Technical & Derivatives Report

January 28, 2016

Sensex (24492) / Nifty (7438)

Exhibit 1: Nifty Daily Chart

Yesterday, our markets opened on a subdued note as

compared to Monday’s close. Subsequently, we witnessed a

range bound action within merely

60 points on Nifty

throughout the session to conclude on a flat note.

Technically speaking, we are not observing any major change

in the chart structure, except, a positive crossover in ‘RSI-

Smoothened’ oscillator on daily chart. Considering this

evidence, we maintain our view that the Nifty is likely to extend

this bounce towards 7520 - 7550 levels. On the flipside,

7327 is now seen as an immediate support level for the index.

The coming session may trade with enhanced volatility on

account of January series derivative expiry on NSE. Thus,

traders should make a note of it and accordingly, form your

trading strategies for the day.

Key Levels

Support 1 - 7327

Resistance 1 - 7520

Support 2 - 7241

Resistance 2 - 7550

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (15535)

The Nifty Bank index opened with marginal gains and traded

in a narrow range throughout the session. Eventually, the

banking index ended the session with negligible losses of 0.17

percent over its previous close.

Although the index remained in a narrow range, we witnessed

positive biasness in the PSU banking space which led to gains

of 1.28% in Nifty PSU Bank index and thus it outperformed the

benchmark. The rangebound movement in last couple of

sessions just seems to be a pause within this pullback move.

We are thus, expecting further upside in the Nifty Bank index

in near term. Owing to F&O expiry slated today, we may see

volatility in the stock specific moves and thus traders are

advised to remain light on their positions with proper exit

strategy. For short term trading, the crucial support for the

index is placed around 15425 and 15270 whereas resistances

are seen around 15765 and 16150.

