Technical & Derivatives Report

October 25, 2016

Sensex (28179) / Nifty (8709)

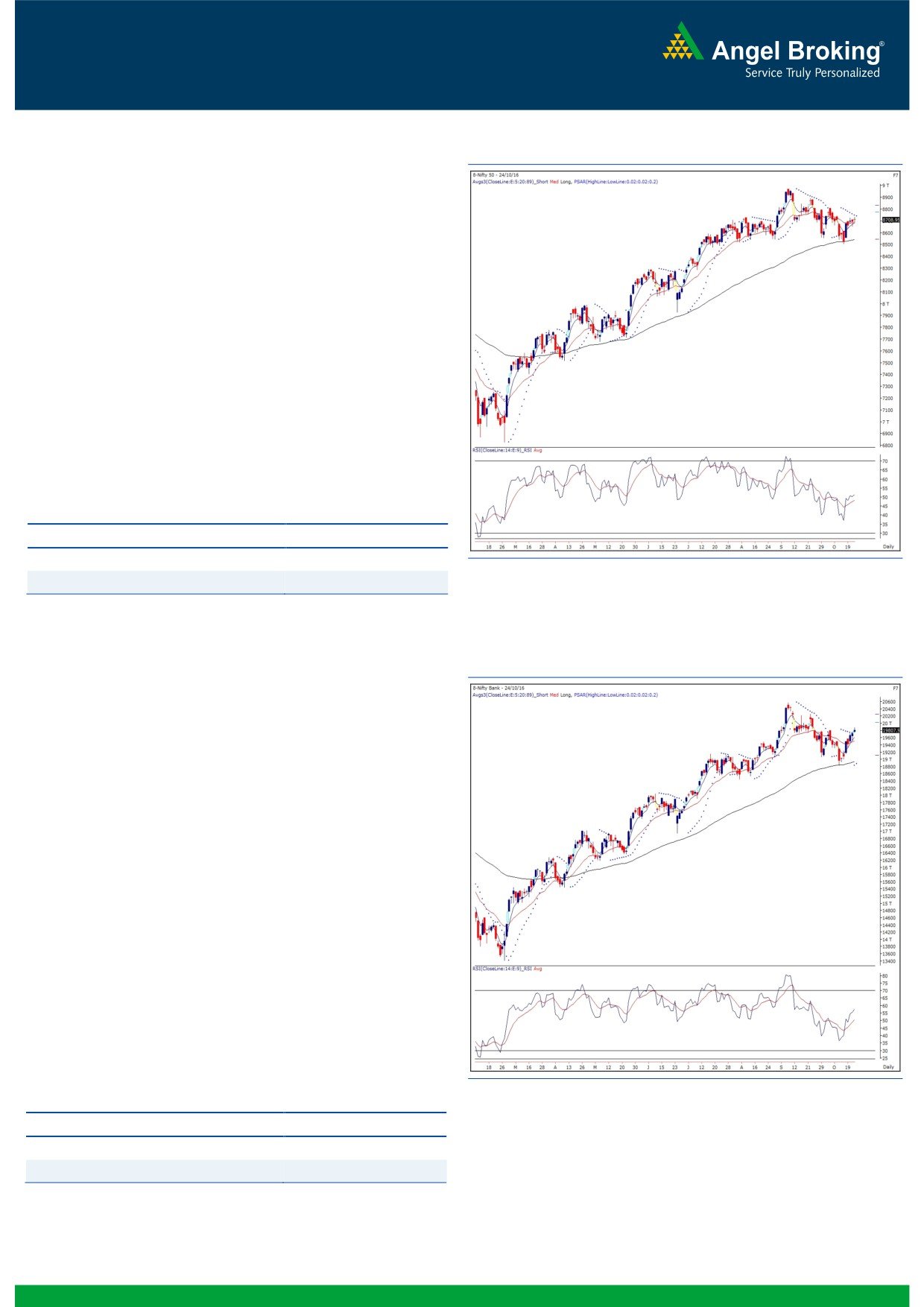

Exhibit 1: Nifty Daily Chart

Yesterday, our benchmark index opened with a marginal upside

gap owing to positive cues from the Asian cues. Subsequently, we

witnessed a small extension of this up move in the first half.

