Technical & Derivatives Report

August 26, 2016

Sensex (27836) / Nifty (8592)

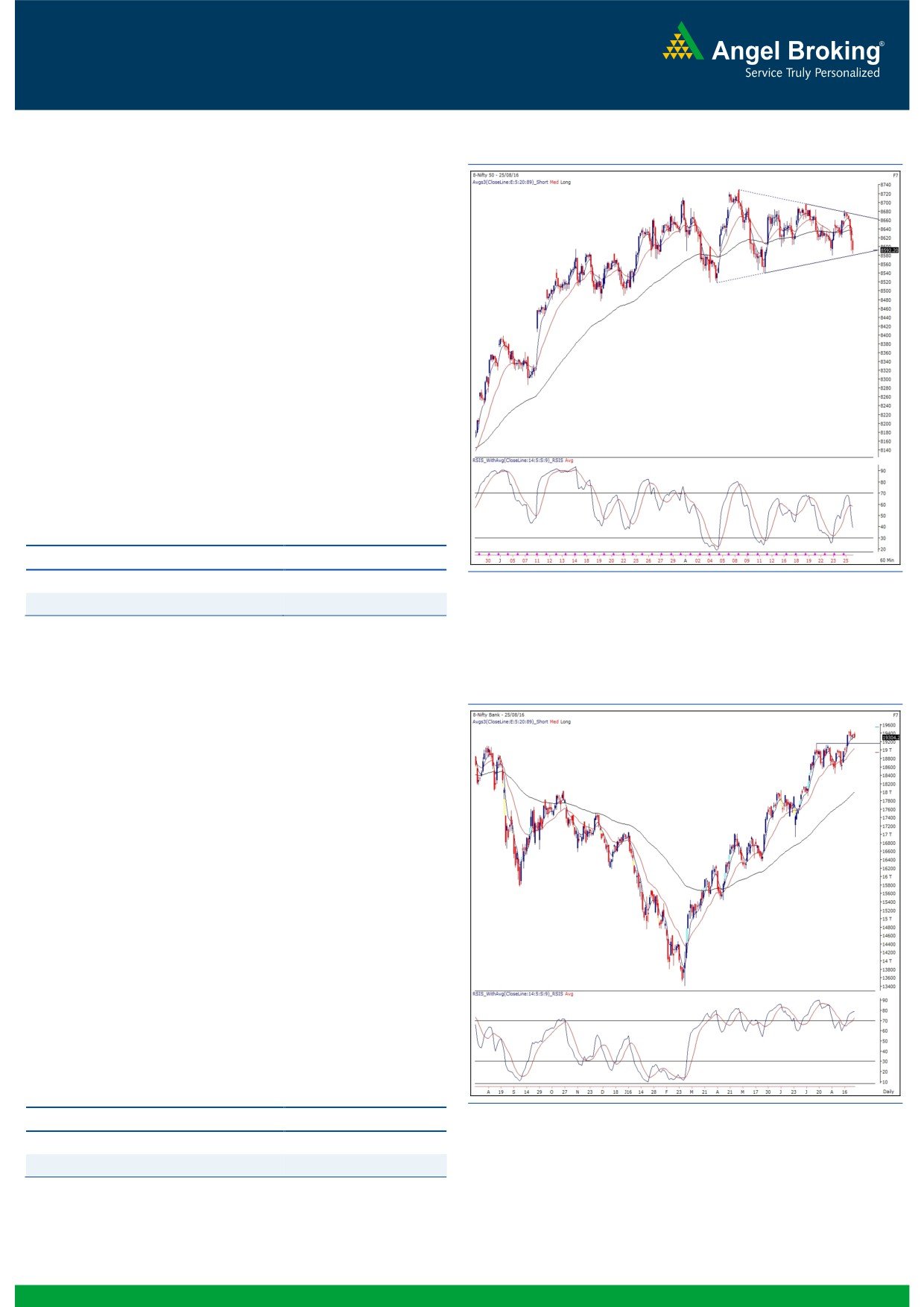

Exhibit 1: Nifty Hourly Chart

Yesterday, once again we witnessed a gap opening with marginal

gains despite unfavourable cues from the Asian bourses.

