Technical & Derivatives Report

October 27, 2016

Sensex (27837) / Nifty (8615)

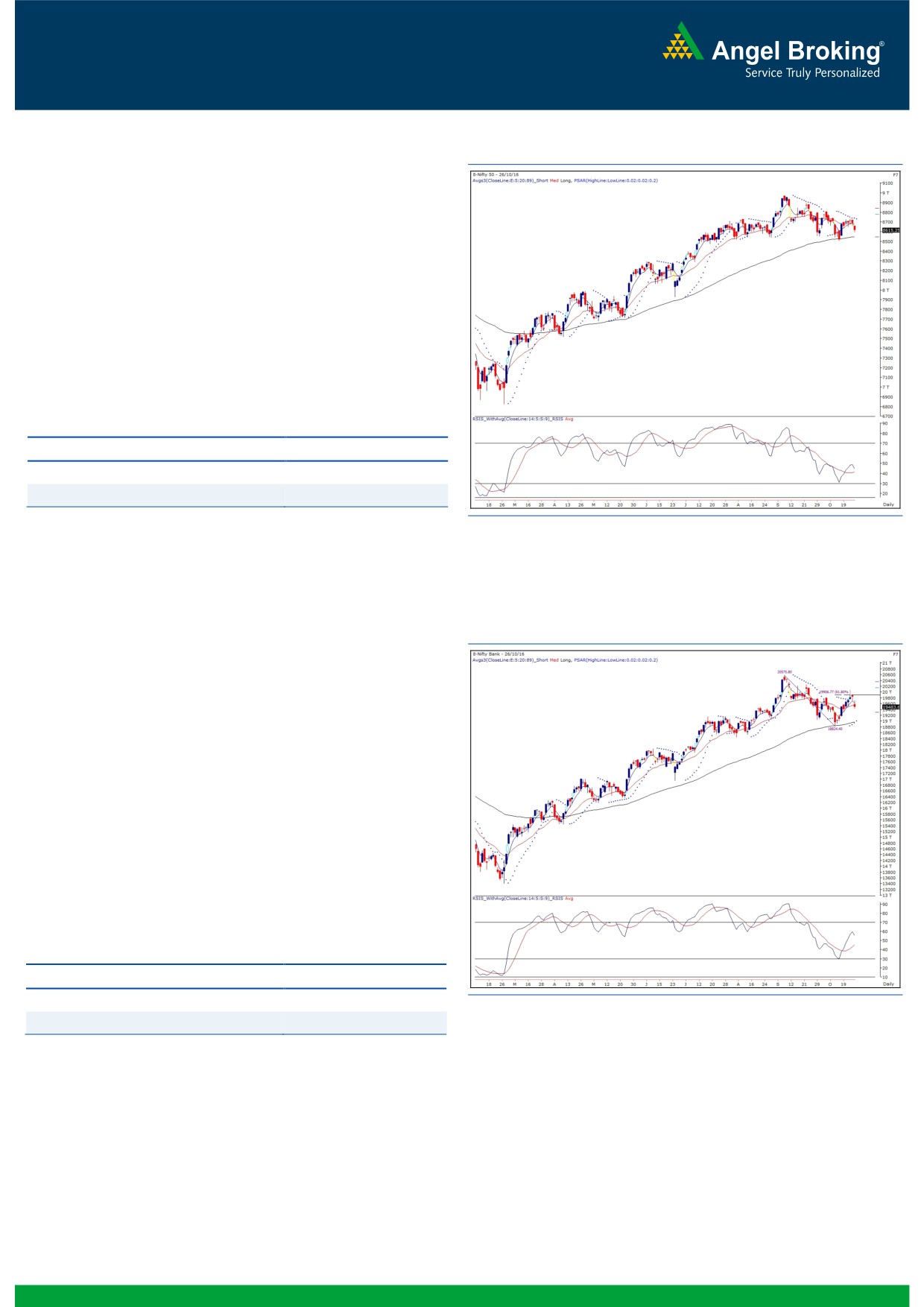

Exhibit 1: Nifty Daily Chart

Yesterday's session opened on a pessimistic note owing to

negative cues from the global peers. Subsequently, we witnessed

an acceleration of the downward momentum as the day

progressed to end the session with a decent cut.

