Technical & Derivatives Report

July 26, 2016

Sensex (28095) / Nifty (8636)

Exhibit 1: Nifty Daily Chart

Yesterday, we saw Nifty opening lower mainly on the back of

weak set of 1QFY2017 numbers from the heavyweight banking

counter, Axis Bank, over the weekend. However, this weakness

was merely a sentimental impact and thus, did not last long. The

Nifty first pared down early losses and then went on to post a

smart rally to end the session convincingly above the 8600 mark.

Technically speaking, the Nifty confirmed yet another breakout

after nearly two weeks of consolidation. This move was very much

on expected lines and now, its a matter of time, the Nifty is likely

to surpass the 8655 mark. We maintain our positive stance on the

market and thus, traders are repeatedly advised not to be in hurry

to expect any major correction in the market. On the downside,

8580 - 8540 are now seen as immediate support levels.

Key Levels

Support 1 - 8580

Resistance 1 - 8655

Support 2 - 8540

Resistance 2 - 8700

Nifty Bank Outlook - (18990)

Exhibit 2: Nifty Bank Daily Chart

Post marginal negative opening, the Nifty Bank index rallied

higher in yesterday's session and ended the day with gains of

1.60 percent.

The index has formed a large body bullish candle on the daily

charts, indicating that the bulls are back in control post a

consolidation phase. As we have been mentioning earlier, the

broader trend continues to be positive and thus traders should

continue to trade with a positive bias. Although the near term

resistance is seen around 19229 (July 2015 high), the positive

chart structure post a consolidation phase indicates continuation

of the uptrend and thus the index should well surpass the

mentioned resistance in near term. The intraday support for the

Nifty Bank index is placed around 18826 and 18665 whereas

resistances are seen around 19229 and 19320.