Subsequently, the index slipped into a consolidation mode and

post the mid session, a sharp cut in the market pulled the index

below 8600 on a closing basis.

The Nifty has now breached the psychological level of 8600 on a

closing basis and is now nearing the lower end of the recent

range i.e. 8560 - 8540. Going forward, traders need to keep a

close eye on 8620 - 8630, which would be seen as intraday

resistance zone. In case of a sustainable move above this zone,

we may see the index moving towards 8670 - 8695 levels.

However, a failure to do so may result into some weakness in the

market. Considering this mixed picture, we would advise traders

to stick to a stock centric approach, which may offer better trading

opportunities.

Key Levels

Support 1 - 8560

Resistance 1 - 8630

Support 2 - 8540

Resistance 2 - 8670

Nifty Bank Outlook - (19304)

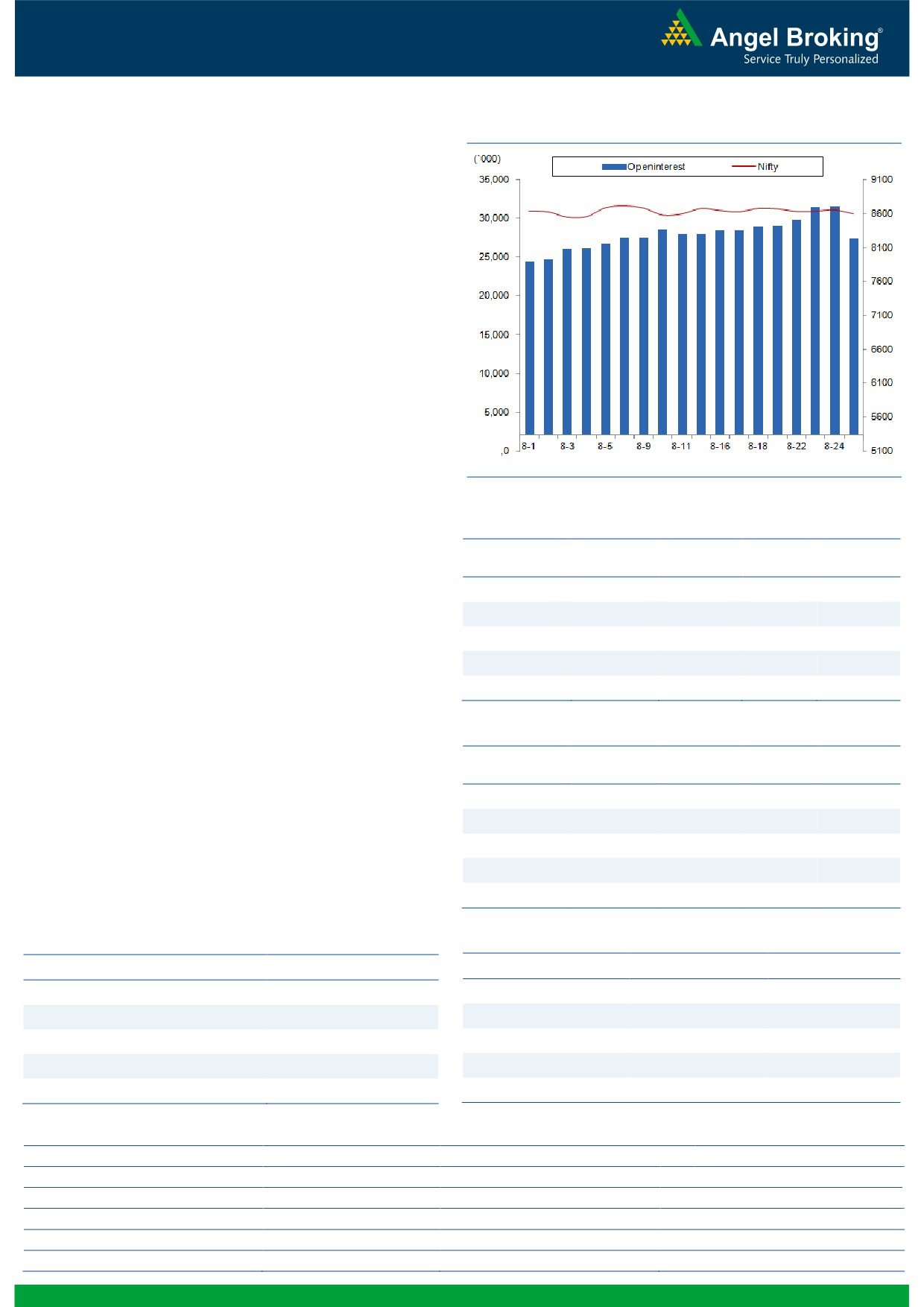

Exhibit 2: Nifty Bank Daily Chart

In yesterday's trading session, the Nifty Bank index opened on a

flat note and traded in a narrow range to end the session with

minor loss of 0.27 percent over its previous session's close. The

last hour of trading, however, saw some corrective move in the

PSU Banking space and as the result, the Nifty PSU bank index

ended yesterday's session with loss of 1.26 percent.

In our last few reports, we have been highlighting about the

monthly 'SuperTrend' resistance of 19485 in the Nifty Bank index.

Since last five trading sessions, the index has consolidated and

has been unable to surpass the mentioned resistance. Thus, we

continue to advise traders to book profits on long positions in the

index and re-initate longs only above 19485 or on any corrective

decline. Meanwhile, traders can focus on stock specific trades

with proper risk management. The intraday support for the index

are placed around 19250 and 19127 whereas resistances are

seen around 19428 and 19485.

