Technical & Derivatives Report

October 28, 2015

Sensex (27253) / Nifty (8233)

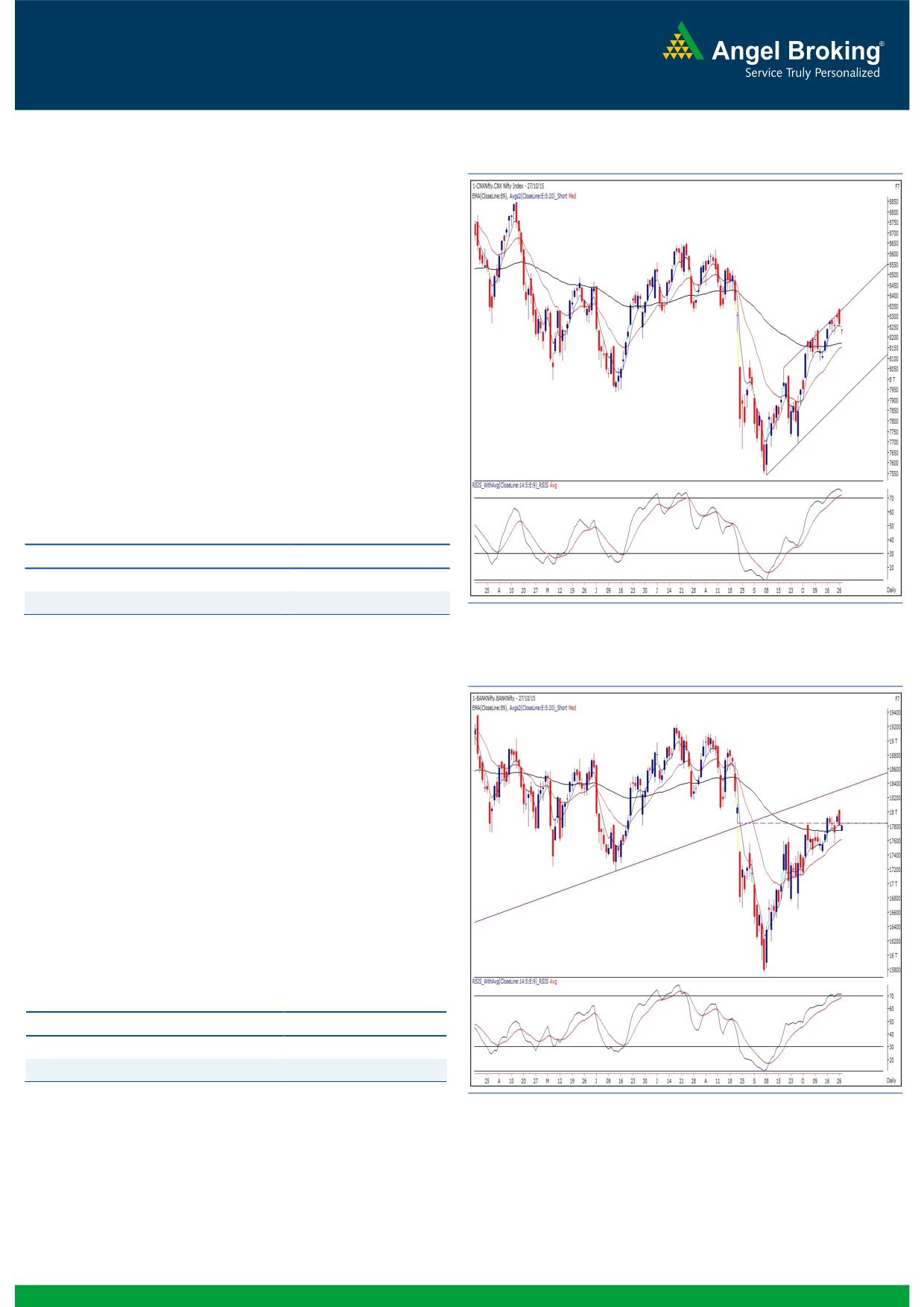

Exhibit 1: Nifty Daily Chart

Yesterday, our benchmark index opened lower tracking weak

global bourses. Subsequently, we witnessed a very thin trading

range throughout the session to end the session tad below the

8250 mark.