However, post the mid session, we witnessed a lack of activity

from the bulls which eventually resulted in a minor correction to

close with negligible gains.

Due to very narrow trading range, the chart structure remains the

same and so as our view. Hence, unless the index closes above

8745, we would continue to advise traders to stay on sidelines. In

case of a failure to cross the resistance, we can expect another leg

of corrective move towards 8630 and 8540. However, a firm

close above 8745 would negate our recent cautious stance on the

market and then it would compel us to reassess the situation in

order to provide a near term outlook.

Key Levels

Support 1 - 8668

Resistance 1 - 8745

Support 2 - 8630

Resistance 2 - 8785

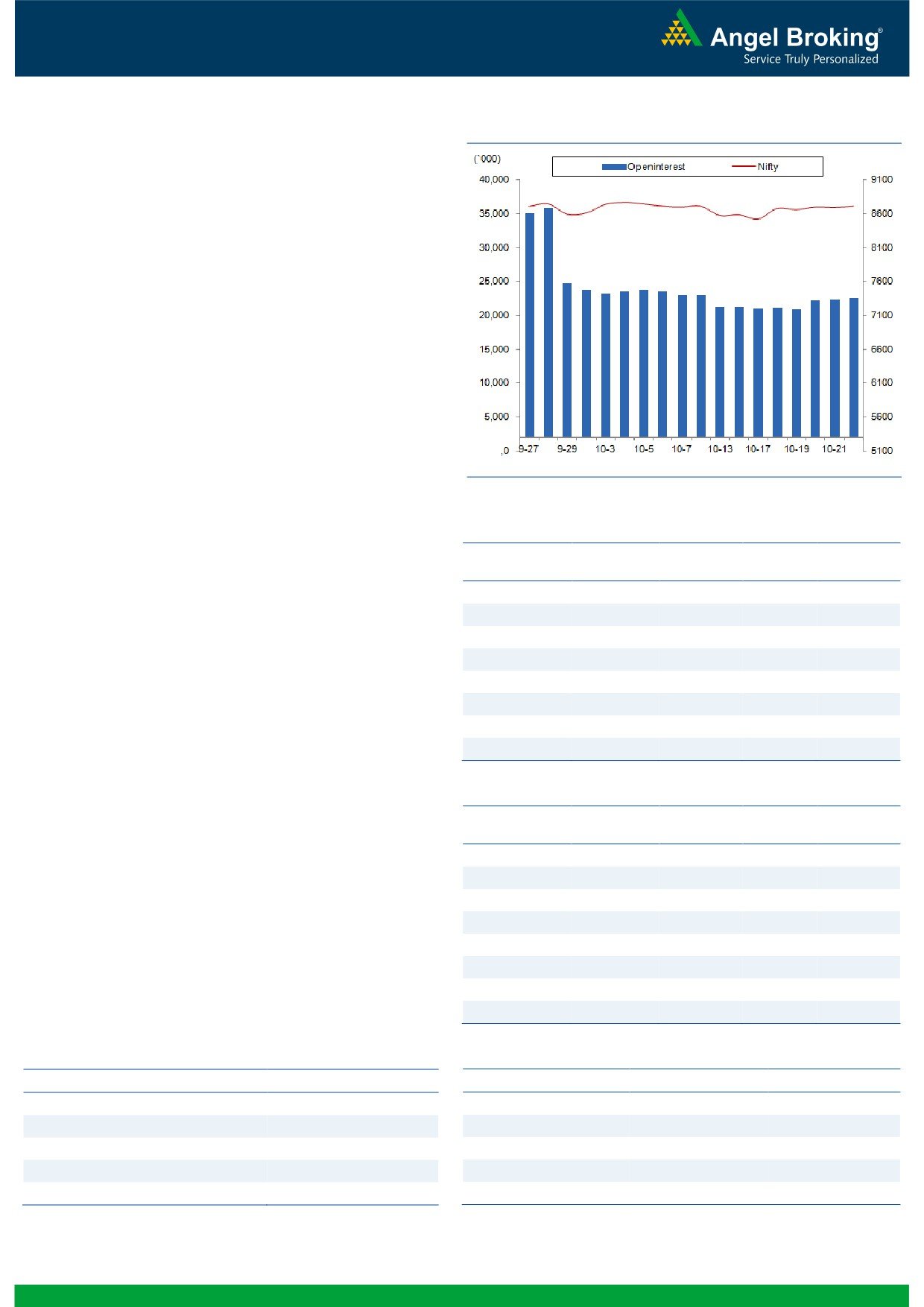

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19808)