Key Levels

Support 1 - 19250

Resistance 1 - 19428

Support 2 - 19127

Resistance 2 - 19485

1

Technical & Derivatives Report

August 26, 2016

Comments

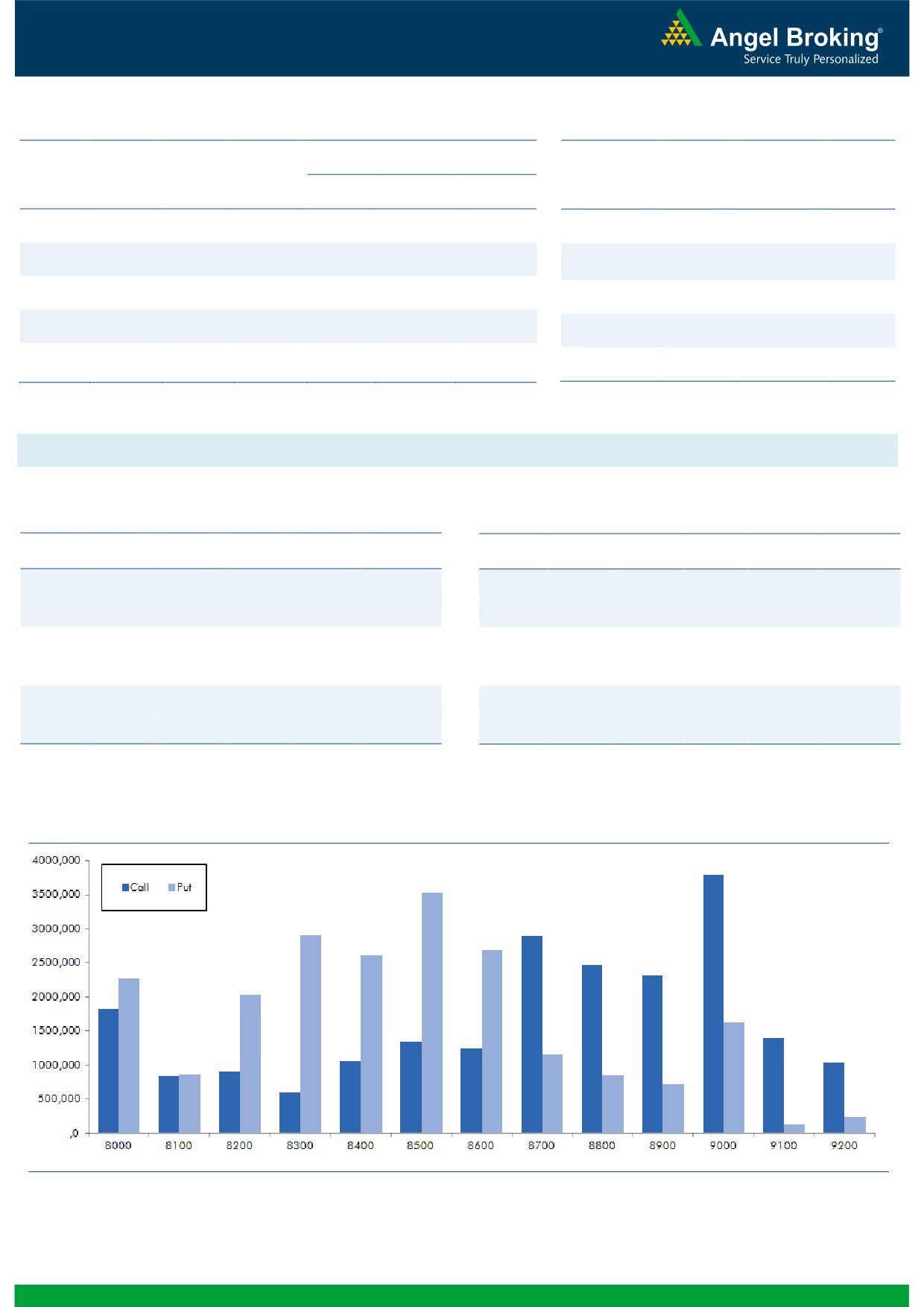

Nifty Vs OI

The Nifty futures open interest has decreased by 13.14%

BankNifty futures open interest has decreased by 28.32%

as market closed at 8592.20 levels.

The Nifty September future closed with a premium of

52.75 points against a premium of 52.45 points in

previous session. The October series closed at a

premium of 92.35 points.

The Implied Volatility of at the money options has

decreased from 13.20% to 12.03%.

The total OI of the market is Rs. 2,06,489/- cr. and the

stock futures OI is Rs. 73,200/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, ADANIPOWER, JINDALSTEL,

IBREALEST and ULTRACEMCO.

Views

Yesterday, FIIs were net sellers in cash market segment to

the tune of Rs. 372 crores. While, in Index Futures they

OI Gainers

were net buyers worth Rs. 942 crores with significant fall

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

in OI, due to F&O expiry of August series.

TORNTPHARM

276000

17.15

1626.45

-4.89

On Index Options front, FIIs were net buyers of Rs. 107

PFC

12213000

11.38

239.30

-1.12

crores with fall in OI. In call options, 8700, 8900 and

9000 strikes added good amount of

fresh positions.

WOCKPHARMA

2940600

5.72

837.35

3.27

While in put options, OI addition was seen in 8300,

STAR

2444500

2.82

967.55

-0.38

8400 and 8600 strikes. Highest OI in September series is

TATAGLOBAL

29709000

1.99

141.75

0.07

visible in 9000 call and 8500 put options.

Yesterday, FIIs have squared off most of their short

OI Losers

positions in index future segment, which they formed in

OI

PRICE

SCRIP

OI

PRICE

last six sessions. Rollovers in Nifty and BankNifty are on

CHG. (%)

CHG. (%)

the higher side at 84.01% & 73.16% respectively. We

GODREJIND

1227000

-45.76

427.15

0.90

believe longs formed in last series are still intact.

VOLTAS

3334000

-39.80

381.65

-2.02

Currently, 8500-8550 will remain a crucial support for

CANBK

11994000

-39.39

266.20

-0.52

index. Since, derivative data and FIIs activity are showing

IDBI

36488000

-38.61

69.30

-2.74

strength in the market; traders are advised to trade with

MOTHERSUMI

7402500

-36.30

325.45

-0.55

positive bias and focus more on stock specific moves.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

