Technical & Derivatives Report

November 27, 2015

Sensex (25959) / Nifty (7884)

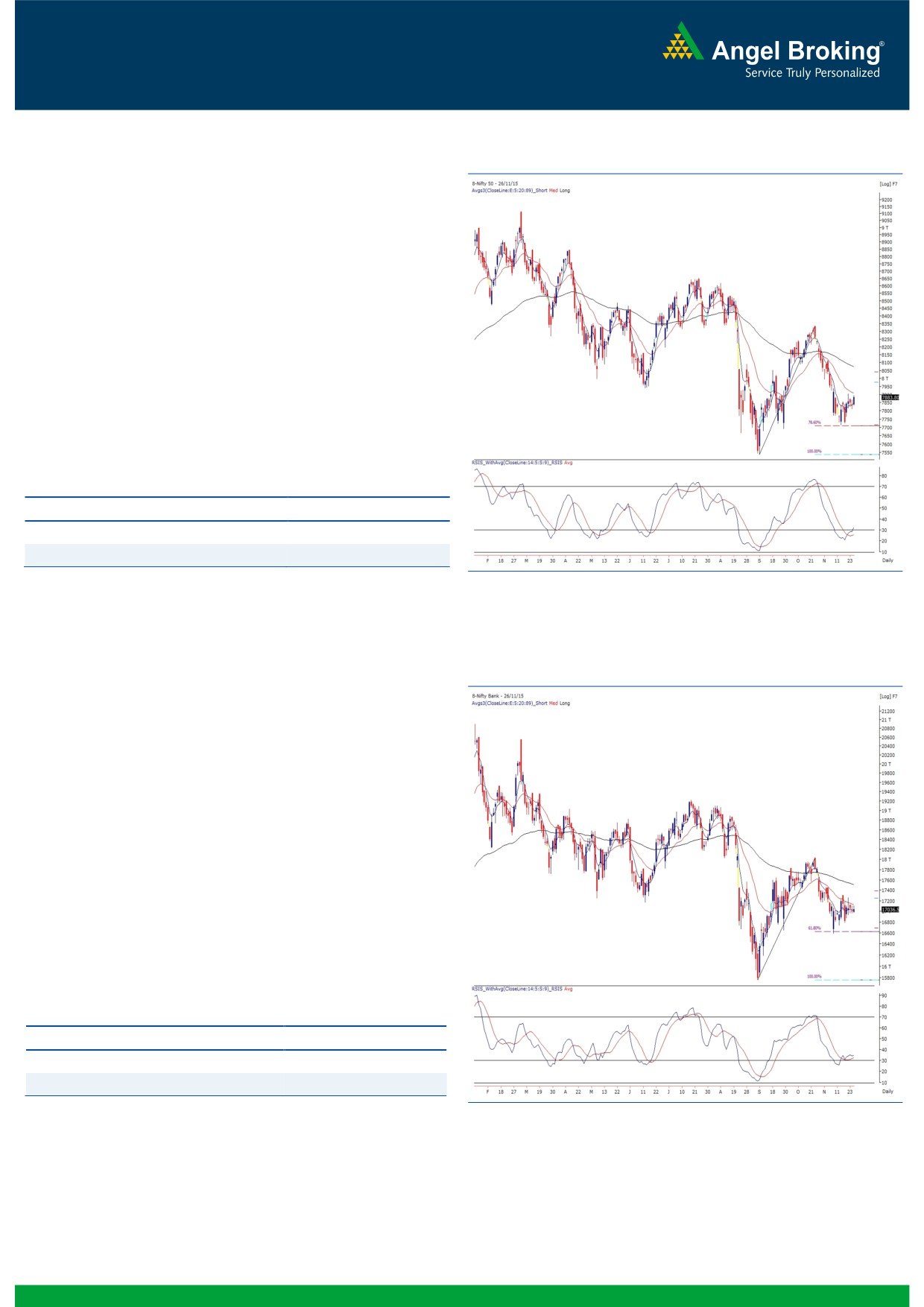

Exhibit 1: Nifty Daily Chart

Yesterday, our markets opened slightly higher tracking

cheerful global cues. The index then extended early morning

lead by a bit to end the session with half a percent gains.

