Technical & Derivatives Report

November 24, 2016

Sensex (26052) / Nifty (8033)

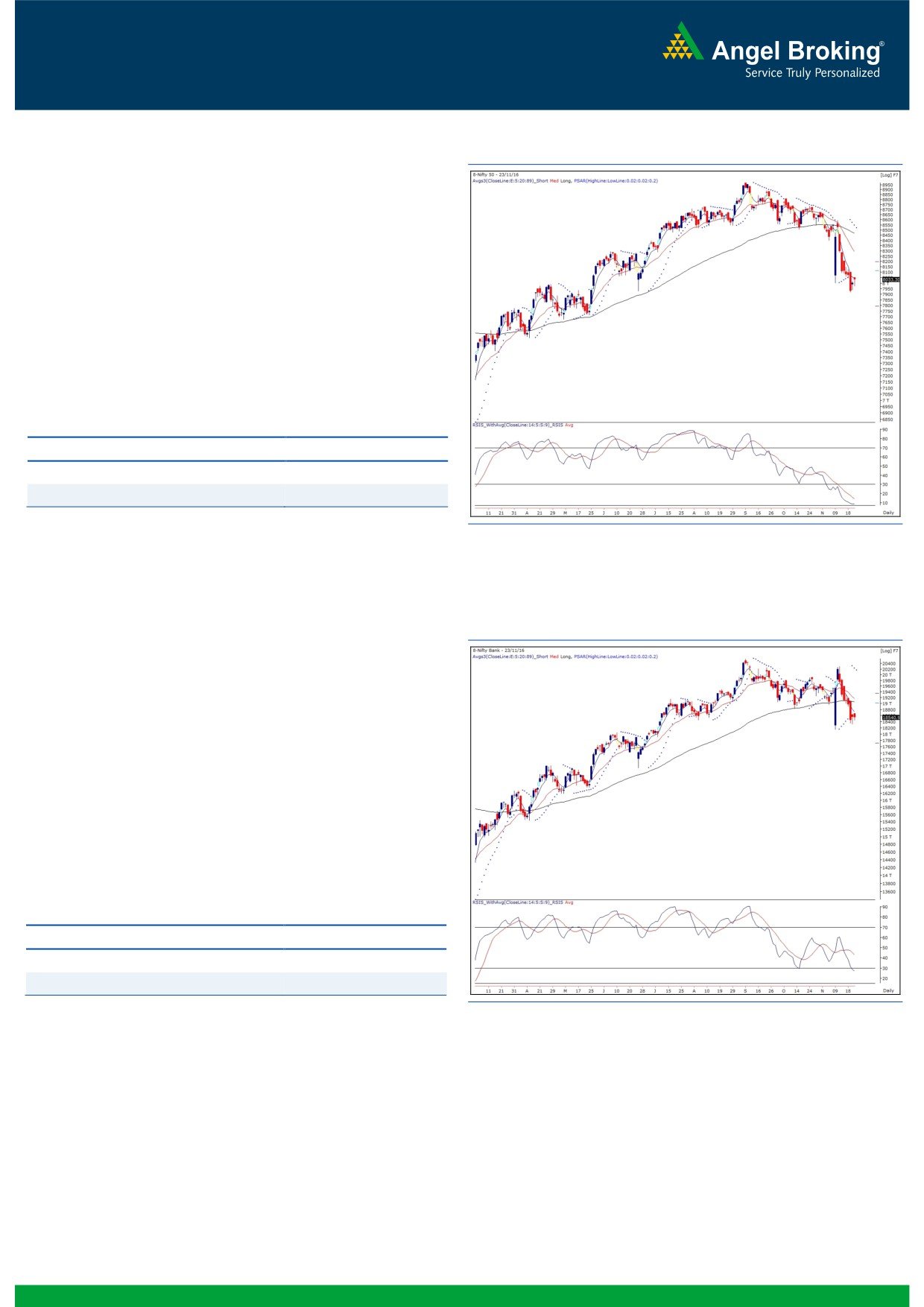

Exhibit 1: Nifty Daily Chart

Yesterday's session too opened higher but similar to previous day,

we witnessed a decent selling pressure at higher levels during the

initial trades. However, we witnessed modest recovery throughout

the day to end the session well above the 8000 mark.