WIPRO

23.51

NIFTY

1.00

1.05

IDBI

38.22

BANKNIFTY

0.95

1.18

TORNTPHARM

52.05

SBIN

0.62

0.44

HEXAWARE

30.44

INFY

0.53

0.69

SINTEX

32.94

RELIANCE

0.61

0.50

Strategy Date

Symbol

Strategy

Status

01-08-2016

RELIANCE

Ratio Bear Put Spread

Active

08-08-2016

SBIN

Bull Call Spread

Active

2

Technical & Derivatives Report

August 26, 2016

FII Statistics for 25-August 2016

Turnover on 25-August 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

7135.85

6193.54

942.31

343897

22720.99

(19.31)

485228

33057.31

52.23

FUTURES

FUTURES

INDEX

INDEX

47416.84

47524.16

(107.32)

751220

48615.18

(34.54)

8423625

574158.02

64.97

OPTIONS

OPTIONS

STOCK

22084.09

23647.89

(1563.81)

799991

52381.40

(18.90)

STOCK

FUTURES

1543846

103248.98

28.40

FUTURES

STOCK

STOCK

2602.07

2497.24

104.82

2842

180.89

(97.22)

OPTIONS

468928

33026.46

7.98

OPTIONS

TOTAL

79238.84

79862.83

(623.99)

1897950

123898.46

(28.72)