Despite November month derivative expiry session, we did not

witness any volatility in the market. The Nifty has closed tad

below its resistance zone of 7900 - 7920 levels. Going

forward, if the Nifty manages to surpass the 7920 mark then

we may witness an impact of the technical indicator (RSI

Smoothened) to push the Nifty northwards. On the flipside,

7810 - 7700 remains to be strong support levels. Meanwhile,

traders should continue with their stock centric approach with

a proper exit strategy.

Key Levels

Support 1 - 7850

Resistance 1 - 7920

Support 2 - 7810

Resistance 2 - 7980

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (17037)

The Nifty Bank index continued to trade in a narrow range

and ended the F&O expiry session on a marginal positive

note. Since last few trading sessions, the index have not shown

any clear directional move on either side and thus breakout

from the range only will led to a directional momentum

picking up. The support zone of the range is placed around

16785 whereas resistance is seen around 17225. Short term

traders are advised to keep a tab on the mentioned levels and

wait for a breakout from the range to initiate directional trade.

The intraday support for the Nifty Bank index is placed around

16950 and 16785 whereas resistances are sen around 17126

and 17225.

Key Levels

Support 1 - 16950

Resistance 1 - 17126

Support 2 - 16785

Resistance 2 - 17225

1

Technical & Derivatives Report

November 27, 2015

Comments

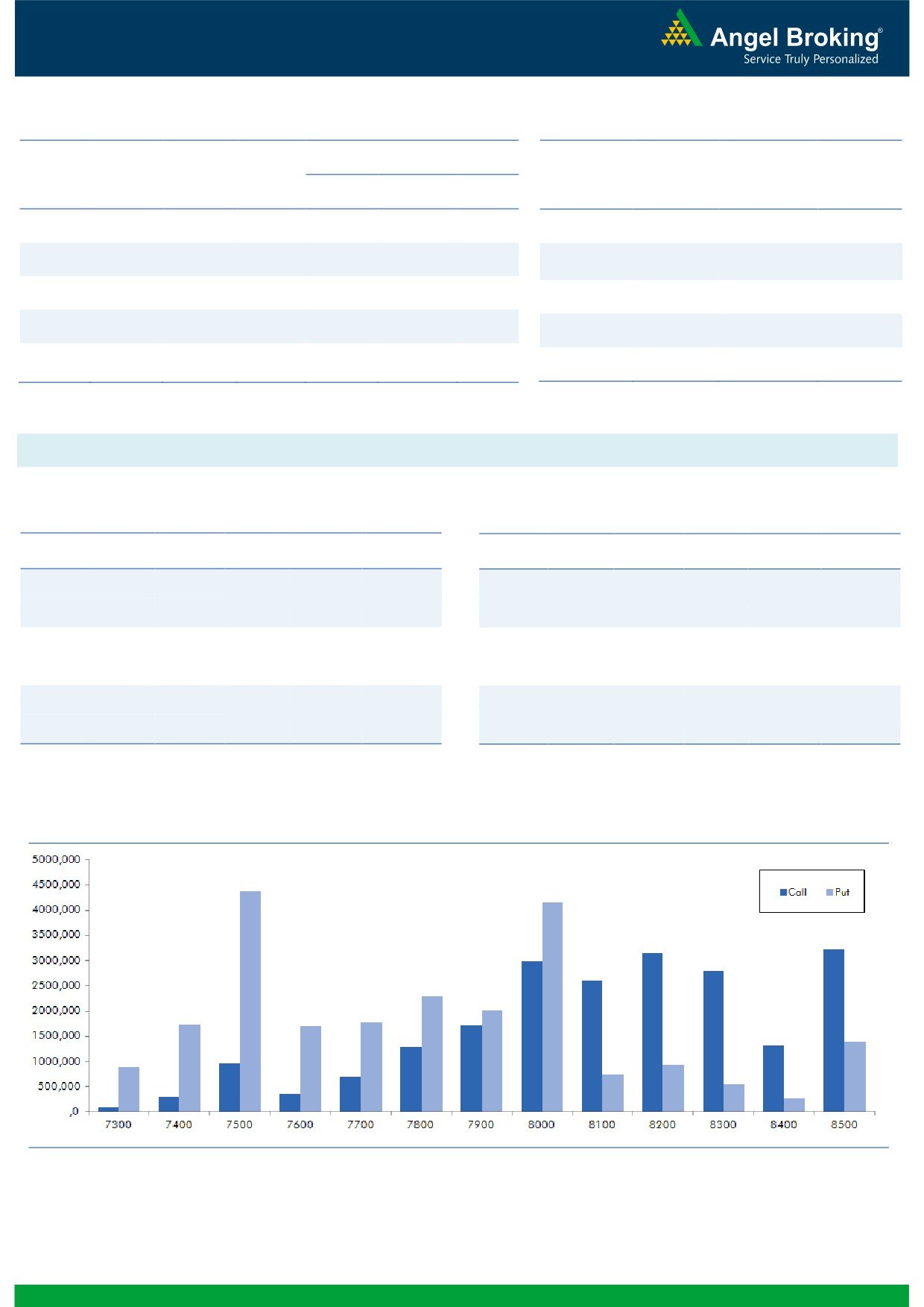

Nifty Vs OI

The Nifty futures open interest has decreased by 26.46%

BankNifty futures open interest has decreased by 28.82%

as market closed at 7883.80 levels.

The Nifty December future closed at a premium of 45.25

points against a premium of 33.15 points. The January

series closed at a premium of 81.55 points.

