Technical & Derivatives Report

May 24, 2016

Sensex (25230) / Nifty (7731)

Exhibit 1: Nifty Daily Chart

We witnessed a gap up opening to start the week on a positive

note. However, this lead was very short lived as we witnessed a

decent correction in the initial hours. This was followed by yet

another attempt to conquer the 7820 mark post the mid-session;

but, once again bears showed their dominance to pull the index

significantly lower to close convincingly below 7750.

Despite this tail-end weakness, we would like to stick to our stance

and thus, expect 7700 - 7680 to act as a strong support zone. As

mentioned in our earlier report, the Nifty has now entered the 9th

time zone of ‘34 Days’.

We would hope this 'Time Zone' to turn positive for our markets.

On the upside, 7820 - 7880 levels are seen as intraday hurdles

for the index.

Key Levels

Support 1 - 7700

Resistance 1 - 7820

Support 2 - 7680

Resistance 2 - 7880

Exhibit 2: Nifty Bank Hourly Chart

Nifty Bank Outlook - (16408)

Yesterday, the Nifty Bank index opened with gains of around half

a percent and started correcting from initial trades. However, post

the first half; we witnessed a good buying interest in the banking

index and as a result, the Nifty Bank bounced by around 180

points. But, this up move immediately got sold into in the

concluding hour. Eventually, the Nifty Bank index ended the

session with a loss of 0.45 percent over its previous close.

The banking index has breached its previous swing low of

16431.65 on hourly chart and thus formed ‘Lower Highs Low

Lows’ on intra day chart. But, at the same time, we are witnessing

a formation of ‘Bullish AB=CD’ pattern on hourly chart around

16370 levels, which depicts a possibility of a healthy bounce in

the index. Additionally, the ‘RSI’ oscillator is also showing positive

divergence on hourly chart. Going forward, we may see a bounce

back in the banking index up to 16635 and 16700 levels. The

mentioned view will get negates below 16250.