After a massive correction, the index has taken a breather. We

continue with our view that the market is deeply oversold and we

may witness a decent bounce soon. Traders are advised not to

trade on the short side. On the lower side, 7940 - 7900 would be

seen as immediate support level; whereas 8055 - 8120 would act

a resistance zone.

Key Levels

Support 1 - 7940

Resistance 1 - 8055

Support 2 - 7900

Resistance 2 - 8120

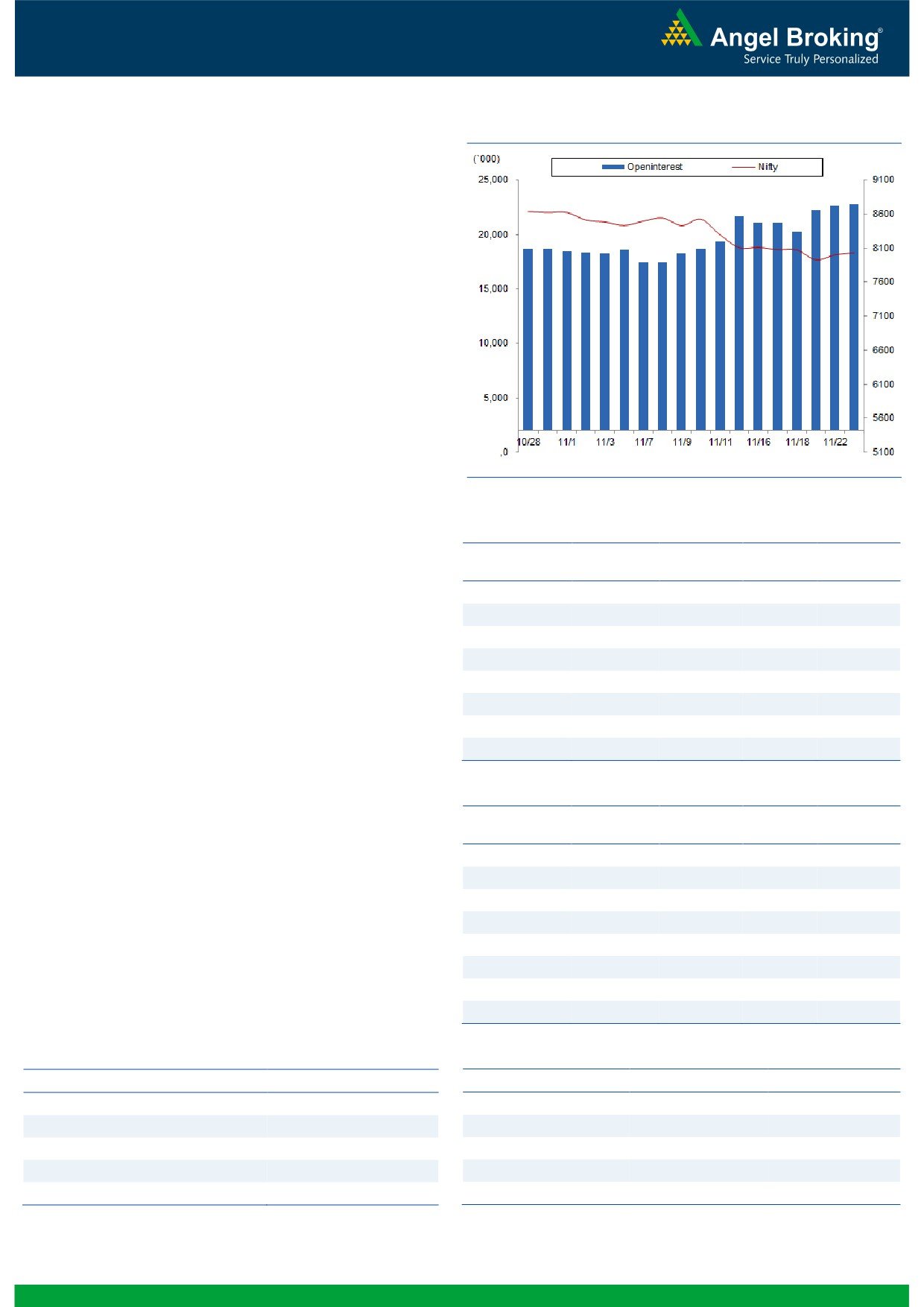

Nifty Bank Outlook - (18541)

