Technical & Derivatives Report

December 27, 2016

Sensex (25807) / Nifty (7908)

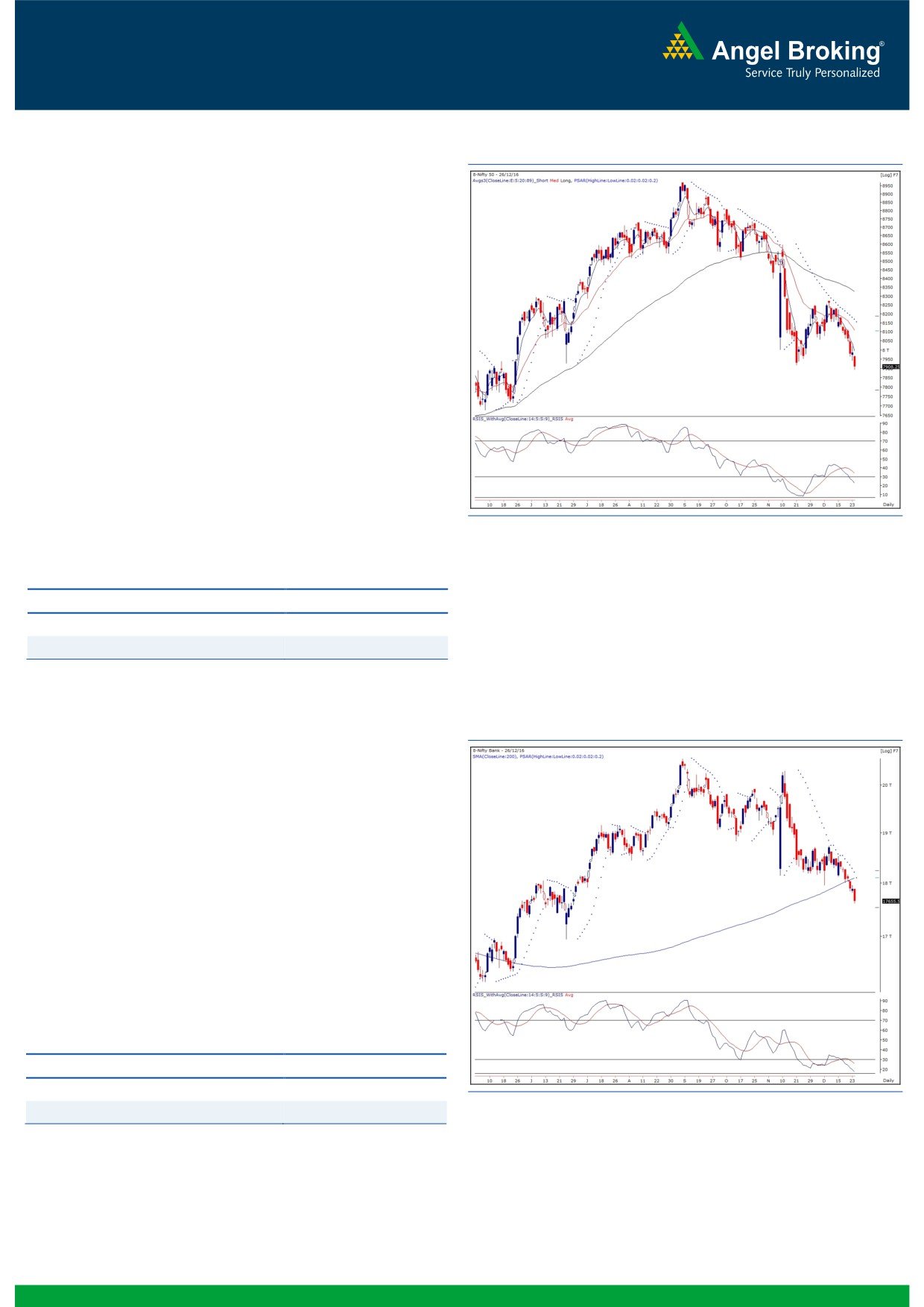

Exhibit 1: Nifty Daily Chart

A breather on Friday was followed by yet another gap down

opening to start the proceedings for the concluding week of the

calendar year. The price movement was certainly not so

encouraging as the Nifty slipped below the important swing low

of 7916.40 to post a new seven-month low.