Key Levels

Support 1 - 16250

Resistance 1 - 16635

Support 2 - 16180

Resistance 2 - 16700

1

Technical & Derivatives Report

May 24, 2016

Comments

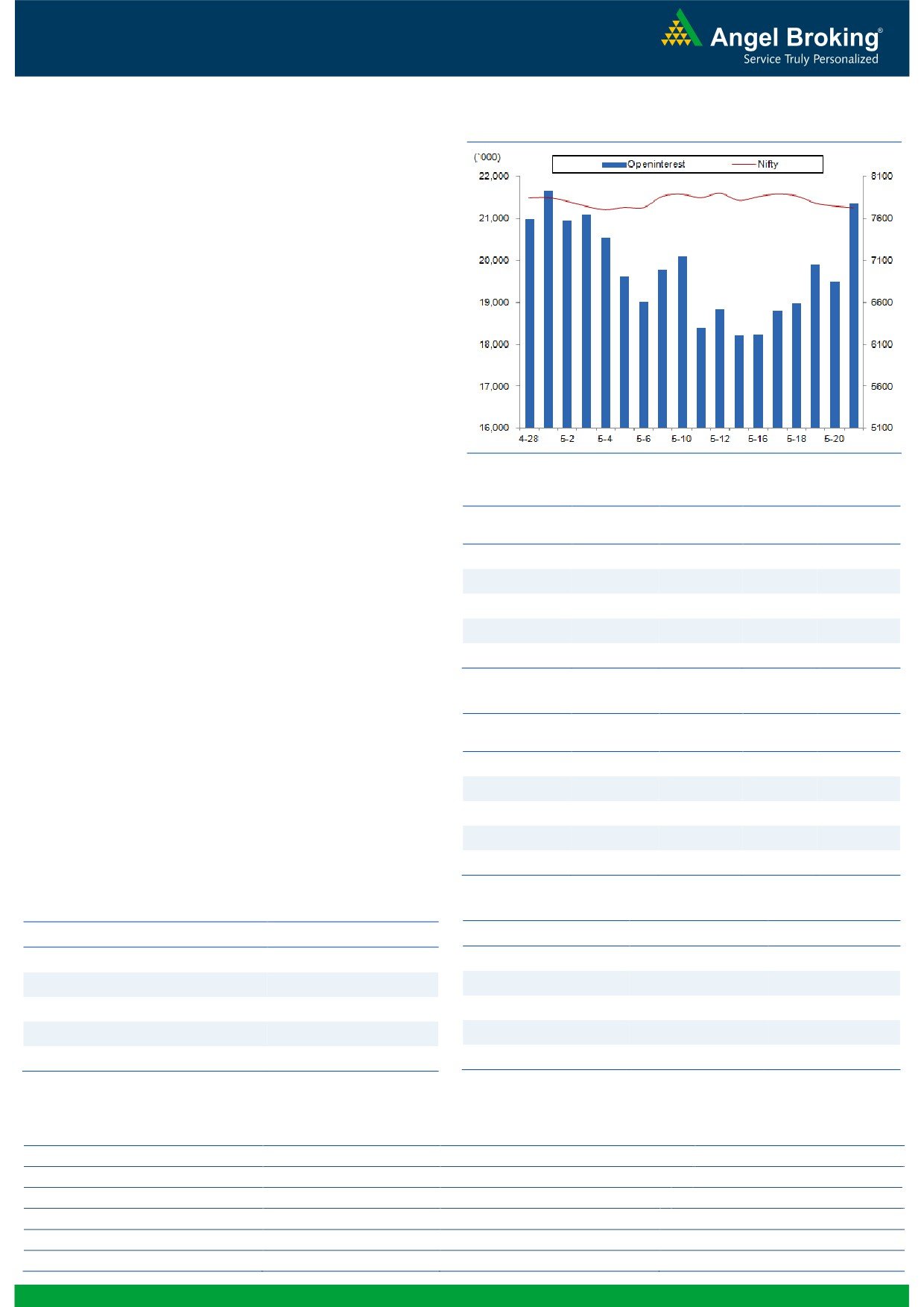

Nifty Vs OI

The Nifty futures open interest has increased by 9.49%

BankNifty futures open interest has decreased by 1.18%

as market closed at 7731.05 levels.

The Nifty May future closed at a premium of 13.80

points against a premium of 13.65 points. The June

series closed at a premium of 19.85 points.

The Implied Volatility of at the money options has

increased from 14.65% to 15.21%.

The total OI of the market is Rs. 2,53,505/- cr. and the

stock futures OI is Rs. 65,317/- cr.

Few of the liquid counters where we have seen high cost

of carry are UNITECH, JPASSOCIAT, STAR, GMRINFRA

and PTC.

Views

OI Gainers

Yesterday, the FIIs activity in equity cash segment

OI

PRICE

remained subdued. While, they bought index future

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

worth Rs. 326 with rise in OI, indicating long formation.