Key Levels

Support 1 - 18826

Resistance 1 - 19229

Support 2 - 18665

Resistance 2 - 19320

1

Technical & Derivatives Report

July 26, 2016

Comments

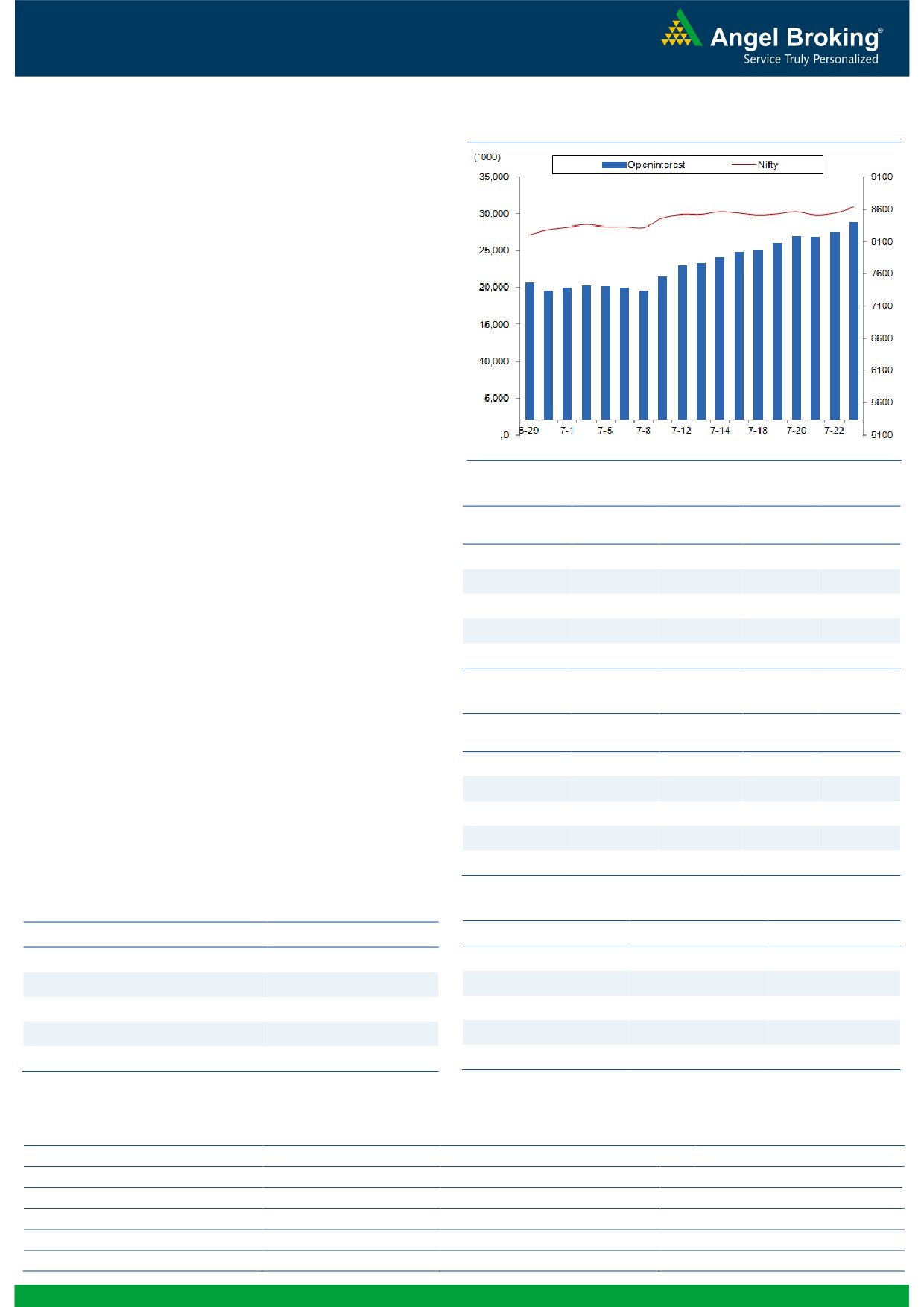

Nifty Vs OI

The Nifty futures open interest has increased by 5.25%

BankNifty futures open interest has increased by 1.86%

as market closed at 8635.65 levels.

The Nifty July future closed with a premium of 4.05

points against a premium of 13.10 points in previous

session. The August series closed at a premium of 46.45

points.

The Implied Volatility of at the money options has

increased from 13.35% to 14.78%.

The total OI of the market is Rs. 2,87,224/- cr. and the

stock futures OI is Rs. 76,416/- cr.

Few of the liquid counters where we have seen high cost

of carry are UNITECH, JINDALSTEL, IFCI, SOUTHBANK

and ENGINERSIN.

Views

OI Gainers

Yesterday, FIIs were net buyer cash market to the tune of

OI

PRICE

Rs. 438 crores. While, they were net sellers of Rs. 288

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

crores in Index Futures with rise in open interest,

HEXAWARE

8280000

17.15

228.05

1.51

indicating some short build-up in last trading session.