Key Levels

Support 1 - 15425

Resistance 1 - 15765

Support 2 - 15270

Resistance 2 - 16150

1

Technical & Derivatives Report

January 28, 2016

Comments

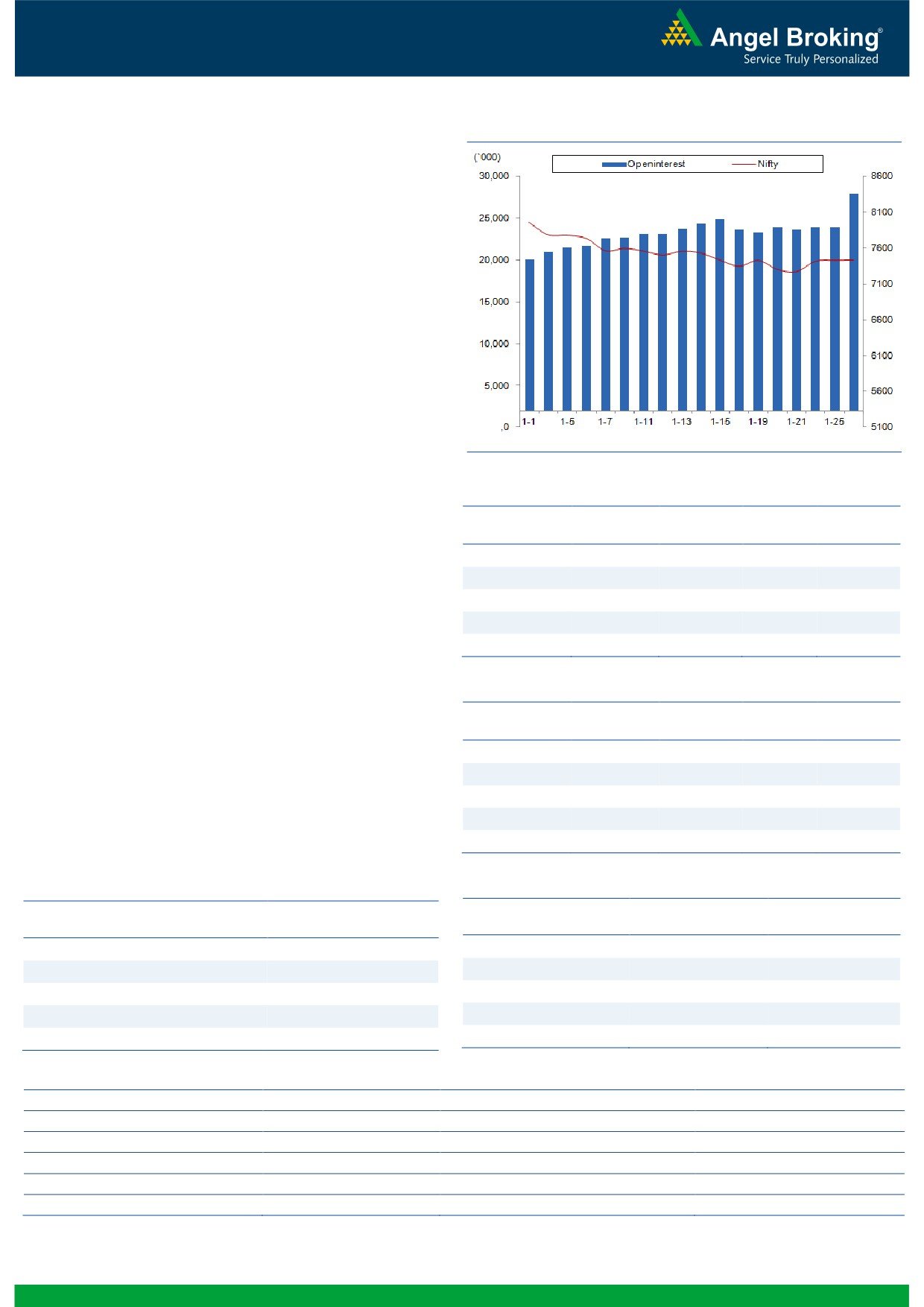

Nifty Vs OI

The Nifty futures open interest has increased by 16.63%

BankNifty futures open interest has decreased by 1.54%

as market closed at 7437.75 levels.

The Nifty January future closed at a discount of 4.35

points against a discount of 0.70 points. The February

series closed at a premium of 5.55 points.

The Implied Volatility of at the money options has

increased from 14.61% to 17.86 %.

The total OI of the market is Rs. 2,66,296/- cr. and the

stock futures OI is Rs. 65,858 /- cr.

Few of the liquid counters where we have seen high cost

of carry are UNITECH, JPASSOCIAT, RELINFRA, GAIL

and FEDERALBNK.

Views

FIIs were net seller in both equity cash and Index future

OI Gainers

segment on Monday. They sold equities to the tune of Rs.

OI

PRICE

SCRIP

OI

PRICE

366 crores; while in Index Futures, they sold worth Rs.

CHG. (%)

CHG. (%)

619 crores with significant rise in OI, indicating short

POWERGRID

27388000

33.18

138.45

3.79

build-up in last trading session.

