BankNifty futures open interest has decreased by 29.86%

as market closed at 8615.25 levels.

The Nifty November future closed with a premium of

40.00 against the premium of 42.75 points in last

trading session. The December series closed at a

premium of 93.45 points.

The Implied Volatility of at the money options has

decreased from 15.33% to 13.13%. At the same time,

the PCR-OI of Nifty has increased from 0.90 to 0.97

levels.

The total OI of the market is Rs. 2,01,831/- cr. and the

stock futures OI is Rs. 74,651/- cr.

Few of the liquid counters where we have seen high cost

of carry are TATACOMM, JINDALSTEL, IBREALEST,

JPASSOCIAT and KPIT.

Views

OI Gainers

Yesterday, FIIs continue to sell in cash market segment to

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

the tune of Rs. 470 crores. While, in index futures, they

IBREALEST

36910000

9.62

88.00

1.62

were net buyers worth Rs. 819 crores with significant fall

TATACHEM

7012500

5.67

542.20

-1.54

in open interest, due to expiry.

-

-

-

-

-

On Index Options front, FIIs bought of worth Rs. 819ng.com

-

-

-

-

-

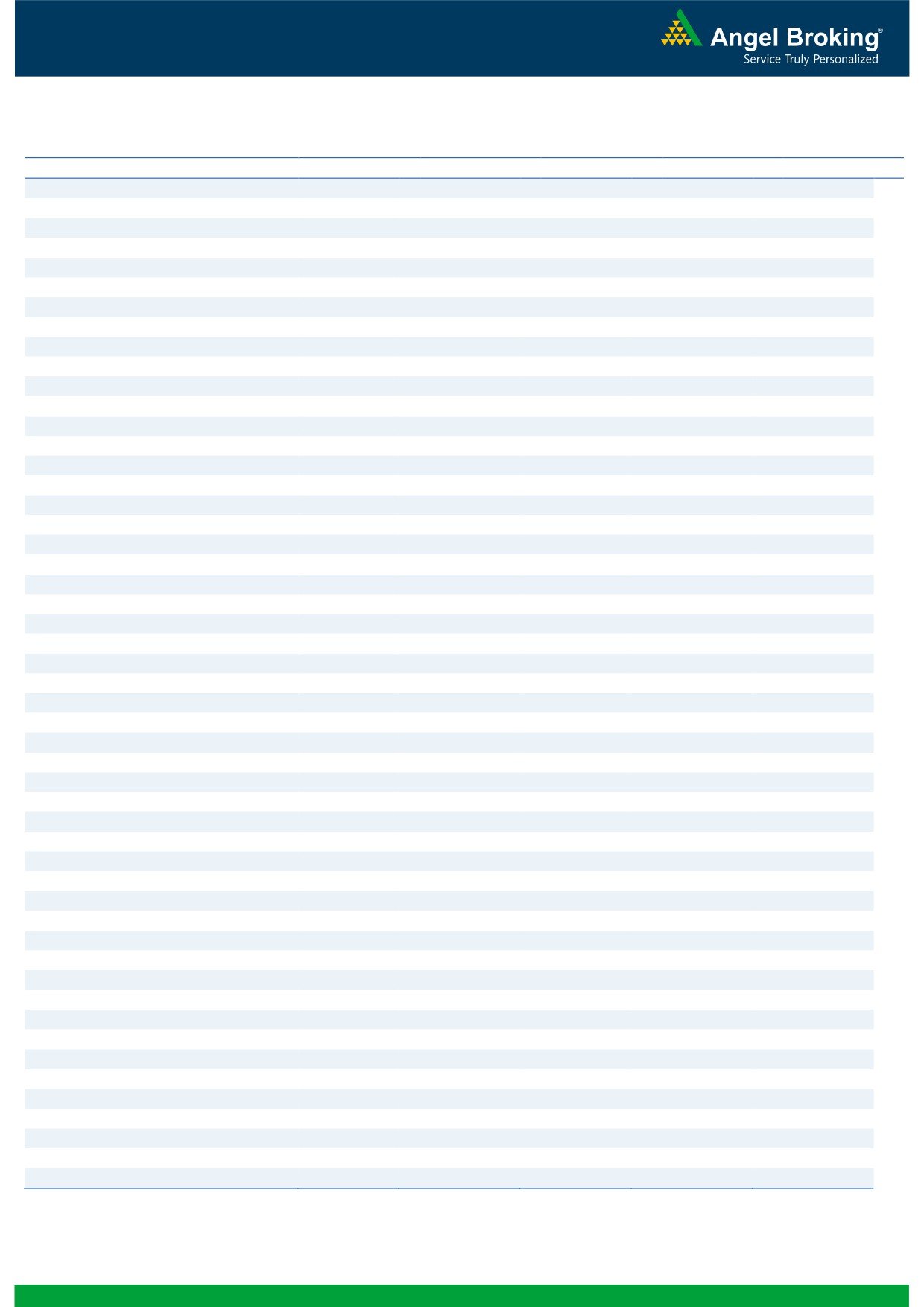

crores with fall in OI. In call options, 8600, 8800 and

-

-

-

-

-

8900 strikes were active and added good amount of

-

-

-

-

-

build-up. On the other hand, in put options, 8200-8600

-

-

-

-

-

strikes added fresh positions. Maximum OI in November

-

-

-

-

-

series has been placed at 9000 call and 8500 put

options.