PTC

11720000

16.83

83.35

0.91

In Index Options segment, FIIs were net buyers of worth

TVSMOTOR

7264000

16.67

301.85

0.00

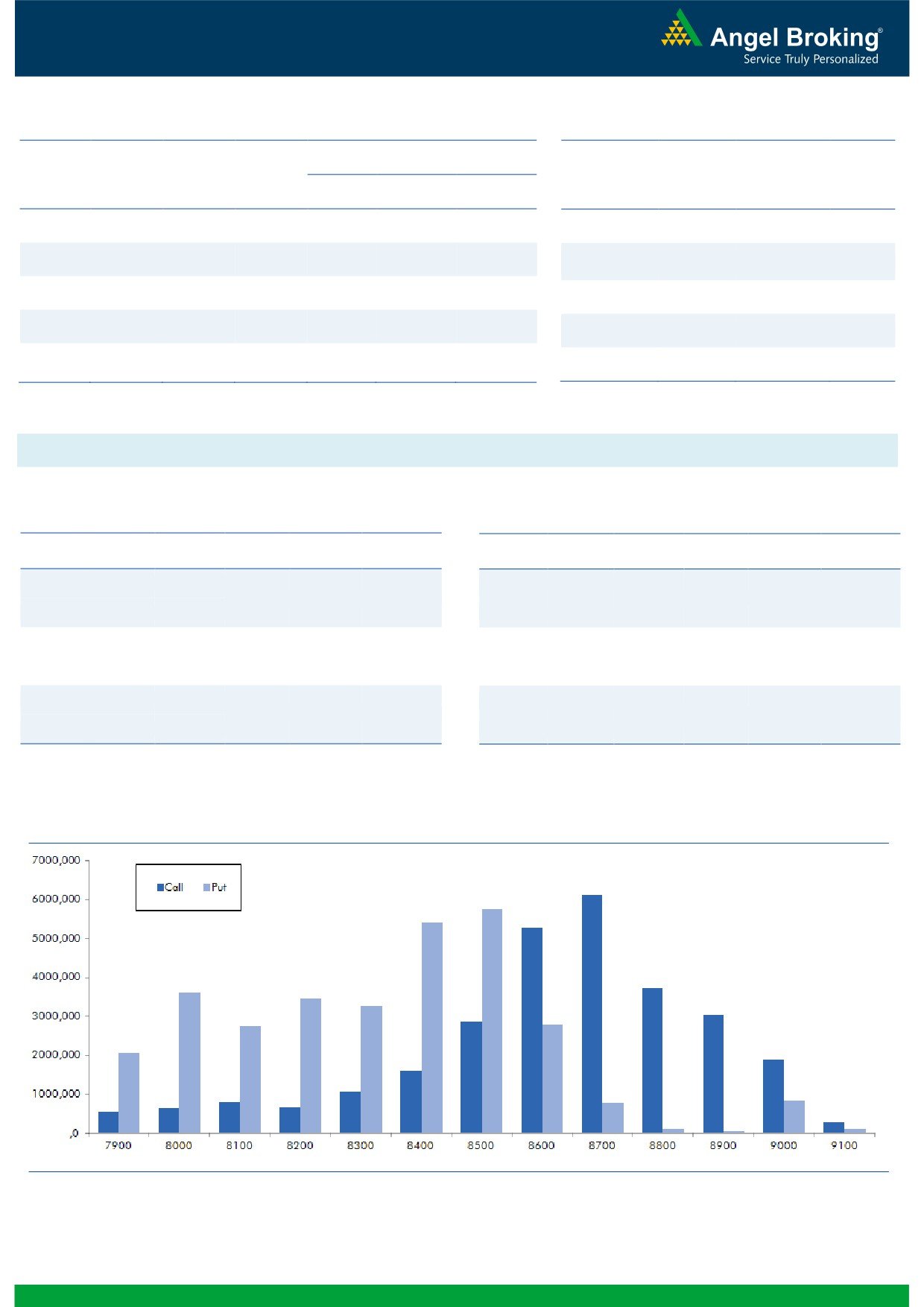

Rs. 604 crores with rise in open interest. In call options,

some build-up was seen in 8700-8750 strikes; followed

RELCAPITAL

15735000

16.63

426.30

4.05

by good amount of unwinding in 8500 and 8600 call

ALBK

17250000

15.69

79.10

6.68

options. On the other hand, in put options, 8500-8650

strikes added huge amount of open interest.

OI Losers

Yesterday, Nifty surpassed its resistance zone of 8580-

OI

PRICE

SCRIP

OI

PRICE

8600 levels with good amount of longs. At the same

CHG. (%)

CHG. (%)

time, highest OI has shifted from 8600 to 8700 call

HAVELLS

7590000

-14.20

381.00

0.73

options and of put from 8400 to 8500 strike. Most of the

PNB

41279000

-12.17

130.25

8.18

longs formed by FIIs are still intact but the rollover is on

HINDZINC

5760000

-6.69

196.80

1.16

the lower side at 25.98%. If, rollover remains low in next

ORIENTBANK

13926000

-6.60

116.15

4.17

2-3 sessions, then Nifty may continue to rally in July

INDIACEM

27405000

-5.89

116.65

1.43

series itself to book optimum gains in longs.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

PCJEWELLER

48.46

NIFTY

1.10

0.96

DRREDDY

31.85

BANKNIFTY

1.36

0.96

PNB

68.97

INFY

0.50

0.40

BANKINDIA

58.61

SBIN

0.80

0.62

RELCAPITAL

34.98

RELIANCE

0.45

0.40

Strategy Date

Symbol

Strategy

Status

04-07-2016

RCOM

Ratio Bull Call Spread

Active

11-07-2016

BANKNIFTY

Bull Call Spread

Didn’t trigger

18-07-2016

TCS

Long Put

Active

25-07-2016

TATAMOTORS

Long Call

Active

2

Technical & Derivatives Report

July 26, 2016

FII Statistics for 25-July 2016

Turnover on 25-July 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

4657.44

4945.52

(288.08)