The Implied Volatility of at the money options has

increased from 13.21% to 15.11%.

The total OI of the market is Rs. 1,63,614/- cr. and the

stock futures OI is Rs. 58,519/- cr.

Few of the liquid counters where we have seen high cost

of carry are UNITECH, NHPC, TV18BRDCST, ADANIENT

and JISLJALEQS.

Views

OI Gainers

OI

PRICE

SCRIP

OI

PRICE

The FIIs continued to sell in cash market segment.

CHG. (%)

CHG. (%)

Yesterday, they sold equities worth Rs. 398 crores. While

CASTROLIND

1994300

17.35

432.05

-1.45

in Index Futures, they sold worth Rs. 307 crores with

significant fall in open interest, which is due to expiry

yesterday.

In Index Options front, FIIs were net buyers of Rs. 1278ng.com

crores with fall in OI. In call options, 8100 and 8300

strikes added some fresh OI. While in put options, 7400

OI Losers

strike was most active. We would suggest avoiding

OI

PRICE

SCRIP

OI

PRICE

forming fresh longs in Nifty; we are hardly seeing any

CHG. (%)

CHG. (%)

buying interest in Nifty.

KSCL

1219500

-40.79

416.40

-1.34

Rollover in NIFTY and BANKNIFTY is on the lower side at

MINDTREE

302800

-37.23

1441.10

-0.75

68.31% and 71.63% respectively.

MARICO

1254500

-36.09

429.80

-0.81

TATAMTRDVR

12602100

-32.84

301.80

2.48

HAVELLS

4492000

-32.59

295.10

1.41

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

BATAINDIA

53.75

NIFTY

0.83

0.74

RPOWER

51.10

BANKNIFTY

1.15

0.92

IDEA

46.34

DRREDDY

0.63

0.66

DRREDDY

75.67

LT

0.76

0.69

TATAMOTORS

48.43

RELIANCE

0.53

0.44

Strategy Date

Symbol

Strategy

Status

November 02, 2015

RELIANCE

Short Strangle

Profit on expiry

November 09, 2015

ITC

Short Strangle

Did not trigger.

November 16, 2015

TATAMOTORS

Long Put Ladder

Marginal loss on expiry.

November 23, 2015

HEROMOTOCO

Ratio Put Spread

Marginal loss on expiry.