GODREJCP

302800

26.80

1148.55

-0.46

In Index Options front, FII’s were net buyers of Rs. 1051

KSCL

3533250

23.88

327.95

-1.07

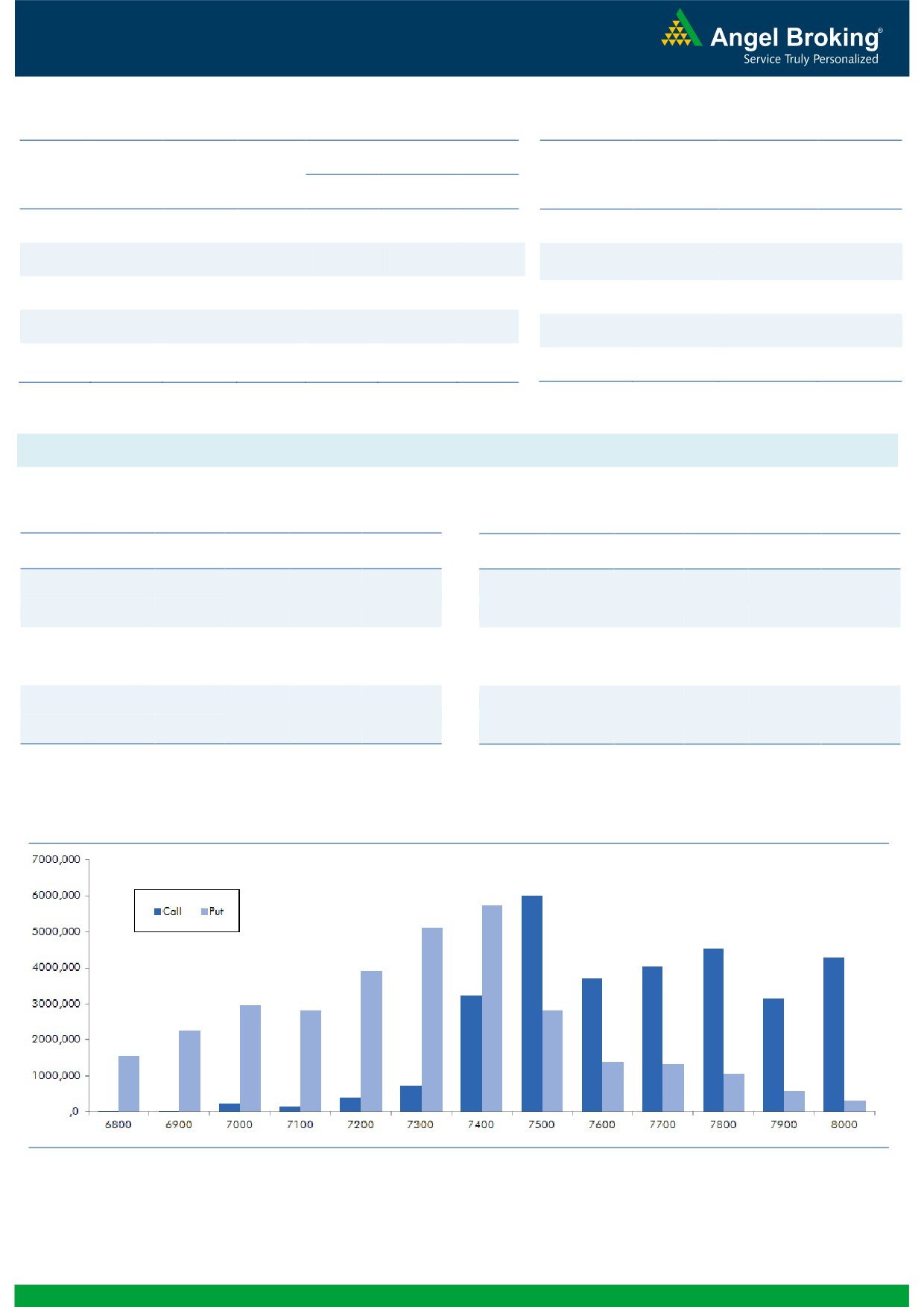

crores with marginal change in OI. In call options, 7450

INDUSINDBK

7515000

23.37

908.15

0.31

strike was active and they added some OI. Good amount

ADANIPOWER

95520000

22.02

28.45

0.89

of unwinding was seen in 7600 call options. While in put

options, 7400 strike added good amount of OI, followed

OI Losers

by unwinding in 7300 put option. Maximum build-up in

OI

PRICE

SCRIP

OI

PRICE

current series is now visible in 7500 call and 7400 put

CHG. (%)

CHG. (%)

options. We believe, we may not see any major fall or

ARVIND

4170100

-16.76

314.00

-0.82

bounce in Nifty from current levels in January series.

IOB

14392000

-16.35

26.10

1.56

Nifty may test the resistance zone of 7500-7550 levels;

MCLEODRUSS

3240600

-15.10

148.65

2.62

one should book profits near these levels.