Honestly speaking, we were not expecting this corrective move to

extend below 8000; but, it has happened and thus, we need to

now reassess the price development for next couple of days.

Although, considering multiple technical evidences, we do not

expect any major downside form current level, we would like to

stay on the sidelines and wait for a clear trend reversal on charts.

We continue with our opinion that one should stay away from

creating fresh short positions as the market seems extremely

oversold. For the coming session, yesterday’s high of 7970 would

act as an immediate hurdle, whereas a sustainable move below

yesterday’s low 7893.80 may lead to further weakness towards

7876 - 7850 levels.

Key Levels

Support 1 - 7876

Resistance 1 - 7970

Support 2 - 7850

Resistance 2 - 8000

Nifty Bank Outlook - (17656)

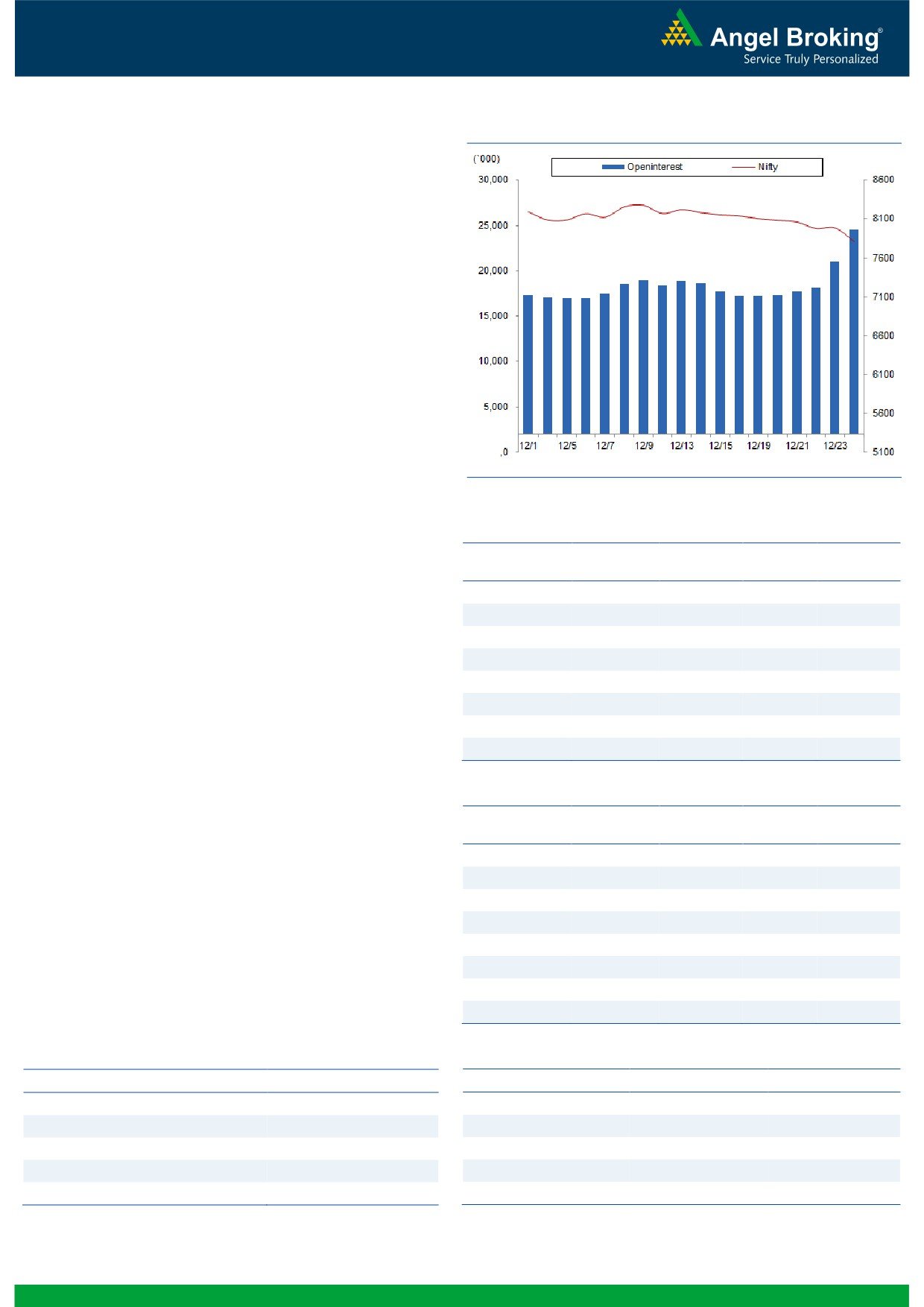

Exhibit 2: Nifty Bank Daily Chart

The Nifty Bank index continued its corrective move and ended

yesterday's session with loss of 1.28 percent.

As of now, the bears seem to be in control over the stocks within

the sector as the index continued its corrective move below the

'200 SMA'. The PSU Banks were clearly under pressure yesterday

as the Nifty PSU Bank index lost 2.70 percent. The index is

trading near the weekly '89EMA' support which is placed around

17600. However, unless signs of reversal seen, traders are

advised to avoid trading in the index and trade on stock specific

moves. The intraday supports for the Nifty Bank index are placed

around 17600 and 17498 whereas resistances are seen around

17820 and 17900.