Exhibit 2: Nifty Bank Daily Chart

The Nifty Bank index traded in a narrow range yesterday and

ended the session almost near its previous session's close.

The Nifty Bank index formed another small body candle yesterday

ahead of the expiry session, indicating lack of directional

momentum in intraday trades. As highlighted yesterday, the

momentum readings are in oversold territory on lower time frame

charts which could lead to a pullback move. However, citing

recent volatility, traders are advised to focus on stock specific

moves and trade with proper risk management. The intraday

supports for the Nifty Bank index are placed around 18320 and

18145 whereas resistances are seen around 18795 and 18955.

Key Levels

Support 1 - 18320

Resistance 1 - 18795

Support 2 - 18145

Resistance 2 - 18955

1

Technical & Derivatives Report

November 24, 2016

Comments

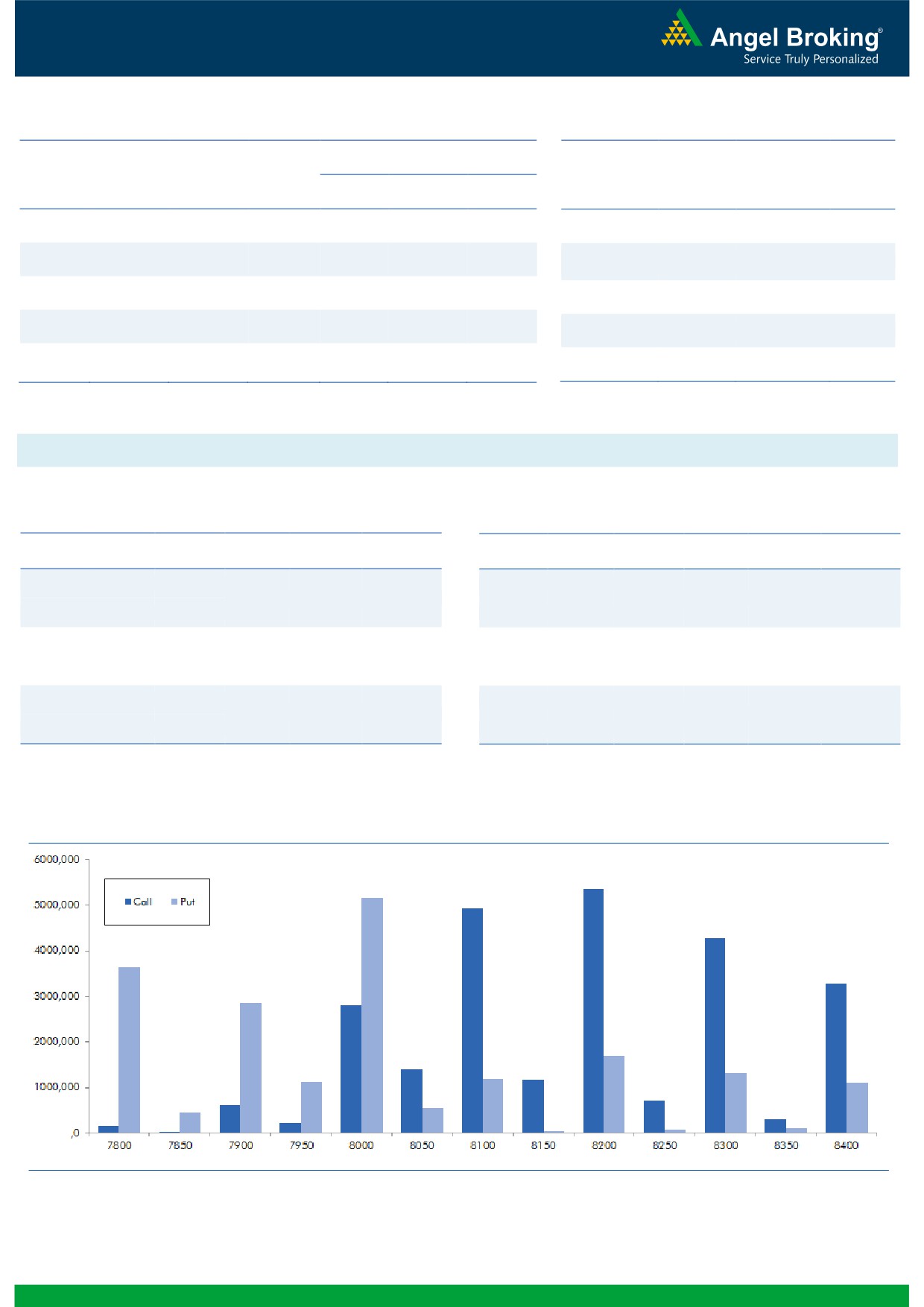

Nifty Vs OI

The Nifty futures open interest has increased by 0.29%

BankNifty futures open interest has decreased by 3.42%

as market closed at 8033.30 levels.

The Nifty November future closed with a discount of 8.45

against the premium of 4.50 points in last trading

session. The December series closed at a premium of

31.40 points.

The Implied Volatility of at the money options has

decreased from 18.89% to 18.24%. At the same time,

the PCR-OI of Nifty has increased from 0.71 to 0.73

levels.

The total OI of the market is Rs. 2,98,769/- cr. and the

stock futures OI is Rs. 73,161/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, IDEA, TORNTPOWER,

GODREJCP and EICHERMOT.

Views

OI Gainers

FIIs continue their selling streak in cash market segment;

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

they sold equities worth Rs. 1023 crores. While, in index

SIEMENS

986000

19.88

1056.05

-2.01

futures, they sold marginally with rise in open interest,

ULTRACEMCO

1821200

15.46

3449.80

1.03

indicating blend of long and short formation in last

NHPC

26946000

14.19

26.00

2.36

trading session.

www.angelbroking.com

BHARTIARTL

30253400

11.43

300.95

-0.76

In Index options segment, FII were net seller worth

CESC

2098800

11.32

569.40

-0.82

Rs. 1054 crores with marginal change in open interest.