The Nifty Bank index opened gap up yesterday and rallied higher

to test the resistance zone around

19900 which is

61.8%

retracement resistance of the recent corrective move. Post testing

the mentioned resistance, the index retraced back marginally,

however, managed to close the session with gains of

0.49

percent.

As highlighted above, the Nifty Bank index has retraced 61.8

percent of the recent corrective move from 20573 to 18821.

However, the index has managed to cross the previous swing

high of 19817 and the broader market remains to be positive.

Thus, a sustained move above 19900 will indicate a continuation

of the up move. However, we would advise traders to take a

stock-specific approach here within the index as there is no

favorable trade set up in the index at the current juncture. The

intraday supports for the Nifty index are placed around 19744

and 19632 whereas resistances are seen around 19905 and

20140.

Key Levels

Support 1 - 19744

Resistance 1 - 19905

Support 2 - 19632

Resistance 2 - 20140

1

Technical & Derivatives Report

October 25, 2016

Comments

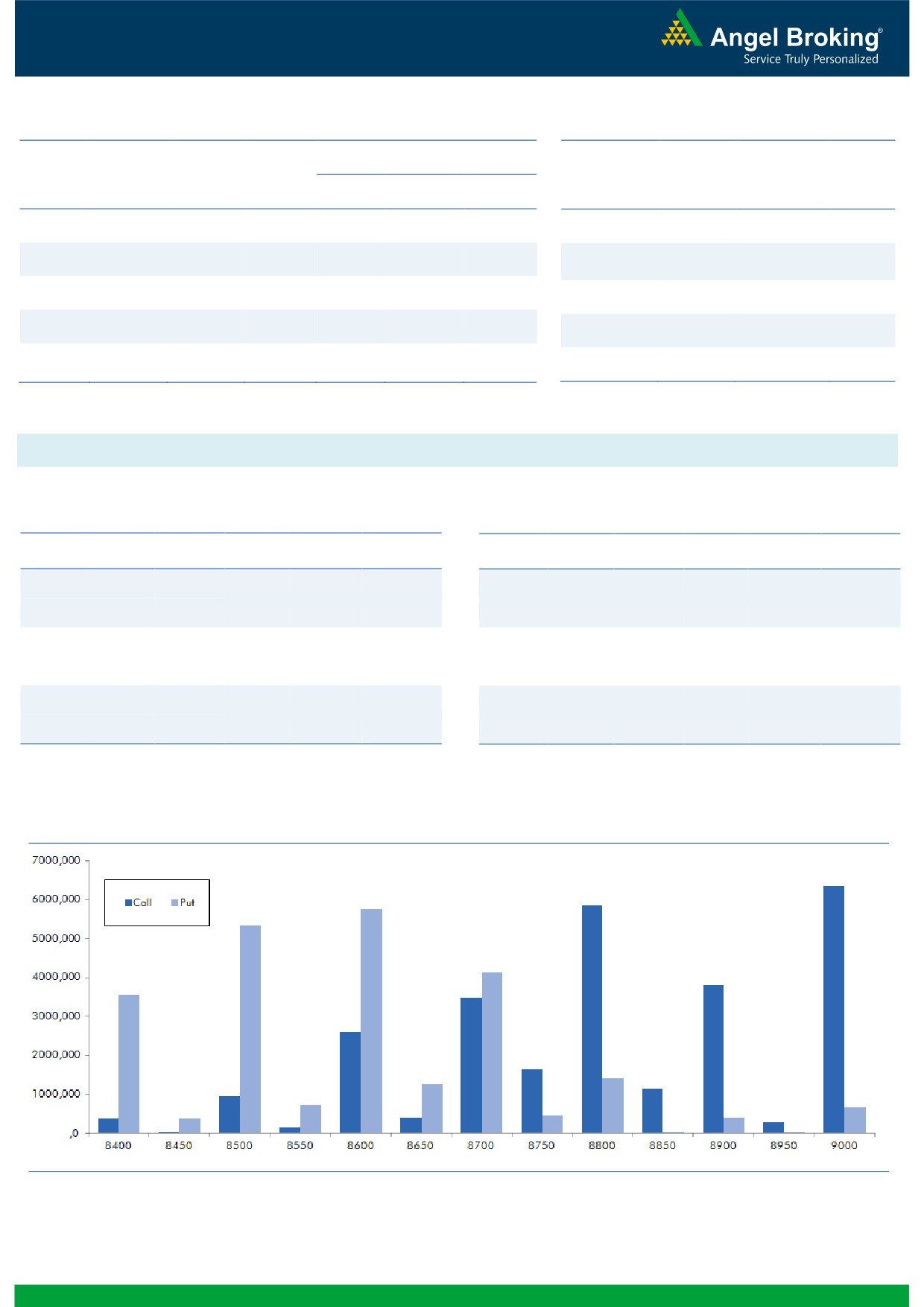

Nifty Vs OI

The Nifty futures open interest has increased by 1.62%

BankNifty futures open interest has increased by 5.94%

as market closed at 8708.95 levels.

The Nifty October future closed with a premium of 11.30

against the premium of 7.30 points in last trading

session. The November series closed at a premium of

53.75 points.

The Implied Volatility of at the money options has

increased from 12.28% to 14.15%. At the same time, the

PCR-OI of Nifty has remained unchanged 1.00 levels.

The total OI of the market is Rs. 2,94,723/- cr. and the

stock futures OI is Rs. 85,336/- cr.

Few of the liquid counters where we have seen high cost

of carry are JINDALSTEl, IDEA, SYNDIBANK,

JPASSOCIAT and CEATLTD.