Technically speaking, we do not see any major change in the

chart structure due to very lethargic movement and narrow

trading range. Thus, we continue to expect a range bound

movement within the range of 8350 to 8170 for next couple of

days atleast. In order to form a directional view on the index, we

need to wait for further developments to happen on the chart.

Until then we continue to recommend a stock centric approach

with proper exits. Going forward, the intraday resistance for the

Nifty is placed at 8270 - 8300 levels; whereas, 8200 - 8170

levels would now act as an immediate support zone for the index.

Key Levels

Support 1 - 8200

Resistance 1 - 8270

Support 2 - 8170

Resistance 2 - 8300

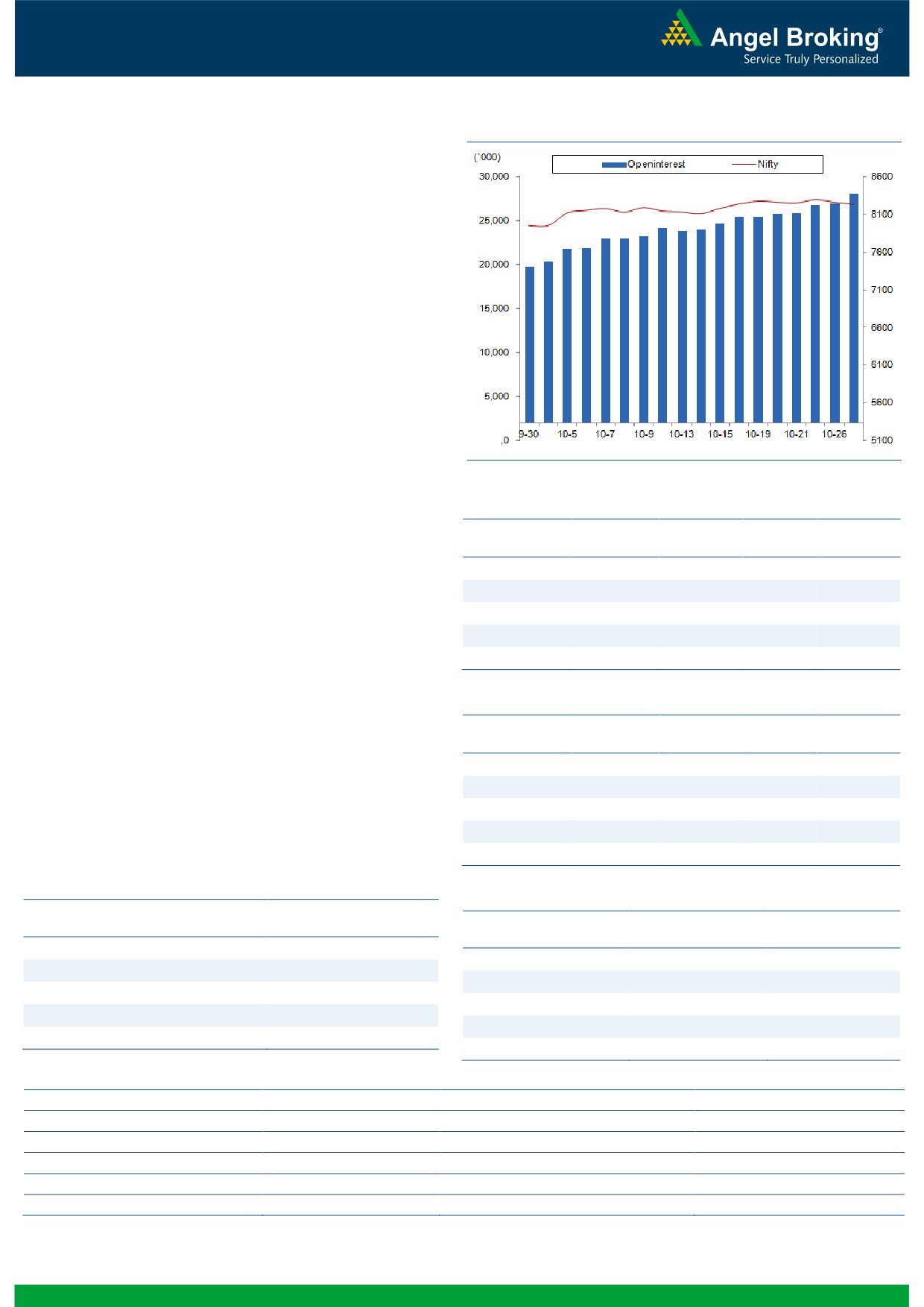

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (17806)

Post the gap down opening, the Bank Nifty continued to trade in

a narrow range and ended the session on a flat note. Recently,

we observed a breakout in the index; but, the follow up buying

interest (momentum) was clearly missing. The index then formed

a bearish engulfing pattern on Monday; but, this time, the bears

failed to keep the momentum on the downside. This indicates

indecisiveness among the market participants. The lack of

momentum clearly suggests no directional bias in the index and

hence, it's a prudent strategy to wait for some clear signs to form

a concrete view. The near term support levels for the index are

placed around 17565 and 17430 levels; whereas, resistances are

seen around 18040 and 18220 levels.