Key Levels

Support 1 - 17600

Resistance 1 - 17820

Support 2 - 17498

Resistance 2 - 17900

1

Technical & Derivatives Report

December 27, 2016

Comments

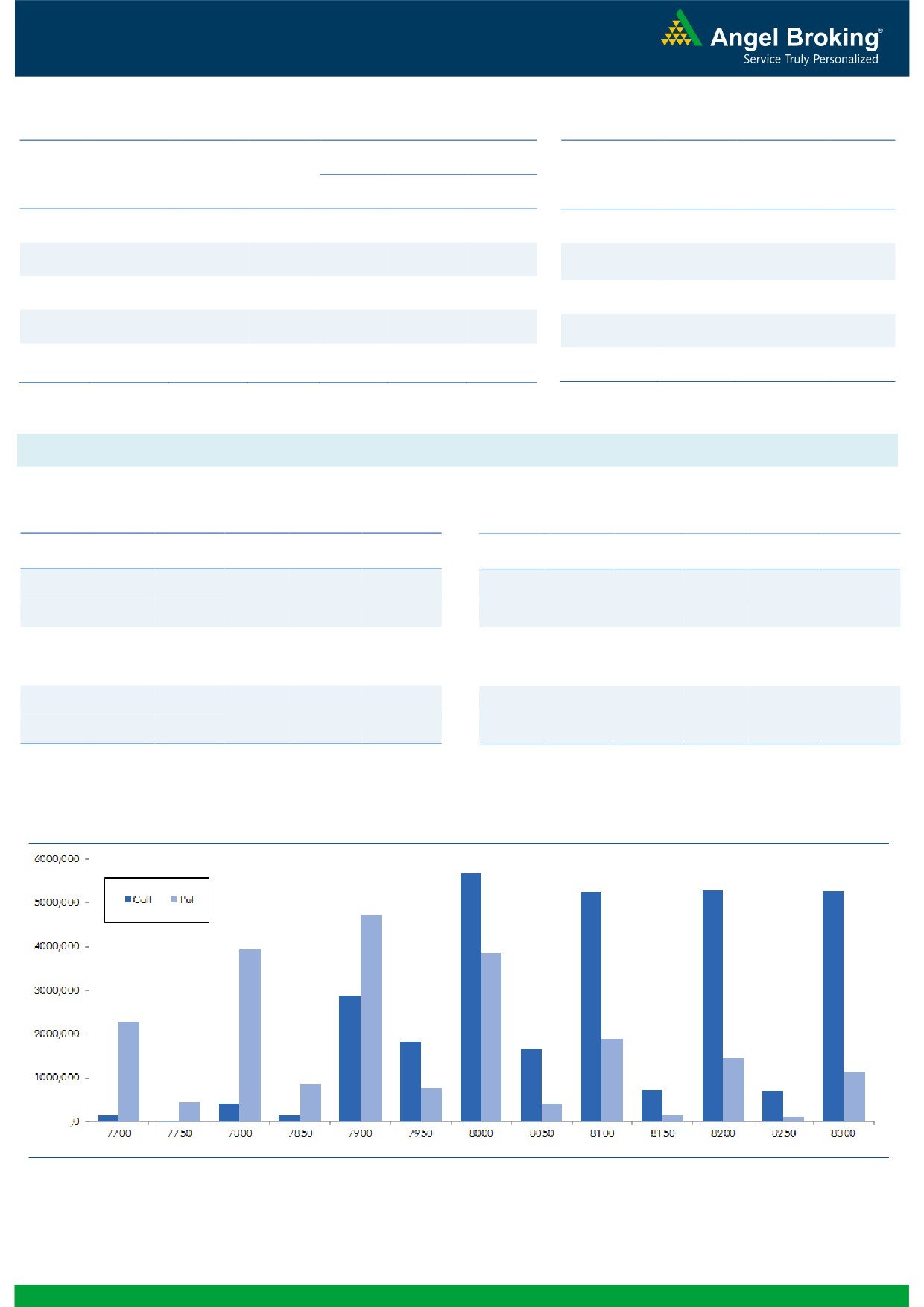

Nifty Vs OI

The Nifty futures open interest has increased by 16.55%

BankNifty futures open interest has increased by 8.76%

as market closed at 7908.25 levels.

The Nifty December future closed with a premium of

3.05 against the premium of 9.25 points in last trading

session. The January series closed at a premium of

34.35 points.

The Implied Volatility of at the money options has

increased from 11.94 % to 14.84%. At the same time,

the PCR-OI of Nifty has decreased from 0.92 to 0.83

levels.

The total OI of the market is Rs. 2,83,096/- cr. and the

stock futures OI is Rs. 73,119/- cr.

Few of the liquid counters where we have seen high cost

of carry are GMRINFRA, JINDALSTEL, RPOWER,

ADANIPOWER and MINDTREE.

Views

OI Gainers

FIIs continued their selling streak in cash segment; they

OI

PRICE

sold equities worth Rs. 1095 crores. While in index

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

futures, they were marginal buyers with significant rise in

DIVISLAB

3238800

48.05

763.95

-11.50

open interest, indicating formation of huge positions on

HDIL

31440000

17.70

54.25

-6.71

both long and short side in previous trading session.