UNIONBANK

16026000

-14.01

130.50

10.17

APOLLOTYRE

9975000

-13.97

145.55

2.36

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

DIVISLAB

31.40

NIFTY

0.83

0.87

POWERGRID

29.24

BANKNIFTY

0.87

0.99

PIDILITIND

27.28

SBIN

0.34

0.40

UNIONBANK

75.97

RELIANCE

0.39

0.46

HINDZINC

46.93

INFY

1.00

1.31

Strategy Date

Symbol

Strategy

Status

January 04, 2016

SBIN

Ratio Bear Put Spread

Loss booked on Jan 15, 2016

January 11, 2016

TCS

Short Strangle

Profit booked on Jan 18, 2016

January 18, 2016

HINDUNILVR

Short Strangle

Profit booked on Jan 25, 2016

January 25, 2016

TCS

Long Call

Didn’t triggered

2

Technical & Derivatives Report

January 28, 2016

FII Statistics for 27-January 2015

Turnover on 27-January 2015

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

7469.20

8088.53

(619.34)

357325

19321.25

14.98

524106

27687.21

27.99

FUTURES

FUTURES

INDEX

INDEX

36358.22

35306.41

1051.81

1638737

89786.70

(0.08)

5590016

305781.04

11.45

OPTIONS

OPTIONS

STOCK

24293.30

23441.03

852.27

1196417

53704.29

6.08

STOCK

FUTURES

1593655

72519.05

32.31

FUTURES

STOCK

STOCK

2200.72

2237.67

(36.95)

101637

4661.66

(1.23)

OPTIONS

339775

16141.93

-0.68

OPTIONS

TOTAL

70321.44

69073.65

1247.79

3294116

167473.90

3.54

TOTAL

8047552

422129.23

15.00

Nifty Spot = 7437.75

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7500

13.45

Buy

7400

24.30

10.60

89.40

7510.60

17.20

82.80

7382.80

Sell

7600

2.85

Sell

7300

7.10

Buy

7500

13.45

Buy

7400

24.30

12.60

187.40

7512.60

21.30

178.70

7378.70

Sell

7700

0.85

Sell

7200

3.00

Buy

7600

2.85

Buy

7300

7.10

2.00

98.00

7602.00

4.10

95.90

7295.90

Sell

7700

0.85

Sell

7200

3.00

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Jan. Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