A sharp correction witnessed during yesterday's session has

proved the significance of 8745 which we have been mentioning

as a strong resistance since last few days. Going ahead, 8660 -

8700 would act as an immediate resistance zone. On the other

hand, a follow- through selling may drag the Nifty towards the

next support levels of 8580 - 8550.

Key Levels

Support 1 - 8580

Resistance 1 - 8660

Support 2 - 8550

Resistance 2 - 8700

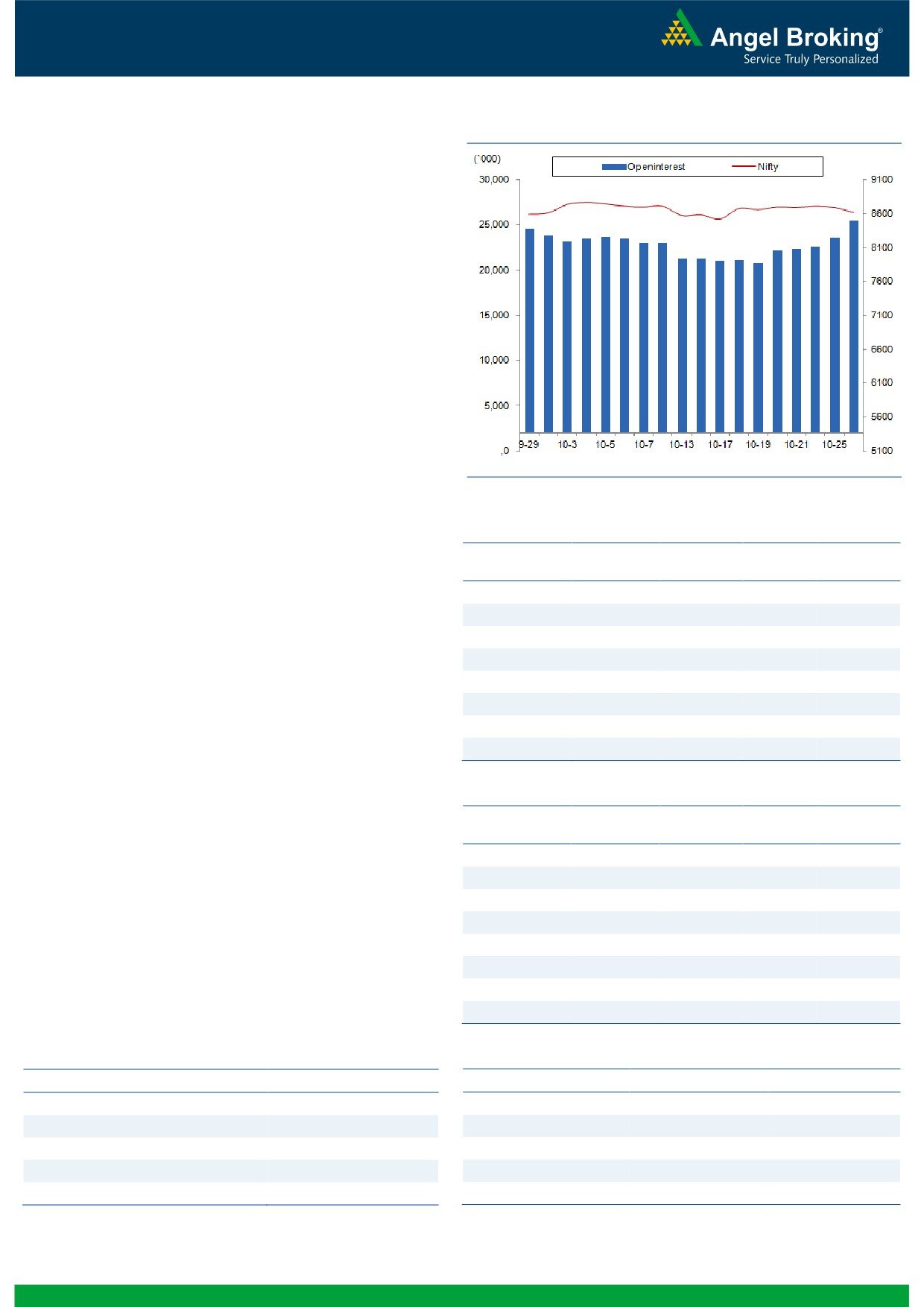

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19484)