BAJAJ-AUTO

1747250

9.94

2596.60

-0.07

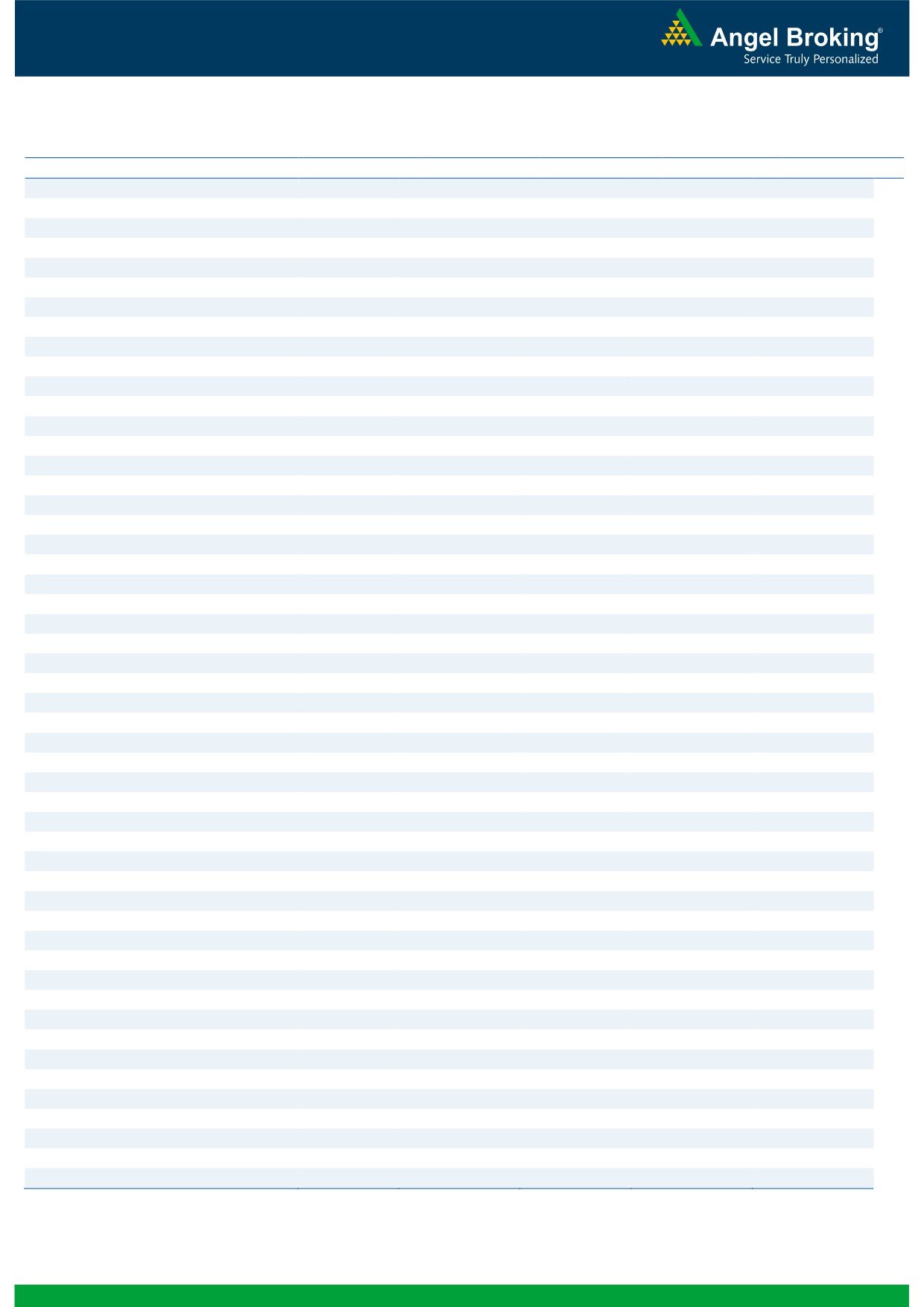

In call options, 8050 and 8100 strikes added some fresh

CUMMINSIND

598200

9.20

760.50

-1.30

positions, followed by unwinding in 8000 call option.

HINDALCO

41615000

9.01

173.55

4.23

While on the other hand in put options, good amount of

build-up was visible in 8000 strike. Highest OI in current

series has been shifted to 8200 from 8500 call and of

OI Losers

put options remains intact in 8000 strike.

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

From last

2-3 trading sessions, we are witnessing

IBREALEST

33490000

-13.55

68.75

9.47

formation of mixed position in Index Future by FIIs;

JETAIRWAYS

5746000

-13.49

361.05

5.79

wherein, majority of positions formed were on long side.

MRF

28890

-13.32

47548.50

1.17

But, these positions have been formed in December

GODREJIND

1492500

-12.33

374.50

-1.81

series. In addition, we are also witnessing good amount

ENGINERSIN

5736500

-11.93

276.25

0.31

of long formation in Stock Futures since last couple of

UNIONBANK

13028000

-11.71

149.50

-0.76

days. However, FIIs continue to write call options of

November series. Thus, looking at the options data, we

COLPAL

586600

-10.85

922.60

2.01

believe we may see November expiry below 8000 mark.