366809

24240.33

5.49

344373

23359.48

58.43

FUTURES

FUTURES

INDEX

INDEX

36897.77

36293.45

604.32

1079923

70851.97

1.42

4828440

323756.09

48.27

OPTIONS

OPTIONS

STOCK

14503.48

15134.56

(631.08)

863622

55990.63

1.93

STOCK

FUTURES

963600

65030.38

38.12

FUTURES

STOCK

STOCK

6204.18

6319.78

(115.61)

117214

7787.54

1.82

OPTIONS

500549

35080.18

2.38

OPTIONS

TOTAL

62262.87

62693.32

(430.45)

2427568

158870.47

2.22

TOTAL

6636962

447226.13

42.22

Nifty Spot = 8635.65

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8600

68.15

Buy

8700

81.65

44.95

55.05

8644.95

51.65

48.35

8648.35

Sell

8700

23.20

Sell

8600

30.00

Buy

8600

68.15

Buy

8700

81.65

62.35

137.65

8662.35

71.15

128.85

8628.85

Sell

8800

5.80

Sell

8500

10.50

Buy

8700

23.20

Buy

8600

30.00

17.40

82.60

8717.40

19.50

80.50

8580.50

Sell

8800

5.80

Sell

8500

10.50

Note: Above mentioned Bullish or Bearish Spreads in Nifty (July Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