Views

OI Gainers

Yesterday, FIIs were net sellers in cash market segment to

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

the tune of Rs. 325 crores. While, in index futures, they

KTKBANK

19735500

25.45

128.65

2.27

bought worth Rs. 155 crores with significant rise in open

JSWSTEEL

6994800

20.50

1710.85

-1.41

interest, indicating formation of both long and short

CEATLTD

1601600

17.03

1273.40

-3.46

positions in previous trading session. www.angelbroking.com

UNIONBANK

15816000

15.89

148.40

0.64

On Index Options front, FIIs bought of worth

OIL

1776500

15.73

418.75

0.81

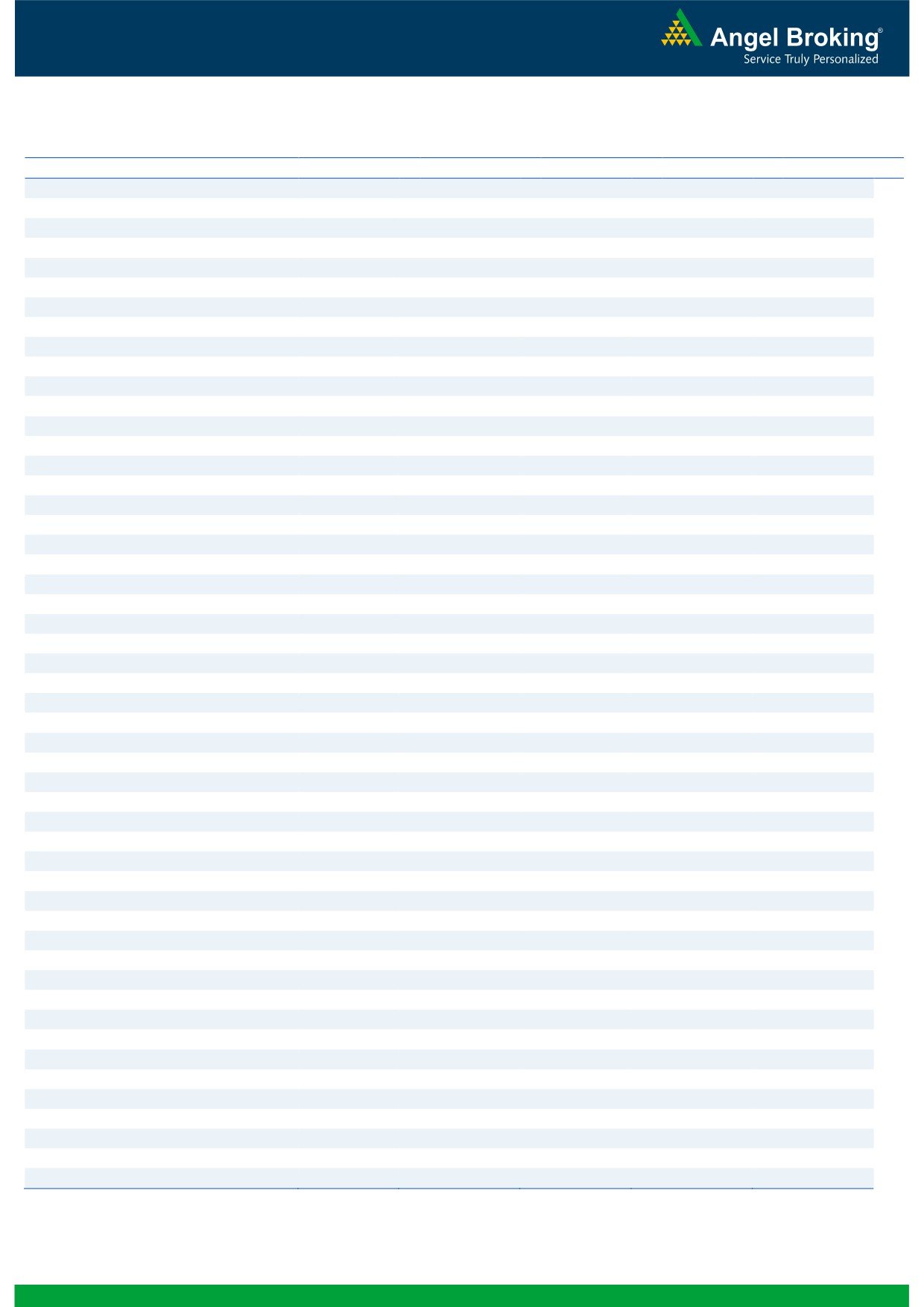

Rs. 804 crores with some rise in OI. In call options, 8750

ORIENTBANK

16026000

15.18

138.25

4.58

- 8800 strikes were active and added good amount of

ONGC

23460000

14.29

292.60

4.31

fresh positions; followed by some unwinding 8600 and

ASIANPAINT

4888800

14.09

1131.30

-2.20

8700 strikes. On the other hand, in put options, except

OI addition in 8700 strike, none of other strikes added

meaningful positions. Maximum OI in October series is

OI Losers

placed at 9000 call and 8600 put option.

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

Despite the long liquidation and fresh shorting seen in

HINDZINC

8515200

-8.56

252.95

1.10

index future by FIIs in last week, Nifty has shown some

TORNTPHARM

370400

-7.77

1611.45

1.63

sign of strength. But, overall data doesn’t support the

COLPAL

1838200

-5.51

965.95

0.88

ongoing up move. Before forming any directional view in

CROMPGREAV

12660000

-5.38

76.75

0.00

the index, we would like to wait for any significant

AMARAJABAT

625200

-5.27

1040.95

1.18

directional positions by FIIs. Thus, at current juncture, we

BANKINDIA

29226000

-4.53

114.60

1.28

advise traders to avoid forming any aggressive

directional trade in Nifty for October expiry.