TOTAL

10921627

743490.77

54.66

Nifty Spot = 8592.20

Lot Size = 75

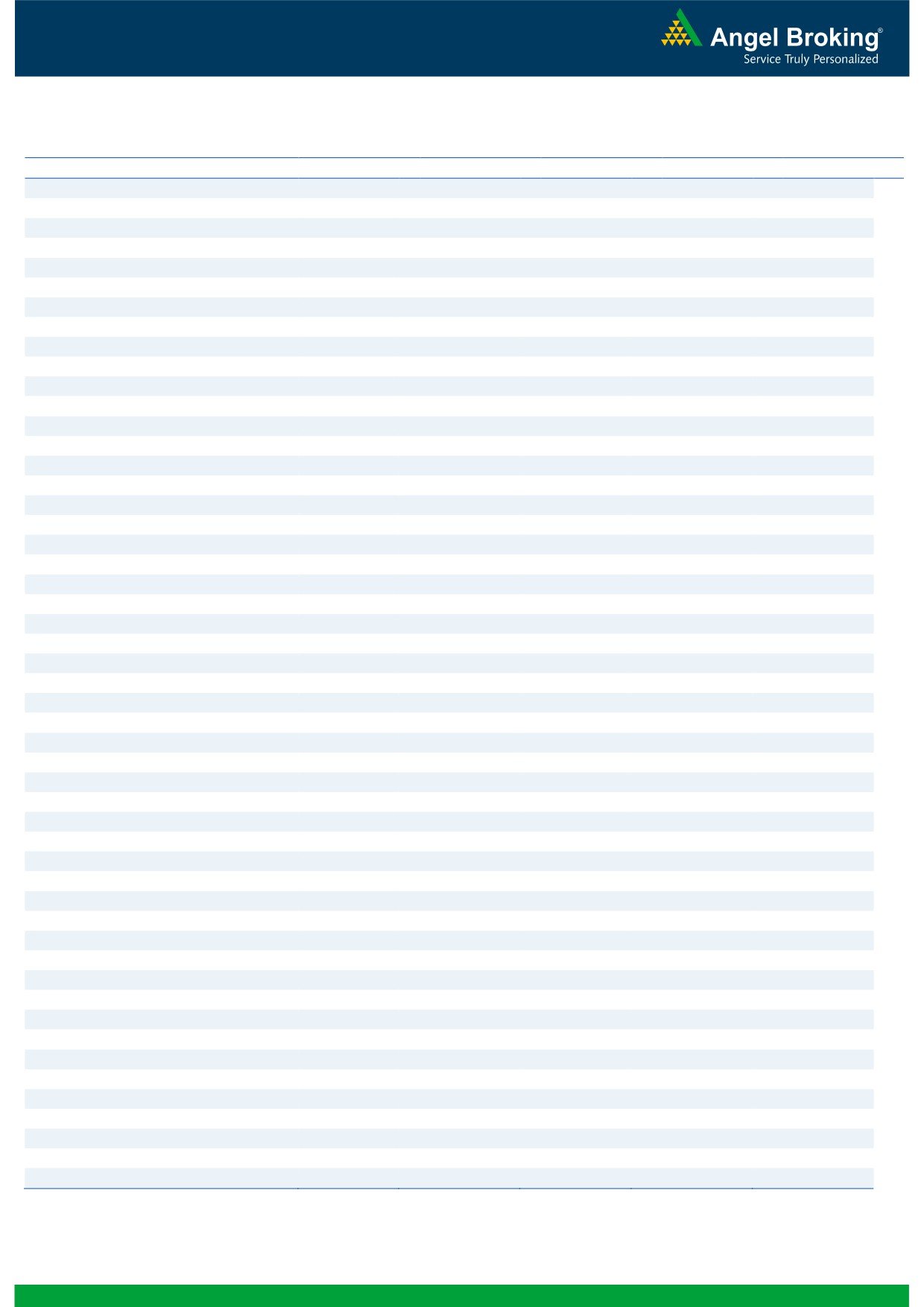

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8700

100.85

Buy

8600

108.05

40.85

59.15

8740.85

33.30

66.70

8566.70

Sell

8800

60.00

Sell

8500

74.75

Buy

8700

100.85

Buy

8600

108.05

68.20

131.80

8768.20

57.50

142.50

8542.50

Sell

8900

32.65

Sell

8400

50.55

Buy

8800

60.00

Buy

8500

74.75

27.35

72.65

8827.35

24.20

75.80

8475.80

Sell

8900

32.65

Sell

8400

50.55

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

August 26, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,626

1,636

1,651

1,661

1,676

ADANIPORTS

253

257

264

269

276

AMBUJACEM

258

262

266

269

274

ASIANPAINT

1,088

1,097

1,112

1,121

1,135

AUROPHARMA

777

784

794

800

811

AXISBANK

580

583

589

592

598

BAJAJ-AUTO

2,817

2,840

2,872

2,895

2,927

BANKBARODA

159

161

163

164

166

BHEL

134

137

140

143

145

BPCL

574

586

593

605

612

BHARTIARTL

338

342

348

352

358

INFRATEL

332

335

342

346

352

BOSCH

23,272

23,522

23,811

24,061

24,350

CIPLA

551

557

566

572

580

COALINDIA

325

328

332

336

340

DRREDDY

3,019

3,035

3,056

3,072

3,093

EICHERMOT

21,756

21,923

22,138

22,306

22,521

GAIL

360

367

371

377

381