AMARAJABAT

902400

42.02

919.40

-3.12

In Index Options front, FIIs were net buyer worth

JUSTDIAL

2899800

30.97

682.50

-5.41

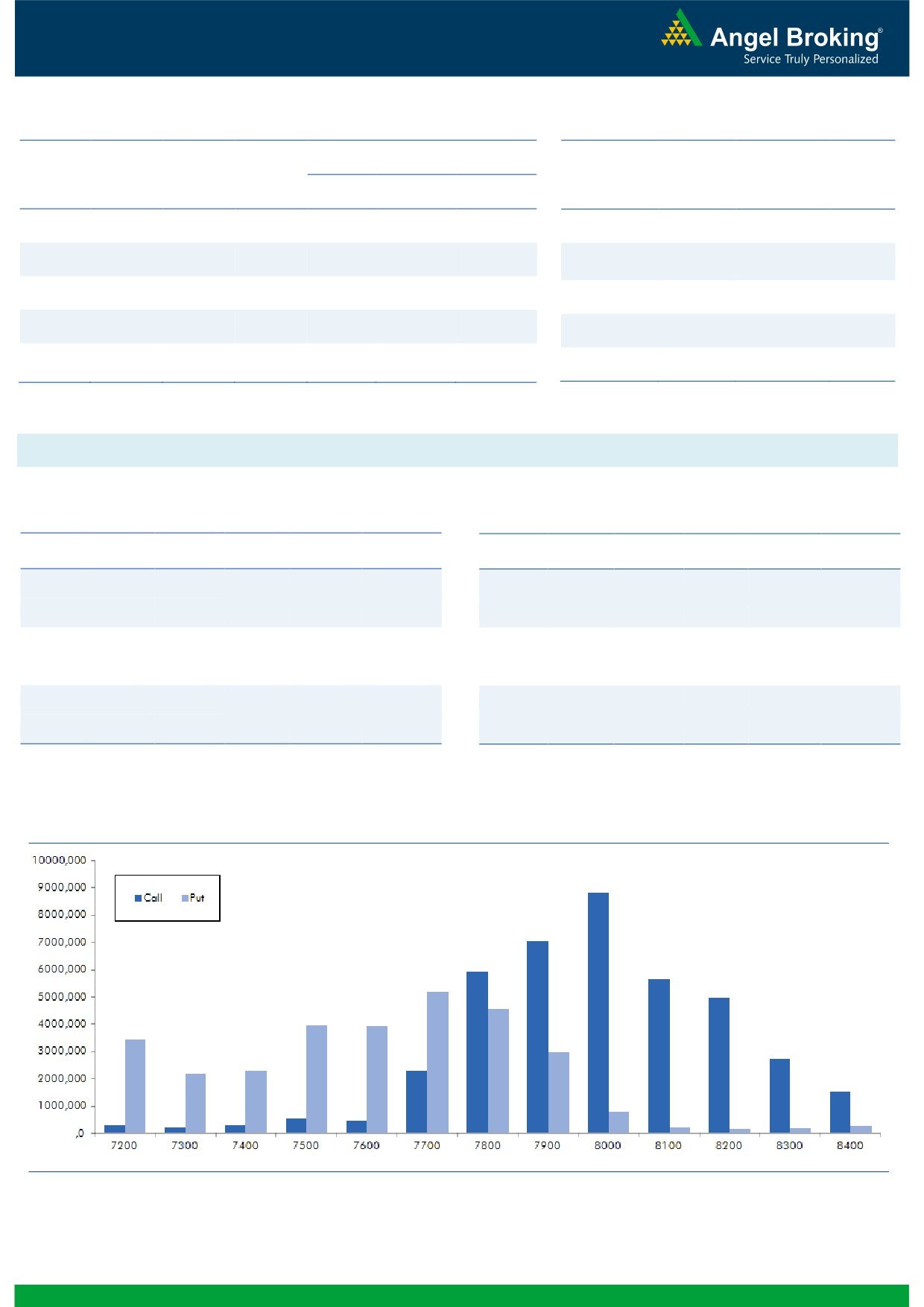

Rs. 1213 crores with fall in OI. In call options, 7750 -

IDFC

83440500

30.11

47.00

-1.36

7800 strikes were active and added fresh positions; while

unwinding was seen in 7900 to 8200 strikes. Whereas,

CASTROLIND

9940200

22.05

370.40

-1.13

in put options, some OI addition was seen in 7650 and

POWERGRID

22392000

19.62

148.25

2.38

7750 strikes; followed by unwinding in 7800 and 7500

strikes. Considering rise in IVs, it seems that the call

OI Losers

writers of higher strike price are booking profit.

OI

PRICE

SCRIP

OI

PRICE

Maximum OI in current series is seen at 8000 call and

CHG. (%)

CHG. (%)

7700 put options.

UNITECH

205106000

-10.05

4.00

0.00

Though, FIIs were buyer in index future in yesterday’s

GMRINFRA

239181000

-9.27

11.00

-2.65

session, we would like to wait for follow-up buying from

ORIENTBANK

14370000

-7.81

78.25

-1.01

them to initiate any fresh trade in index. Rollover in Nifty

SRF

781200

-6.64

1186.10

-1.46

and BankNifty are 23.72% and 12.79% respectively.