BANKBARODA

50781500

16.93

147.70

-3.50

www.angelbroking.com

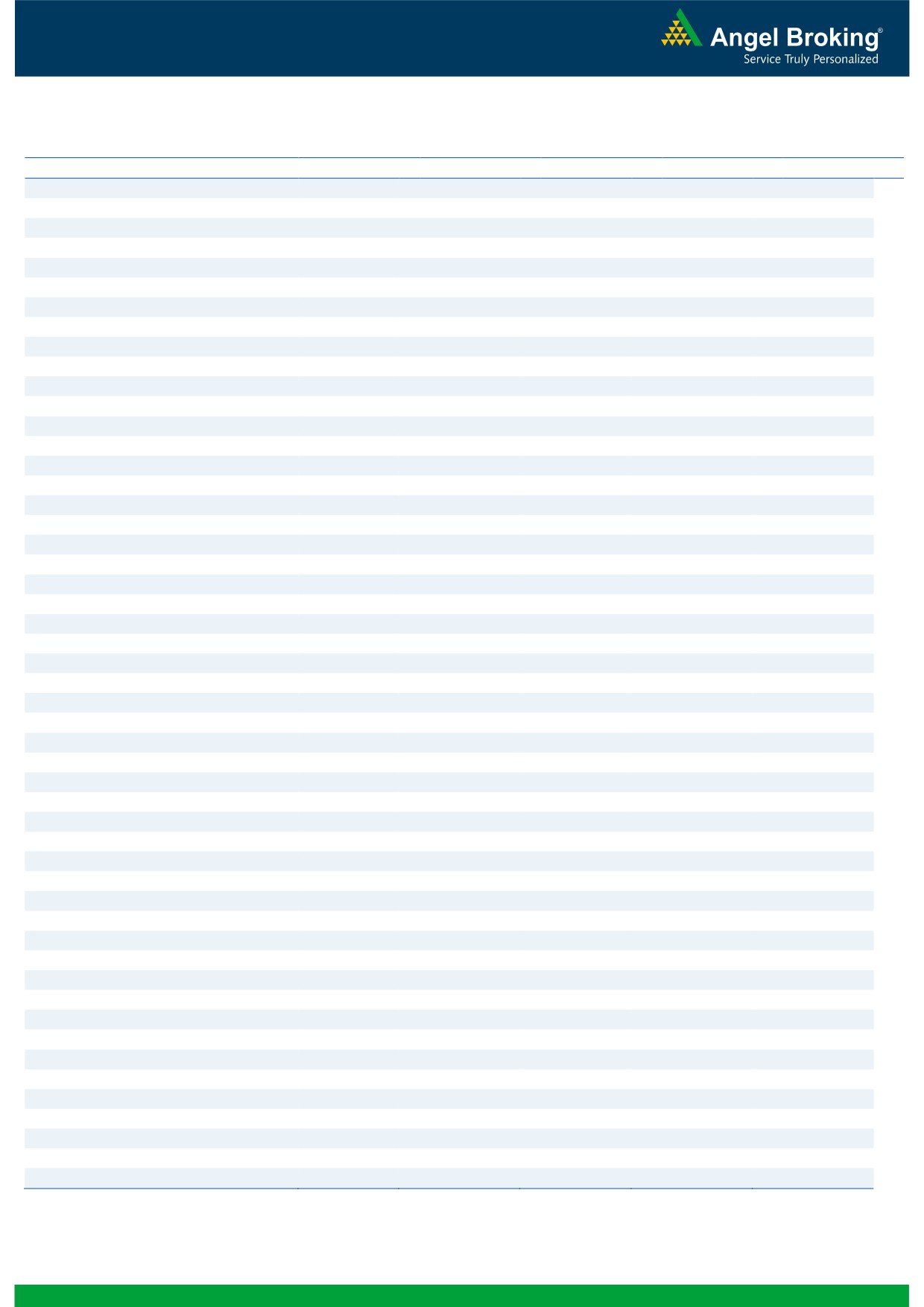

In index option segment, FIIs bought worth Rs.

956

RPOWER

65532000

14.10

39.65

-3.88

crores with negligible change in open interest. In call

ASIANPAINT

7004400

11.10

868.55

-0.64

options, significant build-up was visible in 7900-8000

CUMMINSIND

738600

10.11

790.90

-1.04

strikes and we believe these are longs formed by retailers

JUBLFOOD

2779000

10.04

787.55

0.36

in the hope of market recovering from current levels.

MARICO

9235200

8.29

239.70

-2.52

While in put options, we hardly saw any relevant OI

addition. However, good amount of unwinding was seen

OI Losers

in 8000 put option. Highest OI in current series has been

OI

PRICE

shifted from 8300 to 8000 call and of put option from

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

8000 to 7900 strike price.