July 26, 2016

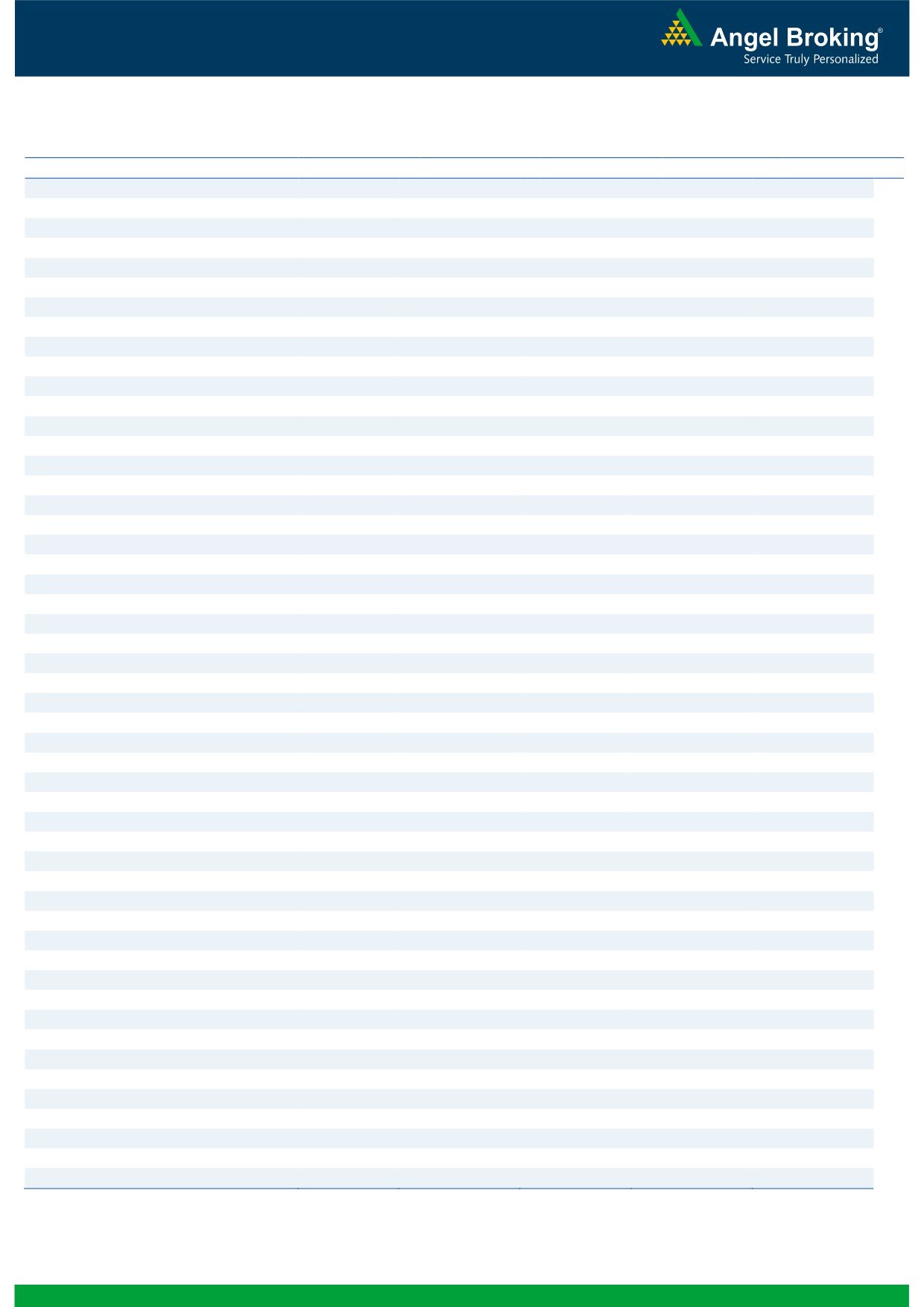

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,654

1,665

1,679

1,690

1,705

ADANIPORTS

223

224

226

228

229

AMBUJACEM

262

266

268

271

273

ASIANPAINT

1,037

1,054

1,064

1,081

1,091

AUROPHARMA

784

792

799

807

814

AXISBANK

511

524

532

546

554

BAJAJ-AUTO

2,638

2,669

2,712

2,743

2,786

BANKBARODA

146

151

154

159

162

BHEL

138

143

145

150

153

BPCL

577

585

594

602

610

BHARTIARTL

360

366

369

375

379

INFRATEL

357

362

367

371

376

BOSCH

24,182

24,324

24,457

24,599

24,732

CIPLA

508

516

521

530

535

COALINDIA

328

331

333

336

337

DRREDDY

3,395

3,439

3,509

3,553

3,623

EICHERMOT

19,659

19,816

19,928

20,084

20,197

GAIL

385

388

393

397

402

GRASIM

4,799

4,830

4,871

4,902

4,943

HCLTECH

719

730

735

746

751

HDFCBANK

1,219

1,233

1,241

1,255

1,264

HDFC

1,337

1,359

1,373

1,396

1,410

HEROMOTOCO

3,231

3,256

3,270

3,294

3,308

HINDALCO

132

134

135

137

138

HINDUNILVR

890

899

904

912

918

ICICIBANK

257

263

267

273

277

IDEA

105

106

107

108

109

INDUSINDBK

1,120

1,138

1,151

1,170

1,183

INFY

1,055

1,068

1,076

1,088

1,096

ITC

248

250

251

253

254

KOTAKBANK

739

752

763

775

786

LT

1,553

1,570

1,579

1,595

1,605

LUPIN

1,690

1,706

1,715

1,731

1,740

M&M

1,427

1,445

1,457

1,475

1,487

MARUTI

4,368

4,459

4,512

4,603

4,656

NTPC

155

156

157

158

159

ONGC

220

223

225

229

231

POWERGRID

165

167

168

170

172

RELIANCE

1,002

1,012

1,018

1,029

1,034

SBIN

220

225

228

233

236

SUNPHARMA

781

792

799

810

817

TCS

2,485

2,522

2,543

2,580

2,600

TATAMTRDVR

326

328

330

333

335

TATAMOTORS

500

505

508

512

515

TATAPOWER

71

71

72

73

73

TATASTEEL

359

361

365

367

370

TECHM

499

504

508

512

516

ULTRACEMCO

3,586

3,628

3,654

3,696

3,722

WIPRO

532

537

541

546

549

YESBANK

1,132

1,157

1,173

1,199

1,215

ZEEL

457

466

471

480

485

4

Technical & Derivatives Report

July 26, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5