CADILAHC

3738000

-6.42

325.00

1.01

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

BRITANNIA

49.41

NIFTY

0.83

0.73

ITC

38.68

BANKNIFTY

0.75

0.76

DISHTV

51.01

SBIN

0.36

0.34

AMARAJABAT

26.00

RELIANCE

0.39

0.63

POWERGRID

22.15

ICICIBANK

0.44

0.53

Strategy Date

Symbol

Strategy

Status

02-05-2016

NIFTY

Long Strangle

Active

09-05-2016

RELIANCE

Long Put

Loss Booked on May 17, 2016

16-05-2016

LT

Short Strangle

Active

23-05-2016

RCOM

Long Straddle

Active

2

Technical & Derivatives Report

May 24, 2016

FII Statistics for 23-May 2016

Turnover on 23-May 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

4055.69

3729.77

325.92

277828

15765.37

5.05

373570

20798.66

33.24

FUTURES

FUTURES

INDEX

INDEX

40348.25

39134.95

1213.30

1252081

71689.68

(2.87)

5433893

312586.21

21.64

OPTIONS

OPTIONS

STOCK

15124.06

14738.26

385.79

1078033

50381.00

2.05

STOCK

FUTURES

1028262

48931.44

67.61

FUTURES

STOCK

STOCK

2990.23

3220.16

(229.93)