Rollovers in Nifty and BankNifty in percentage term are

OI Losers

above last expiry but in terms of open interest it’s on the

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

lower side. Most of the longs formed in past two-three

COLPAL

798700

-59.50

940.65

1.39

series have been lighten up, due to which November

DIVISLAB

1291800

-42.23

1284.50

0.22

series is starting with low open interest. We believe,

CANBK

9048000

-37.87

315.50

-0.17

shorts formed in last few trading sessions are intact and

PCJEWELLER

643500

-37.28

509.75

-0.49

we may see some further downside in start of current

CEATLTD

1243200

-34.63

1205.45

-2.25

series. Large cap counter that started November series

HINDZINC

5824000

-32.97

250.50

-0.85

with high rollovers are ZEEL, GAIL, TATAMOTORS,

AMBUJACEM and AXISBANK.

GODREJCP

307600

-31.03

1586.25

-0.33

ICICIBANK

45882500

-30.07

285.25

1.84

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

TORNTPHARM

52.59

NIFTY

0.97

0.95

EXIDEIND

45.43

BANKNIFTY

0.87

0.66

MRF

55.37

AXISBANK

0.34

0.39

JUSTDIAL

42.90

RELIANCE

0.48

0.50

ASIANPAINT

30.07

ICICIBANK

0.55

0.56

2

Technical & Derivatives Report

October 28, 2016

FII Statistics for 27, October 2016

Turnover on 27, October 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

5443.61

4624.39

819.22

206033

13724.57

(29.15)

500552

34256.35

30.69

FUTURES

FUTURES

INDEX

INDEX

75903.30

72673.21

3230.09

707072

46210.03

(38.46)

10930304

760413.86

69.68

OPTIONS

OPTIONS

STOCK

25603.73

27416.26

(1812.53)

816896

53853.41

(16.35)

STOCK

FUTURES

1739442

120653.65

18.22

FUTURES

STOCK

STOCK

5421.64

5187.35

234.29

5783

368.14

(95.60)

OPTIONS

614496

46015.12

3.84

OPTIONS

TOTAL

112372.28

109901.21

2471.07

1735784

114156.16

(31.87)

TOTAL

13784794

961338.98

54.87

Nifty Spot = 8615.25

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8700

100.05

Buy

8600

101.60

41.30

58.70

8741.30

32.00

68.00

8568.00

Sell

8800

58.75

Sell

8500

69.60

Buy

8700

100.05

Buy

8600

101.60

69.00

131.00

8769.00

54.70

145.30

8545.30

Sell

8900

31.05

Sell

8400

46.90

Buy

8800

58.75

Buy

8500

69.60

27.70

72.30

8827.70

22.70

77.30

8477.30

Sell

8900

31.05

Sell

8400

46.90

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

October 28, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,498

1,514

1,530

1,545

1,561

ADANIPORTS

295

300

304

309

314

AMBUJACEM

238

241

245

248

252

ASIANPAINT

1,047

1,066

1,100

1,119

1,154

AUROPHARMA

791

800

808

818

826

AXISBANK

472

479

484

491

496

BAJAJ-AUTO

2,700

2,731

2,782

2,813

2,865

BANKBARODA

150

152

154

155

157

BHEL

135

137

138

140

141

BPCL

659

668

674

683

689

BHARTIARTL

309

316

321

328

333

INFRATEL

342

348

358

364

374

BOSCH

21,845

21,998

22,252

22,405

22,659

CIPLA

563

573

580

590

598

COALINDIA

312

314

317

319

322

DRREDDY

3,209

3,267

3,300

3,358

3,391

EICHERMOT

23,796

24,198

24,461

24,863

25,126

GAIL

428

432

434

438

441

GRASIM

939

949

963

973

987

HCLTECH

763

769

778

785

793

HDFCBANK

1,212

1,232

1,244

1,265

1,277

HDFC

1,309

1,344

1,363

1,398

1,418

HEROMOTOCO

3,206

3,260

3,355

3,409

3,504

HINDALCO

145

147

149

150

152

HINDUNILVR

805

822

836

854

868

ICICIBANK

271

278

281

288

291

IDEA

75

76

78

79

80

INDUSINDBK

1,154

1,167

1,184

1,196

1,213

INFY

991

998

1,008

1,015

1,025

ITC

237

240

243

245

248

KOTAKBANK

795

801

806

812

817

LT

1,446

1,460

1,471

1,486

1,497

LUPIN

1,453

1,469

1,489

1,505

1,525

M&M

1,280

1,290

1,303

1,313

1,326

MARUTI

5,714

5,798

5,873

5,957

6,032

NTPC

149

151

152

153

154

ONGC

277

284

291

297

304

POWERGRID

172

173

175

177

178

RELIANCE

1,039

1,045

1,049

1,055

1,060

SBIN

252

254

256

258

260

SUNPHARMA

731

739

745

753

758

TCS

2,340

2,379

2,404

2,443

2,468

TATAMTRDVR

326

332

337

343

348

TATAMOTORS

505

513

520

528

535

TATAPOWER

77

78

79

81

82

TATASTEEL

377

387

394

404

410

TECHM

405

411

419

425

433

ULTRACEMCO

3,887

3,919

3,944

3,976

4,001

WIPRO

451

457

465

470

479

YESBANK

1,208

1,233

1,267

1,292

1,326

ZEEL

487

496

508

517

530

4

Technical & Derivatives Report

October 28, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5