GRASIM

4,447

4,488

4,556

4,597

4,666

HCLTECH

788

793

799

804

810

HDFCBANK

1,247

1,253

1,260

1,265

1,272

HDFC

1,329

1,343

1,367

1,381

1,404

HEROMOTOCO

3,264

3,284

3,307

3,328

3,351

HINDALCO

151

153

155

157

159

HINDUNILVR

899

905

913

919

928

ICICIBANK

244

245

248

249

252

IDEA

93

94

96

98

100

INDUSINDBK

1,166

1,174

1,186

1,195

1,207

INFY

1,016

1,026

1,042

1,052

1,067

ITC

248

251

253

256

258

KOTAKBANK

767

774

779

786

791

LT

1,430

1,442

1,463

1,475

1,496

LUPIN

1,494

1,508

1,521

1,535

1,549

M&M

1,385

1,400

1,422

1,437

1,459

MARUTI

4,864

4,899

4,941

4,976

5,017

NTPC

156

157

159

161

163

ONGC

233

236

239

241

245

POWERGRID

178

180

183

185

187

RELIANCE

997

1,005

1,017

1,025

1,037

SBIN

244

247

251

254

258

SUNPHARMA

753

759

768

774

783

TCS

2,492

2,521

2,556

2,585

2,619

TATAMTRDVR

314

316

321

323

328

TATAMOTORS

484

489

496

501

508

TATAPOWER

75

75

76

77

78

TATASTEEL

363

368

375

380

387

TECHM

447

452

462

467

477

ULTRACEMCO

3,708

3,749

3,797

3,837

3,885

WIPRO

490

497

509

516

528

YESBANK

1,331

1,337

1,343

1,350

1,356

ZEEL

496

504

515

522

533

4

Technical & Derivatives Report

August 26, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5