January 28, 2016

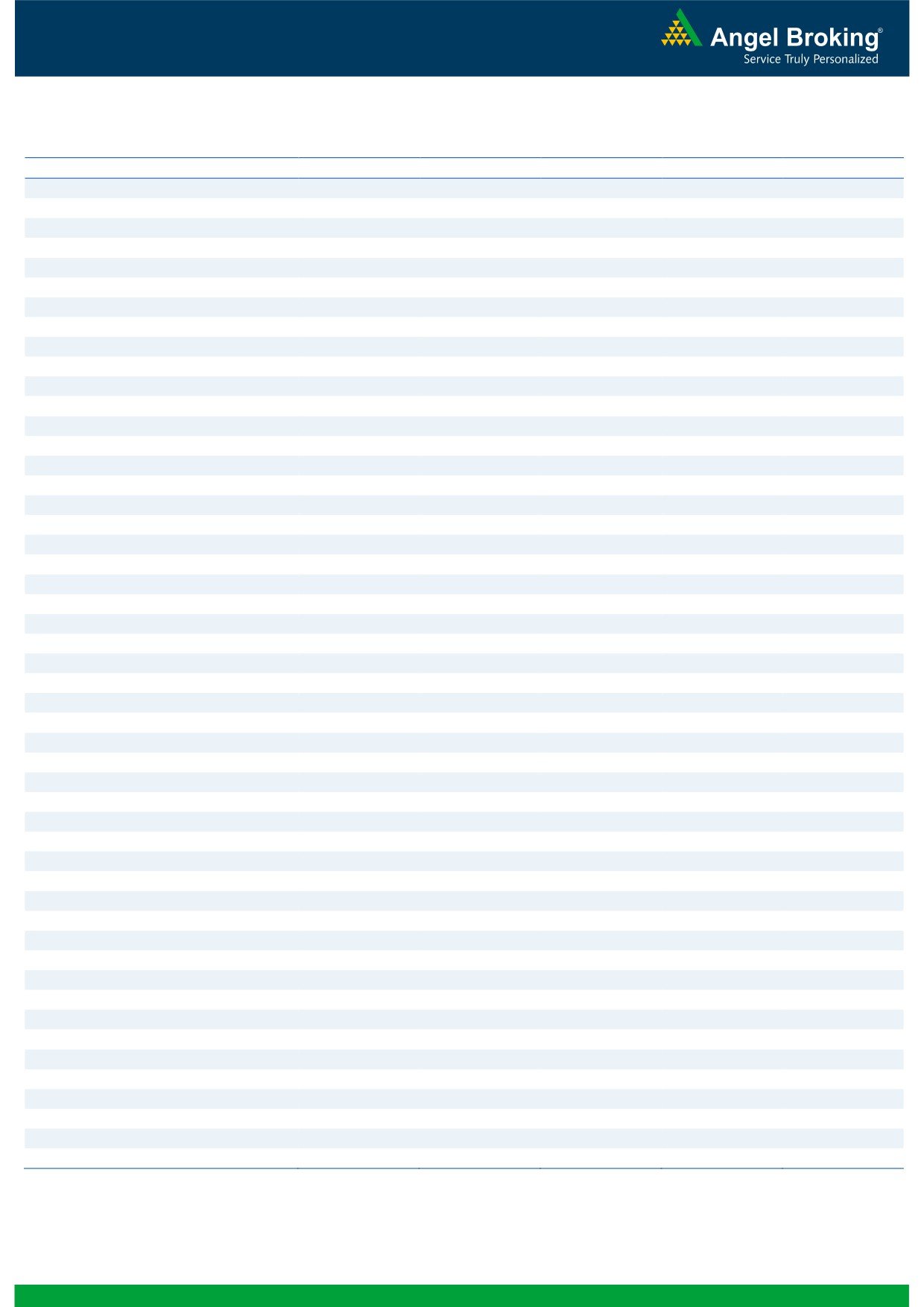

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,214

1,222

1,236

1,244

1,258

ADANIPORTS

211

213

217

219

222

AMBUJACEM

187

189

193

196

200

ASIANPAINT

179

182

184

187

189

AXISBANK

839

849

865

875

892

BAJAJ-AUTO

403

409

418

424

433

BANKBARODA

2,259

2,281

2,307

2,329

2,355

BHARTIARTL

123

126

129

132

135

BHEL

289

293

296

301

304

BOSCHLTD

135

137

142

144

148

BPCL

16,998

17,141

17,383

17,526

17,768

CAIRN

856

863

876

883

896

CIPLA

115

117

118

120

121

COALINDIA

565

573

580

588

596

DRREDDY

295

300

303

307

310

GAIL

2,870

2,921

2,952

3,003

3,034

GRASIM

345

352

357

364

369

HCLTECH

3,372

3,398

3,441

3,467

3,509

HDFC

825

831

836

841

846

HDFCBANK

1,147

1,158

1,173

1,185

1,200

HEROMOTOCO

1,023

1,030

1,039

1,045

1,055

HINDALCO

2,429

2,456

2,502

2,529

2,575

HINDUNILVR

70

70

72

72

74

ICICIBANK

755

762

773

779

790

IDEA

233

235

237

240

242

INDUSINDBK

105

107

109

111

113

INFY

864

886

902

924

940

ITC

1,126

1,132

1,141

1,147

1,156

KOTAKBANK

304

309

311

316

319

LT

658

667

674

683

691

LUPIN

1,085

1,096

1,109

1,121

1,134

M&M

1,626

1,658

1,691

1,723

1,756

MARUTI

1,127

1,152

1,175

1,200

1,223

NTPC

4,041

4,076

4,128

4,163

4,215

ONGC

136

140

142

146

148

PNB

214

216

219

221

224

POWERGRID

89

91

93

95

97

RELIANCE

131

135

137

141

143

SBIN

989

994

1,002

1,007

1,015

VEDL

62

63

64

65

67

SUNPHARMA

804

813

818

827

832

TATAMOTORS

329

333

337

341

345

TATAPOWER

60

61

62

62

63

TATASTEEL

250

254

257

261

263

TCS

2,262

2,291

2,311

2,339

2,359

TECHM

492

498

507

512

521

ULTRACEMCO

2,714

2,733

2,759

2,778

2,804

WIPRO

539

546

550

557

562

YESBANK

656

667

676

687

696

ZEEL

391

394

396

399

402

4

Technical & Derivatives Report

January 28, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5