Key Levels

Support 1 - 17565

Resistance 1 - 18040

Support 2 - 17430

Resistance 2 - 18220

1

Technical & Derivatives Report

October 28, 2015

Comments

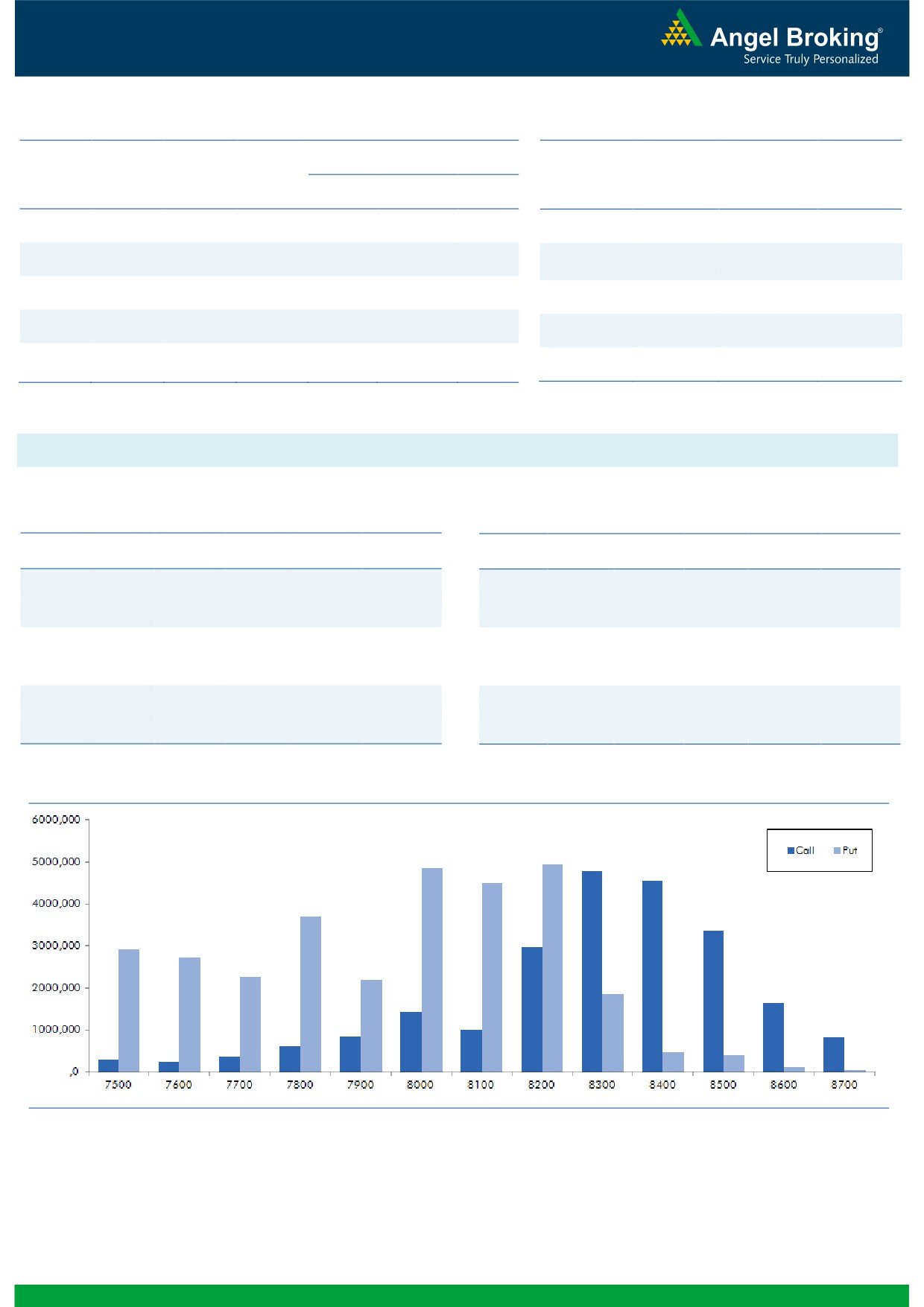

Nifty Vs OI

The Nifty futures open interest has increased by 4.15%

BankNifty futures open interest has increased by 2.59%

as market closed at 8232.90 levels.

The Nifty October future closed at a premium of 11.35

points against a premium of 3.05 points. The November

series closed at a premium of 47.05 points.

The Implied Volatility of at the money options has

decreased from 14.52% to 14.46%.

The total OI of the market is Rs. 2,47,682/- cr. and the

stock futures OI is Rs. 65,506/- cr.

Few of the liquid counters where we have seen high cost

of carry are UNITECH, TV18BRDCST, SAIL, UCOBANK

and GMRINFRA.

Views

OI Gainers

OI

PRICE

FIIs activity in cash market segment was subdued. In

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

Index Futures they bought to the tune of Rs. 624 crores

TVSMOTOR

7476000

32.62

274.90

12.85

with good amount of fall in OI, suggesting covering of

OIL

2301500

25.28

405.95

-2.74

shorts formed earlier in last trading session.