2

Technical & Derivatives Report

November 27, 2015

FII Statistics for 26-November 2015

Turnover on 26-November 2015

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

3662.89

3970.13

(307.25)

252300

14671.82

(39.67)

425990

24133.36

12.32

FUTURES

FUTURES

INDEX

INDEX

27563.29

26284.84

1278.45

764793

45001.49

(40.04)

6471453

375925.17

33.44

OPTIONS

OPTIONS

STOCK

13648.49

14393.81

(745.32)

914058

45605.70

(15.59)

STOCK

FUTURES

1541282

77137.84

11.25

FUTURES

STOCK

STOCK

884.03

828.66

55.37

1272

59.83

(98.33)

OPTIONS

417315

21664.06

35.00

OPTIONS

TOTAL

45758.70

45477.44

281.26

1932423

105338.84

(32.26)

TOTAL

8856040

498860.42

28.38

Nifty Spot = 7883.80

Lot Size = 25

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8000

113.70

Buy

7800

96.85

37.85

62.15

8037.85

27.65

72.35

7772.35

Sell

8100

75.85

Sell

7700

69.20

Buy

8000

113.70

Buy

7800

96.85

65.45

134.55

8065.45

48.05

151.95

7751.95

Sell

8200

48.25

Sell

7600

48.80

Buy

8100

75.85

Buy

7700

69.20

27.60

72.40

8127.60

20.40

79.60

7679.60

Sell

8200

48.25

Sell

7600

48.80

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Dec. Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