Yesterday's fall in the benchmark index was mainly led by the

banking conglomerates after posting the disappointing set of Q2

numbers by Axis Bank. The rub off effect was seen on its peer

counter ICICI Bank, which eventually had an adverse effect on the

Nifty Bank index. As a result, the index tanked by nearly one and

half percent to display weakness on daily chart.

This down move was very much on our expected lines as we had

initiated a 'Sell' position in Nifty Bank on Tuesday. Going forward,

we expect an extension of these losses towards 19300 - 19200

levels and traders are now advised to revise their stop losses tad

above 19700 for existing shorts. The intraday resistance would

now be seen in the range of 19550 - 19600 levels.

Key Levels

Support 1 - 19300

Resistance 1 - 19550

Support 2 - 19200

Resistance 2 - 19600

1

Technical & Derivatives Report

October 27, 2016

Comments

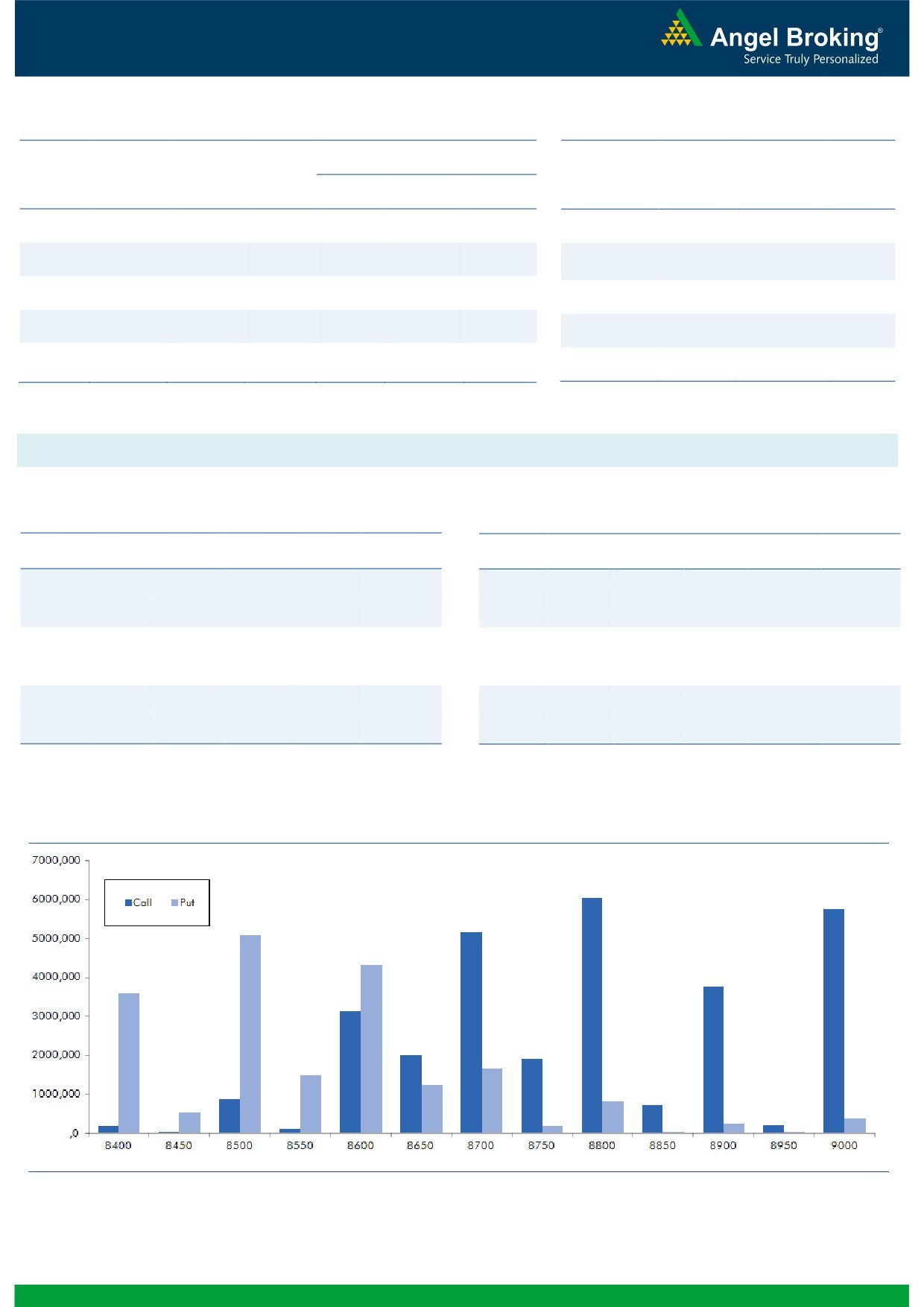

Nifty Vs OI

The Nifty futures open interest has increased by 8.18%

BankNifty futures open interest has decreased by 9.54%

as market closed at 8615.25 levels.

The Nifty October future closed with a premium of 1.50

against the premium of 9.05 points in last trading

session. The November series closed at a premium of

42.75 points.

The Implied Volatility of at the money options has

increased from 13.81% to 15.33%. At the same time, the

PCR-OI of Nifty has decreased from 0.98 to 0.90 levels.

The total OI of the market is Rs. 3,06,730/- cr. and the

stock futures OI is Rs. 88,379/- cr.

Few of the liquid counters where we have seen high cost

of carry are JINDALSTEL, TATACOMM, IBREALEST, IDBI

and TECHM.