INDUSINDBK

4347250

16.26

956.05

-0.25

In Index Options front, they sold of worth Rs. 1087 crores

VOLTAS

6835400

16.01

287.45

-2.01

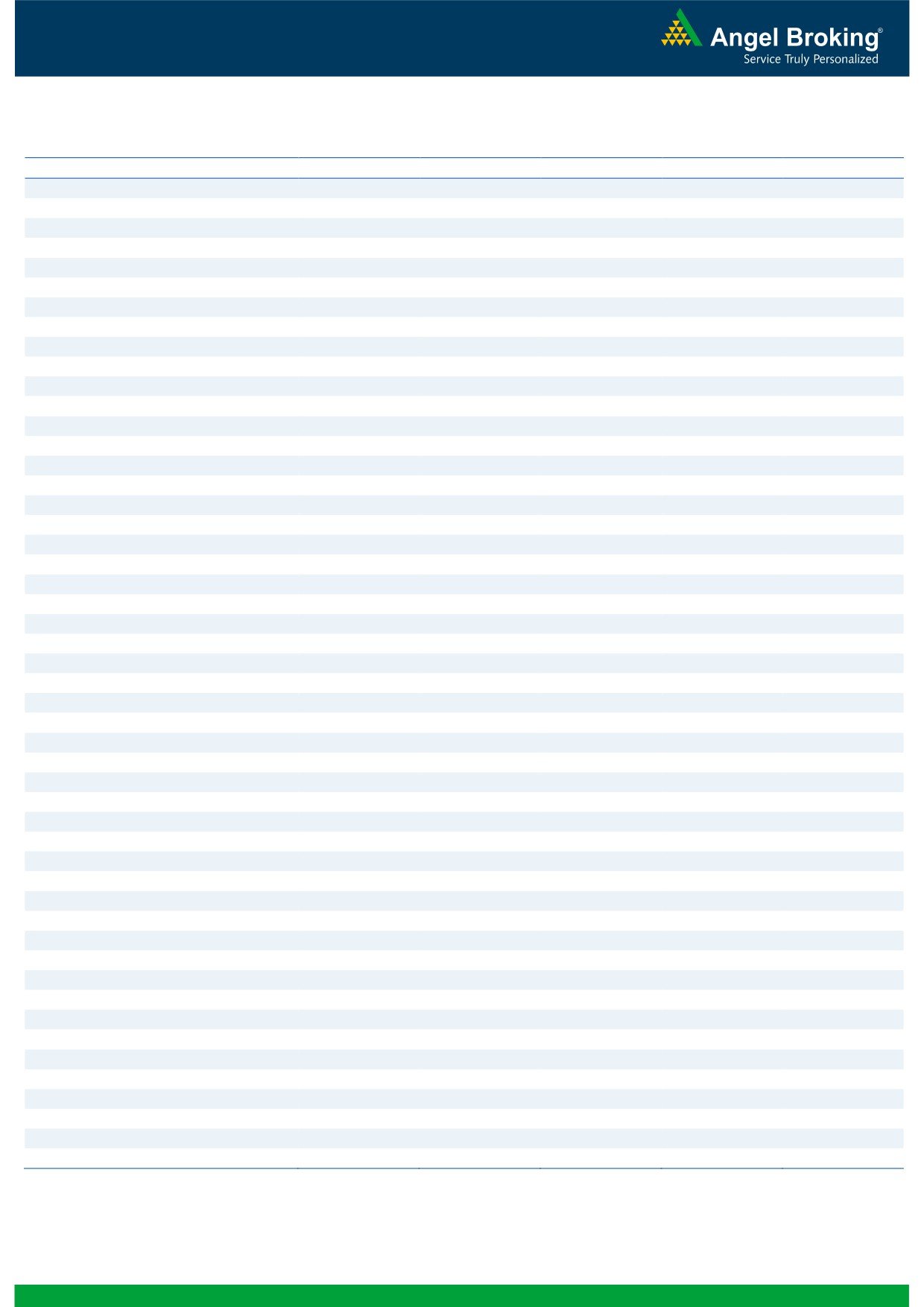

with fall in OI. In call options, we saw decent build-up inng.co

JSWENERGY

8762000

15.62

91.45

3.74

8250 call options, followed by huge unwinding in 8200

& 8300 call options. Out of the money calls 8350-8500

OI Losers

also shed good amount of OI. On the other hand in put

OI

PRICE

options, we hardly saw any strikes adding fresh OI, good

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

amount of unwinding was visible in 8200-8300 put

BATAINDIA

2570500

-12.39

523.45

1.02

options. Maximum OI is seen in 8300 call and 8200 put

JUSTDIAL

1651750

-8.50

993.15

-0.17

options. One should avoid forming shorts in Nifty till we

BHEL

21551000

-8.04

214.90

-1.53

see any short formation. Roll-over in Nifty and BankNifty

MCLEODRUSS

2764600

-5.89

178.95

2.37

is at 46.10% & 31.41% respectively.

PETRONET

4176000

-5.69

194.85

-0.26

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

TVSMOTOR

67.94

NIFTY

1.10

0.86

LUPIN

40.01

BANKNIFTY

0.97

0.93

UPL

48.39

INFY

0.36

0.42

APOLLOHOSP

33.21

RELIANCE

0.97

0.70

SYNDIBANK

47.90

TATAMOTORS

1.20

0.96

Strategy Date

Symbol

Strategy

Status

September 28, 2015

NIFTY

Long Strangle

Profit booked on October 16, 2015

October 05, 2015

SBIN

Ratio Bear Put Spread

Active

October 12, 2015

LT

Long Put Ladder

Active

October 19, 2015

NIFTY

Long Put

Book Loss on October 27, 2015

October 26, 2015

INFY

Long Call

Active

2

Technical & Derivatives Report

October 28, 2015

FII Statistics for 27-October 2015

Turnover on 27-October 2015

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

5713.96

5089.69

624.28

895664

28107.65

(5.65)