November 27, 2015

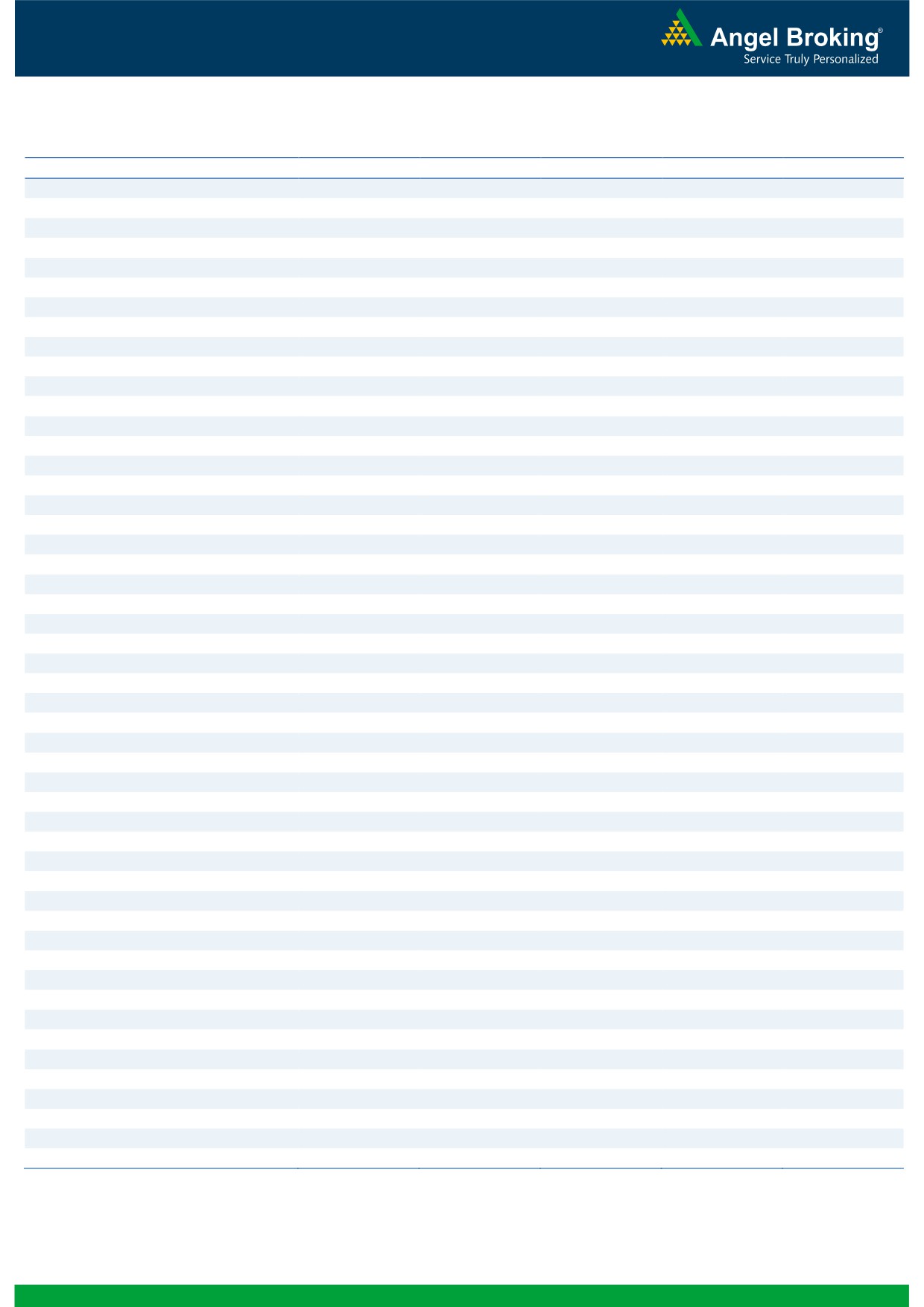

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,316

1,336

1,348

1,368

1,380

ADANIPORTS

264

266

269

271

275

AMBUJACEM

200

201

203

205

206

ASIANPAINT

846

854

860

868

874

AXISBANK

462

464

466

468

470

BAJAJ-AUTO

2,341

2,395

2,459

2,512

2,576

BANKBARODA

165

168

170

172

175

BHARTIARTL

337

340

343

345

348

BHEL

171

172

174

175

177

BOSCHLTD

17,866

18,157

18,403

18,694

18,941

BPCL

893

899

907

913

921

CAIRN

134

136

138

140

142

CIPLA

628

631

637

640

645

COALINDIA

326

331

336

341

346

DRREDDY

3,008

3,055

3,127

3,173

3,246

GAIL

346

357

363

374

381

GRASIM

3,657

3,693

3,717

3,753

3,776

HCLTECH

851

857

863

869

875

HDFC

1,208

1,215

1,224

1,231

1,239

HDFCBANK

1,045

1,054

1,061

1,070

1,077

HEROMOTOCO

2,570

2,629

2,670

2,729

2,770

HINDALCO

73

74

75

76

76

HINDUNILVR

801

807

814

820

827

ICICIBANK

261

262

265

267

269

IDEA

131

139

144

152

158

INDUSINDBK

907

911

918

922

928

INFY

1,031

1,042

1,051

1,061

1,070

ITC

331

337

341

347

351

KOTAKBANK

672

679

683

690

694

LT

1,315

1,324

1,339

1,348

1,363

LUPIN

1,812

1,824

1,844

1,856

1,877

M&M

1,302

1,324

1,339

1,361

1,376

MARUTI

4,533

4,570

4,615

4,652

4,697

NTPC

130

131

132

134

135

ONGC

229

232

235

237

240

PNB

136

138

139

141

142

POWERGRID

130

132

133

135

136

RELIANCE

959

974

983

998

1,007

SBIN

239

241

243

245

247

VEDL

89

90

91

91

92

SUNPHARMA

707

722

731

745

754

TATAMOTORS

396

410

418

433

441

TATAPOWER

66

66

67

67

67

TATASTEEL

222

225

227

231

233

TCS

2,311

2,328

2,355

2,373

2,400

TECHM

517

523

534

540

551

ULTRACEMCO

2,711

2,757

2,786

2,832

2,861

WIPRO

553

561

567

575

581

YESBANK

739

742

748

750

757

ZEEL

391

400

407

416

423

4

Technical & Derivatives Report

November 27, 2015

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5