HAVELLS

3486000

-9.64

327.10

3.69

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

LUPIN

43.38

NIFTY

0.73

0.80

NTPC

35.09

BANKNIFTY

0.73

0.77

RELINFRA

60.08

SBIN

0.49

0.42

TATAELXSI

53.54

ICICIBANK

0.50

0.66

CADILAHC

60.31

RELIANCE

0.46

0.59

2

Technical & Derivatives Report

November 24, 2016

FII Statistics for November 23, 2016

Turnover on November 23, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

6183.55

6238.13

(54.58)

304004

19062.99

4.92

442512

24523.07

-0.67

FUTURES

FUTURES

INDEX

INDEX

53603.75

54657.34

(1053.58)

1321143

82097.41

0.23

6911166

409100.42

6.94

OPTIONS

OPTIONS

STOCK

25490.45

24032.87

1457.58

982889

58709.02

2.88

STOCK

FUTURES

975739

75897.09

23.41

FUTURES

STOCK

STOCK

4777.75

4816.37

(38.62)

127572

8075.54

(1.98)

OPTIONS

435175

26984.61

-2.39

OPTIONS

TOTAL

90055.50

89744.71

310.79

2735608

167944.96

1.57

TOTAL

8764592

536505.19

8.08

Nifty Spot = 8033.30

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8000

47.30

Buy

8100

81.30

40.40

59.60

8040.40

54.65

45.35

8045.35

Sell

8100

6.90

Sell

8000

26.65

Buy

8000

47.30

Buy

8100

81.30

46.00

154.00

8046.00

74.75

125.25

8025.25

Sell

8200

1.30

Sell

7900

6.55

Buy

8100

6.90

Buy

8000

26.65

5.60

94.40

8105.60

20.10

79.90

7979.90

Sell

8200

1.30

Sell

7900

6.55

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

November 24, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,259

1,281

1,299

1,321

1,339

ADANIPORTS

256

260

262

266

269

AMBUJACEM

191

195

197

200

203

ASIANPAINT

899

921

933

955

968

AUROPHARMA

711

721

726

736

742

AXISBANK

464

472

477

486

491

BAJAJ-AUTO

2,535

2,568

2,604

2,636

2,672

BANKBARODA

158

160

163

164

167

BHEL

121

123

125

127

129

BPCL

615

625

634

643

652

BHARTIARTL

294

297

303

306

312

INFRATEL

353

356

360

364

368

BOSCH

18,254

18,615

18,838

19,198

19,422

CIPLA

541

547

553

559

565

COALINDIA

300

302

304

307

309

DRREDDY

3,072

3,100

3,123

3,151

3,174

EICHERMOT

20,209

20,585

21,025

21,401

21,841

GAIL

402

407

414

419

425

GRASIM

796

804

811

819

826

HCLTECH

751

757

763

769

775

HDFCBANK

1,168

1,176

1,190

1,198

1,212

HDFC

1,179

1,203

1,229

1,253

1,279

HEROMOTOCO

2,978

2,996

3,013

3,031

3,048

HINDALCO

166

170

172

176

178

HINDUNILVR

808

820

827

839

846

ICICIBANK

258

262

264

267

269

IDEA

70

71

72

74

75

INDUSINDBK

1,050

1,057

1,068

1,075

1,086

INFY

908

914

919

925

929

ITC

221

223

225

227

230

KOTAKBANK

759

763

768

772

777

LT

1,326

1,342

1,363

1,379

1,400

LUPIN

1,385

1,436

1,466

1,517

1,547

M&M

1,162

1,177

1,202

1,217

1,241

MARUTI

4,810

4,846

4,895

4,931

4,980

NTPC

147

154

157

164

167

ONGC

274

277

279

282

285

POWERGRID

175

178

183

186

191

RELIANCE

995

1,002

1,006

1,013

1,017

SBIN

252

255

258

261

264

SUNPHARMA

685

693

699

707

713

TCS

2,113

2,135

2,149

2,170

2,185

TATAMTRDVR

286

291

295

301

305

TATAMOTORS

456

464

470

477

483

TATAPOWER

68

69

69

70

70

TATASTEEL

374

384

389

398

404

TECHM

442

448

453

459

464

ULTRACEMCO

3,342

3,397

3,436

3,491

3,530

WIPRO

438

443

448

453

457

YESBANK

1,102

1,114

1,130

1,141

1,158

ZEEL

430

444

453

467

477

4

Technical & Derivatives Report

November 24, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5