Views

OI Gainers

Yesterday, FIIs were net sellers in both cash market and

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

index future segment. They sold equities to the tune of

DABUR

7270000

30.23

297.05

4.19

Rs. 1451 crores. While, in index futures, they sold worth

CUMMINSIND

758400

27.42

880.75

1.54

Rs. 232 crores with rise in open interest, indicating short

M&MFIN

15727500

20.68

363.85

1.95

build-up in previous trading session. www.angelbroking.com

JUSTDIAL

4563200

19.78

448.20

-0.02

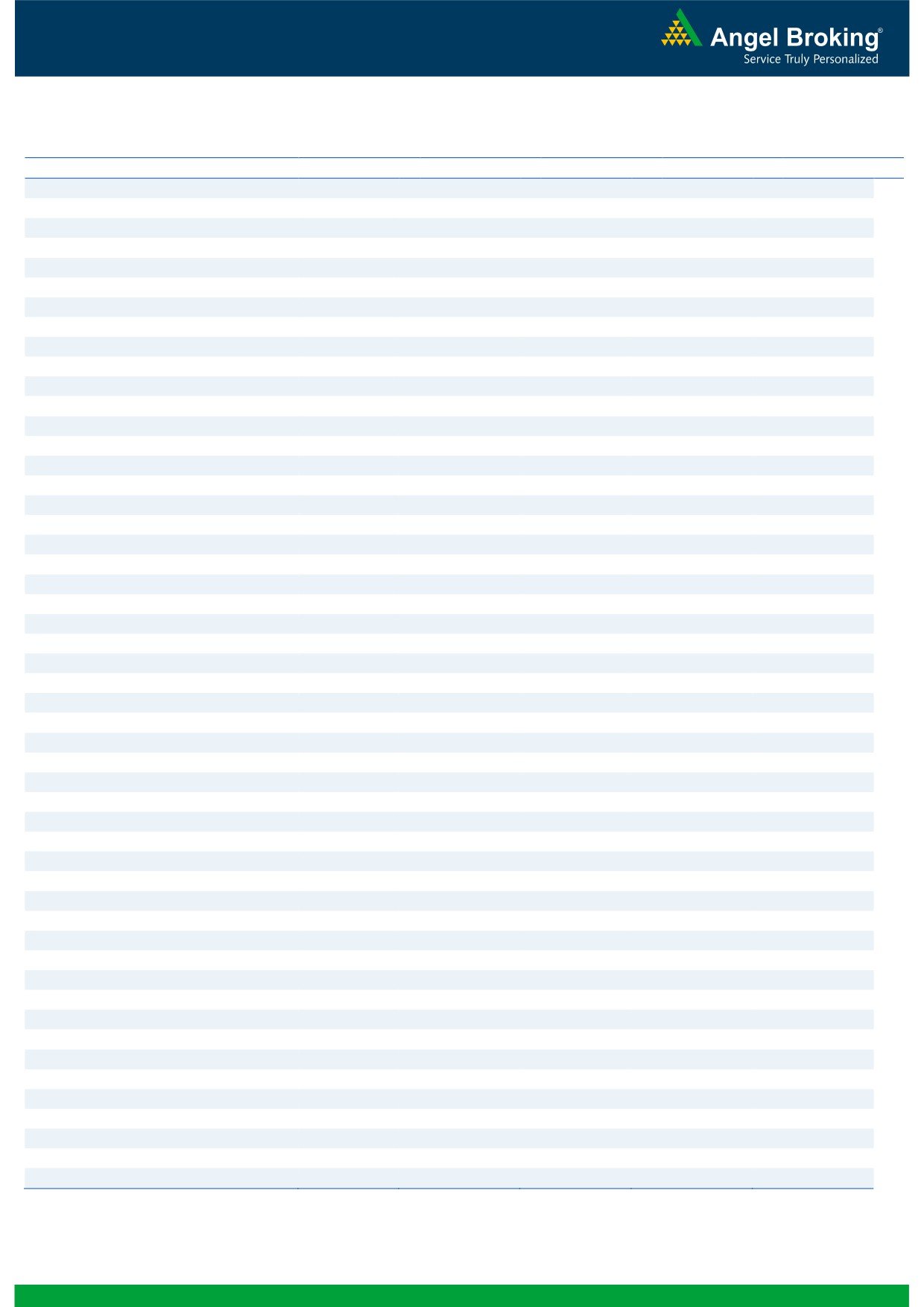

On Index Options front, FIIs bought of worth Rs. 764

JPASSOCIAT

221748000

18.19

11.30

-1.31

crores with marginal change in OI. In call options, 8600

AXISBANK

45031200

17.84

487.15

-7.95

- 8700 strikes were active and added good amount of

MARUTI

2596200

14.53

5877.10

1.37

fresh positions; followed by some unwinding 8900 strike.

CADILAHC

3174400

14.35

387.90

-5.19

On the other hand, in put options, 8550 strike added

fresh longs. We also witness good amount of unwinding

in 8600-8800 put options yesterday. Maximum OI in

OI Losers

October series has been shifted to 8800 call and 8500

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

put options.

ORIENTBANK

10572000

-17.82

129.95

-2.84

As we mentioned in our previous reports that we didn’t

NCC

29904000

-17.54

92.00

-3.06

see any buying interest by FIIs in this bounce. In fact,

ARVIND

8872000

-12.81

405.60

0.55

from last two trading sessions, we are witnessing fresh

BANKINDIA

24348000

-10.79

113.45

-0.26

short addition in Index Futures. Yesterday, good amount

IGL

1915100

-10.17

857.85

-0.88

of unwinding was also visible in 8600-8700 put options

KOTAKBANK

9382400

-10.08

809.90

3.07

and we believe these are covering of shorts formed

earlier. Thus, we belive Nifty may remain under pressure

ENGINERSIN

10535000

-9.69

270.00

-1.33

and we may see October series expiry near 8550 levels.