102181

4835.39

6.19

OPTIONS

392117

19183.91

-3.85

OPTIONS

TOTAL

62518.23

60823.14

1695.09

2710123

142671.44

0.15

TOTAL

7227842

401500.21

24.80

Nifty Spot = 7731.05

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7700

71.55

Buy

7800

75.75

48.60

51.40

7748.60

48.15

51.85

7751.85

Sell

7800

22.95

Sell

7700

27.60

Buy

7700

71.55

Buy

7800

75.75

66.65

133.35

7766.65

67.70

132.30

7732.30

Sell

7900

4.90

Sell

7600

8.05

Buy

7800

22.95

Buy

7700

27.60

18.05

81.95

7818.05

19.55

80.45

7680.45

Sell

7900

4.90

Sell

7600

8.05

Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

May 24, 2016

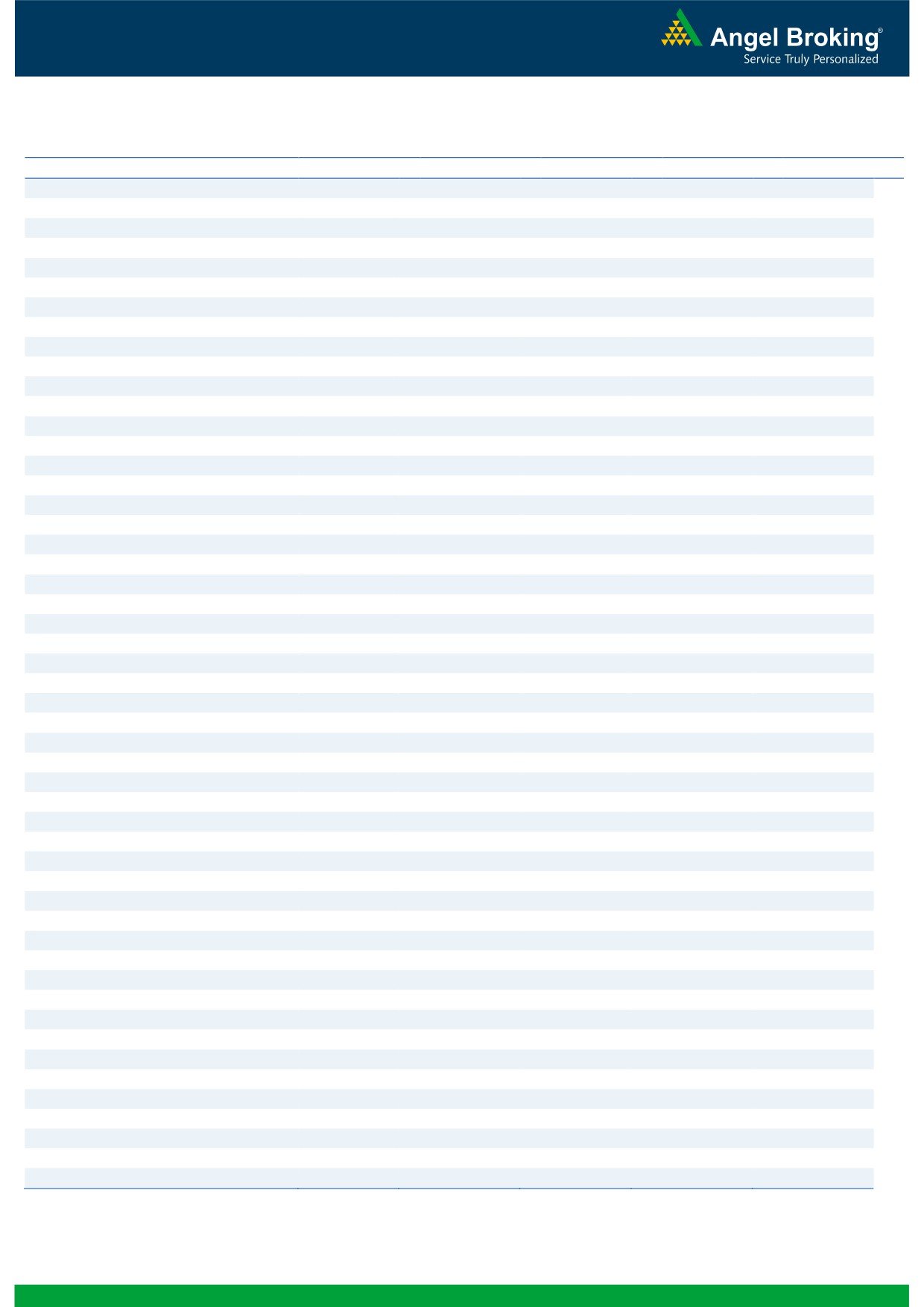

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,374

1,396

1,412

1,434

1,450

ADANIPORTS

176

179

181

183

185

AMBUJACEM

207

210

212

214

216

ASIANPAINT

934

940

950

957

966

AUROPHARMA

739

749

765

775

791

AXISBANK

479

483

489

493

499

BAJAJ-AUTO

2,376

2,399

2,431

2,454

2,487

BANKBARODA

128

130

133

135

138

BHEL

117

118

119

120

121

BPCL

901

911

922

932

943

BHARTIARTL

338

342

345

349

353

INFRATEL

370

377

382

389

394

BOSCH

20,578

20,818

21,106

21,345

21,634

CIPLA

486

491

501

507

516

COALINDIA

277

279

280

282

283

DRREDDY

3,004

3,017

3,032

3,045

3,060

EICHERMOT

18,063

18,165

18,303

18,405

18,543

GAIL

361

366

373

378

385

GRASIM

4,153

4,182

4,220

4,250

4,288

HCLTECH

727

730

735

738

743

HDFCBANK

1,123

1,130

1,140

1,147

1,157

HDFC

1,140

1,150

1,169

1,179

1,197

HEROMOTOCO

2,851

2,869

2,887

2,905

2,923

HINDALCO

85

86

87

88

89

HINDUNILVR

807

813

819

826

832

ICICIBANK

218

220

222

223

225

IDEA

108

109

110

111

112

INDUSINDBK

1,033

1,044

1,062

1,074

1,092

INFY

1,173

1,180

1,193

1,200

1,213

ITC

332

339

347

354

362

KOTAKBANK

695

699

705

709

715

LT

1,221

1,231

1,248

1,259

1,276

LUPIN

1,405

1,435

1,481

1,511

1,556

M&M

1,268

1,276

1,289

1,297

1,310

MARUTI

3,859

3,886

3,927

3,955

3,996

NTPC

134

135

136

137

139

ONGC

203

206

210

213

217

POWERGRID

143

146

147

150

151

RELIANCE

917

924

932

939

947

SBIN

165

167

170

171

174

SUNPHARMA

771

778

786

792

800

TCS

2,440

2,466

2,506

2,532

2,572

TATAMTRDVR

255

257

262

264

269

TATAMOTORS

374

378

384

388

394

TATAPOWER

70

70

71

71

72

TATASTEEL

304

309

317

322

331

TECHM

469

473

477

481

485

ULTRACEMCO

3,083

3,103

3,130

3,149

3,176

WIPRO

535

537

541

543

547

YESBANK

969

973

979

984

990

ZEEL

428

432

438

442

448

4

Technical & Derivatives Report

May 24, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5