567343

17446.09

5.87

FUTURES

FUTURES

INDEX

INDEX

11959.91

13047.33

(1087.42)

2230056

75410.41

(5.92)

7954209

190230.12

-4.28

OPTIONS

OPTIONS

STOCK

15392.23

16037.22

(645.00)

1478678

52005.09

(8.18)

STOCK

FUTURES

1683860

56286.91

19.45

FUTURES

STOCK

STOCK

3101.64

3039.17

62.47

141506

3876.32

8.25

OPTIONS

627576

20259.86

43.65

OPTIONS

TOTAL

36167.73

37213.41

(1045.68)

4745904

159399.48

(6.22)

TOTAL

10832988

284222.98

2.81

Nifty Spot = 8232.90

Lot Size = 25

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8300

15.10

Buy

8200

19.05

13.10

86.90

8313.10

14.15

85.85

8185.85

Sell

8400

2.00

Sell

8100

4.90

Buy

8300

15.10

Buy

8200

19.05

14.55

185.45

8314.55

17.50

182.50

8182.50

Sell

8500

0.55

Sell

8000

1.55

Buy

8400

2.00

Buy

8100

4.90

1.45

98.55

8401.45

3.35

96.65

8096.65

Sell

8500

0.55

Sell

8000

1.55

Nifty Put-Call Analysis

3

Technical & Derivatives Report

October 28, 2015

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,370

1,378

1,388

1,396

1,406

AMBUJACEM

201

203

207

209

212

ASIANPAINT

813

820

825

832

837

AXISBANK

509

515

522

528

535

BAJAJ-AUTO

2,537

2,560

2,577

2,600

2,617

BANKBARODA

165

167

170

171

175

BHARTIARTL

345

349

352

356

358

BHEL

209

212

216

218

222

BOSCHLTD

21,302

21,463

21,622

21,783

21,941

BPCL

888

901

909

922

930

CAIRN

154

156

158

160

162

CIPLA

666

675

682

691

697

COALINDIA

325

329

332

336

339

DRREDDY

4,126

4,153

4,189

4,215

4,251

GAIL

307

313

322

328

337

GRASIM

3,643

3,665

3,692

3,714

3,741

HCLTECH

846

857

865

876

885

HDFC

1,251

1,263

1,284

1,296

1,317

HDFCBANK

1,088

1,100

1,107

1,118

1,125

HEROMOTOCO

2,560

2,590

2,617

2,647

2,674

HINDALCO

82

83

85

86

87

HINDUNILVR

793

803

809

818

824

ICICIBANK

280

282

284

286

288

IDEA

138

139

141

143

145

INDUSINDBK

946

950

955

959

964

INFY

1,139

1,144

1,150

1,155

1,160

ITC

352

354

355

358

359

KOTAKBANK

653

657

661

665

670

LT

1,470

1,482

1,503

1,515

1,536

LUPIN

1,875

1,910

1,968

2,003

2,061

M&M

1,221

1,235

1,248

1,263

1,275

MARUTI

4,322

4,410

4,464

4,551

4,605

NMDC

96

97

98

99

100

NTPC

130

131

132

134

134

ONGC

243

245

250

252

257

PNB

133

133

134

135

136

POWERGRID

132

133

135

136

137

RELIANCE

931

935

942

946

953

SBIN

246

247

250

251

254

VEDL

100

102

104

107

109

SUNPHARMA

875

892

902

919

929

TATAMOTORS

379

381

384

386

389

TATAPOWER

70

70

71

72

72

TATASTEEL

241

243

247

249

253

TCS

2,508

2,519

2,532

2,544

2,557

TECHM

532

535

540

543

548

ULTRACEMCO

2,807

2,859

2,887

2,938

2,967

WIPRO

561

568

573

580

584

YESBANK

736

743

750

758

764

ZEEL

418

421

425

428

432

4

Technical & Derivatives Report

October 28, 2015

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5