TVSMOTOR

6858000

-9.43

399.90

-1.87

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

AXISBANK

50.29

NIFTY

0.90

0.76

JUBLFOOD

61.89

BANKNIFTY

0.95

0.98

KOTAKBANK

22.18

RELIANCE

0.31

0.34

CADILAHC

39.25

AXISBANK

0.44

0.59

DABUR

29.71

INFY

0.51

0.60

2

Technical & Derivatives Report

October 27, 2016

FII Statistics for 26, October 2016

Turnover on 26, October 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

6226.42

6458.60

(232.18)

290788

19395.97

4.50

380733

26211.40

19.60

FUTURES

FUTURES

INDEX

INDEX

44636.57

43872.46

764.12

1148899

76019.45

(0.33)

6427745

448148.79

41.25

OPTIONS

OPTIONS

STOCK

26034.66

26422.16

(387.51)

976567

64801.38

2.05

STOCK

FUTURES

1459192

102055.18

23.64

FUTURES

STOCK

STOCK

7746.70

7964.35

(217.65)

131473

8911.05

3.31

OPTIONS

609215

44315.50

7.94

OPTIONS

TOTAL

84644.35

84717.57

(73.22)

2547727

169127.85

1.30

TOTAL

8876885

620730.87

34.13

Nifty Spot = 8615.25

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8600

36.80

Buy

8700

85.90

32.15

67.85

8632.15

63.15

36.85

8636.85

Sell

8700

4.65

Sell

8600

22.75

Buy

8600

36.80

Buy

8700

85.90

35.85

164.15

8635.85

81.20

118.80

8618.80

Sell

8800

0.95

Sell

8500

4.70

Buy

8700

4.65

Buy

8600

22.75

3.70

96.30

8703.70

18.05

81.95

8581.95

Sell

8800

0.95

Sell

8500

4.70

Note: Above mentioned Bullish or Bearish Spreads in Nifty (October Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

October 27, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,528

1,536

1,542

1,550

1,556

ADANIPORTS

290

297

307

315

324

AMBUJACEM

245

247

248

250

251

ASIANPAINT

1,088

1,106

1,131

1,149

1,174

AUROPHARMA

790

798

811

819

832

AXISBANK

474

481

491

498

509

BAJAJ-AUTO

2,765

2,794

2,820

2,849

2,875

BANKBARODA

151

153

156

158

161

BHEL

137

138

140

141

143

BPCL

662

669

678

685

693

BHARTIARTL

310

314

318

322

327

INFRATEL

357

364

372

379

387

BOSCH

22,222

22,342

22,499

22,619

22,775

CIPLA

569

574

579

583

589

COALINDIA

315

317

319

322

324

DRREDDY

3,115

3,179

3,217

3,280

3,319

EICHERMOT

23,820

24,119

24,459

24,759

25,098

GAIL

426

429

433

437

441

GRASIM

953

962

975

984

997

HCLTECH

778

784

794

801

810

HDFCBANK

1,217

1,228

1,246

1,258

1,276

HDFC

1,308

1,321

1,333

1,346

1,357

HEROMOTOCO

3,334

3,376

3,413

3,455

3,492

HINDALCO

147

148

150

152

154

HINDUNILVR

818

831

839

851

859

ICICIBANK

273

275

280

283

287

IDEA

73

76

78

81

82

INDUSINDBK

1,187

1,195

1,206

1,213

1,224

INFY

1,004

1,009

1,014

1,020

1,025

ITC

229

234

238

243

247

KOTAKBANK

765

788

805

828

844

LT

1,462

1,472

1,481

1,491

1,499

LUPIN

1,477

1,492

1,515

1,531

1,554

M&M

1,277

1,293

1,309

1,325

1,341

MARUTI

5,738

5,803

5,851

5,916

5,964

NTPC

150

151

152

153

154

ONGC

283

287

290

293

296

POWERGRID

173

174

176

178

180

RELIANCE

1,048

1,051

1,055

1,058

1,063

SBIN

252

255

260

263

268

SUNPHARMA

728

734

741

746

754

TCS

2,360

2,378

2,391

2,409

2,421

TATAMTRDVR

328

336

349

357

370

TATAMOTORS

509

519

534

544

559

TATAPOWER

79

80

81

82

83

TATASTEEL

375

387

403

415

431

TECHM

414

418

427

431

440

ULTRACEMCO

3,886

3,912

3,956

3,982

4,026

WIPRO

464

468

474

478

484

YESBANK

1,267

1,279

1,296

1,308

1,325

ZEEL

505

511

515

521

525

4

Technical & Derivatives Report

October 27, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5