BHARATFIN

13615000

-10.90

479.55

-7.93

Since past three trading session, we are witnessing

CANBK

15066000

-8.24

263.30

-5.76

significant open interest addition in Index Futures, which

L&TFH

29862000

-5.98

81.75

-3.02

are blend of both long and short positions. While in cash

TVSMOTOR

7888000

-5.47

366.65

-0.91

segment FIIs continue their selling. Hence, considering

CONCOR

662000

-5.29

1095.25

-0.45

the above data, we would like to wait for some clear

WOCKPHARMA

3697800

-5.27

634.85

-4.31

indication on direction front. Traders are suggested to

CEATLTD

1675800

-4.92

1137.25

-0.85

remain light in Index and prefer stock specific approach

M&MFIN

10975000

-3.52

249.85

-2.69

to trade as of now.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

SOUTHBANK

44.73

NIFTY

0.83

0.83

CIPLA

37.83

BANKNIFTY

0.92

0.80

ENGINERSIN

51.53

SUNPHARMA

0.42

0.53

CANBK

45.64

SBIN

0.46

0.49

NIITTECH

33.18

INFY

0.63

0.68

2

Technical & Derivatives Report

December 27, 2016

FII Statistics for December 26, 2016

Turnover on December 26, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

3203.97

3105.93

98.04

262935

16076.18

21.87

275195

16377.69

1.74

FUTURES

FUTURES

INDEX

INDEX

27471.46

26515.48

955.98

1170418

70766.80

0.79

7496361

309714.69

16.12

OPTIONS

OPTIONS

STOCK

14872.41

14796.95

75.45

953241

54974.68

1.66

STOCK

FUTURES

543401

50624.57

16.27

FUTURES

STOCK

STOCK

4002.97

4051.26

(48.30)

94652

5776.12

1.37

OPTIONS

325774

24554.83

0.68

OPTIONS

TOTAL

49550.81

48469.63

1081.18

2481246

147593.78

3.04

TOTAL

8640731

401271.77

14.40

Nifty Spot = 7908.25

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7900

46.10

Buy

7900

39.00

33.35

66.65

7933.35

26.55

73.45

7873.45

Sell

8000

12.75

Sell

7800

12.45

Buy

7900

46.10

Buy

7900

39.00

42.85

157.15

7942.85

34.70

165.30

7865.30

Sell

8100

3.25

Sell

7700

4.30

Buy

8000

12.75

Buy

7800

12.45

9.50

90.50

8009.50

8.15

91.85

7791.85

Sell

8100

3.25

Sell

7700

4.30

Note: Above mentioned Bullish or Bearish Spreads in Nifty (December Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

December 27, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,269

1,277

1,286

1,293

1,302

ADANIPORTS

255

258

260

262

265

AMBUJACEM

195

197

199

201

203

ASIANPAINT

846

857

871

882

896

AUROPHARMA

607

616

631

640

655

AXISBANK

423

427

432

436

440

BAJAJ-AUTO

2,537

2,569

2,609

2,641

2,682

BANKBARODA

142

145

149

151

155

BHEL

115

116

118

119

120

BPCL

594

598

605

609

615

BHARTIARTL

286

291

294

299

302

INFRATEL

316

322

330

336

344

BOSCH

18,986

19,152

19,401

19,567

19,816

CIPLA

528

542

561

575

595

COALINDIA

280

282

285

288

291

DRREDDY

2,949

2,967

2,998

3,016

3,047

EICHERMOT

19,811

20,042

20,459

20,690

21,107

GAIL

419

424

429

433

438

GRASIM

802

808

818

825

835

HCLTECH

776

783

791

798

805

HDFCBANK

1,161

1,168

1,177

1,184

1,193

HDFC

1,198

1,209

1,217

1,227

1,235

HEROMOTOCO

2,936

2,972

3,011

3,047

3,086

HINDALCO

145

148

153

156

161

HINDUNILVR

777

790

797

809

817

ICICIBANK

244

246

249

251

255

IDEA

68

69

70

71

72

INDUSINDBK

1,042

1,051

1,058

1,067

1,074

INFY

965

974

984

993

1,003

ITC

220

223

224

227

228

KOTAKBANK

700

706

710

715

720

LT

1,307

1,322

1,334

1,349

1,360

LUPIN

1,355

1,379

1,421

1,445

1,487

M&M

1,129

1,139

1,156

1,166

1,183

MARUTI

5,085

5,126

5,192

5,233

5,299

NTPC

158

159

160

162

163

ONGC

185

187

190

192

195

POWERGRID

176

177

180

181

184

RELIANCE

1,031

1,039

1,053

1,061

1,074

SBIN

241

242

245

247

250

SUNPHARMA

600

606

615

621

630

TCS

2,251

2,272

2,287

2,308

2,323

TATAMTRDVR

282

285

289

292

296

TATAMOTORS

450

454

460

464

470

TATAPOWER

73

73

74

74

75

TATASTEEL

372

376

383

387

394

TECHM

456

460

464

468

472

ULTRACEMCO

3,039

3,064

3,092

3,117

3,145

WIPRO

449

453

457

460

464

YESBANK

1,074

1,088

1,104

1,118

1,135

ZEEL

423

427

435

439

446

4

Technical & Derivatives Report

December 27, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5