KSCL

2646000

-4.34

442.00

0.83

TVSMOTOR

6876000

-4.29

394.50

-0.39

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

WIPRO

26.46

NIFTY

1.00

0.96

MINDTREE

38.81

BANKNIFTY

1.14

1.03

COALINDIA

20.56

RELIANCE

0.33

0.35

ONGC

37.07

INFY

0.53

0.50

APOLLOHOSP

29.88

ICICIBANK

1.12

0.64

2

Technical & Derivatives Report

October 25, 2016

FII Statistics for 24, October 2016

Turnover on 24, October 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

3132.96

2978.23

154.73

273803

18500.38

5.89

226563

15761.91

22.35

FUTURES

FUTURES

INDEX

INDEX

32146.67

31343.15

803.52

1154365

77242.37

1.28

3837474

266997.38

13.51

OPTIONS

OPTIONS

STOCK

17558.47

17893.18

(334.71)

920537

62005.97

2.92

STOCK

FUTURES

897467

63650.50

42.31

FUTURES

STOCK

STOCK

4812.97

4857.96

(44.98)

124127

8509.16

0.61

OPTIONS

411533

30094.03

-10.58

OPTIONS

TOTAL

57651.07

57072.51

578.56

2472832

166257.88

2.35

TOTAL

5373037

376503.82

15.32

Nifty Spot = 8708.95

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8700

57.15

Buy

8700

38.40

40.95

59.05

8740.95

24.25

75.75

8675.75

Sell

8800

16.20

Sell

8600

14.15

Buy

8700

57.15

Buy

8700

38.40

53.80

146.20

8753.80

32.90

167.10

8667.10

Sell

8900

3.35

Sell

8500

5.50

Buy

8800

16.20

Buy

8600

14.15

12.85

87.15

8812.85

8.65

91.35

8591.35

Sell

8900

3.35

Sell

8500

5.50

Note: Above mentioned Bullish or Bearish Spreads in Nifty (October Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

October 25, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,533

1,549

1,568

1,585

1,603

ADANIPORTS

276

281

288

293

300

AMBUJACEM

244

246

248

249

251

ASIANPAINT

1,100

1,114

1,138

1,152

1,176

AUROPHARMA

808

813

820

825

831

AXISBANK

511

516

523

529

535

BAJAJ-AUTO

2,767

2,779

2,797

2,808

2,826

BANKBARODA

154

156

158

160

162

BHEL

140

141

142

142

143

BPCL

660

673

680

694

701

BHARTIARTL

302

304

306

309

310

INFRATEL

357

363

370

376

382

BOSCH

22,253

22,594

22,847

23,189

23,441

CIPLA

575

580

587

592

599

COALINDIA

309

315

319

325

329

DRREDDY

3,038

3,063

3,098

3,124

3,158

EICHERMOT

24,530

24,722

25,022

25,215

25,515

GAIL

436

440

446

449

455

GRASIM

959

966

971

978

984

HCLTECH

790

801

819

829

847

HDFCBANK

1,251

1,257

1,267

1,273

1,283

HDFC

1,325

1,335

1,342

1,352

1,359

HEROMOTOCO

3,304

3,319

3,346

3,361

3,387

HINDALCO

149

150

151

153

154

HINDUNILVR

838

843

849

854

860

ICICIBANK

276

280

283

288

291

IDEA

74

76

77

79

81

INDUSINDBK

1,206

1,211

1,218

1,223

1,229

INFY

1,015

1,021

1,032

1,038

1,049

ITC

239

240

241

242

243

KOTAKBANK

773

780

785

792

797

LT

1,467

1,480

1,500

1,513

1,533

LUPIN

1,482

1,505

1,522

1,546

1,563

M&M

1,311

1,325

1,334

1,348

1,357

MARUTI

5,627

5,671

5,709

5,753

5,791

NTPC

149

150

151

152

153

ONGC

273

283

288

298

303

POWERGRID

173

175

177

178

180

RELIANCE

1,053

1,058

1,066

1,071

1,079

SBIN

257

260

262

265

268

SUNPHARMA

740

744

749

752

757

TCS

2,389

2,409

2,422

2,441

2,454

TATAMTRDVR

354

359

362

366

369

TATAMOTORS

535

548

556

568

576

TATAPOWER

83

83

84

84

85

TATASTEEL

421

424

427

430

434

TECHM

421

425

432

436

443

ULTRACEMCO

3,927

3,949

3,983

4,006

4,040

WIPRO

471

478

484

490

496

YESBANK

1,293

1,302

1,315

1,324

1,337

ZEEL

501

507

516

521

531

4

Technical & Derivatives Report

October 25, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5